and a central depository initially in Kenya in respect of securities listed on the Nairobi Securities Exchange. also charged with management of daily delivery and settlement of transactions at the NSE 6/

Central Depositories Act (link) nse.co.ke/regulatory-fra… /7

But what is immobilization? /9

The CDSC is thus an electronic book entry system to record and maintain securities and register their transfer

Full ownership changes electronically

/12

under section 24 of the Central Depositories Act, whereby the underlying physical certificate is no longer prima facie evidence of ownership under the Companies Act Cap 486 on or after the dematerialization date /14

Required a new Act

a new body

Aligning interest of all stakeholder

Transition

This is what we will have to do for digitizing physical assets on a DLT

even more problematic for contentious assets /16

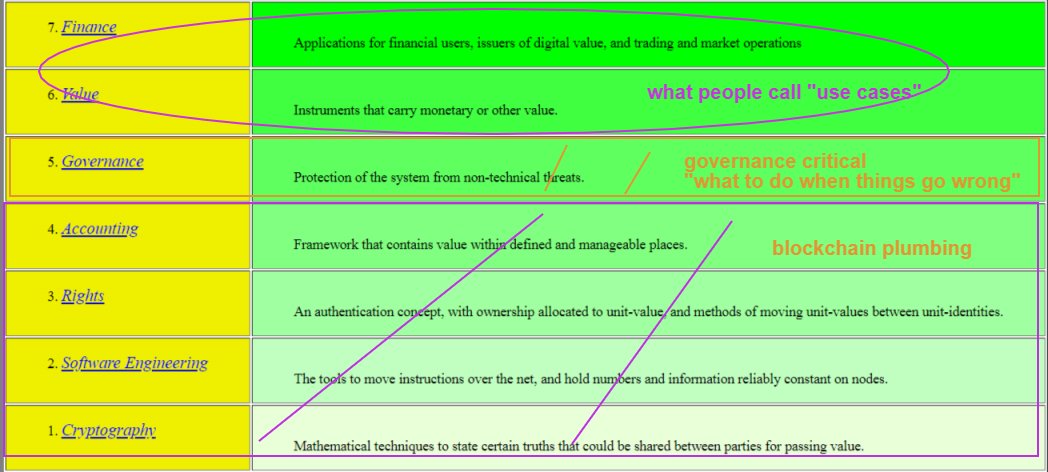

How to dematerialise assets and securities and certificates at scale ( beyond the limits of Kenya and geography) ie for the web economy

what people call 'tokenization' /17

Assets that are already digital native. No need to go through the processes described above.

Much simpler actually /18

before we see tokenized land assets

b/c crypto assets are already digitally native

Take this to the bank! /19

If you're going to build a private one, you have to convince everyone else to join at national level ,regional level, continent level, international and the web /20