MUST READ👇👇👇

While in search of a...

💥💥💥

AND HERE COMES THE FUN PART!

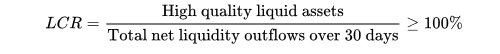

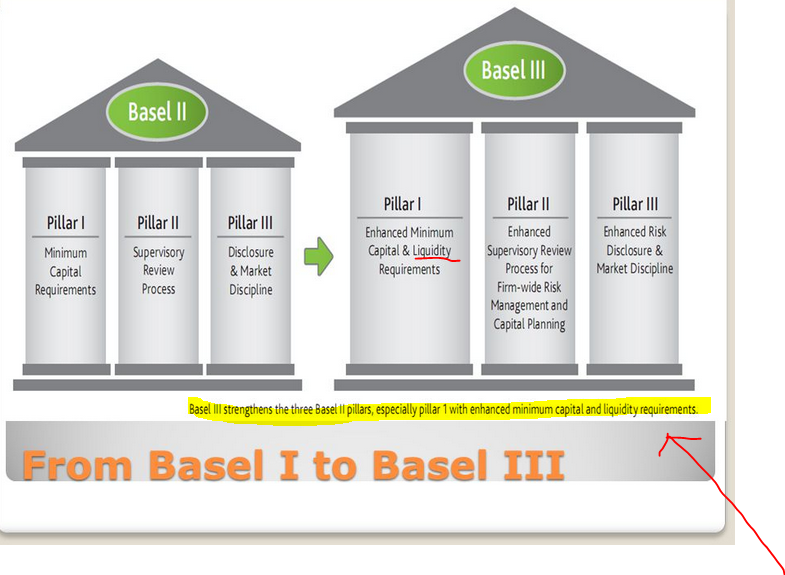

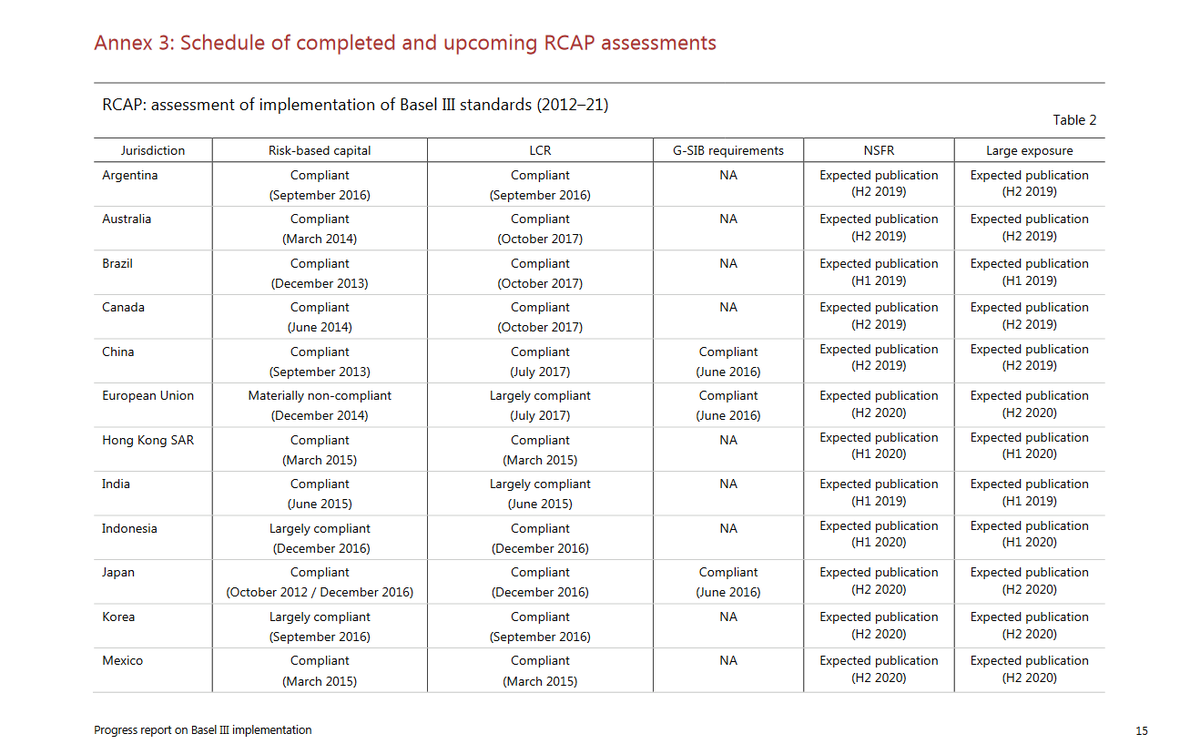

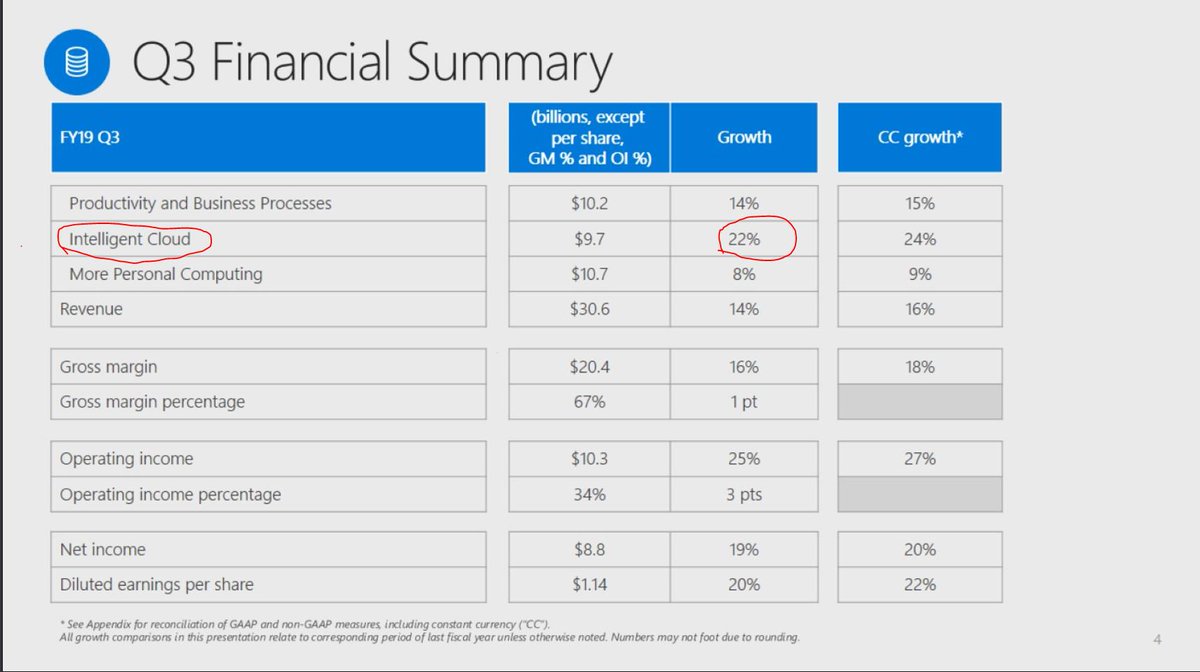

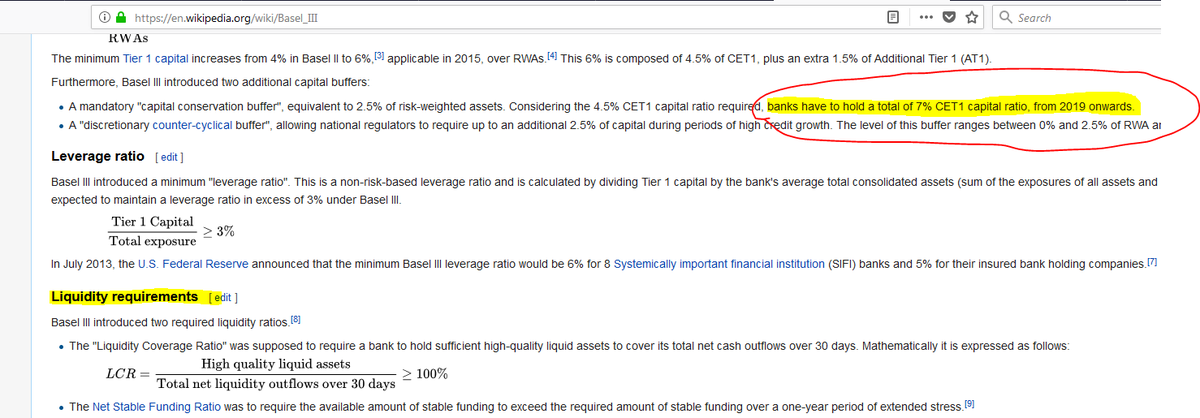

...Banks have to hold a total of 7% CET1 capital ratio, from 2019 onwards"

