The #Fed is watching closely the employment reports to get a better understanding where #inflation is and where it is heading.

Why they do it and what exactly are they looking for in the labor mkt to know for sure the #inflation has peaked?

Let's delve deeper.

A thread.

1/17

Why they do it and what exactly are they looking for in the labor mkt to know for sure the #inflation has peaked?

Let's delve deeper.

A thread.

1/17

The #Fed is led by theoretical concepts like the Phillips Curve.

It was first introduced in 1958 and since then updated in several versions.

All of these versions involve #inflation or wages and UR.

So let's explain it in more detail.

2/17

It was first introduced in 1958 and since then updated in several versions.

All of these versions involve #inflation or wages and UR.

So let's explain it in more detail.

2/17

wage growth = LT wage growth - f(UR) + inflation expectations

f(UR) - function of unemployment rate

High #inflation leads to higher #inflation expectations.

With higher expected #inflation workers demand higher wages.

Hence companies are forced to raise consumer prices.

3/17

f(UR) - function of unemployment rate

High #inflation leads to higher #inflation expectations.

With higher expected #inflation workers demand higher wages.

Hence companies are forced to raise consumer prices.

3/17

This way high #inflation feeds into itself through wage spirals that were common in the 1970s (Arthur Burns).

At that time #inflation expectations were unanchored.

With #CPI eclipsing 9% for the first time since the 1980s the #Fed feared wage spirals could reappear today.

4/17

At that time #inflation expectations were unanchored.

With #CPI eclipsing 9% for the first time since the 1980s the #Fed feared wage spirals could reappear today.

4/17

But #inflation expectations have remained anchored.

5y5y forward inflation expectation rate never spiked above 2.67%, lower than the 2010-2014 period.

Similarly, UoM 5yr consumer inflation expectations never went above 3.1%, lower than 2008/2011.

5/17

5y5y forward inflation expectation rate never spiked above 2.67%, lower than the 2010-2014 period.

Similarly, UoM 5yr consumer inflation expectations never went above 3.1%, lower than 2008/2011.

5/17

Also UoM 1yr consumer inflation expectations peaked at 5.4% in the neighborhood of 2008 levels.

5.4% is much lower than in the late 1970s/early 1980s when the #Fed's Paul Volcker was forced to hike aggressively (above 19%) to tame the wild #inflation expectations near 10%.

6/17

5.4% is much lower than in the late 1970s/early 1980s when the #Fed's Paul Volcker was forced to hike aggressively (above 19%) to tame the wild #inflation expectations near 10%.

