#GM!

1/ With $FCTR launch in the horizon @FactorDAO is not only just hype and bandwagoning real-yield narrative. In this mini visual guide we will see why @FactorDAO is offering the true yield.

#Arbitrum #RealYield

1/ With $FCTR launch in the horizon @FactorDAO is not only just hype and bandwagoning real-yield narrative. In this mini visual guide we will see why @FactorDAO is offering the true yield.

#Arbitrum #RealYield

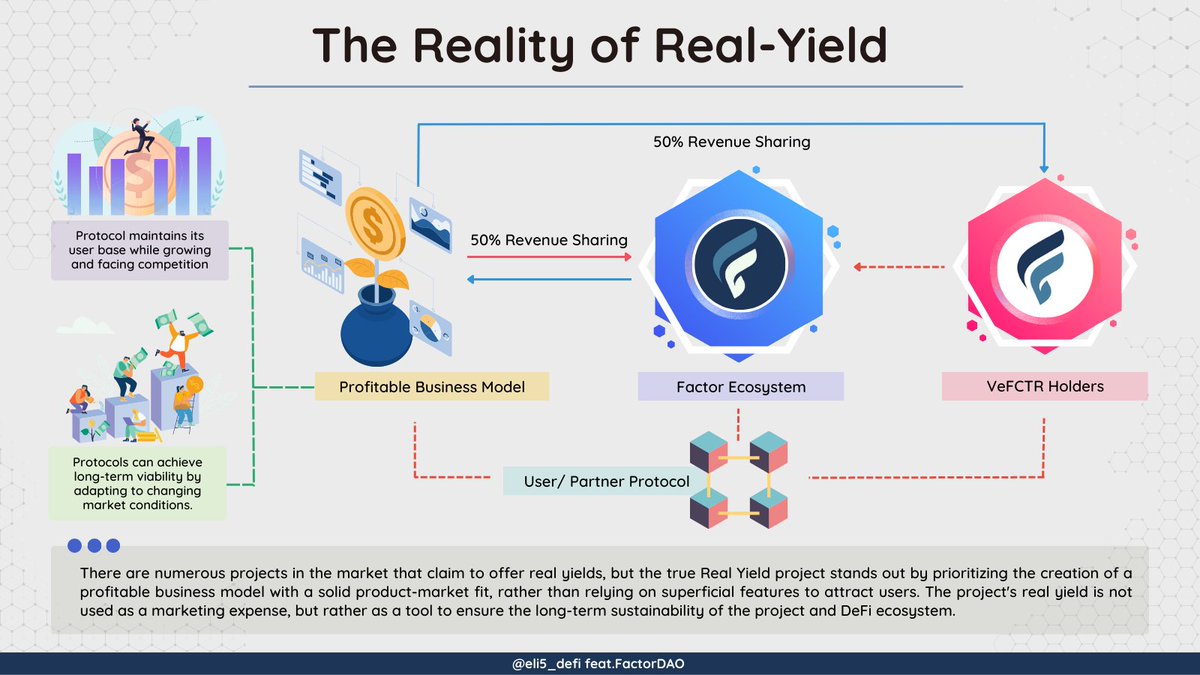

2/ In a crowded market where many projects claim to offer real yields, @FactorDAO stands out by focusing on creating a sustainable business model with a product-market fit, instead of relying on superficial features to attract users.

3/ The main source of revenue for @FactorDAO comes from transaction-based fees, while the platform also earns a percentage of the creator's fees, including management and performance fees.

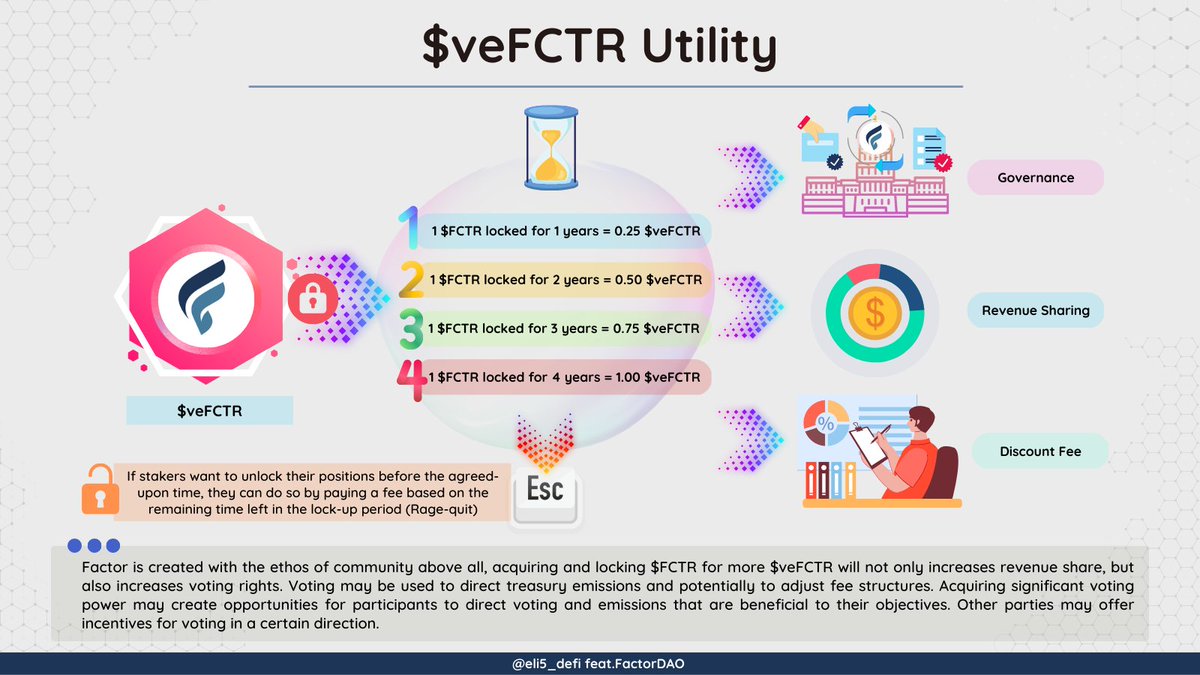

4/ @FactorDAO values the community the most. Locking $FCTR for $veFCTR not only earns revenue share but also voting rights. With more voting power, users can direct treasury and fee adjustments towards their goals, and may receive incentives from external parties to vote.

5/ To prevent conflicts of interest, the DAO's main treasury won't trade $FCTR. Instead, the treasury council will oversee profit sharing pools and use fees to acquire more $FCTR liquidity, allowing Factor to provide liquidity to its own trading pairs on DEXs and earn fees.

6/ To understand more about yield, you can check our previous post here

https://twitter.com/eli5_defi/status/1611777486773448707?s=20

7/ Also you can check in this thread why @FactorDAO will change how we perceive DeFi liquidity and composability.

https://twitter.com/eli5_defi/status/1626237037526519815?s=20

8/ And how @FactorDAO leveraging ERC-4626 to create the liquidity middleware for #DeFi

https://twitter.com/eli5_defi/status/1624403153423855616?s=20

9/ Learn more about @FactorDAO and $FCTR

🌐 Web: factor.fi

📚 Notion: factorlaunch.notion.site/Factor-DAO

📣 Docs: docs.factor.fi

📝 Medium: medium.com/@FactorDAO/

📺 Podcast: anchor.fm/factordao

👾 Discord: discord.gg/factor

🌐 Web: factor.fi

📚 Notion: factorlaunch.notion.site/Factor-DAO

📣 Docs: docs.factor.fi

📝 Medium: medium.com/@FactorDAO/

📺 Podcast: anchor.fm/factordao

👾 Discord: discord.gg/factor

10/ Tagged #RealYield seekers:

@TheCryptoDog

@milesdeutscher

@OnChainWizard

@SamuelXeus

@JackNiewold

@Route2FI

@thedefiedge

@blocmatesdotcom

@CryptoHayes

@takegreenpill

@0xthade

@CryptoKaduna

@MoonKing___

@crypto_condom

@ThorHartvigsen

@AstrologyCrypto

@EricCryptoman

@TheCryptoDog

@milesdeutscher

@OnChainWizard

@SamuelXeus

@JackNiewold

@Route2FI

@thedefiedge

@blocmatesdotcom

@CryptoHayes

@takegreenpill

@0xthade

@CryptoKaduna

@MoonKing___

@crypto_condom

@ThorHartvigsen

@AstrologyCrypto

@EricCryptoman

11/ Tagged amazing #DeFi educators (1):

@danblocmates

@jediblocmates

@rektdiomedes

@JiraiyaReal

@NickDrakon

@ReveloIntel

@RiddlerDeFi

@crypthoem

@TheDeFinvestor

@crypto_linn

@mimiLFG

@launchy_

@Dynamo_Patrick

@jake_pahor

@CryptoDragonite

@VirtualKenji

@defi_mochi

@danblocmates

@jediblocmates

@rektdiomedes

@JiraiyaReal

@NickDrakon

@ReveloIntel

@RiddlerDeFi

@crypthoem

@TheDeFinvestor

@crypto_linn

@mimiLFG

@launchy_

@Dynamo_Patrick

@jake_pahor

@CryptoDragonite

@VirtualKenji

@defi_mochi

12/ Amazing #DeFi educators (2):

@phtevenstrong

@SimplifyDeFi

@thewolfofdefi

@defiprincess_

@DefiIgnas

@TheDeFISaint

@SmallCapScience

@ChadCaff

@Slappjakke

@royalty_crypto

@WinterSoldierxz

@0xTindorr

@2lambro

@ArbiAlpha

@0xCrypto_doctor

@Only1temmy

@CoinSurveyor

@phtevenstrong

@SimplifyDeFi

@thewolfofdefi

@defiprincess_

@DefiIgnas

@TheDeFISaint

@SmallCapScience

@ChadCaff

@Slappjakke

@royalty_crypto

@WinterSoldierxz

@0xTindorr

@2lambro

@ArbiAlpha

@0xCrypto_doctor

@Only1temmy

@CoinSurveyor

13/ #Omake! we also prepared the audio-visual format for @FactorDAO, please put your 🔊on to tune in! cc: @CrossChainAlex,@Kurapika_DAO, @LouisCooper_

🎵 - Sarah, The Illstrumentalist - Del Rey

epidemicsound.com/track/PLtxKIRc…

🎵 - Sarah, The Illstrumentalist - Del Rey

epidemicsound.com/track/PLtxKIRc…

14/ If you love our thread, please follow us and @FactorDAO. Also don't forget to share, like, and retweet to support us!

#DeFi #BlueChip #RealYield #Hyperstructure #Arbitrum #Ethereum #Camelot $ETH $ARBI $GRAIL $FCTR

#DeFi #BlueChip #RealYield #Hyperstructure #Arbitrum #Ethereum #Camelot $ETH $ARBI $GRAIL $FCTR

https://twitter.com/eli5_defi/status/1627313034296446978?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh