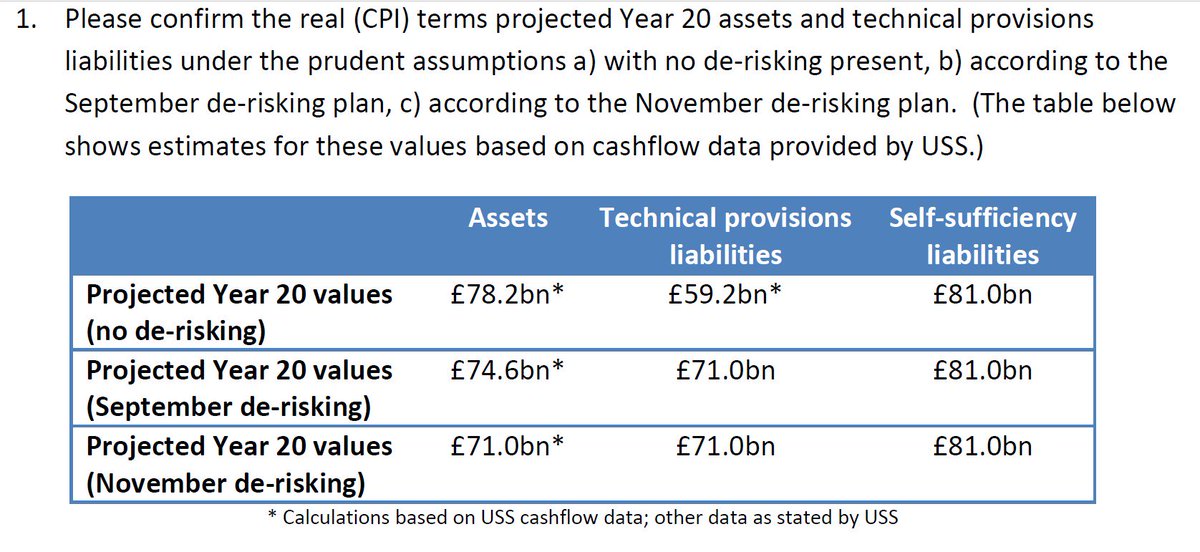

👆That is exactly what the figure in column ONE of row 1 does! /2

medium.com/@mikeotsuka/te…

medium.com/ussbriefs/resi…

uss.co.uk/how-uss-is-run…

threadreaderapp.com/thread/1056461…

Get real-time email alerts when new unrolls are available from this author!

Twitter may remove this content at anytime, convert it as a PDF, save and print for later use!

1) Follow Thread Reader App on Twitter so you can easily mention us!

2) Go to a Twitter thread (series of Tweets by the same owner) and mention us with a keyword "unroll"

@threadreaderapp unroll

You can practice here first or read more on our help page!