en.wikipedia.org/wiki/Basel_III

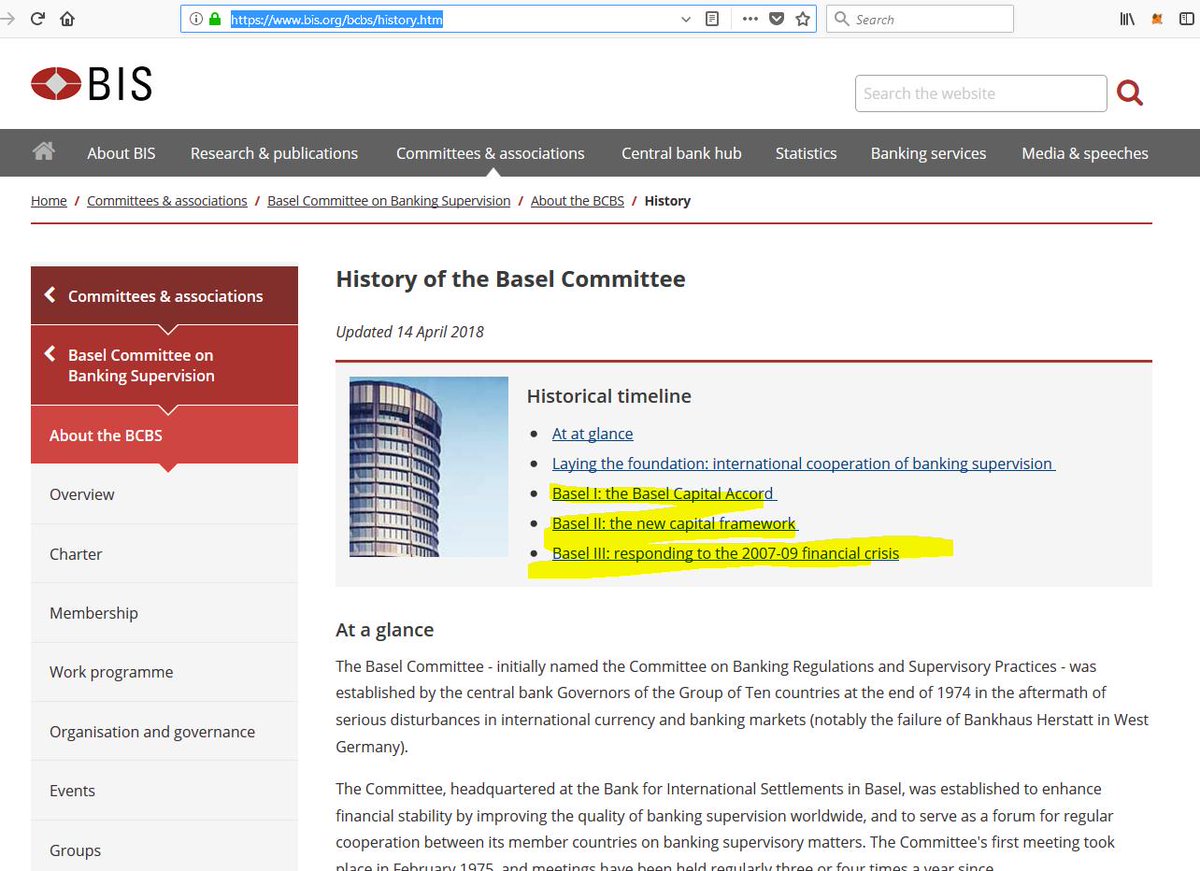

established by the central bank governors of the Group of Ten countries in 1974

The Committee's Secretariat is located at the Bank for International Settlements (BIS) in Basel, Switzerland

bis.org/bcbs/history.h…

The less exposure a banks has to Nostro/Vostro accounts, the more liquid they are. Thus, more "privileges" the banks will have.

#XRPTHESTANDARD

#0Doubt

When will the CB's hold the digital assets themselves!?

The crypto-exchanges, are only acting like a testing-lab!

High value / High volume, will be controlled and supervised by the Banks themselves. For that to happen they need to hold a digital asset

fsb.org/work-of-the-fs…

It starts with:

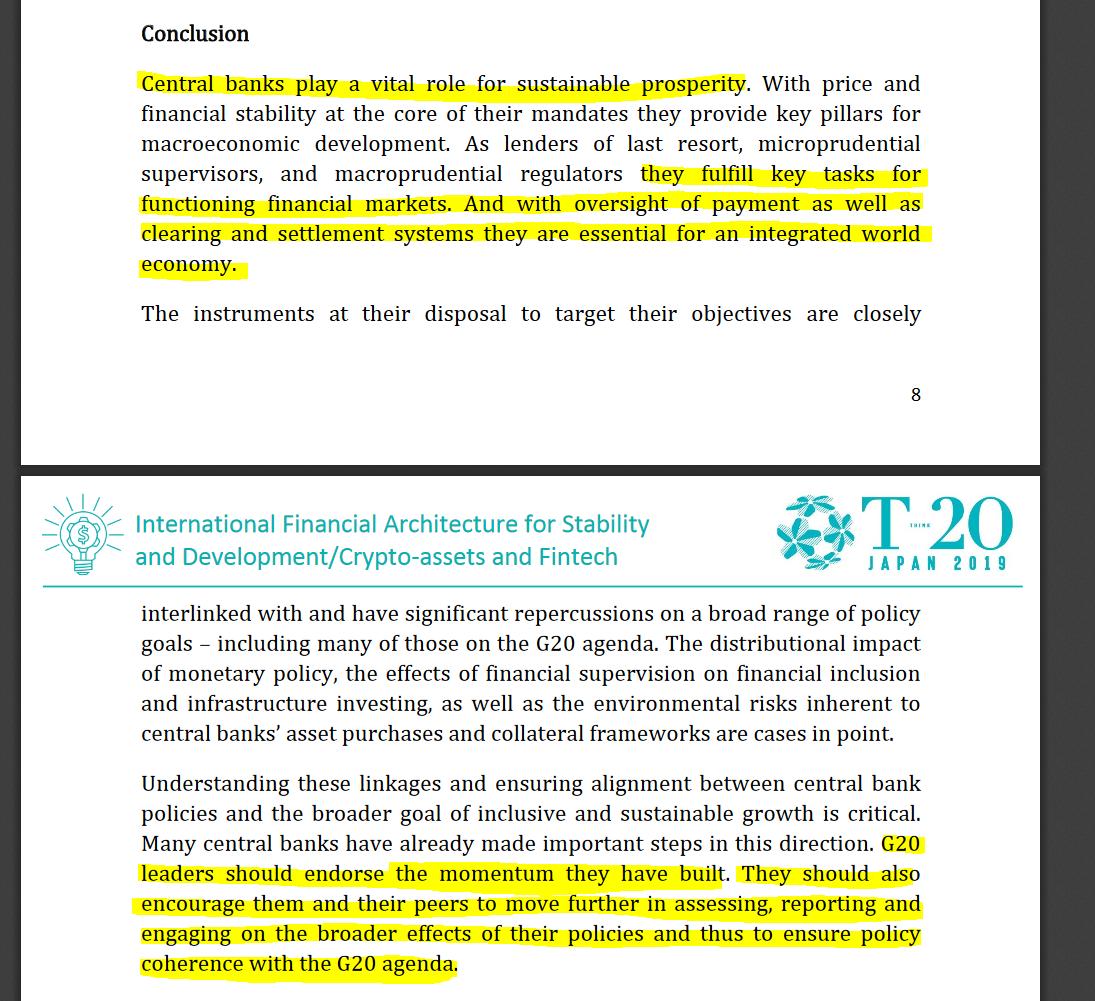

"Full, timely and consistent implementation of Basel III is fundamental to a sound and properly functioning banking system that is able to support economic recovery and growth on a sustainable basis......

Does this mean that, before 1 January 2022 all Banks must be READY?

2years and 9months........

Crawl, walk, run.

We are getting closer and closer.

