I've been saying this the whole yr.

Earlier many disagreed saying the #Fed needs to go to 4, 5, 9%... to "kill" the #inflation but, just as I was saying, it turned out the #Fed can't do a thing to this #inflation as it's running its course no matter what the #Fed does.

🧵

1/22

Earlier many disagreed saying the #Fed needs to go to 4, 5, 9%... to "kill" the #inflation but, just as I was saying, it turned out the #Fed can't do a thing to this #inflation as it's running its course no matter what the #Fed does.

🧵

1/22

https://twitter.com/darioperkins/status/1596427807856680960

In hindsight what could have the #Fed done differently?

Their first policy mistake was not starting hiking #FFR in Mar 2021.

Still, I don't think they could have done much to this #inflation.

Maybe the peak #CPI YoY would be 8%-ish instead of 9.1% but not much less.

2/22

Their first policy mistake was not starting hiking #FFR in Mar 2021.

Still, I don't think they could have done much to this #inflation.

Maybe the peak #CPI YoY would be 8%-ish instead of 9.1% but not much less.

2/22

This is bc of the nature of this #inflation which was mostly caused by factors out of the #Fed's control.

Here is more on that (bear in mind this estimate was done in the early stages of hikes - I think May- by now MP has long eclipsed the demand %)

3/22

Here is more on that (bear in mind this estimate was done in the early stages of hikes - I think May- by now MP has long eclipsed the demand %)

https://twitter.com/MBjegovic/status/1579869162268393475?s=20&t=fcpPfsoKpItTsSQJIUaJhQ

3/22

One could ask why should the #Fed hike at all if they can't do much to this #inflation?

There are 2 reasons:

1) #inflation expectations

2) political risk

4/22

There are 2 reasons:

1) #inflation expectations

2) political risk

4/22

1) If the #Fed was inactive, economic participants would start to factor in high #inflation expectations and high #inflation would become a self-fulfilling prophecy like it did in the 1970s.

But 2022 is different from that period for 2 main reasons:

5/22

But 2022 is different from that period for 2 main reasons:

https://twitter.com/MBjegovic/status/1589283164874510337?s=20&t=mnMcN_Fzn_mqbAizL6ubjg

5/22

2) High #inflation can create political risk for the administration in place.

Although reducing political risk is not the #Fed's official goal, the #Fed has long been used to support administrations in any way that it can.

6/22

Although reducing political risk is not the #Fed's official goal, the #Fed has long been used to support administrations in any way that it can.

6/22

In 2021 the #Fed was widely criticized for their "transitory" stance on the #inflation.

And actually they've been right, it is transitory, only it took longer to "transit" than most ppl believed.

This created way too much political damage to the current administration.

7/22

And actually they've been right, it is transitory, only it took longer to "transit" than most ppl believed.

This created way too much political damage to the current administration.

7/22

Then the #Fed started playing catch-up with the #inflation.

They started slow but soon accelerated to a pace last seen in the 1980s.

This catch-up led to another policy mistake that is even bigger, and will prove to be far more costly, than the one they made last yr.

8/22

They started slow but soon accelerated to a pace last seen in the 1980s.

This catch-up led to another policy mistake that is even bigger, and will prove to be far more costly, than the one they made last yr.

8/22

I'm talking about a mistake of continuing to hike in a disinflationary environment.

Despite what they say, the #Fed has ignored the MP lags.

If they didn't, they would have paused in Sep (after +225 bps in just 4M) to assess how the #economy is doing.

9/22

Despite what they say, the #Fed has ignored the MP lags.

If they didn't, they would have paused in Sep (after +225 bps in just 4M) to assess how the #economy is doing.

9/22

I will say #economy-wise it would have been way better for the #Fed to have let the "transitory" talk in place all along than what they've done in the last few M.

Let's say 0 rates were kept but (this is crucial!) B/S contracted (like it did) dragging the M2 down as well.

10/22

Let's say 0 rates were kept but (this is crucial!) B/S contracted (like it did) dragging the M2 down as well.

10/22

This way the #Fed:

1) doesn't worsen the #economy by hiking rates

2) puts a cap on potential #inflation bc M2 drops

The only problem is how to explain it the critics why it left 0 rates with raging #inflation.

This also carries a political risk as well.

11/22

1) doesn't worsen the #economy by hiking rates

2) puts a cap on potential #inflation bc M2 drops

The only problem is how to explain it the critics why it left 0 rates with raging #inflation.

This also carries a political risk as well.

11/22

So to recap, the #Fed could employ:

1) the best strategy - starting raising rates in Mar 2021 and hiking (multiple times) 25, 50, potentially 75 to reach 225 bps and then stop + reducing B/S and M2

2) 2nd best strategy - leaving 0 rates all along but reducing B/S and M2

12/22

1) the best strategy - starting raising rates in Mar 2021 and hiking (multiple times) 25, 50, potentially 75 to reach 225 bps and then stop + reducing B/S and M2

2) 2nd best strategy - leaving 0 rates all along but reducing B/S and M2

12/22

The #Fed chose neither 1) nor 2) but to play catch-up.

Instead of pausing in Sep it hiked another 150 bps and is now saying they'll hike another 100 bps or even more before they even think about pausing.

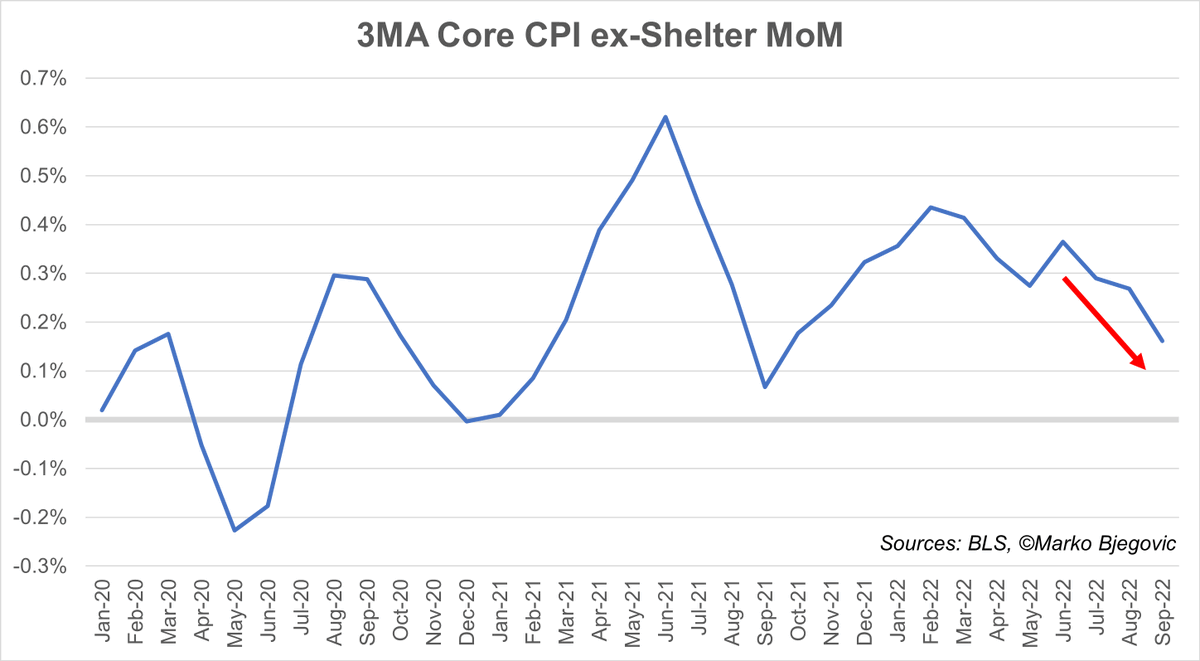

At the same time #inflation is dissipating:

13/22

Instead of pausing in Sep it hiked another 150 bps and is now saying they'll hike another 100 bps or even more before they even think about pausing.

At the same time #inflation is dissipating:

https://twitter.com/MBjegovic/status/1590826241854251008?s=20&t=B61-3MiuoeLqVbMGQLq6Qg

13/22

Now more and more economists are starting to realize disinflation is happening.

Pendulum is swinging and it won't be long before #inflation talks are swapped with #deflation (not disinflation!) talks.

#Fed

14/22

Pendulum is swinging and it won't be long before #inflation talks are swapped with #deflation (not disinflation!) talks.

#Fed

14/22

Crucial issue are MP time lags, which the #Fed estimates are 12M-18M.

Hence we still haven't seen the full impact of that first (smallest) hike in Mar, let alone all the giant ones that followed.

So what will happen when +375 bps (and counting) take full effect?

15/22

Hence we still haven't seen the full impact of that first (smallest) hike in Mar, let alone all the giant ones that followed.

So what will happen when +375 bps (and counting) take full effect?

15/22

This will depend on whether the #Fed leaves the rates high long enough for the hikes to take full effect.

In that case the #Fed wouldn't cut for 1 yr+ from now which could create a severe #recession.

Still, I don't see this as a plausible scenario.

16/22

In that case the #Fed wouldn't cut for 1 yr+ from now which could create a severe #recession.

Still, I don't see this as a plausible scenario.

16/22

Instead I think the #Fed would cut rates before all these hikes take effect which would, in the end, ease the (economic) downward effect.

I also think, at this point, the #Fed has greatly overdone it and at some point it will be forced to cut aggressively.

#recession

17/22

I also think, at this point, the #Fed has greatly overdone it and at some point it will be forced to cut aggressively.

#recession

17/22

For now the #Fed is still able to sell their "high" and "sticky" #inflation narrative.

I've explained how and why #inflation is neither "high" nor "sticky".

A complete overview and explanations in this thread:

18/22

I've explained how and why #inflation is neither "high" nor "sticky".

A complete overview and explanations in this thread:

https://twitter.com/MBjegovic/status/1592870093482233859?s=20&t=5sN6TSFk_Z-gJrZrC8jifA

18/22

I also think the #Fed is aware their #inflation narrative is incorrect but are using it to cover some other agenda.

Here is more on this:

19/22

Here is more on this:

https://twitter.com/MBjegovic/status/1594386099140435968?s=20&t=alebTT6Dc8LrVf_MKLXNwA

19/22

So now we come to the THE Q of all Qs - when will the #Fed pause/cut rates?

This Q is equivalent to the Q - when will the #Fed stop selling their incorrect high&sticky narrative?

20/22

This Q is equivalent to the Q - when will the #Fed stop selling their incorrect high&sticky narrative?

20/22

These threads take a lot of time and effort to write.

If you like the content, please love and retweet to help me spread the message.

21/22

If you like the content, please love and retweet to help me spread the message.

21/22

The answer to that Q of all Qs requires a bit more elaboration that transcends the ability of the $TWTR space.

More about the #Fed's hidden agenda and what would need to happen for them to finally change course I will elaborate in my 2nd Workshop.

Stay tuned.

22/22

More about the #Fed's hidden agenda and what would need to happen for them to finally change course I will elaborate in my 2nd Workshop.

Stay tuned.

22/22

• • •

Missing some Tweet in this thread? You can try to

force a refresh