Some cryptocurrencies gave up their gains yesterday as $BTC slid below $19,000, and $DXY took a rally to 112, which is considered negative for #bitcoin price.

In #Coin360 Daily Digest:

In #Coin360 Daily Digest:

1/ In the pic:

@CFTC @harmonyprotocol @dbsbank @Coinsquare @CoinSmart @Chain @Patriots @BlockdaemonHQ @3commas_io @hadeaninc @TheMonkeyLeague @acmilan @ValourGlobal @cronos_chain @XinFin_Official @feiprotocol @bitfinex @terra_money @ton_blockchain

@CFTC @harmonyprotocol @dbsbank @Coinsquare @CoinSmart @Chain @Patriots @BlockdaemonHQ @3commas_io @hadeaninc @TheMonkeyLeague @acmilan @ValourGlobal @cronos_chain @XinFin_Official @feiprotocol @bitfinex @terra_money @ton_blockchain

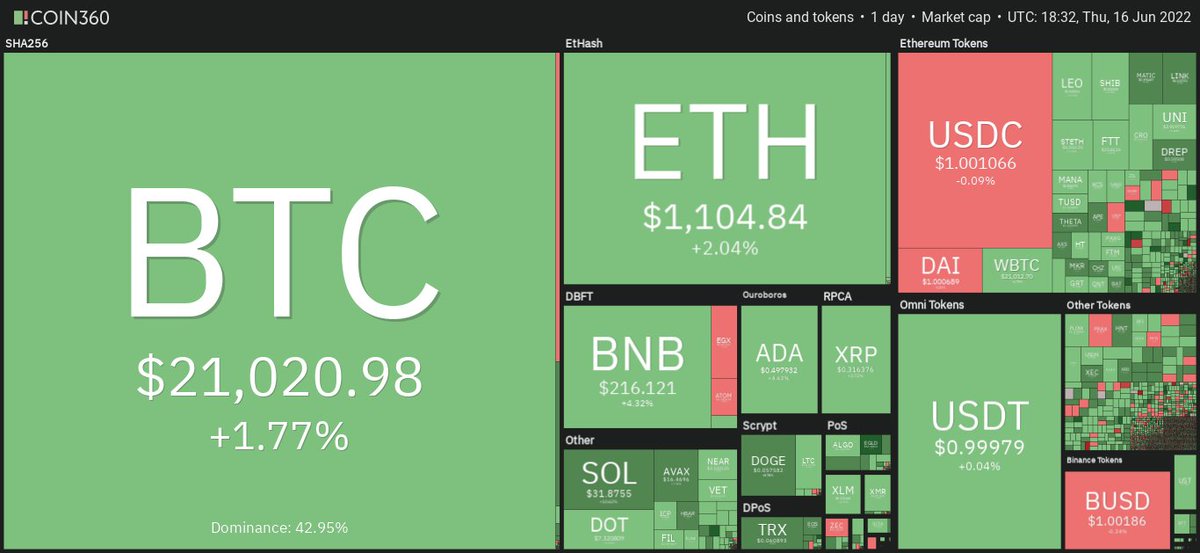

2/ $BTC failed to break $19,500 today.

It is trading under $18,800 at the time of writing, posting a 1.4% drop in the past 24h. Traders are waiting for Powell's comments at the "Fed Listens" event.

Macro, #BTC & #ETH technical analysis: coin360.com/news/btc-afloa…

It is trading under $18,800 at the time of writing, posting a 1.4% drop in the past 24h. Traders are waiting for Powell's comments at the "Fed Listens" event.

Macro, #BTC & #ETH technical analysis: coin360.com/news/btc-afloa…

3/ Meanwhile, $ETH posted a 0.6% increase in the past 24h. From $1,260, it climbed over $1,300 at one point then came back to $1,280.

