Definition of Alpha Figure

An Alpha indicates the measure by which a stock or portfolio has managed to outperform a benchmark like an index of shares.

#investing #StockMarcket

An Alpha indicates the measure by which a stock or portfolio has managed to outperform a benchmark like an index of shares.

#investing #StockMarcket

It takes into account the active returns on investment.

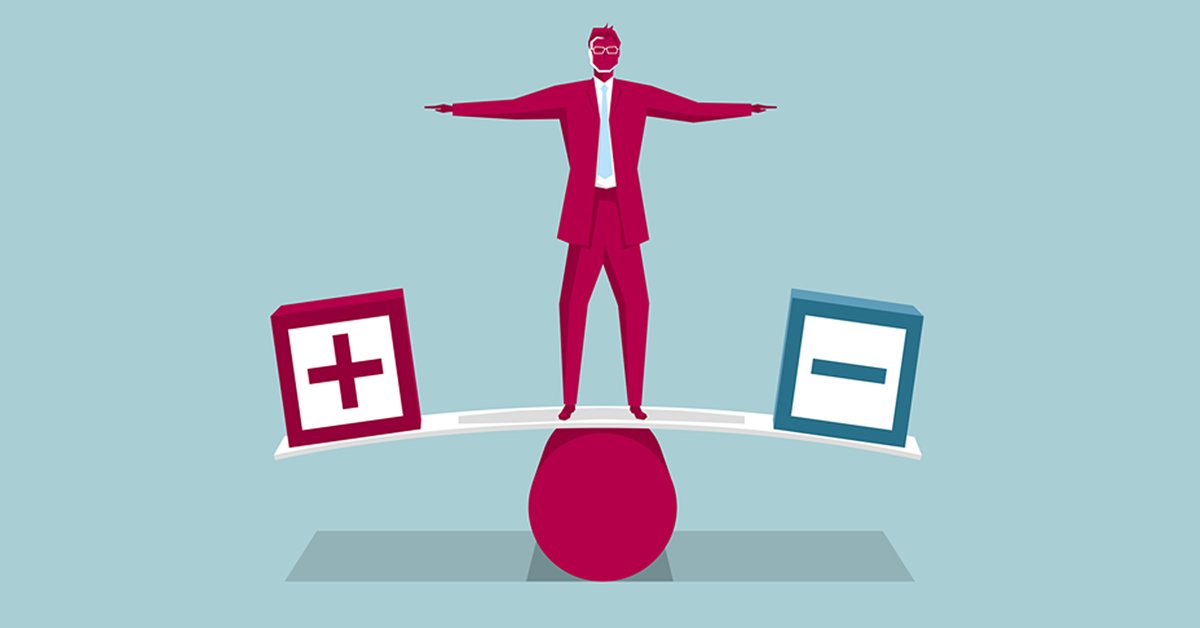

A positive Alpha means that the security or portfolio is beating the market while a negative Alpha means that it is lagging.

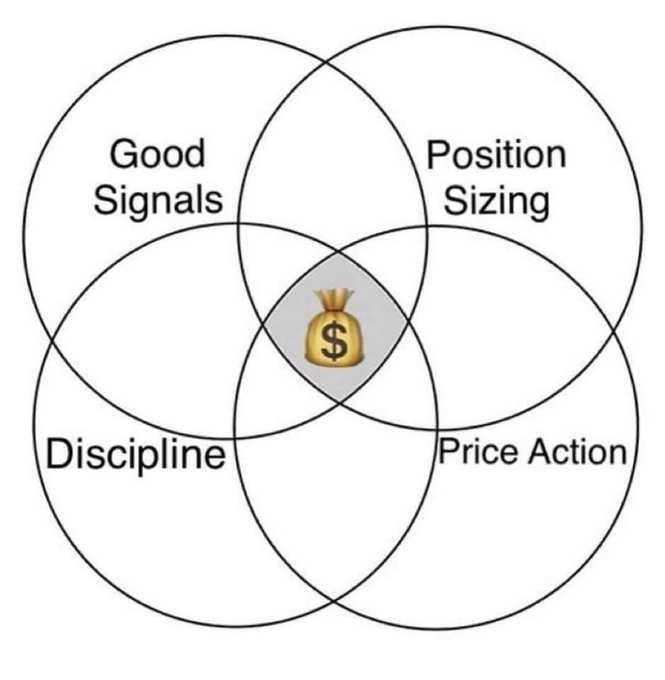

#stocks #nifty #niftybank #trading #priceaction

#StocksToTrade #stockstowatch

A positive Alpha means that the security or portfolio is beating the market while a negative Alpha means that it is lagging.

#stocks #nifty #niftybank #trading #priceaction

#StocksToTrade #stockstowatch

Alpha can also be used to measure the competence of a fund manager and their strategies.

It is also called an ‘abnormal rate of return’ or ‘excess return.’

#stockmarketindia

It is also called an ‘abnormal rate of return’ or ‘excess return.’

#stockmarketindia

Learn more with #Upstox

upstox.com/glossary/?f=KQ…

@rattibha

@threadreaderapp

@UnrollHelper

@SaveToNotion

upstox.com/glossary/?f=KQ…

@rattibha

@threadreaderapp

@UnrollHelper

@SaveToNotion

• • •

Missing some Tweet in this thread? You can try to

force a refresh