Almost 90% of #Ethereum's L2 TVL is on rollups such as #Optimism & #Arbitrum

Which lack critical safety measures & are governed by multisigs

putting billions of user funds at risk

Here are the reasons why these rollups are ticking timebombs,

waiting to go up in flames🧵👇

Which lack critical safety measures & are governed by multisigs

putting billions of user funds at risk

Here are the reasons why these rollups are ticking timebombs,

waiting to go up in flames🧵👇

2/25

Primary factor hindering #blockchain's widespread adoption & competition with Web2 solutions is its lack of scalability

Currently, #blockchains are in a phase where they are exploring ways to scale

while maintaining decentralization & security

That's where rollups come in

Primary factor hindering #blockchain's widespread adoption & competition with Web2 solutions is its lack of scalability

Currently, #blockchains are in a phase where they are exploring ways to scale

while maintaining decentralization & security

That's where rollups come in

3/25

Rollups are L2 solutions designed to improve blockchain performance & capacity

by processing transactions off-chain,

"THEORETICALLY" utilizing the security & #decentralization of L1 protocols

This is why #Ethereum developers have completely shifted their focus to rollups

Rollups are L2 solutions designed to improve blockchain performance & capacity

by processing transactions off-chain,

"THEORETICALLY" utilizing the security & #decentralization of L1 protocols

This is why #Ethereum developers have completely shifted their focus to rollups

3/25

zk-rollups are touted as the future of #Ethereum scaling

BUT

They are still far away from reaching critical development milestones that will make them a viable platform for cheaper transactions

That's why the buzz is around optimistic rollups like #Optimism & #Arbitrum

zk-rollups are touted as the future of #Ethereum scaling

BUT

They are still far away from reaching critical development milestones that will make them a viable platform for cheaper transactions

That's why the buzz is around optimistic rollups like #Optimism & #Arbitrum

4/25

Optimistic rollups' security relies on a fraud-proving mechanism for identifying transactions with discrepancies

BUT

If you dig deeper into these optimistic rollups

You will see that they are also not "market-ready" solutions

That can safely hold BILLIONS of user funds

Optimistic rollups' security relies on a fraud-proving mechanism for identifying transactions with discrepancies

BUT

If you dig deeper into these optimistic rollups

You will see that they are also not "market-ready" solutions

That can safely hold BILLIONS of user funds

5/25

1. #Ethereum rollups suffer from a glaring lack of integration into the L1 protocol level

Meaning,

Ethereum rollups merely exist as smart contracts with admin keys,

making them less secure than alternatives like #tezos' SCORus rollup,

which is secured by the L1 itself

1. #Ethereum rollups suffer from a glaring lack of integration into the L1 protocol level

Meaning,

Ethereum rollups merely exist as smart contracts with admin keys,

making them less secure than alternatives like #tezos' SCORus rollup,

which is secured by the L1 itself

6/25

Using #tezos as an example, we can see that this is not a tech issue

but more of a leadership issue

#Ethereum's leadership has inexplicably failed to incorporate scaling solutions at the protocol level

What's the motivation behind this decision?

That comes later👇

Using #tezos as an example, we can see that this is not a tech issue

but more of a leadership issue

#Ethereum's leadership has inexplicably failed to incorporate scaling solutions at the protocol level

What's the motivation behind this decision?

That comes later👇

7/25

2. Admin keys controlling rollup smart contracts

Admin keys in #Ethereum rollups grant substantial control over smart contract behavior,

With the power to upgrade SC bridges immediately & without warning,

admin key holders wield an unsettling level of authority

2. Admin keys controlling rollup smart contracts

Admin keys in #Ethereum rollups grant substantial control over smart contract behavior,

With the power to upgrade SC bridges immediately & without warning,

admin key holders wield an unsettling level of authority

8/25

Sometimes the people holding the multisigs are the same across the ecosystem

They creep into the power structures within #Ethereum while getting paid for it

As of now, the individuals holding keys for these multisigs are anonymous,

But here's an example from #rocketpool

Sometimes the people holding the multisigs are the same across the ecosystem

They creep into the power structures within #Ethereum while getting paid for it

As of now, the individuals holding keys for these multisigs are anonymous,

But here's an example from #rocketpool

9/25

This concentration of power is antithetical to the decentralized ethos of #blockchain technology

& exposes users to potential manipulation & exploitation

Think of a few individuals having control of 90% of the L2 TVL on #Ethereum through multisigs

Yeah, it’s that scary

This concentration of power is antithetical to the decentralized ethos of #blockchain technology

& exposes users to potential manipulation & exploitation

Think of a few individuals having control of 90% of the L2 TVL on #Ethereum through multisigs

Yeah, it’s that scary

10/25

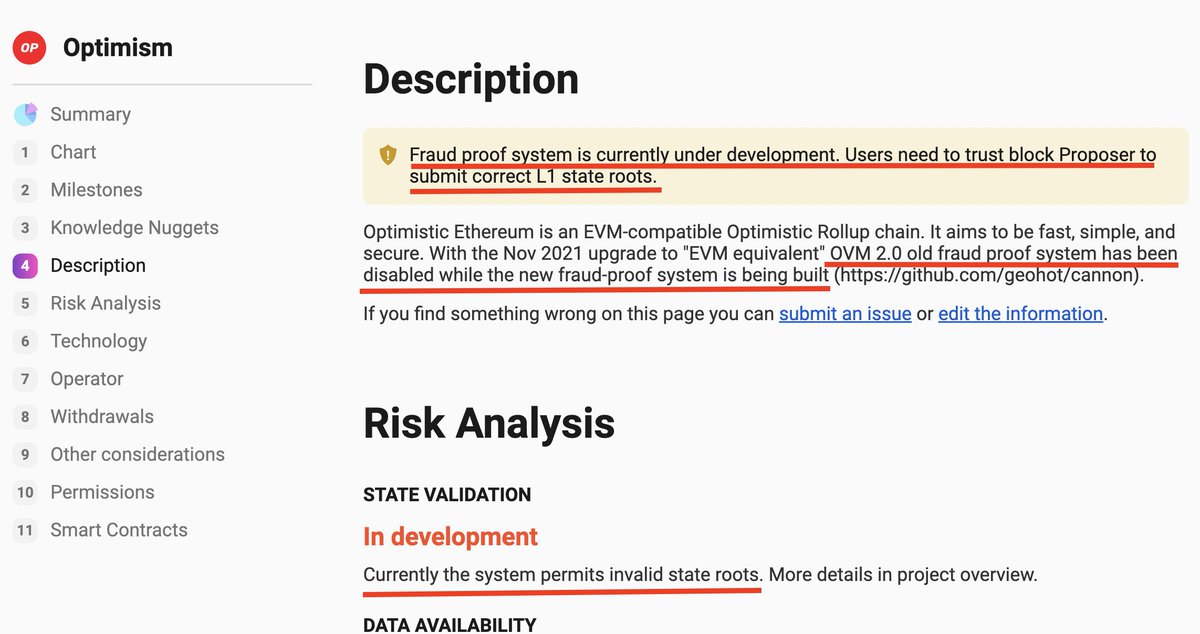

3. No fraud proofs

Security of an optimistic rollup is based on the premise that if someone submits an invalid batch into the rollup

Someone monitoring the chain can detect fraud & submit fraud-proof

As of now, #Optimism (rollup with 2nd highest TVL) has no fraud proofs

3. No fraud proofs

Security of an optimistic rollup is based on the premise that if someone submits an invalid batch into the rollup

Someone monitoring the chain can detect fraud & submit fraud-proof

As of now, #Optimism (rollup with 2nd highest TVL) has no fraud proofs

11/25

Leaving users vulnerable to stolen funds through the submission of invalid state roots

This glaring omission is deeply concerning & demonstrates a reckless disregard for user security

As @ArthurB rightfully said

As of now, #Optimism is an OVER-optimistic rollup

Leaving users vulnerable to stolen funds through the submission of invalid state roots

This glaring omission is deeply concerning & demonstrates a reckless disregard for user security

As @ArthurB rightfully said

As of now, #Optimism is an OVER-optimistic rollup

12/25

4. Centralized sequencers

A sequencer in a rollup is a designated entity responsible for

processing, ordering, and batching transactions

within the rollup's off-chain environment

and also responsible for periodically submitting these roll-up transactions to the L 1

4. Centralized sequencers

A sequencer in a rollup is a designated entity responsible for

processing, ordering, and batching transactions

within the rollup's off-chain environment

and also responsible for periodically submitting these roll-up transactions to the L 1

13/25

Centralized sequencers gives the full control of inputs to the operator running the sequencer

Centralized sequencers in #Ethereum rollups represent a single point of failure for liveness & discrimination

These sequencers can price gouge users through fees & complex MEV

Centralized sequencers gives the full control of inputs to the operator running the sequencer

Centralized sequencers in #Ethereum rollups represent a single point of failure for liveness & discrimination

These sequencers can price gouge users through fees & complex MEV

14/22

Centralized sequencers bring efficiency

But they undermine the decentralized nature of blockchain technology

In the case of #tezos you can use the L 1 blockchain as the sequencer,

and the resulting Smart Rollup is as decentralized & resistant to censorship as Layer 1

Centralized sequencers bring efficiency

But they undermine the decentralized nature of blockchain technology

In the case of #tezos you can use the L 1 blockchain as the sequencer,

and the resulting Smart Rollup is as decentralized & resistant to censorship as Layer 1

15/25

5. Role of Venture Capitalist (VC) Money in Pushing Half-baked Solutions to Market

VC funding is important in the traditional startup space,

but it doesn't belong in L2 scaling solutions that are meant to scale an L1

without compromising decentralization.

Why?👇

5. Role of Venture Capitalist (VC) Money in Pushing Half-baked Solutions to Market

VC funding is important in the traditional startup space,

but it doesn't belong in L2 scaling solutions that are meant to scale an L1

without compromising decentralization.

Why?👇

16/25

#Crypto VCs have a very different business model than VCs in the traditional startup space

#Crypto market cycles are shorter compared to traditional startup investments & inherently very risky

So VCs typically seek high returns on their investments in a shorter time span

#Crypto VCs have a very different business model than VCs in the traditional startup space

#Crypto market cycles are shorter compared to traditional startup investments & inherently very risky

So VCs typically seek high returns on their investments in a shorter time span

17/25

This emphasis on rapid growth & profits has led to the premature launch of L2 Rollups

That are not yet fully matured or adequately tested

Consequently,

Rollup dev teams face immense pressure to deliver solutions fast

potentially risking the security of user funds

This emphasis on rapid growth & profits has led to the premature launch of L2 Rollups

That are not yet fully matured or adequately tested

Consequently,

Rollup dev teams face immense pressure to deliver solutions fast

potentially risking the security of user funds

18/25

6. Unnecessary Governance Tokens in L2 Solutions

Ideally,

L2 scaling solutions should provide public goods for users and foster network growth

For example

there is no Lightning token for the Lightning Network of #Bitcoin, nor is there a rollup token for SCORUs on #tezos

6. Unnecessary Governance Tokens in L2 Solutions

Ideally,

L2 scaling solutions should provide public goods for users and foster network growth

For example

there is no Lightning token for the Lightning Network of #Bitcoin, nor is there a rollup token for SCORUs on #tezos

19/25

But

VC involvement in funding the rollups has resulted in unnecessary governance tokens for rollups.

This is because it's the only way for them to make profits and exit the market from the investments made

essentially using retail investors as exit liquidity

But

VC involvement in funding the rollups has resulted in unnecessary governance tokens for rollups.

This is because it's the only way for them to make profits and exit the market from the investments made

essentially using retail investors as exit liquidity

20/25

7. Half-baked Governance Decisions

Rollups that lack full integration with the L1 now need multisigs to make upgrades

VCs require these rollups to have tokens so that they have a way to exit the market

This creates a perfect opportunity to use tokens for governance

BUT

7. Half-baked Governance Decisions

Rollups that lack full integration with the L1 now need multisigs to make upgrades

VCs require these rollups to have tokens so that they have a way to exit the market

This creates a perfect opportunity to use tokens for governance

BUT

21/25

Governance with these tokens is such a shit show

that it doesn't make any sense to have governance at all

#Arbitrum issued a governance token called $ARB,

which has since led to a series of controversial decisions within the community

Governance with these tokens is such a shit show

that it doesn't make any sense to have governance at all

#Arbitrum issued a governance token called $ARB,

which has since led to a series of controversial decisions within the community

22/25

Moreover, if these solutions were integrated into #Ethereum at a protocol level

These rollups will never require a multisig or governance token in the first place

This shows how #Crypto VC money corrupts even the design of an L1

making it more complicated & centralized

Moreover, if these solutions were integrated into #Ethereum at a protocol level

These rollups will never require a multisig or governance token in the first place

This shows how #Crypto VC money corrupts even the design of an L1

making it more complicated & centralized

23/25

In short,

#Ethereum's rollup solutions

▪️lacks L1-level integration

▪️have admin key control over smart contracts

▪️exhibit an absence of fraud proofs, & use centralized sequencers

all contribute to an ecosystem rife with potential security breaches & manipulation

In short,

#Ethereum's rollup solutions

▪️lacks L1-level integration

▪️have admin key control over smart contracts

▪️exhibit an absence of fraud proofs, & use centralized sequencers

all contribute to an ecosystem rife with potential security breaches & manipulation

24/25

This is also the reason why #Cardano has not yet jumped on the #rollup bandwagon

With its governance being put into place through CIP-1694

It opens a way to use #Cardano treasury to allocate substantial funds for developing scaling solutions

without requiring #Crypto VCs

This is also the reason why #Cardano has not yet jumped on the #rollup bandwagon

With its governance being put into place through CIP-1694

It opens a way to use #Cardano treasury to allocate substantial funds for developing scaling solutions

without requiring #Crypto VCs

25/25

If you like threads like this, you will love our newsletter.

Every Sunday morning, you'll get a fundamental assessment of

- L1 blockchains,

- dApps,

- & practical applications

Revealing the true value of blockchain tech. 🤓 💡

justthemetrics.beehiiv.com/subscribe

If you like threads like this, you will love our newsletter.

Every Sunday morning, you'll get a fundamental assessment of

- L1 blockchains,

- dApps,

- & practical applications

Revealing the true value of blockchain tech. 🤓 💡

justthemetrics.beehiiv.com/subscribe

If you like Tweets, you will love our newsletter.

Every Sunday morning, you'll get a fundamental assessment of

- L1 blockchains,

- dApps,

- & practical applications

Revealing the true value of blockchain tech. 🤓 💡

justthemetrics.beehiiv.com/subscribe

Every Sunday morning, you'll get a fundamental assessment of

- L1 blockchains,

- dApps,

- & practical applications

Revealing the true value of blockchain tech. 🤓 💡

justthemetrics.beehiiv.com/subscribe

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter