Want to find the next $SOL or $MATIC?

Pay attention to a new breed of L1s known as "parallel processing” chains

Protocols like @Aptos_Network, @SeiNetwork and @SuiNetwork claim > 160K TPS and sub-second finality

Here are the 5 things you need to know to gain an edge

👇

🧵

Pay attention to a new breed of L1s known as "parallel processing” chains

Protocols like @Aptos_Network, @SeiNetwork and @SuiNetwork claim > 160K TPS and sub-second finality

Here are the 5 things you need to know to gain an edge

👇

🧵

2/

This thread will cover:

• What are the problems with existing L1s?

• How does parallel processing fix these problems?

• What new L1s are using this technology?

• What are the problems with parallel processing?

• What’s the long-term potential?

This thread will cover:

• What are the problems with existing L1s?

• How does parallel processing fix these problems?

• What new L1s are using this technology?

• What are the problems with parallel processing?

• What’s the long-term potential?

3/

🔶 What are the Problems with Existing #L1s?

There’s no denying that #Ethereum has achieved tremendous success

In just a few years, it has:

• Created > $150B in value for DeFi

• Generated > $35B in NFT sales

• Supported > 11K DAOs

But it's not without its problems

🔶 What are the Problems with Existing #L1s?

There’s no denying that #Ethereum has achieved tremendous success

In just a few years, it has:

• Created > $150B in value for DeFi

• Generated > $35B in NFT sales

• Supported > 11K DAOs

But it's not without its problems

4/

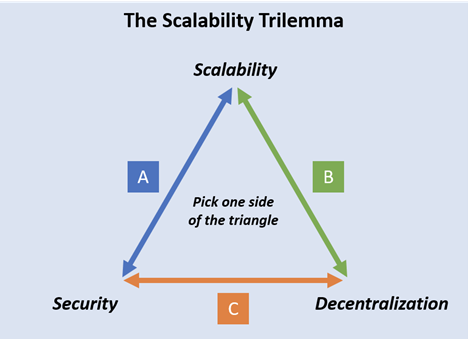

In particular, it has historically been limited by the “scalability trilemma”

This theory states that a blockchain cannot be simultaneously fast, secure and decentralized

Because #Ethereum chose security and decentralization, it limited its efficiency

In particular, it has historically been limited by the “scalability trilemma”

This theory states that a blockchain cannot be simultaneously fast, secure and decentralized

Because #Ethereum chose security and decentralization, it limited its efficiency

5/

This has caused several problems:

• Low Throughput: Ethereum can only handle ~25 tps

• Cost: Fees often exceed $10

• Latency: Transactions can take minutes to hours

This is unacceptable for a network trying to replace the internet or serve as a form of payment

This has caused several problems:

• Low Throughput: Ethereum can only handle ~25 tps

• Cost: Fees often exceed $10

• Latency: Transactions can take minutes to hours

This is unacceptable for a network trying to replace the internet or serve as a form of payment

6/

While a newer generation of blockchains are trying to solve these issues, they come with their own set of problems

#Solana, for instance, is very fast but it has also proven unreliable at times (the protocol has had 9 outages)

While a newer generation of blockchains are trying to solve these issues, they come with their own set of problems

#Solana, for instance, is very fast but it has also proven unreliable at times (the protocol has had 9 outages)

7/

To be fair, #L1s are working hard to solve this problem

Ethereum is working on its own upgrade that uses rollups and a concept known as “danksharing” to increase efficiency

But a new crop of L1s are experimenting with a different solution known as parallel processing

To be fair, #L1s are working hard to solve this problem

Ethereum is working on its own upgrade that uses rollups and a concept known as “danksharing” to increase efficiency

But a new crop of L1s are experimenting with a different solution known as parallel processing

8/

🔶 What is Parallel Processing?

Parallel processing is a novel solution to the “scalability trilemma”

Instead of processing transactions sequentially (i.e. one-at-a-time) like traditional L1s, parallel processing blockchains execute unrelated transactions simultaneously

🔶 What is Parallel Processing?

