1/24 Derivatives products in #DEFI include a lot of things. Future yield trading is one of those =>

@pendle_fi allows users to tokenize and sell future yields & just launched their V2.

So what’s new for users?

All you need to know about Pendle Finance in this 🧵👇:

@pendle_fi allows users to tokenize and sell future yields & just launched their V2.

So what’s new for users?

All you need to know about Pendle Finance in this 🧵👇:

2/24 First of all, if you don’t know what is FUTURE YIELD trading, I would like to congratulate the team for making a pretty interesting webpage to explain all of this:

app.pendle.finance/pro/learn

Learn anon!🧑🎓

app.pendle.finance/pro/learn

Learn anon!🧑🎓

3/24 Pendle Finance launched mid-2021 on #ethereum and also on #Avalanche November 2021

The protocol managed to secure 3.7m$ in a VC fund raising in May 2021

finance.yahoo.com/news/pendle-ra…

That helped the protocol to kick start their product.

The protocol managed to secure 3.7m$ in a VC fund raising in May 2021

finance.yahoo.com/news/pendle-ra…

That helped the protocol to kick start their product.

4/24 Before rolling out V2 details, consider:

- Yield Bearing Asset: Token issued as a proof of deposit,increases in value over time

- Principal Token (PT): Underlying token

- Yield token (YT): Yield generated over time

- Contract: Duration for which maturity is reached

- Yield Bearing Asset: Token issued as a proof of deposit,increases in value over time

- Principal Token (PT): Underlying token

- Yield token (YT): Yield generated over time

- Contract: Duration for which maturity is reached

5/24 Continued:

➡️1 PT gives you the right to redeem 1 unit of underlying asset upon maturity

➡️1 YT gives you the right to receive yields on 1 unit of the underlying asset from now until maturity, claimable in real-time

➡️1 PT gives you the right to redeem 1 unit of underlying asset upon maturity

➡️1 YT gives you the right to receive yields on 1 unit of the underlying asset from now until maturity, claimable in real-time

6/24 How do you mint PT/YT?

See picture below

After 73days you end up having 1,050$ USDC = Yield of USDC on @BenqiFinance of 25% (APY 30%)

See picture below

After 73days you end up having 1,050$ USDC = Yield of USDC on @BenqiFinance of 25% (APY 30%)

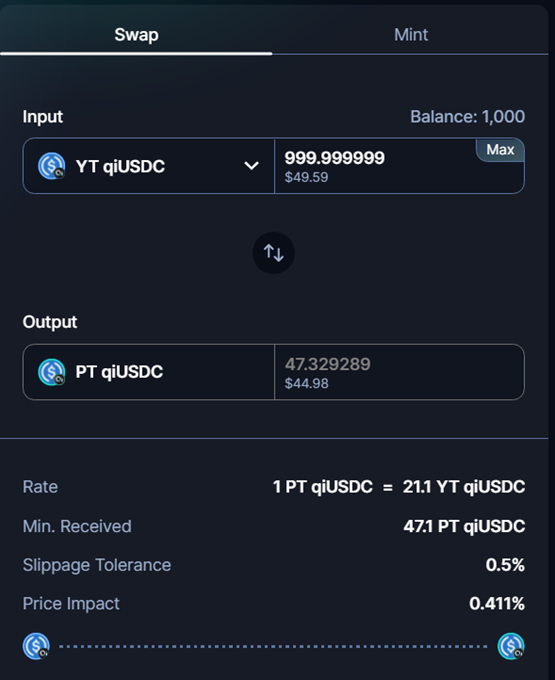

7/24 Strategy1: Fixed yield

If i expect Yield on @BenqiFinance to decrease :

After minting PT & YT, I will swap my YT into more PT and end up by having 1047 PT $qiUSDC

After 73 days, I will redeem: 1,050$ $USDC, securing is the initial yield!

#savingaccount

If i expect Yield on @BenqiFinance to decrease :

After minting PT & YT, I will swap my YT into more PT and end up by having 1047 PT $qiUSDC

After 73 days, I will redeem: 1,050$ $USDC, securing is the initial yield!

#savingaccount

8/24 There are different strategies, as you can also long the yield by selling your PT into more YT.

But let’s not dig too much there, as now it’s time to roll out the news about the new V2 AMM released by @pendle_fi

But let’s not dig too much there, as now it’s time to roll out the news about the new V2 AMM released by @pendle_fi

https://twitter.com/pendle_fi/status/1597567793268133890?s=20&t=JU1-6l4Qo_-S3EXJDIqYBA

9/24 Improvements from V1 are:

1⃣Minimal IL for LPs

2⃣Improvement of capital efficiency

3⃣Low-slippage trades

4⃣Greater earnings for LPs

5⃣Optimized AMM

1⃣Minimal IL for LPs

2⃣Improvement of capital efficiency

3⃣Low-slippage trades

4⃣Greater earnings for LPs

5⃣Optimized AMM

10/24 Capital efficiency

PTs and YTs can be now traded on a single pool of PT Liquidity.

Liquidity Providers will thus earn fees from the 2 markets.

Remember the basics of a Liquidity Pool flywheel:

PTs and YTs can be now traded on a single pool of PT Liquidity.

Liquidity Providers will thus earn fees from the 2 markets.

Remember the basics of a Liquidity Pool flywheel:

11/24 Optimized AMM

Take the best thing of @Uniswap V3 (Concentrated liquidity) ➕ add a dynamic AMM curve fit for purpose for Yield Trading 🟰you end in a special Yield trading platform.

coinmarketcap.com/alexandria/glo…

Take the best thing of @Uniswap V3 (Concentrated liquidity) ➕ add a dynamic AMM curve fit for purpose for Yield Trading 🟰you end in a special Yield trading platform.

coinmarketcap.com/alexandria/glo…

12/24 Reduction of Impermanent Loss

LP comprises the yield bearing asset & it’ associated PT (stETH / PTstETH).

