2022 in #EastMed - The year’s main energy developments wrapped up in a thread 🧵

#Discoveries, #Borders, #Licensing, #Deals, #Infrastructure and more 👇

#Discoveries, #Borders, #Licensing, #Deals, #Infrastructure and more 👇

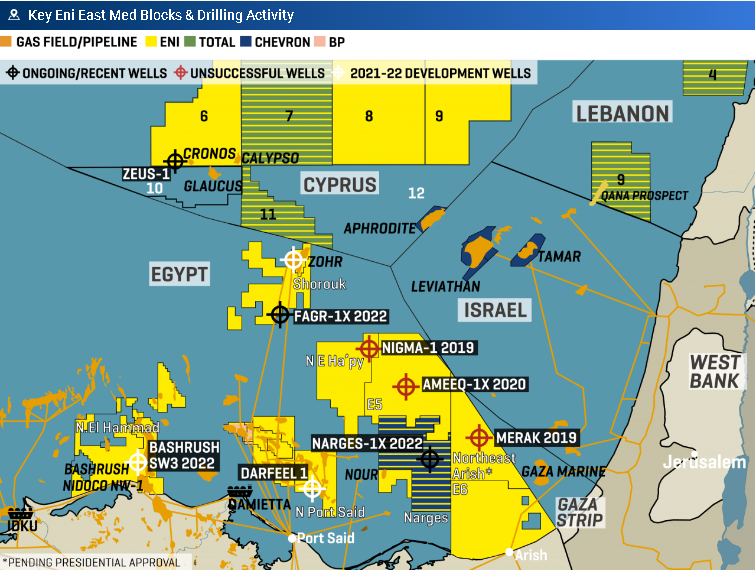

Discoveries:

🇨🇾 Zeus (op. ENI), 2-3 Tcf

🇨🇾 Cronos (ENI), 2.5 Tcf

🇪🇬 Narges (Chevron), est. 3.5 Tcf

🇪🇬 Meleiha (ENI), 8,500 BOED

🇮🇱 Athena (Energean), 0.4 Tcf

🇮🇱 Hermes (Energean), 0.2-0.5 Tcf

🇮🇱 Zeus (Energean), 0.47 Tcf

Maps: Mees, Energean

🇨🇾 Zeus (op. ENI), 2-3 Tcf

🇨🇾 Cronos (ENI), 2.5 Tcf

🇪🇬 Narges (Chevron), est. 3.5 Tcf

🇪🇬 Meleiha (ENI), 8,500 BOED

🇮🇱 Athena (Energean), 0.4 Tcf

🇮🇱 Hermes (Energean), 0.2-0.5 Tcf

🇮🇱 Zeus (Energean), 0.47 Tcf

Maps: Mees, Energean

More discoveries may be announced soon. Ongoing exploration wells in:

🇮🇱 Hercules (Energean)

🇪🇬 Thuraya (ENI)

🇮🇱 Hercules (Energean)

🇪🇬 Thuraya (ENI)

Borders & claims:

One of the most significant developments of the year is the resolution of the #Lebanon-#Israel maritime border dispute, which will create more stable conditions for both countries to pursue exploration along the border.

For more: mesp.me/2022/10/17/the…

One of the most significant developments of the year is the resolution of the #Lebanon-#Israel maritime border dispute, which will create more stable conditions for both countries to pursue exploration along the border.

For more: mesp.me/2022/10/17/the…

In Israel, #Karish came online following the announcement of the deal. In Lebanon, preparations are underway to drill the first exploration well in #Block_9 next year. mesp.me/2022/11/15/the…

The #Lebanon-#Israel border deal adds a new mutually recognized maritime border in East Med. But there are still more unilateral - and often overlapping - claims in East Med than there are actual borders (i.e., delimitation through agreement of the States involved).

#Lebanon wanted to build on the momentum created by settling the dispute with Israel to solve its other maritime border dispute with #Syria involving an area roughly 1000 km2 in size. But Syria said “not so fast” and canceled a meeting with Lebanese officials to discuss the issue

The year ended with a new unilateral claim: #Egypt issued a decree on Dec. 11 defining its western maritime border, in a move that was quickly denounced by #Libya's Government of National Unity.

The move appears to be in response to a Libyan-Turkish oil & gas MoU signed in October, following a controversial 2019 MoU between #Libya & #Turkey demarcating their maritime boundary which was strongly denounced by #Egypt, #Greece and the #EU.

Licensing:

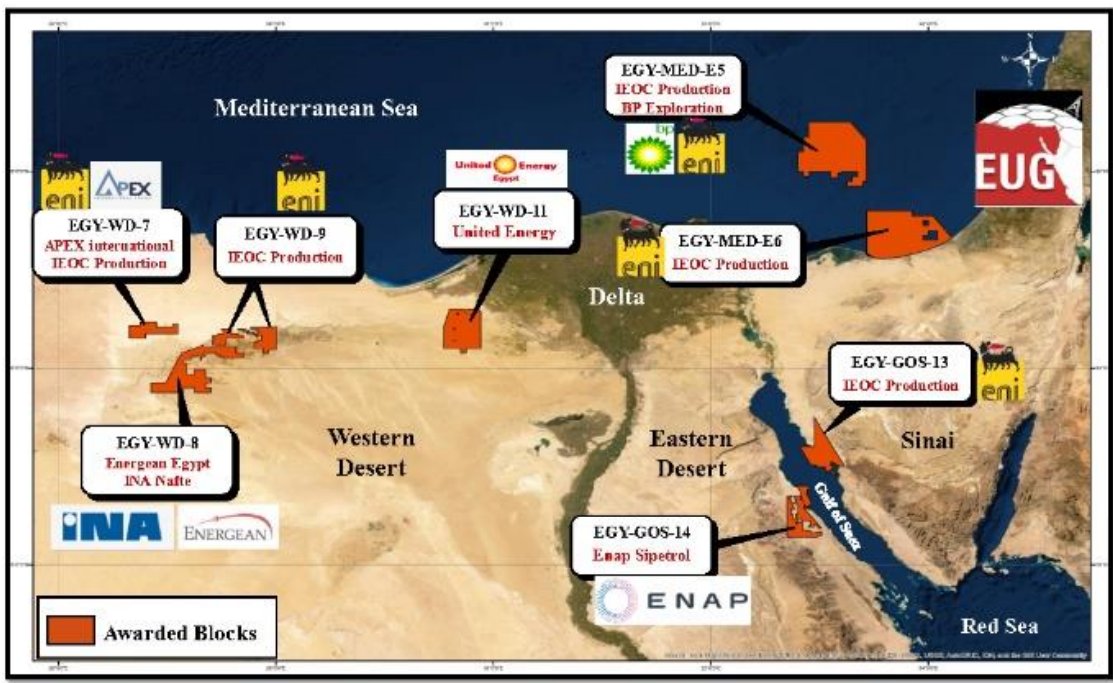

#Egypt announced the results of its first international digital bid round in January, awarding 2 blocks in the Mediterranean, 4 in the Western Desert and 2 in the Gulf of Suez to Eni, BP, Apex, Energean, Ina Nafta, Sipetrol & United Energy.

Map: Egypt Upstream Gateway

#Egypt announced the results of its first international digital bid round in January, awarding 2 blocks in the Mediterranean, 4 in the Western Desert and 2 in the Gulf of Suez to Eni, BP, Apex, Energean, Ina Nafta, Sipetrol & United Energy.

Map: Egypt Upstream Gateway

Other #Egypt news: BP was awarded North King Mariout, North El Tabya & acquired NW Abu Qir; QatarEnergy acquired 40% of Exxon’s North Marakia; Shell acquired Exxon's NE El-Amriya; ENI acquired NE El-Arish, Bellatrix-Seti, North El Fayrouz & reportedly farmed into Chevron’s Narges

In #Lebanon, Russia’s #Novatek pulled out of the Total-led consortium holding exploration rights in Blocks 4 and 9.

#QatarEnergy is in talks to acquire a 30% interest in Block 9.

#QatarEnergy is in talks to acquire a 30% interest in Block 9.

#Lebanon extended its 2nd offshore licensing round in December. 8 blocks on offer.

#Israel, which wanted to give gas a break in 2022, launched its 4th offshore bid round in Dec. 20 blocks in 4 zones on offer.

Both tenders are scheduled to close on June 30, 2023.

(Map by MEES)

#Israel, which wanted to give gas a break in 2022, launched its 4th offshore bid round in Dec. 20 blocks in 4 zones on offer.

Both tenders are scheduled to close on June 30, 2023.

(Map by MEES)

Deals:

#Lebanon signed a deal with #Jordan on Jan. 26 to import 250 MW of #electricity via Syria.

And a deal with #Egypt on June 21 to import 650 mcm/yr of natural #gas via the Arab Gas Pipeline. Infrastructure in #Syria & Lebanon was rehabilitated this year. But 2 challenges:

#Lebanon signed a deal with #Jordan on Jan. 26 to import 250 MW of #electricity via Syria.

And a deal with #Egypt on June 21 to import 650 mcm/yr of natural #gas via the Arab Gas Pipeline. Infrastructure in #Syria & Lebanon was rehabilitated this year. But 2 challenges:

1) securing a deal with the World Bank to provide funding, which hinges on reforming the electricity sector in Lebanon;

2) receiving the needed guarantees from the US that the parties involved in the deal will not be subject to Syria-related sanctions.

2) receiving the needed guarantees from the US that the parties involved in the deal will not be subject to Syria-related sanctions.

Egypt, Israel & the EU signed an MoU on June 15 to boost gas exports to the EU via Egypt’s LNG plants, part of Europe’s efforts to secure alternatives to Russian gas.

The MoU paves the way for companies to conclude commercial agreements but no biding deals have been concluded yet

The MoU paves the way for companies to conclude commercial agreements but no biding deals have been concluded yet

#Chevron signed an MoU with EGAS on June 20 to evaluate options to export #EastMed natural gas.

This includes examining the needed infrastructure to facilitate the transport of East Med gas to #Egypt and carrying out the necessary studies to produce low-carbon LNG.

This includes examining the needed infrastructure to facilitate the transport of East Med gas to #Egypt and carrying out the necessary studies to produce low-carbon LNG.

Israel’s #NewMed Energy (which holds a 45.3% stake in Leviathan) and Germany’s #Uniper announced on Nov. 8 that they signed an MoU to evaluate a potential collaboration to supply natural gas to Europe and produce blue and green hydrogen.

Infrastructure:

2022 started with the US expressing reservations (in an informal document sent to the Greek, Cypriot & Israeli governments) over the #EastMed_Pipeline citing environmental concerns, commercial viability and tensions the project has created in the region.

2022 started with the US expressing reservations (in an informal document sent to the Greek, Cypriot & Israeli governments) over the #EastMed_Pipeline citing environmental concerns, commercial viability and tensions the project has created in the region.

The US embassy in Athens had to publish a statement confirming the US is still committed to “physically interconnecting East Med energy to Europe”, but that it is shifting its focus to greener projects such as the planned #EuroAfrica & #EuroAsia electricity interconnectors.

#Israel started to export gas to #Egypt via a new route through #Jordan on March 1.

Exports via the Jordanian section of the Arab Gas Pipeline will allow Israel to export an additional 2.5 to 3 bcm in 2022, and potentially 4 bcm/year in the future.

Exports via the Jordanian section of the Arab Gas Pipeline will allow Israel to export an additional 2.5 to 3 bcm in 2022, and potentially 4 bcm/year in the future.

#Gastrade announced on Jan. 28 that it took FID for the construction of the 5.5 bcm/year #Alexandroupolis LNG import terminal in Greece. Project to be completed by end of 2023. It will allow gas deliveries to the Greek and other neighboring markets via interconnection projects.

Among these interconnection projects is the Interconnector Greece-Bulgaria (IGB) which started commercial operations on Oct. 1.

The gas link has an initial capacity of 3 bcm/year and can be expanded to 5 bcm/year.

The gas link has an initial capacity of 3 bcm/year and can be expanded to 5 bcm/year.

Two operators in #EastMed are considering #FLNG to export gas outside the region.

#Chevron is examining the option for the next phase of Leviathan’s development.

#Energean is proposing to connect its gas fields in Israel to an FLNG vessel off Cyprus starting 2026.

#Chevron is examining the option for the next phase of Leviathan’s development.

#Energean is proposing to connect its gas fields in Israel to an FLNG vessel off Cyprus starting 2026.

Two pipeline projects are under consideration to boost Israeli gas exports to Egypt: a 3-6 bcm/y onshore pipeline through the Negev and Sinai Peninsula, and an offshore pipeline linking Leviathan to LNG export facilities.

A greener EastMed?

COP27 was held in Egypt in November and was marked by energy security concerns. It ignored calls for fossil fuel phaseout while granting a pass for low-emission energy. Among the key takeaways: developing countries secured an agreement on a loss & damage fund

COP27 was held in Egypt in November and was marked by energy security concerns. It ignored calls for fossil fuel phaseout while granting a pass for low-emission energy. Among the key takeaways: developing countries secured an agreement on a loss & damage fund

In the run up to and during COP27, Cairo signed over a $100bn dollars hydrogen and renewable power deals that could turn Egypt into a regional energy hub if even a fraction of these deals comes to fruition.

The East Med Gas Forum organized a conference on energy transition in Cyprus in October during which highlights of a commissioned study on the #decarbonization of the natural gas value chain in East Med were presented (part of a broader #EMGF decarbonization initiative).

• • •

Missing some Tweet in this thread? You can try to

force a refresh