Discussion on the company has been dominated by the fraud/shenanigans crowd since the @CitronResearch hit piece

I want do change that so let's do a deep dive on the fundamentals of the company with the wild assumption that the company is completely legit

@RobertPera has founded the company as a side project while working at Apple. he officially left and started Ubiquiti in 2005.

Pera had an idea for an outdoor wireless WiFi product and successfully launched it later that year for a great success

AirMax was special because it created a moat - the customers(WISPs) were locked-in

rjpblog.com/page/2/

What are WISPs and how did Ubiquiti enable them?

1. Minimal spend on sales & support

2. Support is given in an Internet forum(the community) by the users themselves (and the actual engineers

3. Pricing the products insanely cheap

In reality though, Pera wasn't leaving any money. The value offering of the products was so incredibly high, that customers have become evangelists of the company.

1. Slow inflexible incumbents

2. Overpriced products

3. Sophisticated end consumers

1. introduce products with disruptive prices

2. be confident that the consumers will find the products without marketing and manage with no support

3. operate under the radar of the incumbents

The chosen industry was Enterprise networking and the platform was UniFi.

1. Inflexible incumbent (Cisco)

2. Overpriced products (hold that thought)

3. Sophisticated consumers (nerd IT types)

Those are businesses who can't afford the stuff from the incumbents and had to use inferior consumer grade hardware prior to the appearance of UniFi

I recommend taking a look at the stories section on the website if you want to understand the customers better:

community.ubnt.com/t5/UniFi-Stori…

The products are steadily improving and the company is in a direct collision course with Cisco

for a more through introduction to UniFi I recommend the following:

arstechnica.com/information-te…

I'm assuming 21% normalized tax rate which leads to 27% net margin on 2018.

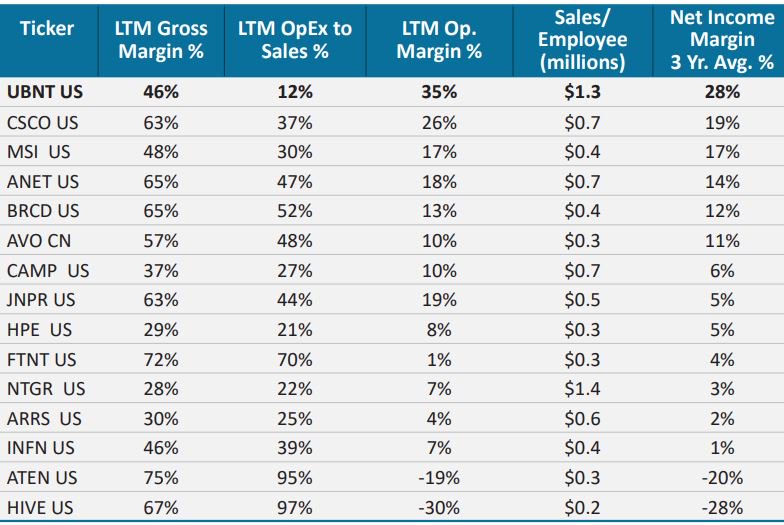

best way to value is sum of parts because of the different outlook of the two segments and their relative independence from each other.

we'll assume the two segments operate at the same margin.

1. WISP: $121M 2018 earnings. 0 growth, probably worth 10x-12x which equals $1.3B

2. net cash: $180M

3. UniFi: $154M 2018 earnings. 40% growth and converting 100% of NI to FCF and buying back stock. market values at 38x - $7.4B

4. option value - market values at 0

So, is 30x appropriate for UniFi?

It's arguable but comparison to parallel rapid growing tech platforms(we'll use $NTNX as example) reveals an interesting situation

Barring a serious SEC outcome I'm pretty confident the stock will yield satisfactory returns for the long term shareholder even at current share price.