As both tokens are correlated, there is no IL.

You don’t know what’s IL? Check below:

LP comprises the yield bearing asset & it’ associated PT (stETH / PTstETH).

As both tokens are correlated, there is no IL.

You don’t know what’s IL? Check below:

https://twitter.com/Subli_Defi/status/1549744293061042177?s=20&t=DNzxL3SS7C18CgScVigPng

13/24 But as seen above, what’s the incentives for LPers to play this game?

Now Liquidity Providers will earn:

🥇Swap fees

🥈PENDLE incentives

🥉Yields from yield bearing asset

🍾Fixed yield from provided PT

Now Liquidity Providers will earn:

🥇Swap fees

🥈PENDLE incentives

🥉Yields from yield bearing asset

🍾Fixed yield from provided PT

14/24 Additional Features to ease User Experience:

- ZAP-in/out function: Allows a user to provide/withdraw from LP using one single token

- Dynamic fees

- New TWAP oracle

Etc…

- ZAP-in/out function: Allows a user to provide/withdraw from LP using one single token

- Dynamic fees

- New TWAP oracle

Etc…

15/24 However what was the real changer was the use of an extended version of ERC-4626 called EIP-5115 also called Standardized Yield Token.

TLDR: all type of yield bearing asset (LP token, and others)

medium.com/pendle/pendle-…

TLDR: all type of yield bearing asset (LP token, and others)

medium.com/pendle/pendle-…

16/24 SY Token allows :

➡️Permissionless listing new pools on @pendle_fi

➡️ 📈 Composability: other protocols can build on top of their SY token

➡️Ability to scale is passed to external projects, letting the team to focus on❔❔

➡️Permissionless listing new pools on @pendle_fi

➡️ 📈 Composability: other protocols can build on top of their SY token

➡️Ability to scale is passed to external projects, letting the team to focus on❔❔

17/24 Going #crosschain

This is the current trend in #DeFi as we have seen this recently with:

@ConvexFinance deployed on #Arbitrum

This is the current trend in #DeFi as we have seen this recently with:

@ConvexFinance deployed on #Arbitrum

https://twitter.com/ConvexFinance/status/1593267816555319299?s=20&t=DNzxL3SS7C18CgScVigPng

19/24 Finally, it’s hard to talk about the fundamentals of a project without going through its #Tokenomics

Following the current trend, @pendle_fi will accelerate:

1⃣Decentralization

2⃣Revenue sharing model aka #RealYield

Following the current trend, @pendle_fi will accelerate:

1⃣Decentralization

2⃣Revenue sharing model aka #RealYield

20/24 Decentralization

$PENDLE is the governance token

The new tokenomics is based on @CurveFinance , the longer you lock the more vePENDLE you get

I definitely suggest you listen to this interview with OG @kaiynne

$PENDLE is the governance token

The new tokenomics is based on @CurveFinance , the longer you lock the more vePENDLE you get

I definitely suggest you listen to this interview with OG @kaiynne

21/24 #RealYield

Lockers will earn:

1⃣Protocol fees

2⃣Rewards Boosting (LPers can boost their rewards by locking $PENDLE)

I see more and more protocols adopting this philosophy, the most recent one being @iearnfinance

Lockers will earn:

1⃣Protocol fees

2⃣Rewards Boosting (LPers can boost their rewards by locking $PENDLE)

I see more and more protocols adopting this philosophy, the most recent one being @iearnfinance

22/24 Some tricks have been made on this tokenomics 🥷

Voters will also receive a share of the fees from the pools they voted for

And finally, boosting LM will be crosschain so that everybody can benefit from this system, taking example from @balancerlabs

Voters will also receive a share of the fees from the pools they voted for

And finally, boosting LM will be crosschain so that everybody can benefit from this system, taking example from @balancerlabs

23/24 So in a nutshell, I see @pendle_fi product built around the on-going narratives in #DEFI:

✅Decentralization

✅Aligning long term holders with project longevity

✅Crosschain

✅Derivatives narratives for 2023

If you want to know more about V2:

✅Decentralization

✅Aligning long term holders with project longevity

✅Crosschain

✅Derivatives narratives for 2023

If you want to know more about V2:

https://twitter.com/pendle_fi/status/1597567793268133890?s=20&t=xYH0F4rOowJ9OMWjSD7rjw

24/24 Congratulations to @pendle_fi V2 who managed to secure partnership with Key leaders with

@LayerZero_Labs & @KyberNetwork

@LayerZero_Labs & @KyberNetwork

I would like to thank the team, who sponsored this thread, for their time and technical clarifications brought to fine tune my understanding of this protocol.

A very interesting discovery!

Thanks to retweet this post if you like it:

A very interesting discovery!

Thanks to retweet this post if you like it:

https://twitter.com/Subli_Defi/status/1597953745295650816?s=20&t=67M2QBMfCPAww-roRpHLnA

Tagging some shads who are experienced enough to see the added value of such #DeFi solutions:

@rektdiomedes

@Ceazor7

@TheDeFinvestor

@DAdvisoor

@ViktorDefi

@crypto_linn

@DeFi_Made_Here

@alpha_pls

@milesdeutscher

@defi_naly

@mastermojo83

@rektdiomedes

@Ceazor7

@TheDeFinvestor

@DAdvisoor

@ViktorDefi

@crypto_linn

@DeFi_Made_Here

@alpha_pls

@milesdeutscher

@defi_naly

@mastermojo83

• • •

Missing some Tweet in this thread? You can try to

force a refresh