Parallel processing is a novel solution to the “scalability trilemma”

Instead of processing transactions sequentially (i.e. one-at-a-time) like traditional L1s, parallel processing blockchains execute unrelated transactions simultaneously

9/

If successful, this technology could have many benefits including:

• High throughput: TPS > 160K

• Low cost: Fees of < $0.001

• Low latency: Sub-second finality

In short, parallel processing may replicate the “Web 2.0 experience”, helping introduce the public to #Web3

If successful, this technology could have many benefits including:

• High throughput: TPS > 160K

• Low cost: Fees of < $0.001

• Low latency: Sub-second finality

In short, parallel processing may replicate the “Web 2.0 experience”, helping introduce the public to #Web3

10/

🔶 Key Players

While several projects are experimenting with parallel processing, three stand out:

• Aptos

• Sui

• Sei

Let’s take a look at each…

🔶 Key Players

While several projects are experimenting with parallel processing, three stand out:

• Aptos

• Sui

• Sei

Let’s take a look at each…

11/

🔹 Aptos

@Aptos_Network was founded in 2021 by two ex-Meta employees – @moshaikhs and @AveryChing

The protocol raised $350M from @a16z, @binance, @cbventures, Mulitcoin, Apollo and Franklin Templeton

Its $APT token launched in late 2022

🔹 Aptos

@Aptos_Network was founded in 2021 by two ex-Meta employees – @moshaikhs and @AveryChing

The protocol raised $350M from @a16z, @binance, @cbventures, Mulitcoin, Apollo and Franklin Templeton

Its $APT token launched in late 2022

12/

#Aptos believes that its use of parallel processing will allow it to achieve speeds of up to 160K TPS with a sub-second finality

This is ideal as it provides internet-like speeds for a variety of use cases such as gaming, micropayments, remittances, etc…

#Aptos believes that its use of parallel processing will allow it to achieve speeds of up to 160K TPS with a sub-second finality

This is ideal as it provides internet-like speeds for a variety of use cases such as gaming, micropayments, remittances, etc…

13/

Another distinguishing feature of #Aptos is its use of the Move programming language

Move was created by Facebook engineers to support the failed Diem project

Another distinguishing feature of #Aptos is its use of the Move programming language

Move was created by Facebook engineers to support the failed Diem project

14/

Many engineers believe that Move is superior to both Solidity (used by Ethereum) and Rust (used by Solana), and much more secure

This could prove to be a game changer, as the crypto space has been plagued by hacks

(losses in 2022 alone were in the billions)

Many engineers believe that Move is superior to both Solidity (used by Ethereum) and Rust (used by Solana), and much more secure

This could prove to be a game changer, as the crypto space has been plagued by hacks

(losses in 2022 alone were in the billions)

15/

While relatively new, #Aptos has achieved significant traction to date

It lists over 150 projects in its ecosystem including #DEXs, wallets, #DeFi, staking, #oracles, #NFTs, etc…

While relatively new, #Aptos has achieved significant traction to date

It lists over 150 projects in its ecosystem including #DEXs, wallets, #DeFi, staking, #oracles, #NFTs, etc…

16/

🔹 Sui

@SuiNetwork was also founded by a cohort of ex-Facebook engineers including @EvanWeb3, @EmanAbio, and @b1ackd0g

The protocol raised $336M from @a16z, @binance, Apollo and Tiger

Sui has yet to release a token but there are always rumors of an airdrop

🔹 Sui

@SuiNetwork was also founded by a cohort of ex-Facebook engineers including @EvanWeb3, @EmanAbio, and @b1ackd0g

