Founder of the Blokland Smart Multi-Asset Fund, a future-proof portfolio that invests in a smart combination of scarce assets, Quality Stocks, Gold, and Bitcoin

4 subscribers

How to get URL link on X (Twitter) App

To be clear, the Dutch government made a big mistake by closing it down in the first place.

To be clear, the Dutch government made a big mistake by closing it down in the first place.

In addition to comparing annual nominal house price levels and mortgage rates since 1986, we also looked at:

In addition to comparing annual nominal house price levels and mortgage rates since 1986, we also looked at:

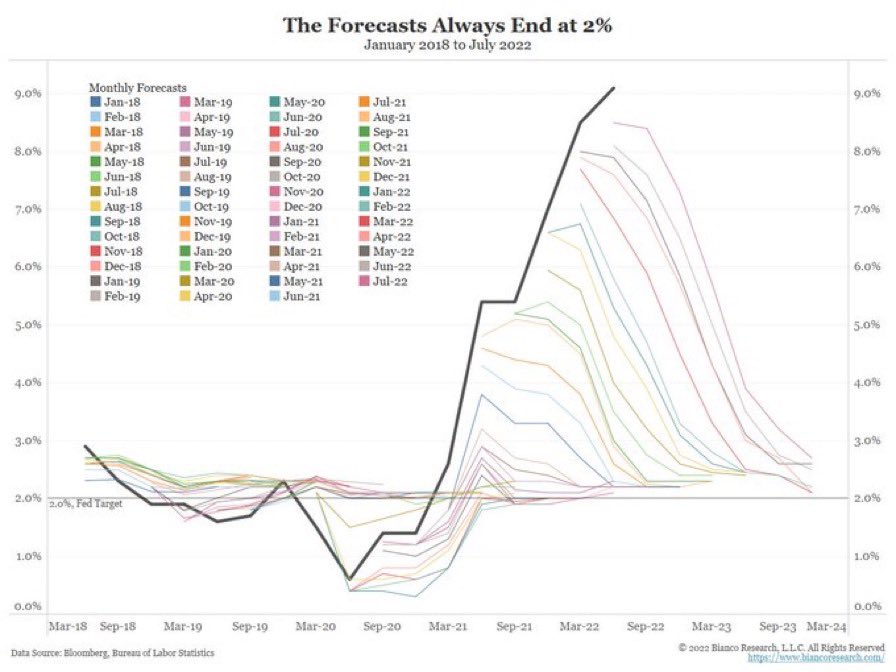

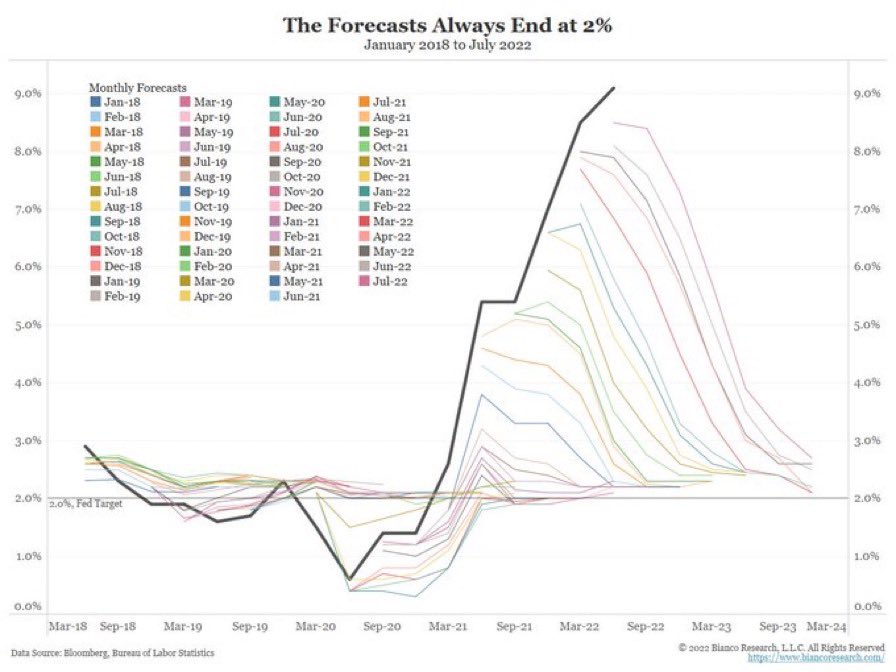

The #federalreserve pivot dream continues! 2/4

The #federalreserve pivot dream continues! 2/4

1/n

1/n

This also answers the many questions about why the value of (UK) #liability-driven investment funds, used by pension funds to match the #duration of their #liabilities, has plummeted. 2/9

This also answers the many questions about why the value of (UK) #liability-driven investment funds, used by pension funds to match the #duration of their #liabilities, has plummeted. 2/9

An earlier note to our clients showed that since 1950 there were just two major moves in #inflation: one up from 1955 until 1980, and one down from 1980 until last year. Before that, inflation was all over the place and more often negative. The last 70 years may be the outlier.

An earlier note to our clients showed that since 1950 there were just two major moves in #inflation: one up from 1955 until 1980, and one down from 1980 until last year. Before that, inflation was all over the place and more often negative. The last 70 years may be the outlier.