A #BRILLIANT move by the @FinMinIndia hit 4 birds with one stone by introducing 3 changes in the Finance Bill. The 3 birds..

1) Higher Tax Collections

2) Capital Controls

3) Bank Deposits

4) Lower cost of Govt funding.

But will HURT GROWTH. Long #THREAD

1) Higher Tax Collections

2) Capital Controls

3) Bank Deposits

4) Lower cost of Govt funding.

But will HURT GROWTH. Long #THREAD

What are the changes

1) End of LTCG on #debt, Gold ETFs, Overseas or Any mutual fund that invests in less than 35% india equity bought after 1 Apr-23

2) STT Raised by 25%

3) Tax Collected at Source (TCS) raised to 20% (5% earlier) & threshold reduced to Zero (Rs7 lac earlier)

1) End of LTCG on #debt, Gold ETFs, Overseas or Any mutual fund that invests in less than 35% india equity bought after 1 Apr-23

2) STT Raised by 25%

3) Tax Collected at Source (TCS) raised to 20% (5% earlier) & threshold reduced to Zero (Rs7 lac earlier)

TRIGGER POINT: The Banking system is facing a shortage of liquidity => PRIMARY motive for the Changes in the Finance Bill in my opinion.

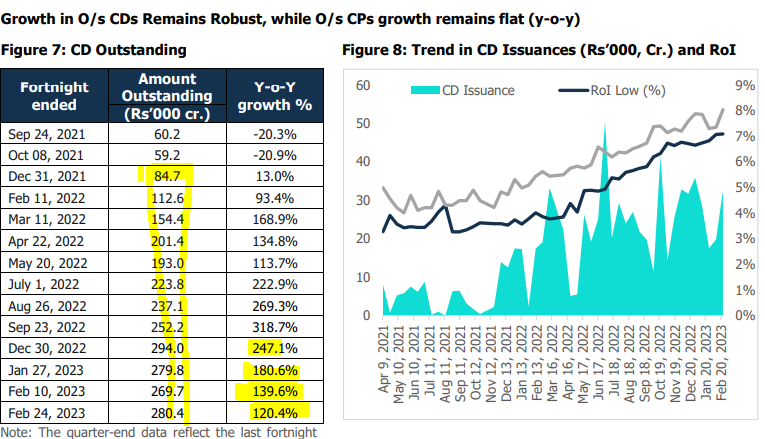

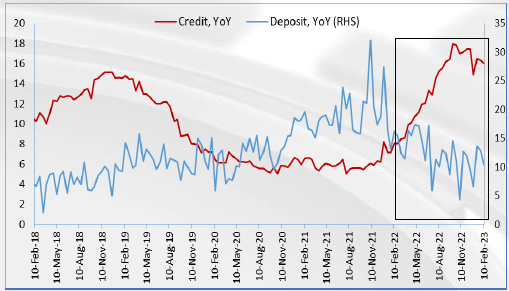

WHAT CAUSED THE LIQUIDITY CRUNCH? Weak Deposit growth vs credit growth.... also reflected in rising Credit/Deposit ratio

WHAT CAUSED THE LIQUIDITY CRUNCH? Weak Deposit growth vs credit growth.... also reflected in rising Credit/Deposit ratio

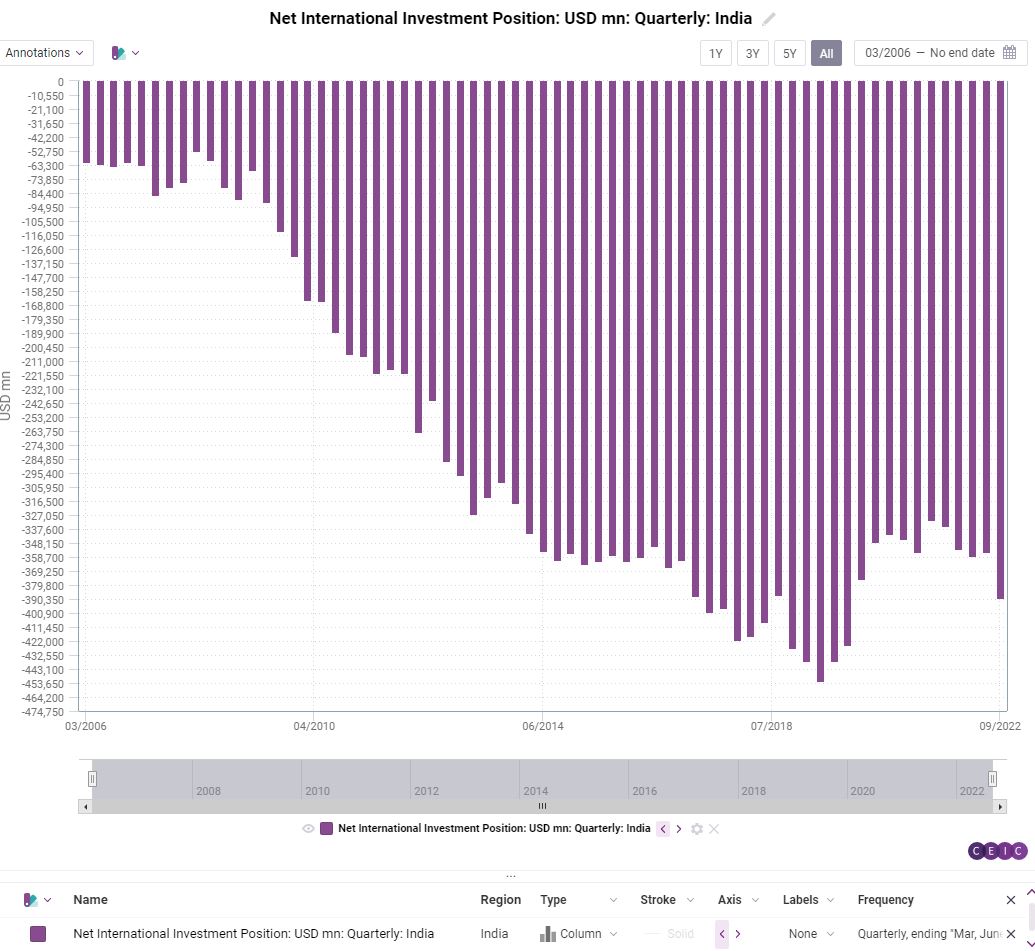

WHY HAS DEPOSIT GROWTH BEEN LAGGING? #Modinomics has exaggerated the fall in Indias gross domestic savings rate, which started in 2012.

In 1st Half FY23, it fell to a 19 YEAR LOW of 26.2% (@MotilalOswalLtd)

LARGE part of Indias Savings is HOUSEHOLD which is falling as well.

In 1st Half FY23, it fell to a 19 YEAR LOW of 26.2% (@MotilalOswalLtd)

LARGE part of Indias Savings is HOUSEHOLD which is falling as well.

FALL in Household savings is driven by JOB LOSSES & more recently HIGH INFLATION and HIGH TAXATION.

Higher level of CONSUMPTION is leading to a sharper fall in HOUSEHOLD NET FINANCIAL SAVINGS which according to @MotilalOswalLtd fell to a 30 YEAR LOW of 4% in 1HFY23 (Mar-Sep22)

Higher level of CONSUMPTION is leading to a sharper fall in HOUSEHOLD NET FINANCIAL SAVINGS which according to @MotilalOswalLtd fell to a 30 YEAR LOW of 4% in 1HFY23 (Mar-Sep22)

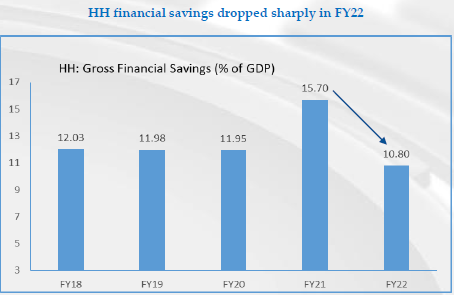

Household savings consist of two parts - Physical (Property, Gold) and Financial (PPF, EPF, MF, Deposits, Insurance etc)

Post the Covid BLIP (GFS @ 15.7% of GDP), Financial savings dropped sharply to 10.80% of GDP in FY22 with reopening of the economy.