The protocol raised $336M from @a16z, @binance, Apollo and Tiger

Sui has yet to release a token but there are always rumors of an airdrop

17/

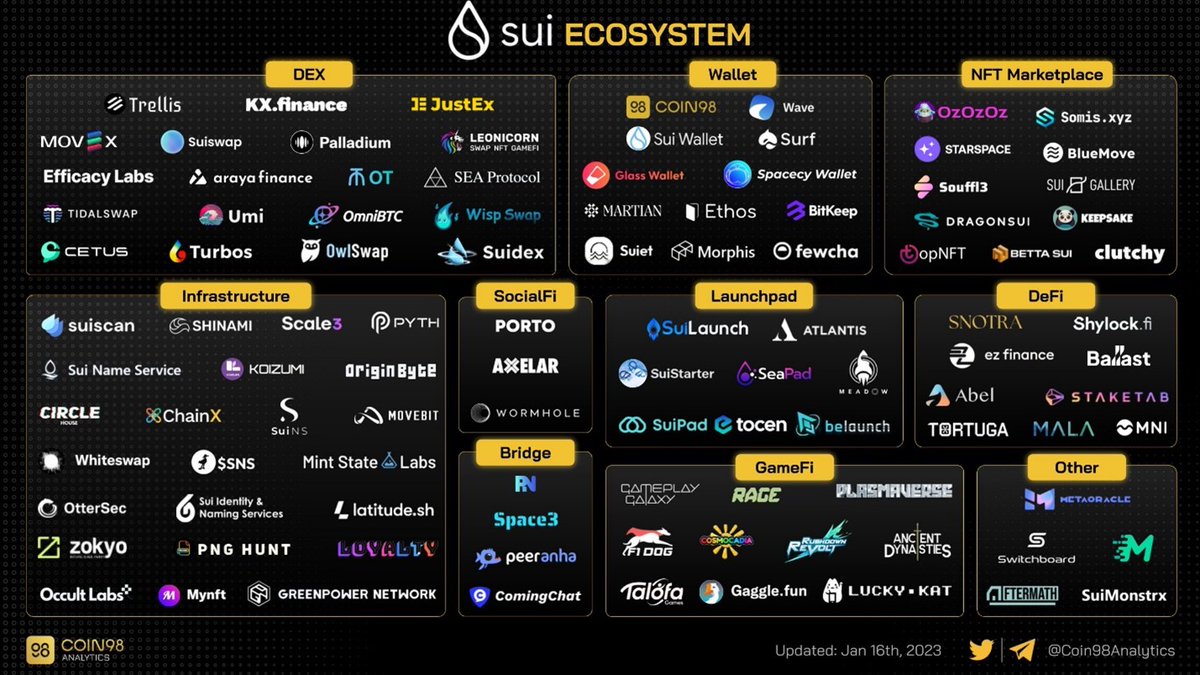

The protocol has around 60 projects in its ecosystem, including #DEXs, #DeFi, #NFTs and wallets.

While #Sui is technically a general purpose blockchain, it is targeting the gaming, DeFi and e-commerce verticals

The protocol has around 60 projects in its ecosystem, including #DEXs, #DeFi, #NFTs and wallets.

While #Sui is technically a general purpose blockchain, it is targeting the gaming, DeFi and e-commerce verticals

19/

#Sui has many similarities to #Aptos. Both projects:

• Are built using the Move programming language

• Use parallel processing to achieve high TPS

• Are targeting the next billion users

• Are backed by top tier VCs

#Sui has many similarities to #Aptos. Both projects:

• Are built using the Move programming language

• Use parallel processing to achieve high TPS

• Are targeting the next billion users

• Are backed by top tier VCs

20/

One of the major differences, however, is the underlying architecture.

#Aptos is a traditional #blockchain while #Sui is a directed acyclic graph (“DAG”).

This means that, on a technical level, the way they perceive and process transactions is fundamentally different

One of the major differences, however, is the underlying architecture.

#Aptos is a traditional #blockchain while #Sui is a directed acyclic graph (“DAG”).

This means that, on a technical level, the way they perceive and process transactions is fundamentally different

21/

Other notable differences include:

• Sui uses a different consensus protocol that allows for higher throughput and lower latency

• Sui uses a modified version of the Move language

• Aptos has more community traction

Other notable differences include:

• Sui uses a different consensus protocol that allows for higher throughput and lower latency

• Sui uses a modified version of the Move language

• Aptos has more community traction

22/

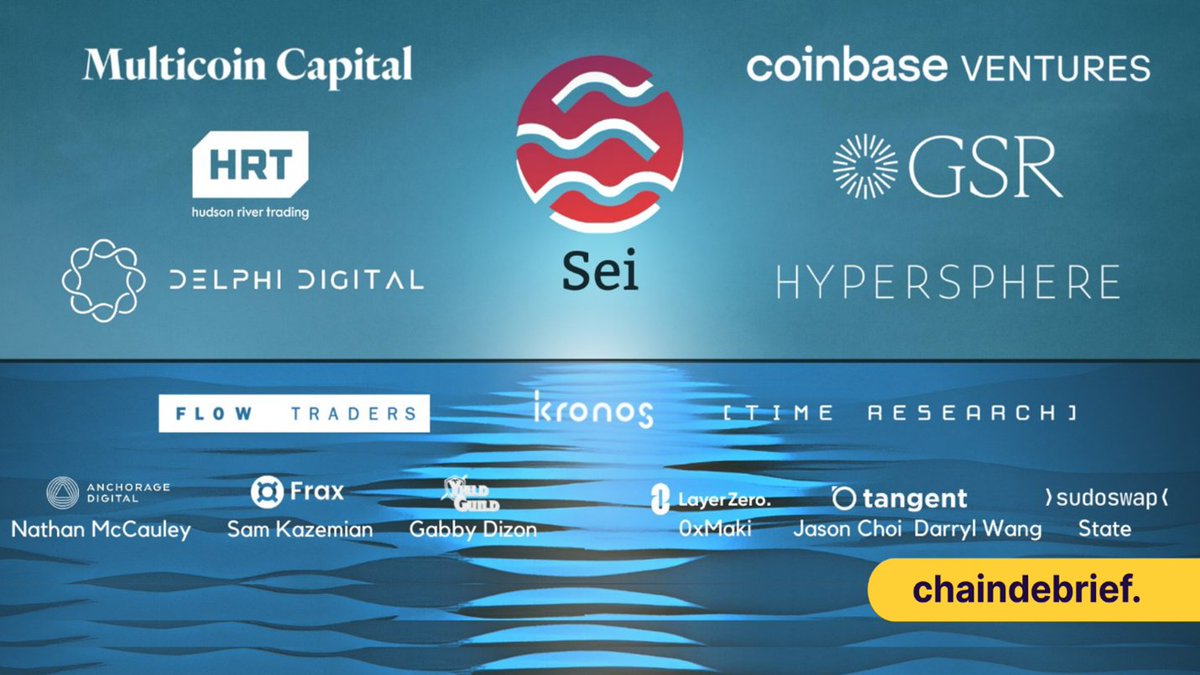

🔹 Sei

@SeiNetwork was founded in 2022 by Jeff Feng and @jayendra_jog

The protocol raised $5M seed round from a consortium including @cbventures and Multicoin Capital and is rumored to be currently pursuing its Series A (at a speculated valuation of $400M)

🔹 Sei

@SeiNetwork was founded in 2022 by Jeff Feng and @jayendra_jog

The protocol raised $5M seed round from a consortium including @cbventures and Multicoin Capital and is rumored to be currently pursuing its Series A (at a speculated valuation of $400M)

23/

Like #Aptos and #Sui, #Sei uses parallel processing to achieve a finality of 600ms and 22K orders per second

Instead of pursuing a more general approach like other L1s, Sei is favoring a “sector specific” strategy

In particular, it’s focused on #DeFi applications

Like #Aptos and #Sui, #Sei uses parallel processing to achieve a finality of 600ms and 22K orders per second

Instead of pursuing a more general approach like other L1s, Sei is favoring a “sector specific” strategy

In particular, it’s focused on #DeFi applications

24/

This has caused many to label the protocol a “decentralized NASDAQ” that provides a CeFi trading experience with #DeFi tools

To this end, #Sei has onboarded more than 50 apps across multiple verticals

This has caused many to label the protocol a “decentralized NASDAQ” that provides a CeFi trading experience with #DeFi tools

To this end, #Sei has onboarded more than 50 apps across multiple verticals

25/

🔶 Potential Problems

While #Aptos, #Sui and #Sei have many strong features, capturing share won’t be easy

Key challenges include:

• Protocols like ETH have an entrenched moat

• Competition from other high TPS chains like Solana

• Devs aren't as familiar with Move

🔶 Potential Problems

While #Aptos, #Sui and #Sei have many strong features, capturing share won’t be easy

Key challenges include:

• Protocols like ETH have an entrenched moat

• Competition from other high TPS chains like Solana

• Devs aren't as familiar with Move

26/

Indeed, we have seen many “Ethereum Killers” come and go

While competitors have definitely lessened the market share of Ethereum, no one has yet managed to knock the king from its mantle

Indeed, we have seen many “Ethereum Killers” come and go

While competitors have definitely lessened the market share of Ethereum, no one has yet managed to knock the king from its mantle

27/

🔶 Long-Term Potential

Despite the challenges listed above, there is a bull case for #Aptos, #Sui and #Sei

In particular:

• There’s room for competitors as the future will likely be #multichain

• The potential value of L1s is immense

Let’s look at each of these...

🔶 Long-Term Potential

Despite the challenges listed above, there is a bull case for #Aptos, #Sui and #Sei

In particular:

• There’s room for competitors as the future will likely be #multichain

• The potential value of L1s is immense

Let’s look at each of these...

28/

🔹Multi-chain

Many crypto analysts believe that the future will be “multi-chain”

In other words, it’s likely that many blockchains will co-exist, leaving room for new entrants

For more on this check out the following thread:

🔹Multi-chain

Many crypto analysts believe that the future will be “multi-chain”

In other words, it’s likely that many blockchains will co-exist, leaving room for new entrants

For more on this check out the following thread:

https://twitter.com/MTorygreen/status/1603797185585242113

29/

🔹 Market potential

As a potential replacement for money, the market potential for #Aptos, #Sui and #Sei is in the tens to hundreds of trillions

For more on this check out the following thread:

🔹 Market potential

As a potential replacement for money, the market potential for #Aptos, #Sui and #Sei is in the tens to hundreds of trillions

For more on this check out the following thread:

https://twitter.com/MTorygreen/status/1603434783807193088

30/

🔶 Recommended Resources

If you want to learn more about Aptos, Sui and Sei, I’d recommend checking out the following reports

👇

🔶 Recommended Resources

If you want to learn more about Aptos, Sui and Sei, I’d recommend checking out the following reports

👇

31/

“Aptos and Sui - The New Kids on the Block” by Shivam Sharma of @BinanceResearch

research.binance.com/en/analysis/ap…

“Aptos and Sui - The New Kids on the Block” by Shivam Sharma of @BinanceResearch

research.binance.com/en/analysis/ap…

32/

“The Bear Necessities: 7 Trends and Theses Part 2” by Dustin Teander of @MessariCrypto

messari.io/report/the-bea…

“The Bear Necessities: 7 Trends and Theses Part 2” by Dustin Teander of @MessariCrypto

messari.io/report/the-bea…

I hope you've found this thread helpful.

Follow me @MTorygreen for more fundamental analysis on Web3 protocols.

Like/Retweet the first tweet below if you can:

Follow me @MTorygreen for more fundamental analysis on Web3 protocols.

Like/Retweet the first tweet below if you can:

https://twitter.com/MTorygreen/status/1634322911678066688

• • •

Missing some Tweet in this thread? You can try to

force a refresh