Finance 📈 l Wealth Solutions I Investor I Trader I Multibaggers I support@invesys.in

How to get URL link on X (Twitter) App

https://twitter.com/InvesysCapital/status/1304294380719620101#Lauraslabs

Example- Nifty Major Correction in 2000-2003 bear Market Happened from 1818 to 850

Example- Nifty Major Correction in 2000-2003 bear Market Happened from 1818 to 850

Upper & Lower Bands are constructed by Adding / Subtracting Standard Deviation Values from SMA

Upper & Lower Bands are constructed by Adding / Subtracting Standard Deviation Values from SMA

2. India 10 Yr Yields

2. India 10 Yr Yields

https://twitter.com/InvesysCapital/status/1184876871764209664#ADANIPOWER on 30M

SmallCap Index Showing Major Signs Of Bottoming Out But Will Face Hurdle at 52WMA & Trendline Placed at 6100-6200 Zone

SmallCap Index Showing Major Signs Of Bottoming Out But Will Face Hurdle at 52WMA & Trendline Placed at 6100-6200 Zone

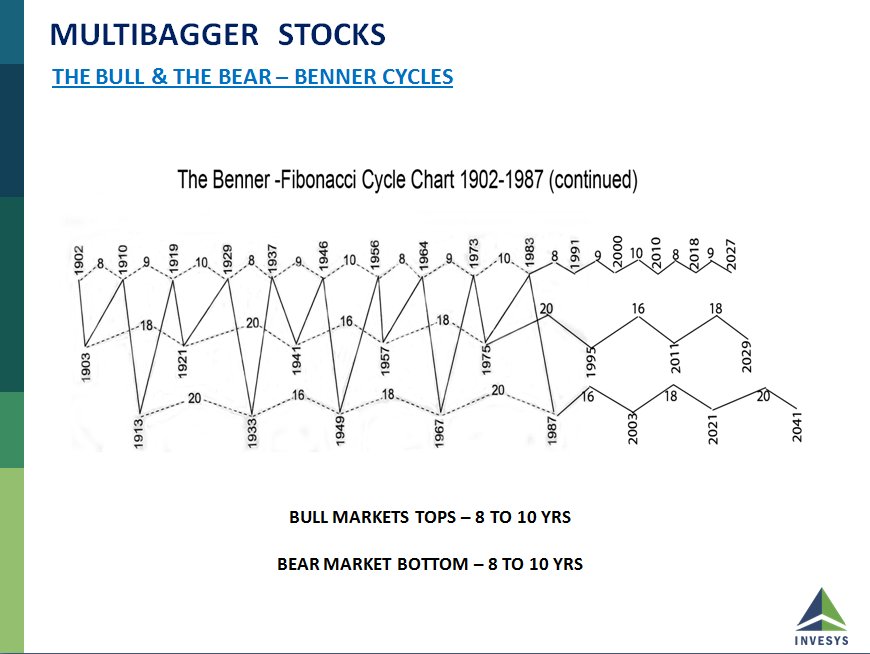

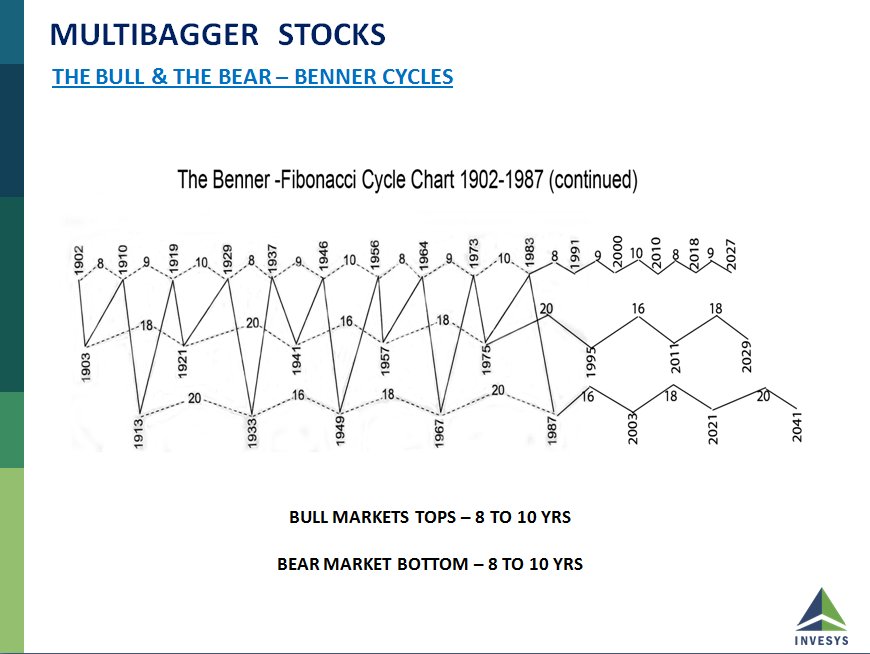

We Had Major Market Tops In SENSEX at 1992, Followed By 2000 (8Yr), Followed By 2008(8Yr).. Now We are in 2018 (10 yrs). There Are Intermediate Corrections Also In-Between. The Difference -Correction After Benner Time Cycle is Complete Are Severe With Index Dropping 40-50% (2/n)

We Had Major Market Tops In SENSEX at 1992, Followed By 2000 (8Yr), Followed By 2008(8Yr).. Now We are in 2018 (10 yrs). There Are Intermediate Corrections Also In-Between. The Difference -Correction After Benner Time Cycle is Complete Are Severe With Index Dropping 40-50% (2/n)