When it comes to #Momentum investing or rather any other type of investing, knowing when to exit > knowing when to enter!!

#MostlyMomentum #investing #StockMarket

👇🏻

#MostlyMomentum #investing #StockMarket

👇🏻

Following are few basic types of technical ratios, indicators, other methods, etc., you can use for exits. This is mainly for rule based investing, and non-discretionary type of investments!

All following examples are just for illustration purpose, go with what suits your behavior as an investor, but once selected, do not change it again and again.

I am using default settings, test and try what works best for you, I use some of these to check potential candidates for exits.

1. Hard Stop loss: Meaning certain % from investment rate; e.g., 10%, e.g., if you bought something at 1000, your stoploss in this case would be 900.

2. Basic Trailing stoploss: e.g. If you bought something at 1000, and it goes till 5000, you should ideally not wait for 900, so your trailing stoploss should be 5000*90% i.e., 4500.

3. #RSI: Default settings are 30-70, that means below 30 you sell.

investopedia.com/terms/r/rsi.asp

4. #MACD: MACD line cuts the MACD Signal line from below: “Buy,” and vice versa.

investopedia.com/terms/m/macd.a…

investopedia.com/terms/r/rsi.asp

4. #MACD: MACD line cuts the MACD Signal line from below: “Buy,” and vice versa.

investopedia.com/terms/m/macd.a…

5. #ADX: ADX basically tells the strength in the trend, so this cannot be used alone, buy lower ADX means there is no strength in the trend, so you can exit when there is no strength.

investopedia.com/articles/tradi…

investopedia.com/articles/tradi…

6. #MovingAverages: Sell if the stock falls below the moving average line.

7. Moving Average Crossovers: Sell when the lower period moving average line crosses higher period line from above.

investopedia.com/terms/m/moving…

7. Moving Average Crossovers: Sell when the lower period moving average line crosses higher period line from above.

investopedia.com/terms/m/moving…

8. #Supertrend: It is by default a Volatility adjusted trailing stoploss; if you have no idea what it is, do check, sell when stock price goes below Supertrend line.

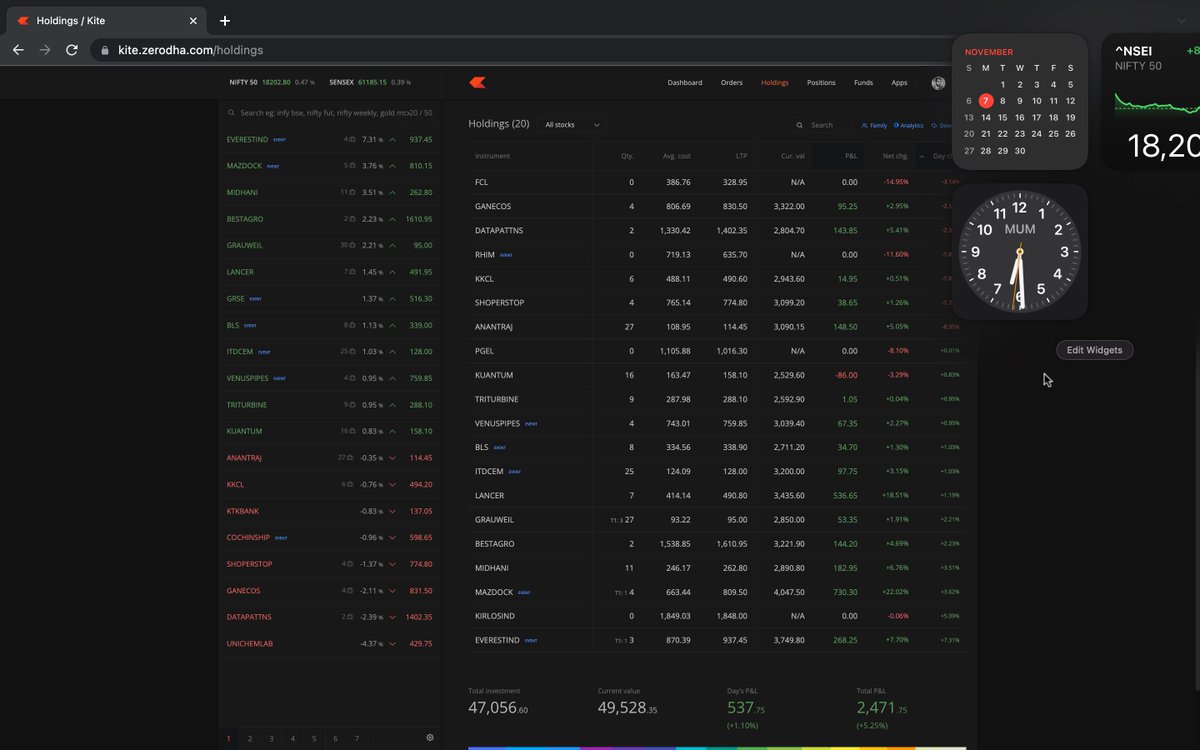

I do not know how to read chart patterns; but I have been doing Momentum Investing since almost 5 years; you can too, few other points related to exiting a stock in #Momentum investing:

a. Sell when your system says “Sell” don’t go looking for reasons not to sell just because you have a gut feeling.

b. Don’t regret if you sold something and it doubles in next few days, there is no one way of Momentum Investing.

b. Don’t regret if you sold something and it doubles in next few days, there is no one way of Momentum Investing.

c. Momentum investing does not mean short term investing; I will show you some examples after this list; that momentum did not end for years together.

d. If you do not have a new stock after exiting; cash can form part of your Momentum portfolio.

d. If you do not have a new stock after exiting; cash can form part of your Momentum portfolio.

Few examples of Long-Term Stocks that did not break Default “Supertrend” line and Default RSI for years (Monthly Timeframe), just for illustration purposes, no recommendations:

Atul Limited: Sep 2009 (86) till date (8400) IRR 42%;

Atul Limited: Sep 2009 (86) till date (8400) IRR 42%;

Bajaj Finance: July 2009 (19) to Mar 2020 (2200) IRR 56%;

Aarti Industries: Dec 2007 (11) till date (740) IRR 33%.

Aarti Industries: Dec 2007 (11) till date (740) IRR 33%.

So, my basic points above are:

1. In Momentum investing keep stop losses;

2. Do not get emotionally attached to a particular stock;

3. Get rid of losers, ride the winners;

1. In Momentum investing keep stop losses;

2. Do not get emotionally attached to a particular stock;

3. Get rid of losers, ride the winners;

4. Use combinations of 1-3 indicators as stoploss; do not use all available indicators, it will mess you up;

5. Do not keep changing indicators, saying it with experience, it will hurt you;

5. Do not keep changing indicators, saying it with experience, it will hurt you;

6. Decide your timeframe, frequency of checking conditions and number of stocks does not matter 10 or 200;

7. Personal Bias point: I do not like ETFs very much; if you cannot plan well, there are 8 momentum/ alpha based indices by NSE, check those.

7. Personal Bias point: I do not like ETFs very much; if you cannot plan well, there are 8 momentum/ alpha based indices by NSE, check those.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh