Investor. Founder Longlead Capital Partners & author of The Inferential Investor. Ex Deputy Head at Regal Funds. PhD Finance. Not financial advice.

How to get URL link on X (Twitter) App

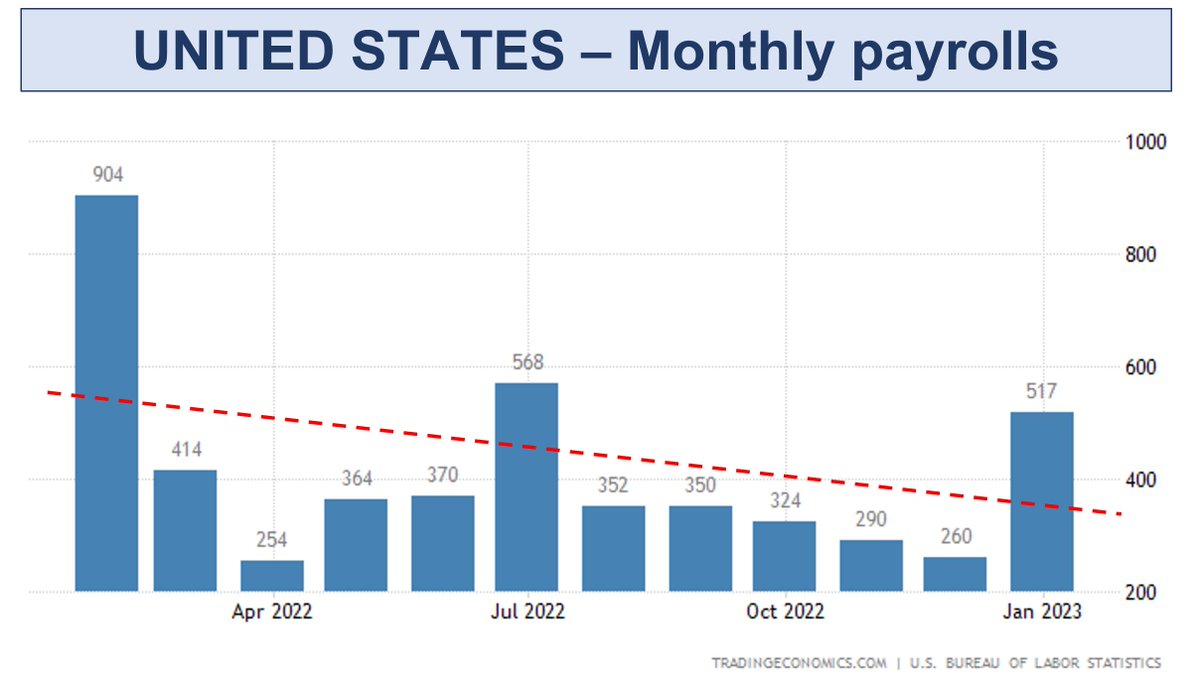

2/ But less well understood is that under the payroll strength is both falling Hires and Separations.

2/ But less well understood is that under the payroll strength is both falling Hires and Separations.

https://twitter.com/ShaneOliverAMP/status/1632953104428843009

2/ On the back of this, we have flowed through a scenario of an AU rate pause to the HQ AUD model, with US rates still rising to 5.3%

2/ On the back of this, we have flowed through a scenario of an AU rate pause to the HQ AUD model, with US rates still rising to 5.3%

2/ Lets focus on whats happened, before future expectations

2/ Lets focus on whats happened, before future expectations

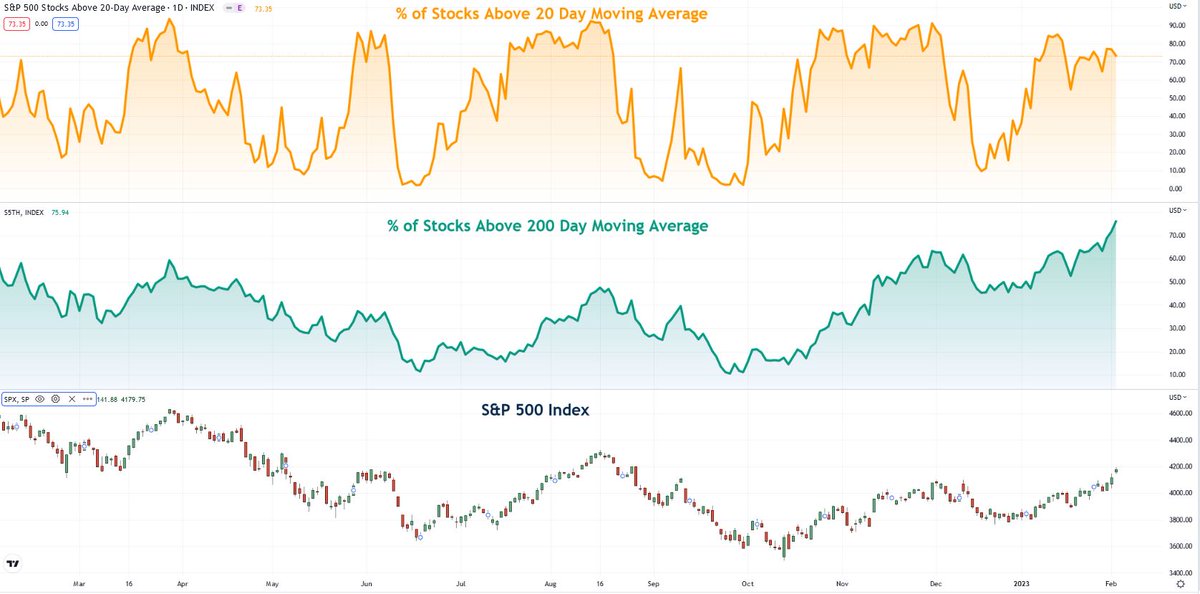

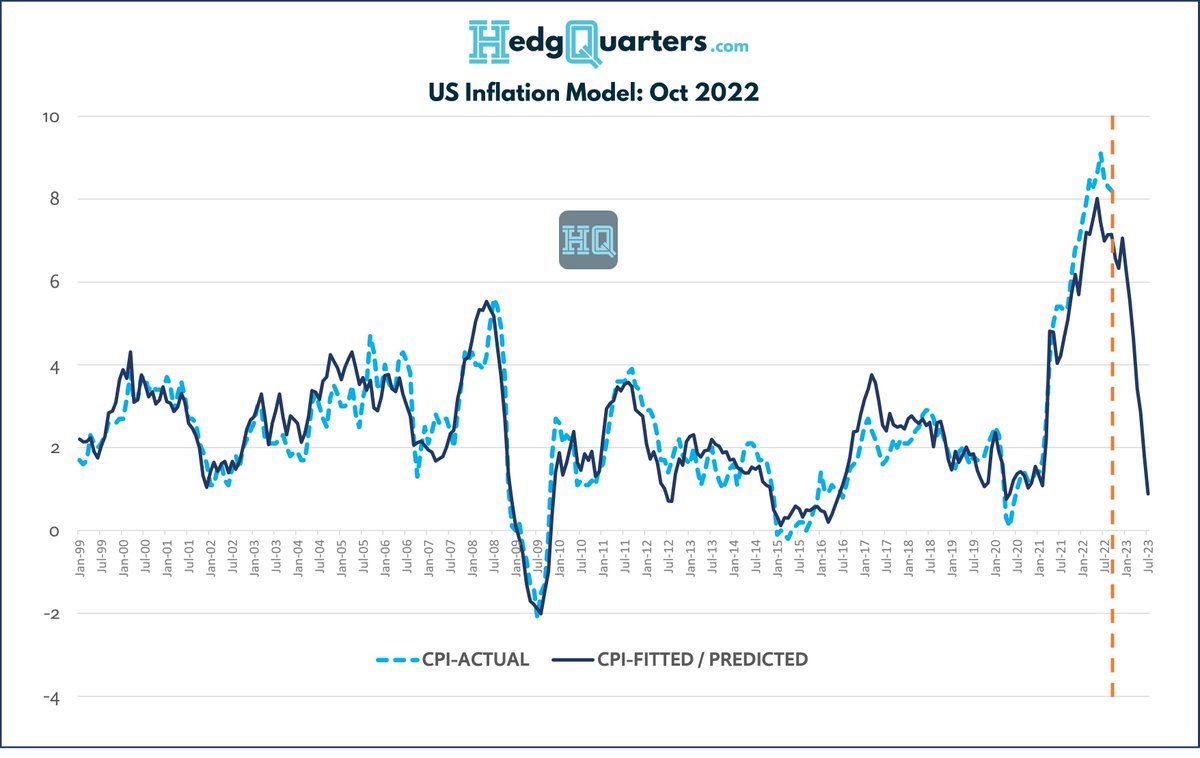

2/ As always we present 2 scenarios. With variable lags to the impact of rate hikes, these models map out 2 assumption sets:

2/ As always we present 2 scenarios. With variable lags to the impact of rate hikes, these models map out 2 assumption sets:

2/ The chart shows that as inflation rose, the Nowcast underestimated it and as it falls, theres been overestimation. Why?

2/ The chart shows that as inflation rose, the Nowcast underestimated it and as it falls, theres been overestimation. Why?

2/8

2/8

https://twitter.com/andycwest/status/1620230875542847488

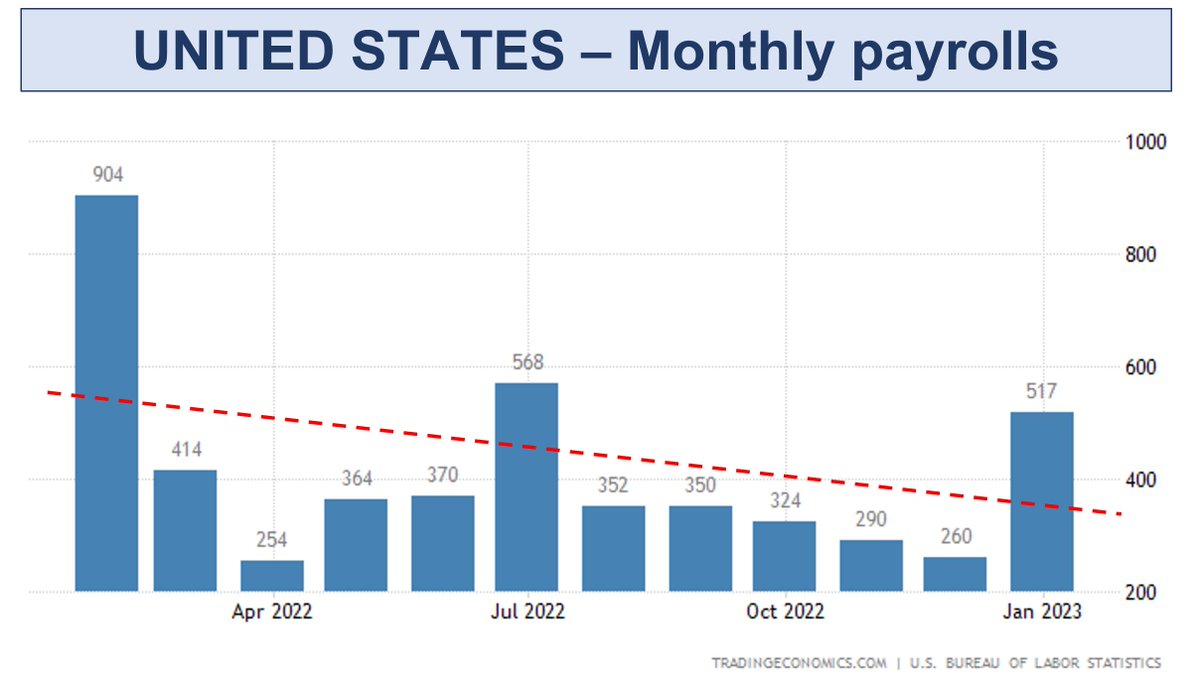

2/4 Whats this really showing?

2/4 Whats this really showing?

will fall (particularly in Q1), potentially to even ~5% by March data, but wage gains will see medium term services & core inflation drivers inconsistent in the Fed's lens with a sustainable return to 2-3% target.

will fall (particularly in Q1), potentially to even ~5% by March data, but wage gains will see medium term services & core inflation drivers inconsistent in the Fed's lens with a sustainable return to 2-3% target.

https://twitter.com/andycwest/status/1557110837059325952?s=20&t=3Ezw1vdqQ1s372hDh4O60A

This is complicated to map given various dynamics, sectors & lags, particularly with 280 char limits! But lets give it a go anyway. This is descriptive to help you think through aspects & trades you may not have yet considered

This is complicated to map given various dynamics, sectors & lags, particularly with 280 char limits! But lets give it a go anyway. This is descriptive to help you think through aspects & trades you may not have yet considered

Why is process so critical?

Why is process so critical?

The chart shows the Nasdaq 100 (white) overlayed with job cut announcements (green) and 10yr yields (orange). Critically, employment is the largest driver of tech spend. When job cuts rise as macro deteriorates, tech spend growth stagnates or falls. 10 yr yields fall as well. 2/7

The chart shows the Nasdaq 100 (white) overlayed with job cut announcements (green) and 10yr yields (orange). Critically, employment is the largest driver of tech spend. When job cuts rise as macro deteriorates, tech spend growth stagnates or falls. 10 yr yields fall as well. 2/7

Cycle timing: In the '01 and '08 cycles, the real #recession (rising #unemployment) did not start till after the Fed had broken something and stopped hiking. Its at this time we see the ISM services really deteriorate. But in past thats been 19-36 mths after hikes started. 2/5

Cycle timing: In the '01 and '08 cycles, the real #recession (rising #unemployment) did not start till after the Fed had broken something and stopped hiking. Its at this time we see the ISM services really deteriorate. But in past thats been 19-36 mths after hikes started. 2/5