What is options trading?

Options are used in different ways depending on investors' goals and how they plan to use them.

Learn more in this Thread 🧵 with @Stocktwit_IN & @valuelevels

#optionbuying

#optionstrade

#OptionChain

#bankniftyoption

Options are used in different ways depending on investors' goals and how they plan to use them.

Learn more in this Thread 🧵 with @Stocktwit_IN & @valuelevels

#optionbuying

#optionstrade

#OptionChain

#bankniftyoption

An investor's portfolio consists of various financial instruments like stocks, exchange traded funds (ETFs), mutual funds and bonds. However, the Options are altogether different. Options are used in different ways depending upon investors' goals and how they plan to use them....

Investors often use options to reduce the risk associated with the stock they have in their portfolio. Similarly, others may use options to earn additional income. Most importantly, options provide an opportunity to traders or investors to benefit from the price movement ...

Options are defined as derivatives instruments that enable buyer (holder/owner) of the instrument to buy or sell the underlying asset. Right to buy or sell is without any obligation. Seller of option is, however, obligated to buy or sell, should buyer exercise his or her right

Simply put, option trading includes:

- A right to buy or sell, but not an obligation

- Buy or sell at predetermined price

- Buy or sell on or before predetermined date

Learn more- bit.ly/3MKtIpE

- A right to buy or sell, but not an obligation

- Buy or sell at predetermined price

- Buy or sell on or before predetermined date

Learn more- bit.ly/3MKtIpE

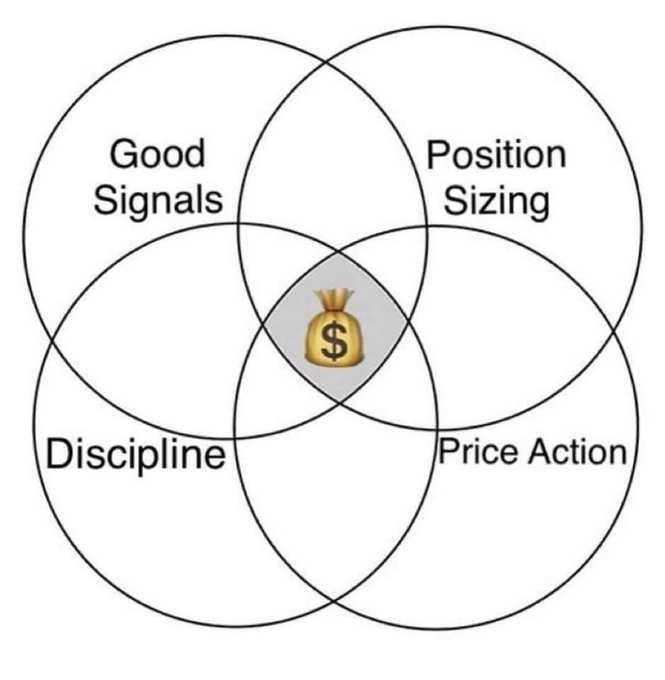

There are three components that have a strong and direct impact on option prices:

- Intrinsic value

- Time value

- Volatility

- Intrinsic value

- Time value

- Volatility

Benefits of options trading

Let's understand how options differ from the other financial instruments and how a trader can use them effectively to minimise risks and maximise profits.

bit.ly/3MKtIpE

Let's understand how options differ from the other financial instruments and how a trader can use them effectively to minimise risks and maximise profits.

bit.ly/3MKtIpE

• • •

Missing some Tweet in this thread? You can try to

force a refresh