6/17

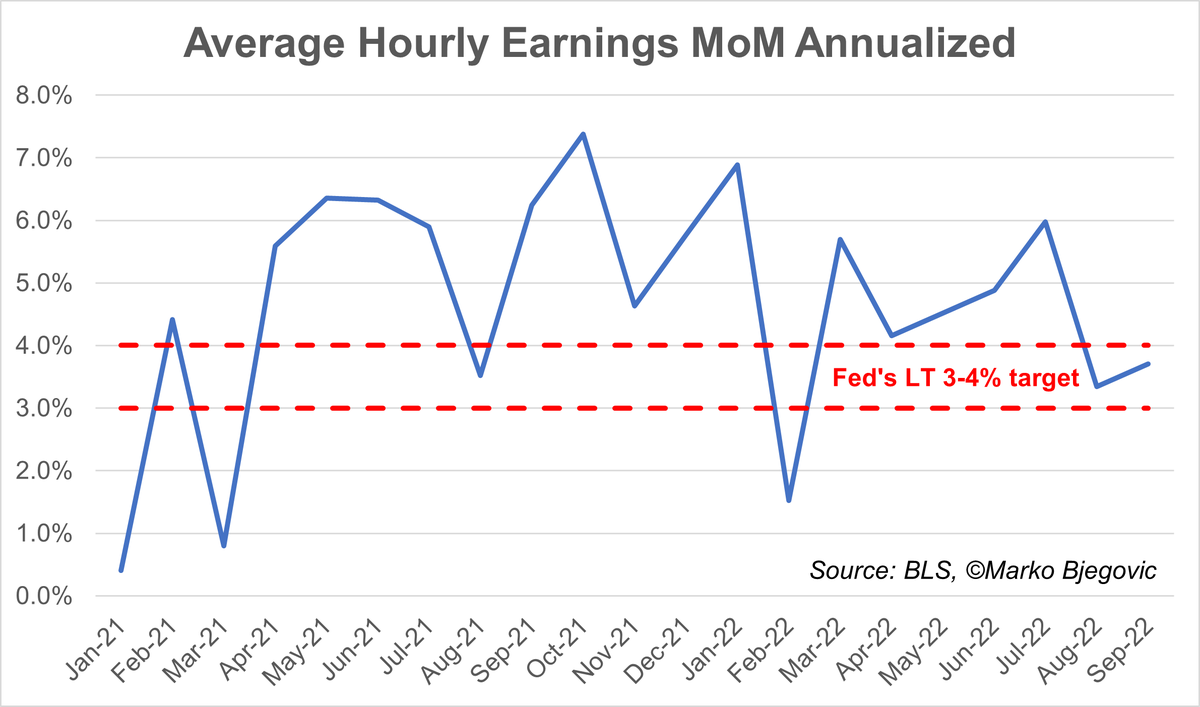

The #Fed expects a wage growth of 3-4% to be consistent with 2% #inflation.

With #inflation expectations anchored, LT wage is constant so we can remove them out of the equation to reflect:

wage growth = -f(UR)

Explanation: Lower UR increases wage growth and vice versa.

7/17

With #inflation expectations anchored, LT wage is constant so we can remove them out of the equation to reflect:

wage growth = -f(UR)

Explanation: Lower UR increases wage growth and vice versa.

7/17

NAIRU (non-accelerating inflation rate of unemployment) is UR at which #inflation is at 2% and wage growth is 3-4%.

Equation accounted for NAIRU:

wage growth = -f(UR-NAIRU)

Explanation: If UR>NAIRU wage growth is lower than 3-4% and vice versa.

8/17

Equation accounted for NAIRU:

wage growth = -f(UR-NAIRU)

Explanation: If UR>NAIRU wage growth is lower than 3-4% and vice versa.

8/17

Equation can be rearranged to account for #inflation:

core PCE = -f(UR-NAIRU) + inflation expectations

(just like with wages, inflation expectations can be omitted if anchored)

Explanation: If UR<NAIRU core #PCE (#PCE ex food, energy and supply side!)>2% and vice versa.

9/17

core PCE = -f(UR-NAIRU) + inflation expectations

(just like with wages, inflation expectations can be omitted if anchored)

Explanation: If UR<NAIRU core #PCE (#PCE ex food, energy and supply side!)>2% and vice versa.

9/17

The #Fed thinks UR is currently below NAIRU bc:

1) core #PCE is above 2% and

2) UR is low by historical standards.

This view is problematic bc:

1) official core #PCE doesn't exclude supply driven components and

2) UR had been lower in the past (1948, 1951-1953, 1968-1969)

10/17

1) core #PCE is above 2% and

2) UR is low by historical standards.

This view is problematic bc:

1) official core #PCE doesn't exclude supply driven components and

2) UR had been lower in the past (1948, 1951-1953, 1968-1969)

10/17

About 70% of the #CPI is not demand-driven (energy, food and supply side).

If we apply the same % to the #PCE, then we come to a conclusion that most of the core #PCE is not even driven by low UR.

Yet the #Fed want's UR to rise to 4.5%, 0.5 pp above their NAIRU estimate.

11/17

If we apply the same % to the #PCE, then we come to a conclusion that most of the core #PCE is not even driven by low UR.

Yet the #Fed want's UR to rise to 4.5%, 0.5 pp above their NAIRU estimate.

11/17

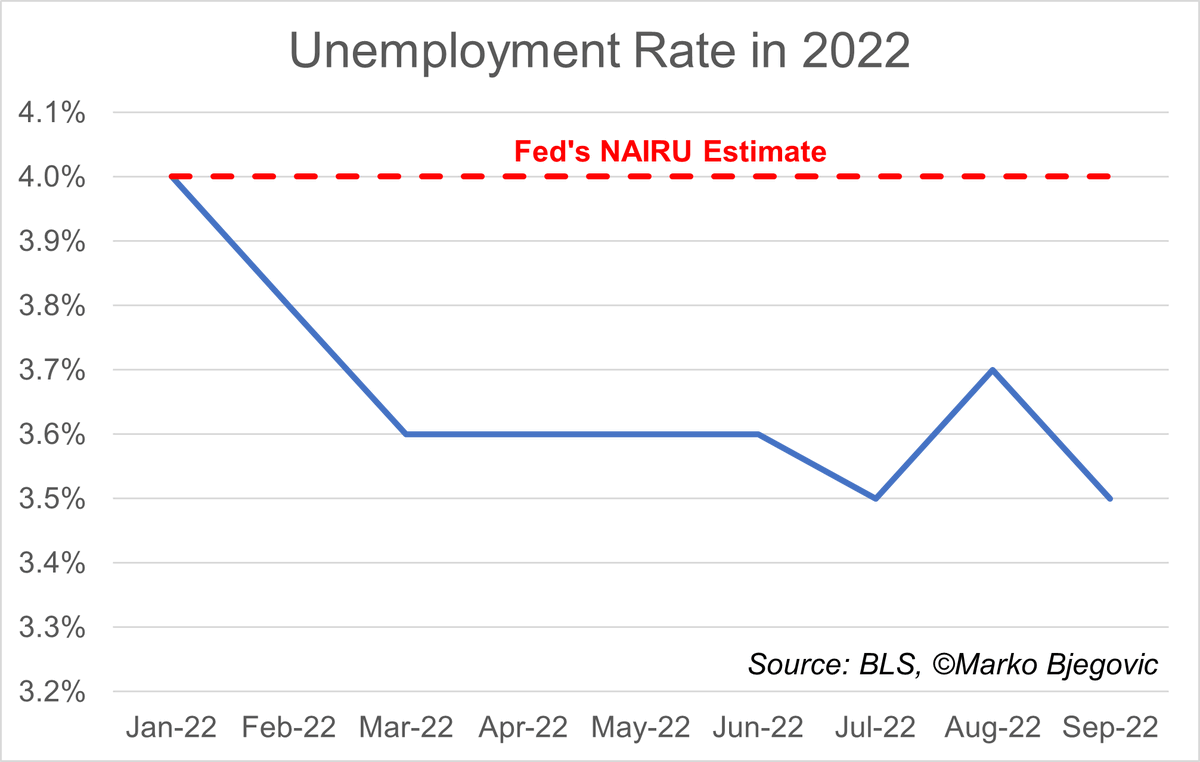

The #Fed sees NAIRU at 4% and UR has been below 4% almost YTD (since Feb).

In Aug and Sep AHE fell to 3.6% annualized.

Wage growth returning to levels consistent with 2% #inflation when UR<NAIRU is inconsistent with the Phillips Curve (NAIRU) theory.

12/17

In Aug and Sep AHE fell to 3.6% annualized.

Wage growth returning to levels consistent with 2% #inflation when UR<NAIRU is inconsistent with the Phillips Curve (NAIRU) theory.

12/17

If NAIRU is not at 4% like the #Fed thinks, but lower, say 3-3.5%, this could explain the move lower in wage growth.

Or it could be that NAIRU theory is flawed like some have suggested over the years.

Either way, this shows that low UR is mostly not driving #inflation.

13/17

Or it could be that NAIRU theory is flawed like some have suggested over the years.

Either way, this shows that low UR is mostly not driving #inflation.

13/17

The #Fed's problems:

1) they are following lagging indicators (#CPI, NFPs) to see where the #inflation is/going

2) they think they need to increase UR to 4.5% to decrease #inflation

3) by front-loading rate hikes they are not respecting time lags

14/17

1) they are following lagging indicators (#CPI, NFPs) to see where the #inflation is/going

2) they think they need to increase UR to 4.5% to decrease #inflation

3) by front-loading rate hikes they are not respecting time lags

https://twitter.com/MBjegovic/status/1577446236004749314?s=20&t=a9B4sqihG9oVj0QYjQXfQA

14/17

This leads to a serious overshoot and a possible #depression.

Lately some #Fed officials (Brainard, Evans...) have mentioned they are wary of the time lag and watching the situation closely.

It's a step in positive direction but a more determined approach is needed.

15/17

Lately some #Fed officials (Brainard, Evans...) have mentioned they are wary of the time lag and watching the situation closely.

It's a step in positive direction but a more determined approach is needed.

15/17

These threads take a lot of time and effort to write.

If you like the content, please love and retweet to help me spread the message.

16/17

If you like the content, please love and retweet to help me spread the message.

16/17

So the #Fed will need to change its course (#pivot) soon if they are to avoid a severe economic downturn after all the rate hikes really kick in.

This could be an even more severe problem than this #inflation.

More about the #Fed pivot story:

17/17

This could be an even more severe problem than this #inflation.

More about the #Fed pivot story:

https://twitter.com/MBjegovic/status/1577446150801604610?s=20&t=TgzK1yVtyfI-GREGPvOL9w

17/17

• • •

Missing some Tweet in this thread? You can try to

force a refresh