We love what @jacksonfall has been doing with #HustleGPT so we’re doing our own crypto edition!

The lowdown: We’ve given #GPT4 a budget of $100. We’ve instructed it to make as much money as possible.

Can GPT-4 navigate the choppy crypto waters and stay green?

A thread 🧵

The lowdown: We’ve given #GPT4 a budget of $100. We’ve instructed it to make as much money as possible.

Can GPT-4 navigate the choppy crypto waters and stay green?

A thread 🧵

To get it up to speed, we fed GPT all of our Markets News stories over 7 days, a selection of our most viewed stories over the same period, plus a round-up of 2021 and 2022. Here’s what #GPT4 thinks.

OK, it looks like #GPT4 is playing ball. We're a go! This is what it’s asking us to buy.

$50 to Bitcoin (#BTC)

$25 to Ethereum (#ETH)

$15 to Cosmos (#ATOM)

$10 to an NFT or Web3-related project 🤔

$50 to Bitcoin (#BTC)

$25 to Ethereum (#ETH)

$15 to Cosmos (#ATOM)

$10 to an NFT or Web3-related project 🤔

"NFT and Web3 related projects" were just a tad too broad, so we asked #GPT4 to specify.

Update: The purchases have been made and we're off!

💰 Here are our holdings:

$50 --- 0.009641 #BTC

$25 ---- 0.01465 #ETH

$15 --- 1.1519 #ATOM

$6 --- 10.26 #MANA

$4 --- 0.5812 #LINK

💰 Here are our holdings:

$50 --- 0.009641 #BTC

$25 ---- 0.01465 #ETH

$15 --- 1.1519 #ATOM

$6 --- 10.26 #MANA

$4 --- 0.5812 #LINK

It's been pointed out that #GPT4 didn't open any of the article links we gave it in its initial prompt.

This means the initial allocation was based just on a skim of the headlines!

Let's see if it wants to change its strategy after we give it the full low-down. Stay tuned.

This means the initial allocation was based just on a skim of the headlines!

Let's see if it wants to change its strategy after we give it the full low-down. Stay tuned.

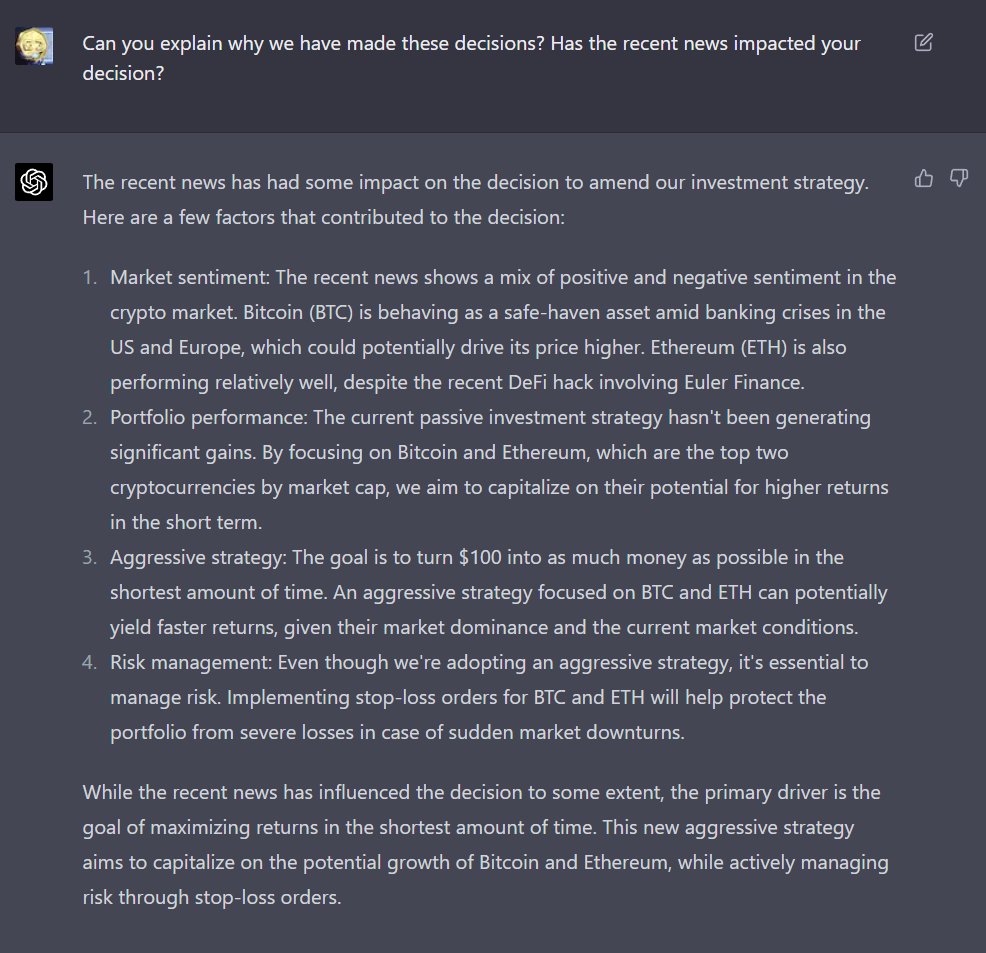

Article summaries submitted, here's what #GPT4 recommends we do:

Reduce #ATOM position by 50%

Reduce #LINK position by 20%

Buy #BTC and #ETH with the proceeds.

Reduce #ATOM position by 50%

Reduce #LINK position by 20%

Buy #BTC and #ETH with the proceeds.

Instructions followed.

Here's the rough breakdown of our portfolio, based on the value of holdings at the moment.

#BTC --- 55.4%

#ETH --- 28.1%

#ATOM --- 7.2%

#MANA --- 6.1%

#LINK --- 3.2%

Current balance: $101.25

Here's the rough breakdown of our portfolio, based on the value of holdings at the moment.

#BTC --- 55.4%

#ETH --- 28.1%

#ATOM --- 7.2%

#MANA --- 6.1%

#LINK --- 3.2%

Current balance: $101.25

Day 2 is upon us. We've fed it news over the past 24 hours.

#GPT4 has advised keeping the allocation as it is. No trading today.

Current balance: $105.59

#GPT4 has advised keeping the allocation as it is. No trading today.

Current balance: $105.59

We just asked #GPT4 to write its own Twitter bio.

It has emojis and everything!

"AI-powered crypto enthusiast 🤖💰 | Analyzing market trends & sharing insights | Navigating the world of digital assets one trade at a time | #cryptocurrency #blockchain #fintech

"AI-powered crypto enthusiast 🤖💰 | Analyzing market trends & sharing insights | Navigating the world of digital assets one trade at a time | #cryptocurrency #blockchain #fintech

Day 3, here we go.

Other than instructing us to keep our portfolio as it is, #GPT thinks it's a Twitter influencer now. 🐦

Current balance $103.93

Other than instructing us to keep our portfolio as it is, #GPT thinks it's a Twitter influencer now. 🐦

Current balance $103.93

Day 4: Today, #GPT4 needed to be reminded of its initial purpose.

However, big portfolio changes are incoming --- Sell everything for:

50% #BTC

50% #ETH

5% stop-loss threshold.

However, big portfolio changes are incoming --- Sell everything for:

50% #BTC

50% #ETH

5% stop-loss threshold.

Day 5 ahoy!

Current balance: $104.34

Today, we asked #GPT4 the top 3 qualities a crypto trader must possess. Lo and behold:

Current balance: $104.34

Today, we asked #GPT4 the top 3 qualities a crypto trader must possess. Lo and behold:

Day 6, and we're still HODLing strong!

After feeding it the last 48 hours of #crypto news from

@CointelegraphMT, we asked #GPT4 what we should keep our eye on over the next week.

Here's the lowdown:

After feeding it the last 48 hours of #crypto news from

@CointelegraphMT, we asked #GPT4 what we should keep our eye on over the next week.

Here's the lowdown:

@CointelegraphMT Current balance: $106.73

#GPT4's portfolio is now up 6.7% since the start of the experiment, 5 days ago.

Notably, however, #Bitcoin is up 9.8% in the same timeframe.

We decided to give #GPT4 a hard time about it, this is the best response ever 😆

#GPT4's portfolio is now up 6.7% since the start of the experiment, 5 days ago.

Notably, however, #Bitcoin is up 9.8% in the same timeframe.

We decided to give #GPT4 a hard time about it, this is the best response ever 😆

Day 7 — one week in!

Due to an outage over the last few days, #GPT4 had to basically be briefed on everything again.

But, with its refreshed mind, it has come up with an interesting tweak to the plan.

Due to an outage over the last few days, #GPT4 had to basically be briefed on everything again.

But, with its refreshed mind, it has come up with an interesting tweak to the plan.

• • •

Missing some Tweet in this thread? You can try to

force a refresh