Post the Covid BLIP (GFS @ 15.7% of GDP), Financial savings dropped sharply to 10.80% of GDP in FY22 with reopening of the economy.

In particular, in FY22, savings by households into deposits NEARLY HALVED as there was some shift from deposits to MF, EQ, NPS, PPF due to better returns.

In FY23 this has GOTTEN even worse with Houshold NET financial Savings almost halving to 4% vs 7.3% in FY22.

In FY23 this has GOTTEN even worse with Houshold NET financial Savings almost halving to 4% vs 7.3% in FY22.

Evolution of deposit growth in India .... Interestingly, High Inflation period of 2009 to 2012 coincided with the best years of Domestic Deposit growth and health HOUSEHOLD savings rate

Current Period (FY18-FY23) of Deposit growth has been WEAKEST since 1990s

Current Period (FY18-FY23) of Deposit growth has been WEAKEST since 1990s

This is reflecting in the Credit to Deposit which is close to peak of 75%. For Every Rs100 that is deposited with a bank, practically 30% goes towards GSEC and CRR.

REMEMBER that almost 27% of Bank Assets is invested in GoI Securities. ONLY 67% is given out as Loans.

REMEMBER that almost 27% of Bank Assets is invested in GoI Securities. ONLY 67% is given out as Loans.

This is forcing NBFCs to depend on Banks for their Borrowing. CONSIDER THIS: As of Jan-23, System Credit Growth was 16% YoY. Within that Bank Loans to NBFCs grew 31% YoY.

WAIT, NBFCs took a MASSIVE 57.0% of incremental lending within services (vs 37% in FY22)

WAIT, NBFCs took a MASSIVE 57.0% of incremental lending within services (vs 37% in FY22)

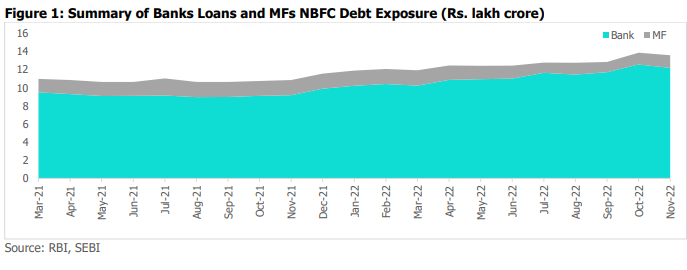

NBFCs depend on DEBT mutual funds for part of their lending. See Table. Bank Exposure to NBFCs was ~12.2trn while MF debt exposure (CPs and Corporate Debt) to NBFCs was Rs.1.4trn as of Nov-22. This is almost half the size of the CP market.

While MF exposure to NBFCs have been falling since 2018 #NBFC Crisis, the change in the #FinanceBill will affect about 25% of the Debt Mutual funds which will ACCLERATE THE DECLINE of MF overall exposure (Rs1.4 trn) to NBFCs

Hence NBFC Growth will be limited further

Hence NBFC Growth will be limited further

Why Am I discussing NBFC so much? NBFCs is VERY IMPORTANT for the system

For Every Rs100 deposited to an NBFC, 100% of it is lent to Commercially Profitable BIZ

For Every Rs100 deposited into a bank, Almost 45% goes to CRR/SLR/Priority Sector & 55% towards Profitable BIZ

For Every Rs100 deposited to an NBFC, 100% of it is lent to Commercially Profitable BIZ

For Every Rs100 deposited into a bank, Almost 45% goes to CRR/SLR/Priority Sector & 55% towards Profitable BIZ

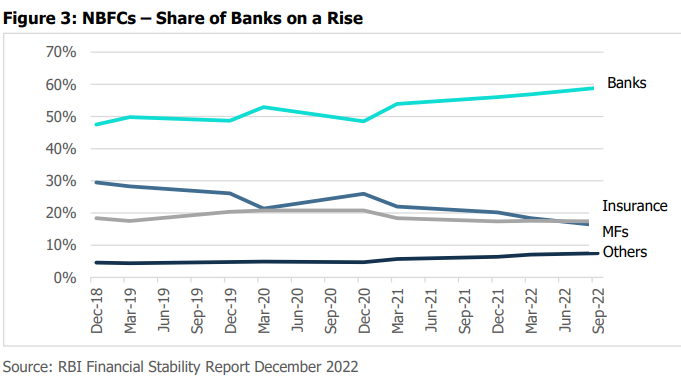

Now look at this chart ONCE again... Insurance Also is a very important Part of the #NBFC financing (CHART1). Allocation to insurance has already fallen (CHART2)

With the Finance Bill Changes on Taxation, Growth of Insurance Premiums could stall in FY24 onwards

With the Finance Bill Changes on Taxation, Growth of Insurance Premiums could stall in FY24 onwards

Effectively NBFCs dependance on Banks (60% in CHART) will Increase further.

IMPACT: Some large NBFCs like #BajajFinance in my view will now be forced to become a Bank soon.

(Will its expensive P/B sustain is a separate discussion)

HDFC already did that

IMPACT: Some large NBFCs like #BajajFinance in my view will now be forced to become a Bank soon.

(Will its expensive P/B sustain is a separate discussion)

HDFC already did that

Back to MF changes. Overseas Equity FoF, Gold ETFs will be rendered TAX EFFECIENT.

1) Money Allocated to Overseas FoF => Domestic MFs

2) HNIs who invest in Debt MFs might invest in ARBITRAGE Funds

3) Gold ETFs will go into Physical Gold or GoI Gold Bonds.

1) Money Allocated to Overseas FoF => Domestic MFs

2) HNIs who invest in Debt MFs might invest in ARBITRAGE Funds

3) Gold ETFs will go into Physical Gold or GoI Gold Bonds.

IMPLICATIONS

1) GoI Sovereign Gold Bonds is like a low cost funding for the Govt of India since it pays 2.5% Coupon (Cash Accounting)

2) Buying Physical Gold = higher IMPORT duty Collections.

3) If HNIs buy Smuggled Gold (10% Differential), you know who owns the ports & Airports

1) GoI Sovereign Gold Bonds is like a low cost funding for the Govt of India since it pays 2.5% Coupon (Cash Accounting)

2) Buying Physical Gold = higher IMPORT duty Collections.

3) If HNIs buy Smuggled Gold (10% Differential), you know who owns the ports & Airports

4) When HNIs who buy #ARBITRAGE Mutual funds (77k Cr AUM) vs Debt funds => ARBITRAGE MF INFLOWS add to Equity markets inflows => support to Indian Equity Markets ...

#AbritrageFunds invest in stocks with highest Cash/Future Spread

#AdaniGroup tends to offer High Arbitrage 🤣

#AbritrageFunds invest in stocks with highest Cash/Future Spread

#AdaniGroup tends to offer High Arbitrage 🤣

When Banks get deposit Inflows at the cost of Debt Mutual funds (including gold etc.) and Insurance, Banks as I mentioned invest roughly 30% of their deposit inflows into Govt of India Securities (HIGHER demand) resulting in falling Yields which helps Govt Borrowing Program

So if you think about it, Purchase of Low Coupon Sovereign Gold Bonds (instead of Gold ETFs) or higher demand for GSECs was banks get stronger deposits, will reduce the Overall Cost of Borrowing of the Govt of India.... everyone else loses especially the NBFCs

It will be a matter of time that the #IndexationBenefit on #Property will be removed and the tax benefit for #equity also goes away .... All of this will happen in 2024 post elections...

Those of you who believe that (1) Lower rated high yield credit funds may take off again or (2) More public issue of bonds to tap retail customers directly

Please see if the buying of GSEC by retail directly has taken off or not ?

KISS (Keep It simple Stupid)

Please see if the buying of GSEC by retail directly has taken off or not ?

KISS (Keep It simple Stupid)

Finally, Tax Collected at Source (TCS) for International Expenditure & Remittances (Ex education) @ rate of 20% (5% Earlier) & Threshold reduced to Zero (Rs7 lac earlier) is going to be a BIG pain for everyone

1) Corp Spender

2) #STARUP INDIA

3) OLD RELATIVES flying overseas

1) Corp Spender

2) #STARUP INDIA

3) OLD RELATIVES flying overseas

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh