As a collective organized network - competition

You can build a tech gateway yes.

But you can also build a network of people gateway.

they have *agents* - people

maketplaces of networks of peer to peer crypto fx brokers

these peers can also form an entity and scale their business like any other company including BitPesa

Think strategy

Seek partnerships

Compliance

Lobby

network and marketplace

this essentially becomes the gateway

can tap in multiple channels in eg remittances, bill payments

can push out multiple channels locally

Trade, networks and trust intruments are the core of most scalable digital products.

My assessment is based on a bottom up approach

And more likely to succeed

An agent network.

So informal networks of online currency exchangers stepped up to fill the service gap

PayPal to Mpesa money changers

Skrill to Mpesa changers et al

So partnered with Online money services like Skrill and Paypal to offer Kenya's online freelancers and alternative.

A fintech service

Some still remain, there are still gaps. but the Mpesa service took a big bite of their market share

see what i did there?

I called it *their* market share

i think if the p2p money changers had been smarter, theyd have pulled together and built a formal compliant agency network company

And offer an alternative competing service

You see, current money laws are strict as hell. You need a license. 100 million KES as deposit for a license.

This locks out most people from exploring this as a business option. Its how the BIG boys stay in control

Regulations limit opportunities for people and also limit what is possible as business models

Bitcoin and cryptocurrency is unregulated.

So there are no chains of old, until someone sits down and crafts regulations.

Its like the online currency of old on steroids and speed. Its literally out of this world.

Its peer to peer. no set up costs. anyone can join. all material is online. and its a growing industry

Even the p2p money changers who lost to Mpesa, jumped on board.

So now you have a large network of p2p traders balancing supply and demand of an *unregulated* crypto

Why Kenya’s Cryptocurrency Agents of 2017 remind me of airtime p2p networks kioneki.com/2017/10/09/why…

Bitcoin ATMs in Nairobi are only a great idea on paper. Electronic ATMs have lost to human agents in Kenya kioneki.com/2017/10/16/why…

there's your gateway. no fancy fintech required

This already happens in nairobi with mobile money agents. You find a chain of 20 mobile money, bank, prepaid token agents operating as an outfit

Its the same w/minor tweaks.

B. One is intermediating a cryptocurrency, the other mobile money

C. One not yet regulated, the other is regulated

strategy

compliance

seek out partnerships

and most importantly

lobby!

women traders of Kenya - Uganda - Rwanda corridor

"How do we grow adoption in Africa"

I tell them build peer to peer marketplaces and peer to peer marketplaces enablers

Give the "peers" the tools.

They'll do the rest

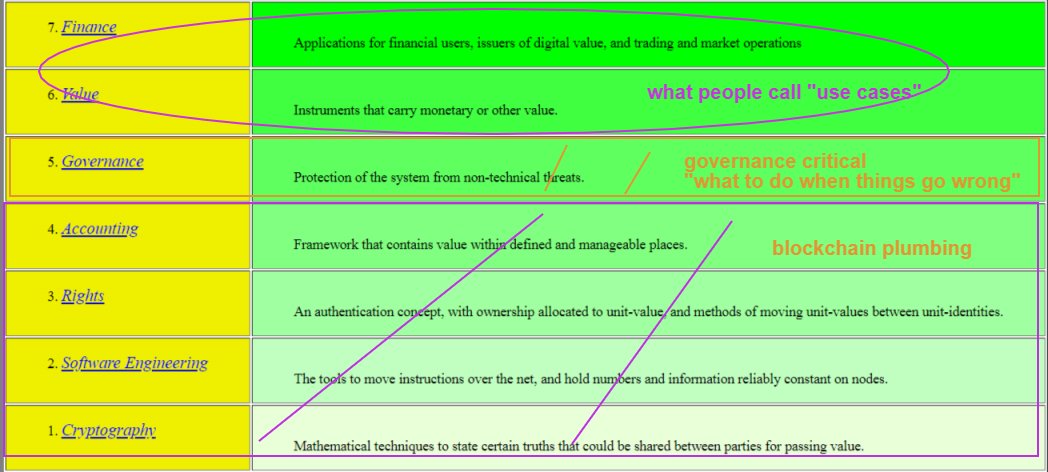

A. BitPesa type companies

B. Peer to peer type collectives

Peer to peer type collective more likely to succeed by a mile in this context - the East African market.

Competition

KBA formed IPSL and launched a collective payment network. One company, composed of member banks

Anyone can form a company and do this

The current money transmitter companies in Kenya can pivot to this

Who will do this?

Elizabeth Rossiello

BitPesa – Building Financial Platforms for Frontier Markets

epicenter.tv/episode/215/