Here's an interesting table that takes #CosmosEcosystem #crypto and compares the amounts being unbonded to the total circulating supply, as well as to the currently unbonded supply. If you hold $KUJI in particular, but also $JUNO, $AKT or $SCRT you may want to read below:

1. So, a fairly safe assumption is that any coins being unbonded are doing so to predominantly be sold. Some may be being moved to DeFi or liquid staking protocols, but I think that's a small percentage.

2. By staking a coin, it's taken out of circulation for a while. The pool that can be bought/sold becomes smaller, and therefore any buy or sell pressure has a stronger effect on price.

3. If we look at $AKT, there's an amount unbonding equal to 11.7% of the currently unbonded tokens. That's a lot - if it's sold quickly it'll definitely dump the price. However, having 87.7% bonded means people are overall confident in the project and therefore likely to buy dips

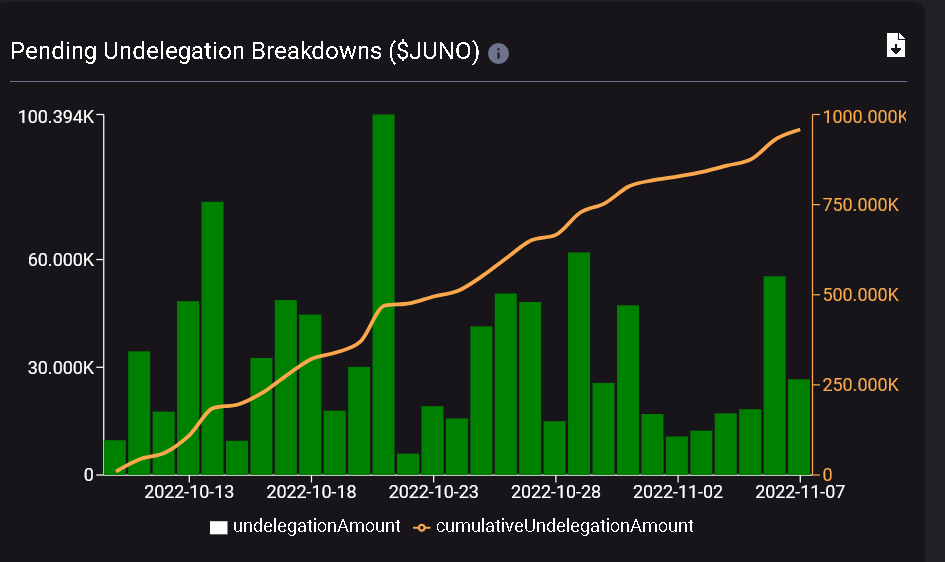

4. The same goes for $JUNO and $SCRT where there's amounts unbonding that are large compared to the unbonded amounts, but small compared to the total circulating supply.

5. $KUJI on the other hand, has a large amount unbonding (9.68% of unbonded supply) which is also a large amount of the total supply (5.98%). This almost certainly means a long-term drop in price.

6. More on $KUJI. There has been a pretty large pump over the last 24-48 hours. Consequently, looking at the unbonding info, there is a massive amount that has just been unbonded and will hit the markets on 24OCT22.

ps thanks @SmartStake for the excellent metrics.

pps.

Thank @PostTenebras2 for picking up an error in the total supply. The original table had the last half exaggerated due to pulling the wrong data. Corrected version:

Thank @PostTenebras2 for picking up an error in the total supply. The original table had the last half exaggerated due to pulling the wrong data. Corrected version:

• • •

Missing some Tweet in this thread? You can try to

force a refresh