Might be a good time, especially in this market environment, for a thread about leverage and how to *properly* use it.

It's using borrowed funds, typically from your broker, to open a position larger than one could with just the funds on the exchange. This increases both your reward, but also your risk.

The liquidation point is the price at which the exchange forcibly closes your position, and is determined by what amount of leverage you use.

This is because most retail traders see leverage as a 'get rich quick' tool by increasing risk.

1) Reduce counterparty risk (risk of storing funds on exchange)

2) Allow you to deploy more capital in various trades, thus increasing capital efficiency.

By asking 'I wonder if opening a 2x long here is safe', you're asking entirely the wrong question.

Calculate it using this: (Position Size)/(Portfolio Size) * (Stop Distance)

Example: $2,000/$1,000 * 0.01% = 0.02%

If this result is above the % you risk per trade, you are doing something WRONG.

In fact, it's smarter to do this because you reduce your counterparty risk.

You should be using just enough leverage that matches your risk limit and stop placement, based on how much of your portfolio is in Mex.

The first and simpler version is called Isolated Leverage.

If the position gets liquidated, you only lose the margin initially set.

Cross uses your entire account balance as margin for positions, so if you get liquidated on cross, your entire account is wiped.

However, the learning curve is a bit steep, so try it out on testnet or on small positions to start.

Your leverage on cross is determined based on the position size divided by the account balance, which then determines your liquidation price. It should, typically, be low.

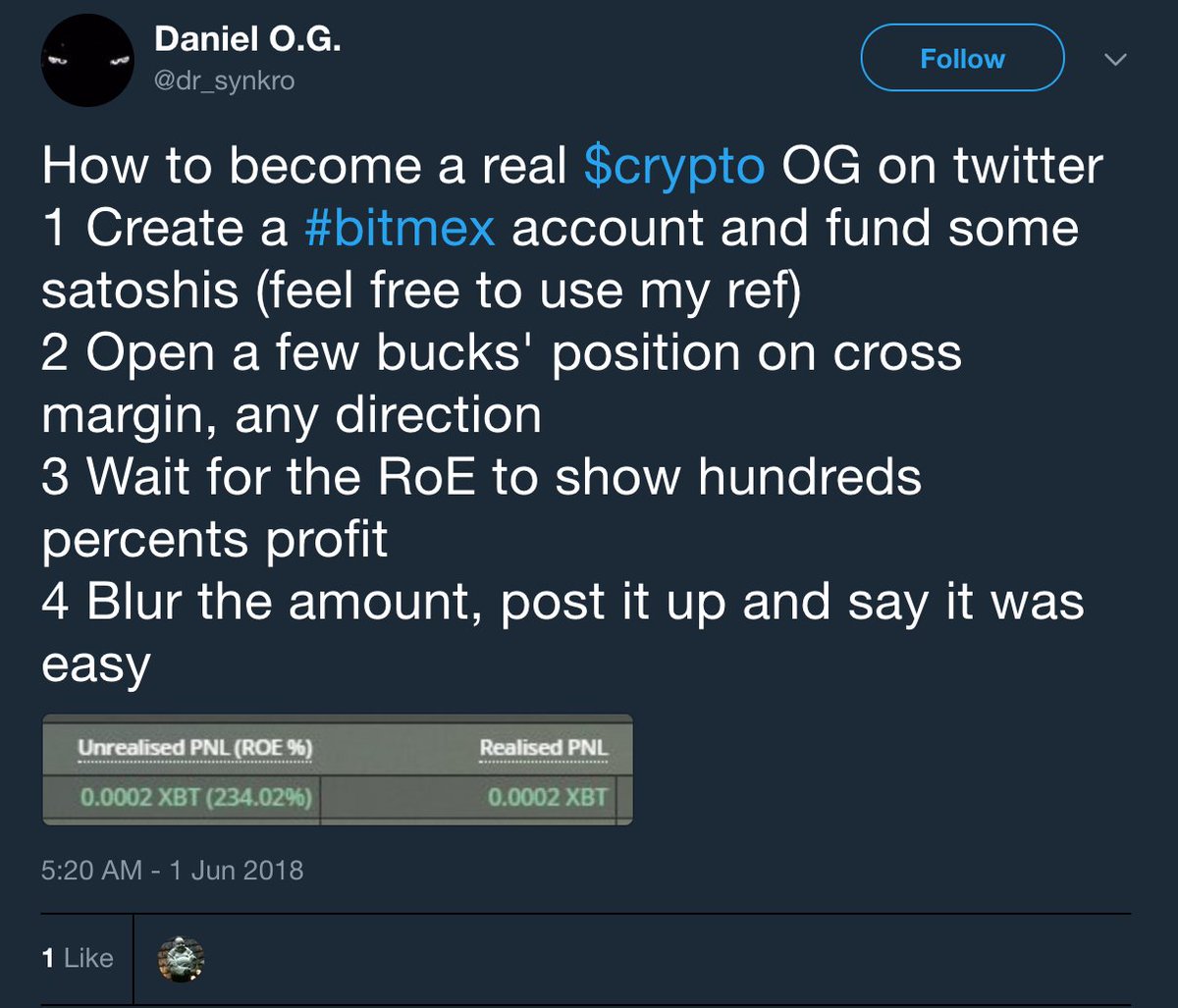

The ROE screenshot is irrelevant and means almost nothing. All it shows is what percentage move the position has been kept open for (E.g 100% roe on 100x = 1% move caught).

It's not about how much leverage you use on a specific position.

It's about how much you risk compared to your portfolio.

Someone's portfolio is worth $1M.

If they take a 20x leverage long w/ $50k of margin, meaning the position size is $1M, this is perfectly fine if they have a stop about 2% away.

Even though the *leverage* is 20x, they still only risk 2% of their portfolio.

Someone's portfolio is worth $1M.

If they take a 5x leverage long w/ $1M margin, meaning the position size is $5M, and they have a stop 2% away, this is terrible risk management.

They're risking 10% of their portfolio, even though they're at a lower leverage.

It's entirely above the amount risked of your *entire* trading portfolio determined by your position size & stop.

- The amount you risk per trade is all that matters.

- The amount of leverage itself is irrelevant.

- Leverage is a risk management tool, not a gambling tool.

- Don't overleverage your portfolio across multiple positions too aggressively.

1) Increasing your leverage does not increase your profits. You must increase your position size.

2) Set your stop based on the position size, not based on the leverage used. Leverage only changes the margin needed for a position.