📦 #Amazon releases results after markets close today

☎️ A conference call is scheduled at 1430 PT (1730 ET)

Here is a 🧵 on what to expect from the #earnings...

☎️ A conference call is scheduled at 1430 PT (1730 ET)

Here is a 🧵 on what to expect from the #earnings...

🐌 Virtually all of Amazon's businesses are suffering a slowdown, from ecommerce to cloud computing

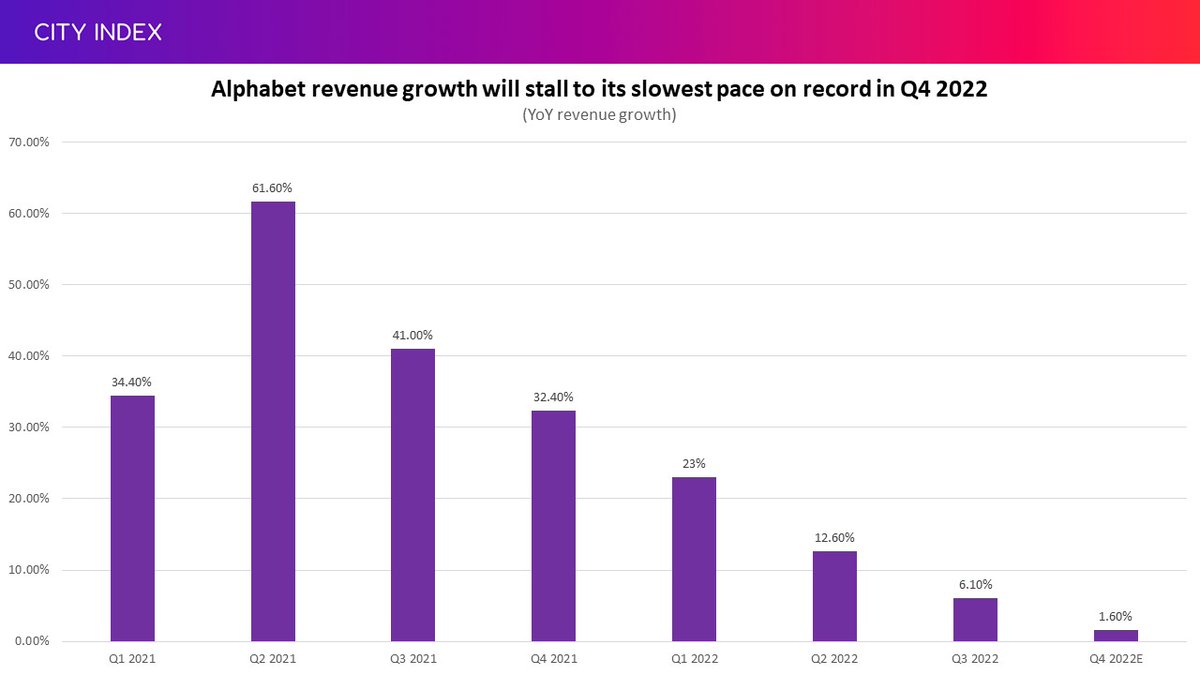

This is set to see it deliver its slowest sales growth on record for any Q4 - an important quarter covering the busy holiday shopping season.

This is set to see it deliver its slowest sales growth on record for any Q4 - an important quarter covering the busy holiday shopping season.

#Ecommerce sales are falling as the explosion in demand seen during the pandemic continues to unwind.

However, they remain considerably higher than back in 2019

However, they remain considerably higher than back in 2019

Meanwhile, its #cloudcomputing arm #AWS - which makes the bulk of its profits - has seen sales growth slow for over a year as businesses pullback on spending.

Still, it should keep growing at double-digit rates and counter softness elsewhere in the business

Still, it should keep growing at double-digit rates and counter softness elsewhere in the business

Amazon is not as profitable as #BigTech rivals and more labour intensive. That means it has smaller margins to protect from rising costs.

It has cut 18,000 jobs already, but this is just a fraction of its 1.6m-strong workforce.

Getting a better grip on costs will be crucial

It has cut 18,000 jobs already, but this is just a fraction of its 1.6m-strong workforce.

Getting a better grip on costs will be crucial

However, Q4 should be the trough for Amazon.

👍 Sales and earnings are forecast to start growing again in 2023 and cashflow will also improve

👍 Sales and earnings are forecast to start growing again in 2023 and cashflow will also improve

🌬️ Amazon's valuation has deflated from bloated levels seen during the pandemic, but it still trades at a premium as it is geared more toward growth - which is now harder to come by

This could prompt a shift more toward profitability over growth if things remain subdued

This could prompt a shift more toward profitability over growth if things remain subdued

🚨 $AMZN still trading below pre-pandemic levels but, compared to 2019, Amazon has seen:

💰 Annual sales grow over 80%

🎫 Subscribers grow by 50m to 100m

☁️ AWS sales and profits double

🔺 #Advertising unit treble in size

👎 But a much slower growth outlook

💰 Annual sales grow over 80%

🎫 Subscribers grow by 50m to 100m

☁️ AWS sales and profits double

🔺 #Advertising unit treble in size

👎 But a much slower growth outlook

Quick look at the $AMZN chart before the results

🔔 Up 3.9% before the bell

📈 At 3-month high

👍 Has closed gap created after plunging post-Q3 earnings

🚨 RSI to enter overbought territory

🔍 Brokers are bullish and see 30% upside from here

🔔 Up 3.9% before the bell

📈 At 3-month high

👍 Has closed gap created after plunging post-Q3 earnings

🚨 RSI to enter overbought territory

🔍 Brokers are bullish and see 30% upside from here

👍 That's it, you're all set and ready for the results.

Thanks for reading!

You can find out more, including the consensus numbers to look out for today, in our full preview here 👇

ms.spr.ly/60165G6NE

Thanks for reading!

You can find out more, including the consensus numbers to look out for today, in our full preview here 👇

ms.spr.ly/60165G6NE

• • •

Missing some Tweet in this thread? You can try to

force a refresh