0/ stablecoin liquidity is a core element of a flourishing, decentralized financial system

let's explore the #stablecoin landscape & have a look at the largest & most innovative stablecoins out there

featuring $USDT, $DAI, $FRAX, $UXD & more

mega-🧵 on stablecoins (0/50)✨👇

let's explore the #stablecoin landscape & have a look at the largest & most innovative stablecoins out there

featuring $USDT, $DAI, $FRAX, $UXD & more

mega-🧵 on stablecoins (0/50)✨👇

1/ stablecoins are #cryptocurrencies the value of which is pegged, or tied, to that of another currency, commodity or financial instrument

2/ most #stablecoins use the the U.S. dollar as their “stable” reserve asset. Stablecoins are designed to reduce volatility relative to unpegged #cryptocurrencies like Bitcoin and bridge the worlds of crypto & fiat currencies

3/ combining traditional-asset stability with digital-asset flexibility has proven to be a very popular idea in the #crypto space and billions of dollars have flowed into #stablecoins as they’ve become one of the most popular ways to store and trade value in the crypto ecosystem

4/ today, stablecoin market cap stands at >150bn USD with $USDT dominating the market cap at 44%

top 3 USD #stablecoins by mcap:

- $USDT at $68bn

- $USDC at $51bn

- $BUSD at $20bn

top 3 USD #stablecoins by mcap:

- $USDT at $68bn

- $USDC at $51bn

- $BUSD at $20bn

5/ while the top 3 stablecoins are all based on a centralized issuance model (@Tether_to, @circlepay, @binance) & are collateralized by 100% USD (or other liquid real-world assets), there are also other approaches to building stablecoins

6/ similar to the better known blockchain trilemma (in the context of scaling), #stablecoins face a trilemma between three desirable features, out of which only two can be achieved at once

7/ while algorithmic #stablecoins like the collapsed $UST made sacrifices on peg stability by prioritizing capital efficiency & decentralization, the above-mentioned centralized stablecoins go for peg stability & capital efficiency

8/ but lets have a more comprehensive look at the types of #stablecoins that exist:

- centralized & fully collateralized (USD & RWA)

- decentralized & overcollateralized (crypto)

- decentralized & algorithmic

- decentralized & fractional-algorithmic

- centralized & fully collateralized (USD & RWA)

- decentralized & overcollateralized (crypto)

- decentralized & algorithmic

- decentralized & fractional-algorithmic

9/ in order to better understand the differences between the various #stablecoin models, let's explore the stablecoin landscape in more detail

10/ centralized & fully collateralized (in USD):

- $USDT by @Tether_to

- $USDC by @circlepay

- $BUSD by @binance & @PaxosGlobal

these stablecoins all prioritize peg stability & capital efficiency (no over-collateralization) but sacrifice decentralization

- $USDT by @Tether_to

- $USDC by @circlepay

- $BUSD by @binance & @PaxosGlobal

these stablecoins all prioritize peg stability & capital efficiency (no over-collateralization) but sacrifice decentralization

11/ $USDT is a USD-pegged stablecoin that is centrally issued by @Tether_to and collateralized 100% by mainly USD & cash equivalents, but also other assets (see below image). It is the largest stablecoin with a market cap of $68bn

12/ $USDC, the second largest stablecoin is also USD-pegged and collateralized at 100% (see screenshot below). It differentiates itself from @Tether_to with a stronger focus on regulatory compliance and currently stands at $51bn market cap

13/ finally, we have $BUSD, another fiat-collateralized USD stablecoin launched in collaboration btwn @binance & @PaxosGlobal. $BUSD is issued by Paxos, a NY-regulated financial institution & each $BUSD token is collateralized 1:1 by USD held in Paxos-owned US bank accounts

14/ decentralized & over-collateralized (in crypto):

- $DAI by @MakerDAO

- $LUSD by @LiquityProtocol

- $USDJ by @DeFi_JUST

- $USDX by @kava_platform

- $MAI by @QiDaoProtocol

- $GHO by @AaveAave (not live)

- $crvUSD by @CurveFinance (not live)

- $MIM by @MIM_Spell

- $DAI by @MakerDAO

- $LUSD by @LiquityProtocol

- $USDJ by @DeFi_JUST

- $USDX by @kava_platform

- $MAI by @QiDaoProtocol

- $GHO by @AaveAave (not live)

- $crvUSD by @CurveFinance (not live)

- $MIM by @MIM_Spell

15/ all of these stablecoins are based on a system of collateralized debt positions (CDPs) pioneered by @MakerDAO. Users deposit collateral into a vault & can subsequently mint $DAI. If the minimum collateral ratio is breached, $DAI borrowers face liquidation of collateral

16/ which types of crypto-collateral are eligible for opening vaults depends on the protocol. However, over-collateralization ratios are similar across protocols and range from 120% to 150%

18/ however, while the over-collateralization brings security, it also means that in order to try to achieve peg stability & decentralization, protocols must sacrifice on capital efficiency

19/ but some protocols like @AaveAave with its upcoming $GHO stablecoin have come up with approaches to improve capital efficiency of the CDP model. In $GHO's case, by using productive assets generating interest (aTokens) as collateral in the CDPs

governance.aave.com/t/introducing-…

governance.aave.com/t/introducing-…

20/ why does @AaveAave want its own stablecoin you ask?

easy:

easy:

https://twitter.com/tokenterminal/status/1566458893382942722

21/ @CurveFinance's $crvUSD which was announced in July, will also be based on a CDP model. It will definitely be interesting to see what design opportunities #stablecoin issuance by a major DEX will create, as this is the first time we see this

22/ it is for example likely that LP tokens will be integrated into the collateral system, increasing capital efficiency similar to how $GHO makes use of aTokens

coindesk.com/tech/2022/09/0…

coindesk.com/tech/2022/09/0…

23/ while there have been a couple of projects that tried to challenge Maker in the past, #Maker's safety & stability orientied approach remains king in the decentralized #stablecoin space

24/ ambitious projects like #Abracadabra's $MIM using a wide range and complex collateral such as interest-bearing tokens, have often miscalculated risks

when $UST collapsed, $MIM for example suffered from $UST collateral & its mcap subsequently dropped from >$4.5bn to ∼$200m

when $UST collapsed, $MIM for example suffered from $UST collateral & its mcap subsequently dropped from >$4.5bn to ∼$200m

25/ decentralized & algorithmic:

- $UST by @terra_money

- $USDD by @trondao

- $USDN by @wavesprotocol

- $CUSD by @CeloOrg

while $UST has been a painful reminder of the risks that come with algorithmic stablecoins, there are still stablecoins relying on algorithmic models

- $UST by @terra_money

- $USDD by @trondao

- $USDN by @wavesprotocol

- $CUSD by @CeloOrg

while $UST has been a painful reminder of the risks that come with algorithmic stablecoins, there are still stablecoins relying on algorithmic models

26/ $UST has famously collapsed in May. I won't cover $UST in more detail here

for more info, see:

for more info, see:

https://twitter.com/expctchaos/status/1524795622775263235

27/ the three algo #stablecoins that you should be aware of are the following:

- $USDD: minting is centralized & limited to 9 TronDAO members

- $USDN: current collateral ratio is only 11%

- $CUSD: Minted only by $CEL but more transparent than others

- $USDD: minting is centralized & limited to 9 TronDAO members

- $USDN: current collateral ratio is only 11%

- $CUSD: Minted only by $CEL but more transparent than others

28/ @DefiIgnas has written a great thread on those:

https://twitter.com/DefiIgnas/status/1559857905524174848

29/ decentralized & fractional-algorithmic stablecoins:

- $FRAX by @fraxfinance

- $UXD by @UXDProtocol

- $FEI by @feiprotocol

- $FRAX by @fraxfinance

- $UXD by @UXDProtocol

- $FEI by @feiprotocol

30/ since the Tribe DAO that controls $FEI is planning to shut down, $FEI won't be covered in this thread

for more info, see:

-

-

for more info, see:

-

https://twitter.com/DefiIgnas/status/1560794521977626624

-

https://twitter.com/samkazemian/status/1560922661387001856

31/ focus in this thread will be on $FRAX & $UXD, which probably have the most innovative #stablecoin models

32/ $FRAX is a fractional-algorithmic stablecoin that is partially backed by collateral & partially stabilized algorithmically

$FRAX started at 100% collateralization in USDC. However, some of the value that enters into the system during minting becomes $FXS (which is burned)

$FRAX started at 100% collateralization in USDC. However, some of the value that enters into the system during minting becomes $FXS (which is burned)

33/ also, unlike in purely over-collateralized models ($DAI) where the debt minted is owned by the owner of the CDP, the protocol owns the debt in $FRAX's fractional-algorithmic model

hence, the protocol must simply ensure that it can honor redemptions by guaranteeing collateral

hence, the protocol must simply ensure that it can honor redemptions by guaranteeing collateral

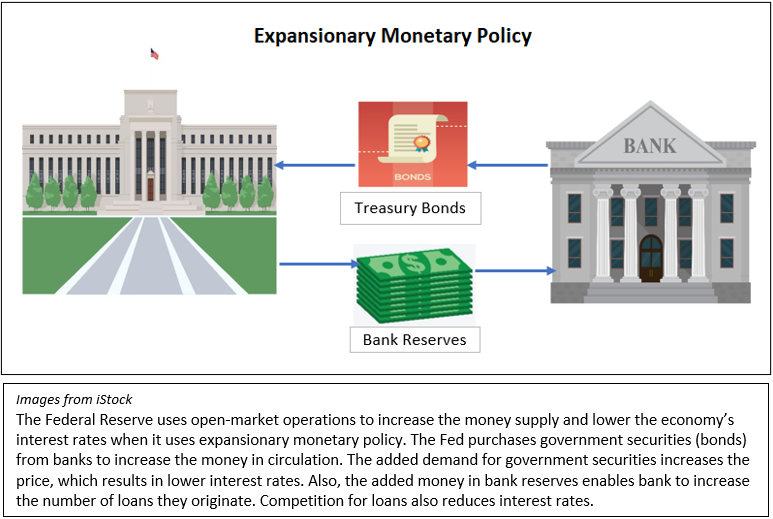

34/ This brings us to the probably most important innovation in #DeFi stablecoins: automated market operations

as outlined below, the federal reserve engages in open market operations, thereby influencing money supply & manipulating interest rates

#DeFi has learned from the fed

as outlined below, the federal reserve engages in open market operations, thereby influencing money supply & manipulating interest rates

#DeFi has learned from the fed

35/ automated market operations (AMOs) enable #DeFi protocols (@fraxfinane) to

- increase $FRAX supply

- decrease borrowing rates on lending markets (e.g. $AAVE)

- improve capital efficiency by creating cheap money

- generate revenue for the protocol

literally what the fed does

- increase $FRAX supply

- decrease borrowing rates on lending markets (e.g. $AAVE)

- improve capital efficiency by creating cheap money

- generate revenue for the protocol

literally what the fed does

36/ initially, $FRAX started out with four #AMO strategies:

- Investor AMO (e.g. yield farming on @iearnfinance)

- $CRV AMO (providing #Curve liquidity)

- Lending AMO (mint $FRAX into $COMP & $AAVE)

- Liquidity AMO (LPing on Uniswap v3)

- Investor AMO (e.g. yield farming on @iearnfinance)

- $CRV AMO (providing #Curve liquidity)

- Lending AMO (mint $FRAX into $COMP & $AAVE)

- Liquidity AMO (LPing on Uniswap v3)

37/ however, there are more strategies in the pipeline:

- $FRAX Base Pools (3CRV competitors)

- FraxSwap (own constant product AMM)

- FraxLend ($FEI/$RARI competitor, lending market)

- FxsETH (liquid staking)

- $FRAX Base Pools (3CRV competitors)

- FraxSwap (own constant product AMM)

- FraxLend ($FEI/$RARI competitor, lending market)

- FxsETH (liquid staking)

38/ how much $FRAX is available to deploy in these #AMO strategies depends on the collateral ratio (CR) of the protocol

in the case of $FRAX, its basically the market that sets the CR. When $FRAX is $1.01 the CR lowers. When the price of FRAX is $0.99 the CR increases

in the case of $FRAX, its basically the market that sets the CR. When $FRAX is $1.01 the CR lowers. When the price of FRAX is $0.99 the CR increases

39/ when demand for $FRAX is high & price is $1.01, @fraxfinance uses this excess value as input to lower the CR by minting more $FRAX. Seigniorage, fees & excess collateral accrues to the governance token $FXS that is also minted to increase the CR when $FRAX is $0.99

40/ this concept basically allows the protocol to ask the market how much supply of money is okay to be unbacked. The market responds collectively through the $FRAX price

41/ after $FRAX v2 introduced the concept of algorithmic market operations introduced above, the protocol can basically do anything with new $FRAX & collateral as long as the market doesn't respond by pricing FRAX below 1$

42/ in summary, AMOs increase capital efficiency by allowing protocols to create money very cheaply. Simultaneously, it generates revenue for the protocol

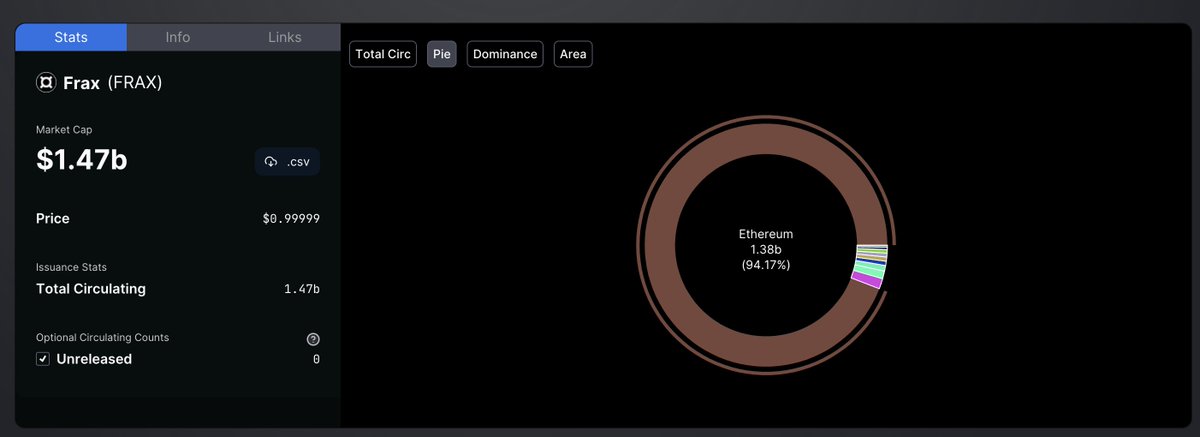

43/ $FRAX has already become the second largest decentralized stablecoin (behind $DAI) at a market cap of $1.5bn

$DAI has a market cap of $6.4bn

$DAI has a market cap of $6.4bn

44/ At least partially, this also explains why $AAVE & $CRV are launching their own stablecoins

both $AAVE & $CRV need liquidity to generate revenue, which they currently attract through liquidity mining programs

own stablecoins will likely increase capital efficiency for LPs

both $AAVE & $CRV need liquidity to generate revenue, which they currently attract through liquidity mining programs

own stablecoins will likely increase capital efficiency for LPs

45/ interestingly, while their tokens will require collateral (CDPs), the #stablecoin implementations will also allow $AAVE & $CRV to mint #stablecoins at little cost & generate revenues through AMOs

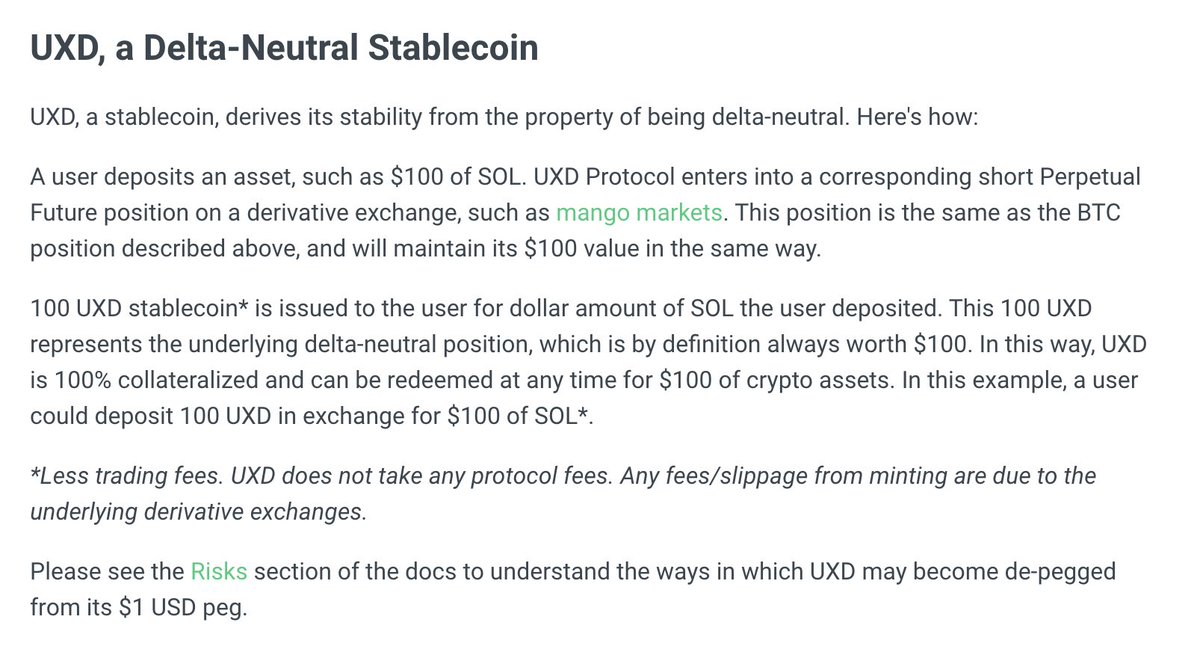

46/ finally, another interesting stablecoin project is @UXDProtocol. With a market cap of only $20m, the #Solana-based project has gone largely unnoticed so far

@UXDProtocol uses delta-neutral derivates position to keep the peg

@UXDProtocol uses delta-neutral derivates position to keep the peg

47/ when 1 $SOL is deposited into the protocol, a corresponding short positions is opened on @mangomarkets, enabling the protocol to earn funding rate, which is subsequently distributed to UXD holders

48/ #stablecoins play a key role in overall #DeFi ecosystem. It is therefore definitely worth keeping an eye on the space stay on top of the most promising concepts. Fractional-algorithmic stablecoins & AMOs are likely to reshape the stablecoin space

49/ however, (especially algorithmic) #stablecoins will likely face increased regulatory headwinds in the upcoming months

@HubbleProtocol has recently posted an insightful thread on stablecoin regulation:

@HubbleProtocol has recently posted an insightful thread on stablecoin regulation:

https://twitter.com/HubbleProtocol/status/1560926328030986240

50/ thanks for reading if you made it until the end! If you liked this thread, please support me by following & sharing the first post of the thread 🥰✨

• • •

Missing some Tweet in this thread? You can try to

force a refresh