To understand what happened on the 21/09/18, you need to go back to the beginning. I'll like to categorize it under 3 headings.

1. Before The Acquisition of MBL

2. During the Acquisition of MBL

3. After the acquisition of MBL

A THREAD!

1. What led to the takeover?

2. What role did the CBN play leading up to the decision?

3. What role did insider related loans play to bring the bank down?

4. What's the end game?

#SkyeBank

Stay with me. This will be a very long thread. #SkyeBank

2005

Skye bank was the product of the merger of 5 banks namely; Prudent Bank, EIB, Bond Bank, Reliance Bank and Cooperative Bank. It was listed in the NSE in November of the same year.

#SkyeBank

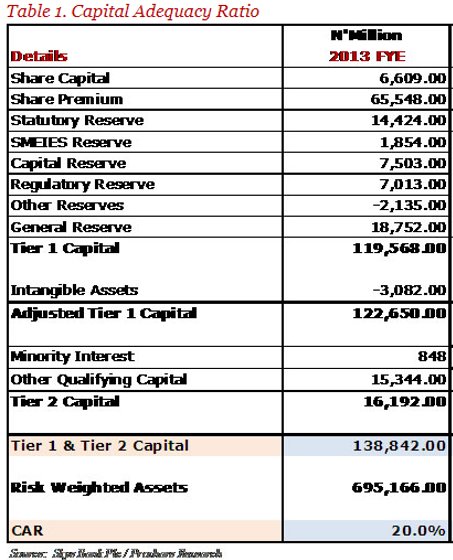

In Aug 2009, the CBN recapitalized 5 banks (including Afribank) to the tune of N400 Billion on the back of huge non-performing loans said to be over 40%. The % of NPL to total loans ranged from 19% - 48%. All 5 banks were below the minimum capital adequacy ratio. #SkyeBank

After the failed attempt of recapitalising Afribank, the CBN announced its nationalization and handed it over to the AMCON to manage through a capital injection program. Afribank was renamed MainStreet Bank otherwise known as a “Bridge Bank”. #SkyeBank

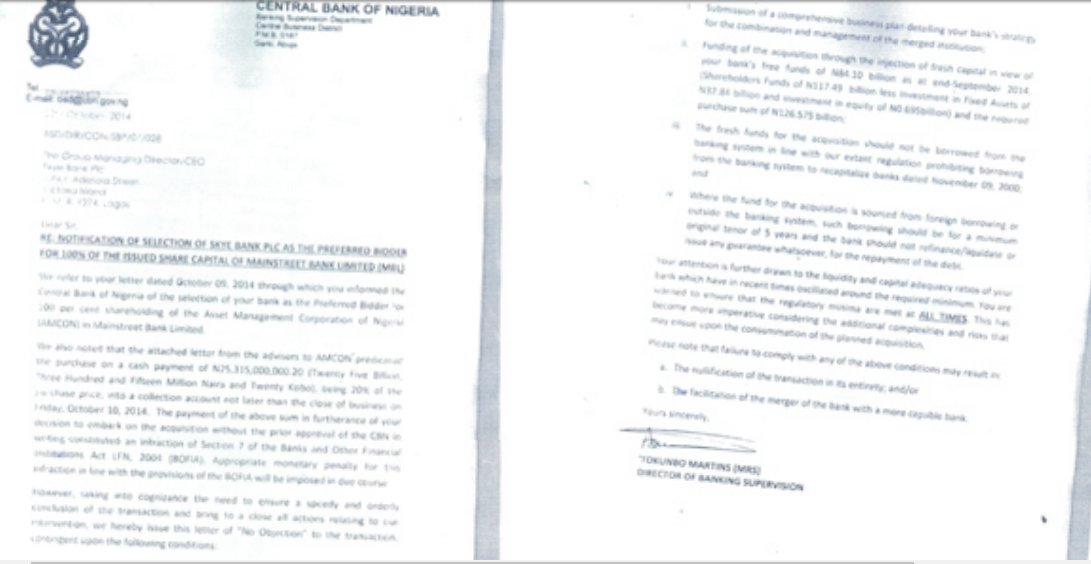

AMCON announced that it was taking bids for sale of 100% if it’s stake in MBL. #Skyebank emerged the preferred bidder with a bid of N126 Billion. It paid the initial 20% deposit (N26B) and on Oct 31, paid the balance of N100Billion ahead of the Nov 3 deadline to acquire MBL

2014

At the time of bidding, the net asset of MBL was N69 Billion (N67B at FYE). Skye bank however, bid N126 Billion for it. This shows that the purchase consideration paid by Skye Bank was well above the net asset of MBL by about N59 billion. #SkyeBank

Will be right back. Stay Tuned.