How big is the market for L1s like $ETH, $SOL, $AVAX, $ATOM, $ADA, $NEAR, $TRON, etc…?

While predicting the future is difficult, I believe it’s at least $35 trillion

This means that many L1s still have the potential for 100x to 1,000x returns

Here’s my rationale…

🧵

👇

While predicting the future is difficult, I believe it’s at least $35 trillion

This means that many L1s still have the potential for 100x to 1,000x returns

Here’s my rationale…

🧵

👇

2/15

The following thread is relatively short (15 tweets) but it will cover a lot:

• What are Layer 1s?

• What is the total addressable market of #L1 coins?

• What is the serviceable obtainable market for L1 coins?

• What does this imply for returns?

The following thread is relatively short (15 tweets) but it will cover a lot:

• What are Layer 1s?

• What is the total addressable market of #L1 coins?

• What is the serviceable obtainable market for L1 coins?

• What does this imply for returns?

3/15

🔶 What are Layer 1s?

Layer 1s – also known as “smart contract platforms” - are the computer networks that run #Web3

The most popular L1s by market cap are $ETH, $BNB, $ADA, $MATIC, $DOT, $TRX, $SOL, $AVAX, $ATOM, $XLM, $ALGO and $NEAR

🔶 What are Layer 1s?

Layer 1s – also known as “smart contract platforms” - are the computer networks that run #Web3

The most popular L1s by market cap are $ETH, $BNB, $ADA, $MATIC, $DOT, $TRX, $SOL, $AVAX, $ATOM, $XLM, $ALGO and $NEAR

4/15

A #Layer1 can do anything a traditional computer can do including:

• Execute programs (smart contracts)

• Host applications (dApps)

• Access financial products (DeFi)

• Trade digital goods (NFT)

• Host digital businesses (DAOs)

A #Layer1 can do anything a traditional computer can do including:

• Execute programs (smart contracts)

• Host applications (dApps)

• Access financial products (DeFi)

• Trade digital goods (NFT)

• Host digital businesses (DAOs)

5/15

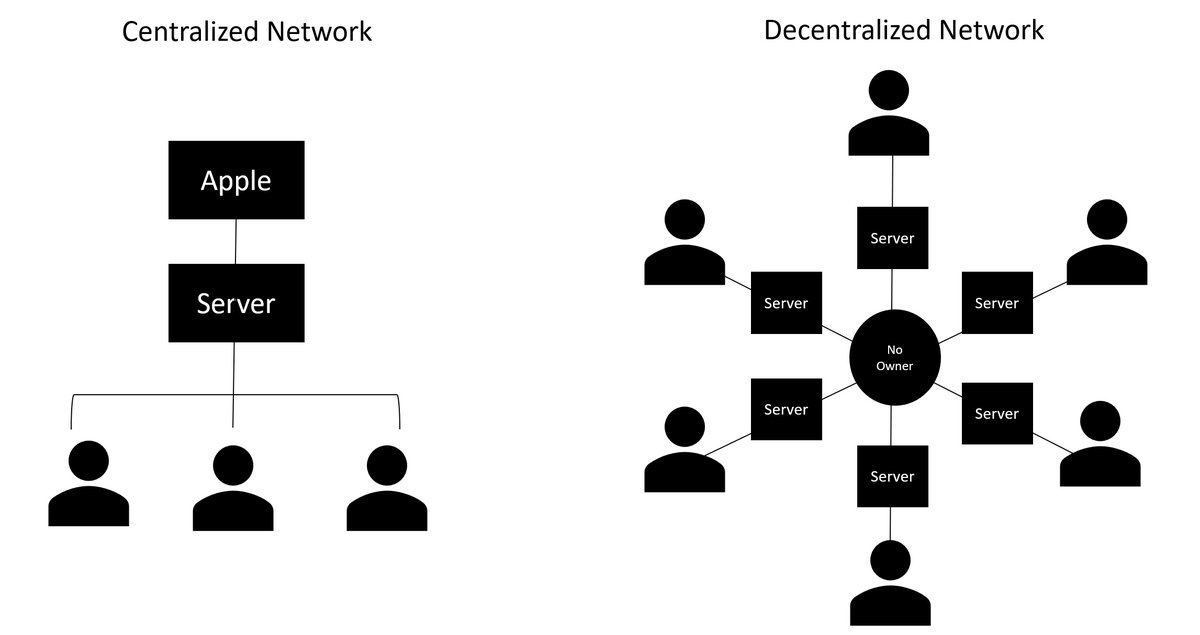

Unlike traditional computer networks, Layer 1s are “decentralized” and “distributed"

This means that no one party can control the network and no one can ever turn them off or shut them down

This is why many refer to Layer 1s as “shared world computers”

Unlike traditional computer networks, Layer 1s are “decentralized” and “distributed"

This means that no one party can control the network and no one can ever turn them off or shut them down

This is why many refer to Layer 1s as “shared world computers”

6/15

Layer 1s have the potential to create FULLY AUTONOMOUS ONLINE ECONOMIES

These economies will operate outside the purview of the existing financial, legal and political ecosystem

The native coins of these L1s will become the currency of these "digital nations"

Layer 1s have the potential to create FULLY AUTONOMOUS ONLINE ECONOMIES

These economies will operate outside the purview of the existing financial, legal and political ecosystem

The native coins of these L1s will become the currency of these "digital nations"

7/15

🔶 The TAM of Layer 1 Coins

The total addressable market opportunity for Layer 1 coins is immense

In short, they can function as a replacement for traditional money and, as such, could capture a significant share of global M3

🔶 The TAM of Layer 1 Coins

The total addressable market opportunity for Layer 1 coins is immense

In short, they can function as a replacement for traditional money and, as such, could capture a significant share of global M3

8/15

In fact, if we compare #cryptocurrencies to fiat currencies using the six properties of money — durability, portability, uniformity, divisibility, scarcity and acceptability, we see that they are superior in almost every category

In fact, if we compare #cryptocurrencies to fiat currencies using the six properties of money — durability, portability, uniformity, divisibility, scarcity and acceptability, we see that they are superior in almost every category

9/15

Indeed, Layer 1 coins are already being used as money:

• Store-of-Value: They are the preferred form of collateral for #DeFi protocols

• Unit of account: Most #NFTs are priced in crypto

• Medium of exchange: Many #dApps only accept #crypto as a medium of exchange

Indeed, Layer 1 coins are already being used as money:

• Store-of-Value: They are the preferred form of collateral for #DeFi protocols

• Unit of account: Most #NFTs are priced in crypto

• Medium of exchange: Many #dApps only accept #crypto as a medium of exchange

10/15

As such, we can make a reasonable argument that the TAM for #cryptocurrencies is $137T, the global M3 base

As such, we can make a reasonable argument that the TAM for #cryptocurrencies is $137T, the global M3 base

11/15

🔶 The SOM of Layer 1 Coins

While the thought of the digital currencies replacing physical ones may seem ridiculous, such a feat is not without precedent as there is a long history of disruptive technologies stealing market share from incumbents

🔶 The SOM of Layer 1 Coins

While the thought of the digital currencies replacing physical ones may seem ridiculous, such a feat is not without precedent as there is a long history of disruptive technologies stealing market share from incumbents

12/15

For instance:

• Digital entertainment is 72% of all entertainment revenue

• Online advertising makes up 2/3rds of total advertising

• Global eCommerce sales are approximately 20% of total retail sales and expected to grow to nearly 25% by 2025

For instance:

• Digital entertainment is 72% of all entertainment revenue

• Online advertising makes up 2/3rds of total advertising

• Global eCommerce sales are approximately 20% of total retail sales and expected to grow to nearly 25% by 2025

13/15

As #cryptocurrencies mature, they too will likely begin to take share

While how much is still up for debate, we can start to make some predictions using digital penetration in other industries

As #cryptocurrencies mature, they too will likely begin to take share

While how much is still up for debate, we can start to make some predictions using digital penetration in other industries

14/15

Let’s take a conservative estimate though, and assume that cryptocurrencies can capture 25% of the global M3 base within the next 10–30 years (in line with the penetration of eCommerce into physical commerce)

That will yield a SOM of $34.5 trillion

Let’s take a conservative estimate though, and assume that cryptocurrencies can capture 25% of the global M3 base within the next 10–30 years (in line with the penetration of eCommerce into physical commerce)

That will yield a SOM of $34.5 trillion

15/15

Given that the total market capitalization of all Layer 1 coins is currently less than $300B, it is clear that the market has a lot of room to appreciate

(127x if we use these calculations)

Given that the total market capitalization of all Layer 1 coins is currently less than $300B, it is clear that the market has a lot of room to appreciate

(127x if we use these calculations)

I hope you've found this thread helpful.

Follow me @MTorygreen for more fundamental analysis on Web3 protocols.

Like/Retweet the first tweet below if you can:

Follow me @MTorygreen for more fundamental analysis on Web3 protocols.

Like/Retweet the first tweet below if you can:

https://twitter.com/MTorygreen/status/1603434783807193088

• • •

Missing some Tweet in this thread? You can try to

force a refresh