Top gainers: $CRO $XDC $FEI

Top losers: $LEO $LUNC $TON

More details in our heatmap: coin360.com

Top gainers: $CRO $XDC $FEI

Top losers: $LEO $LUNC $TON

More details in our heatmap: coin360.com

4/ @CFTC created strong criticism after the regulator fined bZeroX and its founders $250,000 for various violations, and settled the same charges against @OokiTrade DAO.

thedefiant.io/cftc-sues-dao

thedefiant.io/cftc-sues-dao

5/ In the new proposal, @harmonyprotocol shared the goal of “preserving the foundation of the #Harmony blockchain with 0% minting,” and proposed to use the foundation treasury for recovery funds.

en.ethereumworldnews.com/harmony-recove…

en.ethereumworldnews.com/harmony-recove…

6/ Singapore banking giant @dbsbank has rolled out #crypto trading for its wealth clients who are accredited investors.

forkast.news/headlines/dbs-…

forkast.news/headlines/dbs-…

7/ @Coinsquare, one of Canada's largest digital asset trading platforms, acquired @CoinSmart for an undisclosed amount.

cointelegraph.com/news/coinsquar…

cointelegraph.com/news/coinsquar…

8/ @Chain signed a four-year deal to be an official blockchain and #web3 sponsor for the @Patriots #football team.

decrypt.co/110344/nft-web…

decrypt.co/110344/nft-web…

9/ Crypto-focused finance company Delio has partnered with @BlockdaemonHQ to launch retail-focused staking services.

The firm didn’t specify which crypto assets will be included in the new staking services.

thedefiant.io/ethereum-staki…

The firm didn’t specify which crypto assets will be included in the new staking services.

thedefiant.io/ethereum-staki…

10/ @3commas_io, an automated trading bot platform for crypto, raised $37M in a Series B funding round.

@AlamedaResearch, @jump_, @TargetGlobalVC, and @tokarev_d co-led the round. A subsidiary called DeCommas will be born using the funds.

coindesk.com/business/2022/…

@AlamedaResearch, @jump_, @TargetGlobalVC, and @tokarev_d co-led the round. A subsidiary called DeCommas will be born using the funds.

coindesk.com/business/2022/…

11/ #Metaverse infrastructure developer @hadeaninc secured $30M in its Series A funding round led by @MoltenVentures.

Other investors included @EpicNewsroom, 2050 Capital, @alumniventures, Aster Capital, Entrepreneur First and InQTel.

venturebeat.com/games/hadean-r…

Other investors included @EpicNewsroom, 2050 Capital, @alumniventures, Aster Capital, Entrepreneur First and InQTel.

venturebeat.com/games/hadean-r…

12/ @acmilan is partnering with @TheMonkeyLeague on a new collection of #NFTs.

The collaboration will let fans mint Rossoneri-branded wearables and give them access to game tournaments.

coindesk.com/business/2022/…

The collaboration will let fans mint Rossoneri-branded wearables and give them access to game tournaments.

coindesk.com/business/2022/…

13/ @ValourGlobal announced the launch of its new Carbon Neutral #Bitcoin ETP on Börse Frankfurt, which begins on Sept 23.

cointelegraph.com/news/european-…

cointelegraph.com/news/european-…

14/ Other news:

World Economic Forum launches coalition to use web3, #blockchain for positive climate action: forkast.news/world-economic…

IRS targets crypto tax evaders with M.Y. Safra Bank summons over SFOX data: decrypt.co/110370/irs-tar…

World Economic Forum launches coalition to use web3, #blockchain for positive climate action: forkast.news/world-economic…

IRS targets crypto tax evaders with M.Y. Safra Bank summons over SFOX data: decrypt.co/110370/irs-tar…

15/ UK introduces law to seize, freeze and recover crypto: coindesk.com/policy/2022/09…

@sudoswap surpasses $50M in volume months after launch: theblock.co/post/172448/ro…

Russia more bullish on $BTC than ever as it legalizes crypto for international payments: zycrypto.com/russia-more-bu…

@sudoswap surpasses $50M in volume months after launch: theblock.co/post/172448/ro…

Russia more bullish on $BTC than ever as it legalizes crypto for international payments: zycrypto.com/russia-more-bu…

16/ Liking our daily digests? Like, retweet and join us on Twitter & Telegram!

We also provide you with a collection of insights from thought leaders in the Telegram channel every day 😉

Telegram chat: t.me/COIN360com

Telegram announcement: t.me/COIN360Channel

We also provide you with a collection of insights from thought leaders in the Telegram channel every day 😉

Telegram chat: t.me/COIN360com

Telegram announcement: t.me/COIN360Channel

• • •

Missing some Tweet in this thread? You can try to

force a refresh