thexrpdaily.com/index.php/2019…

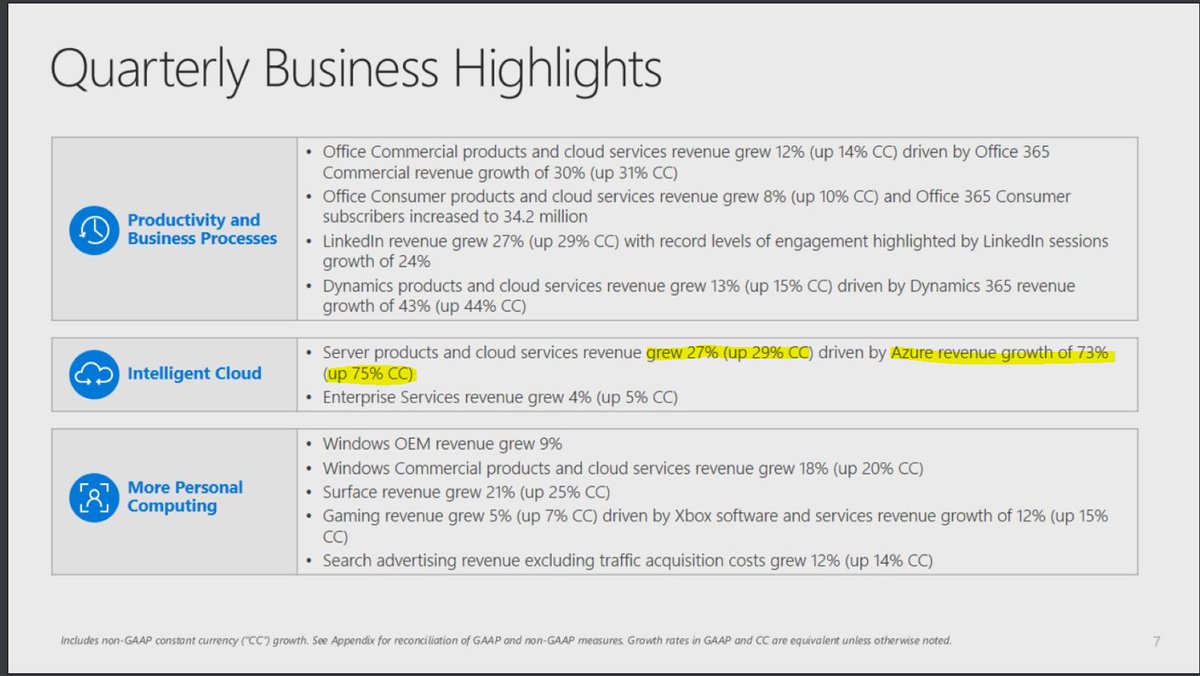

We are far beyond PoC.

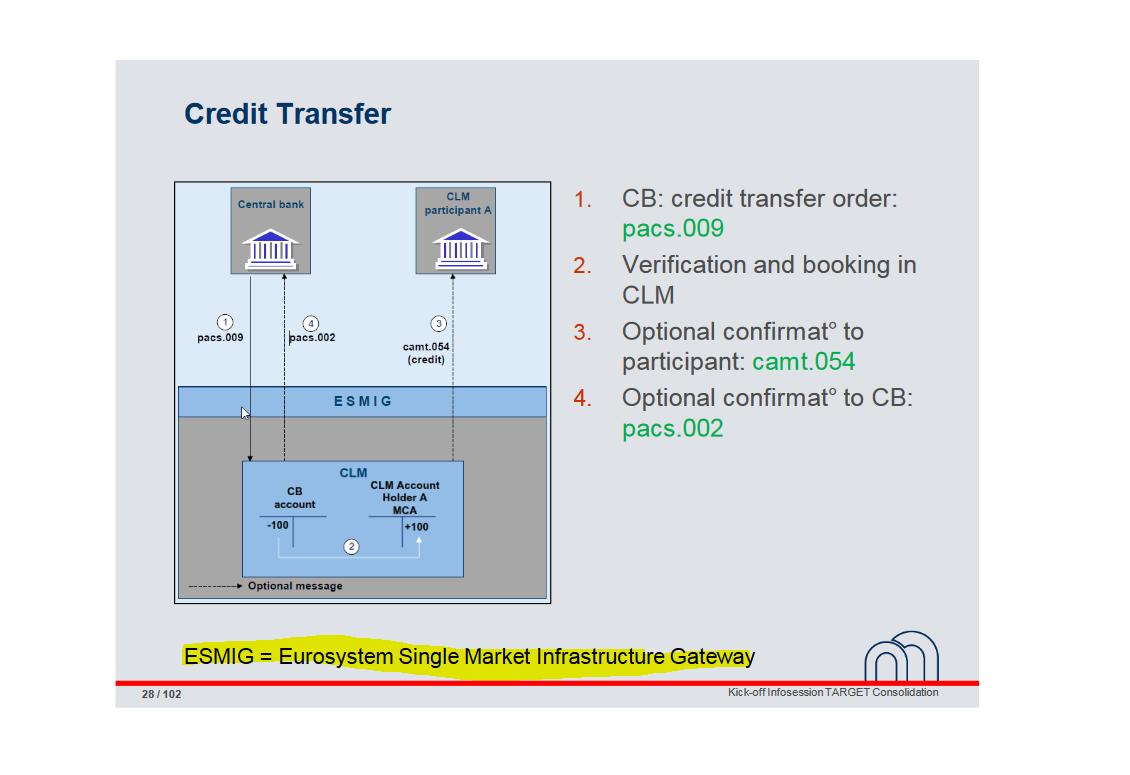

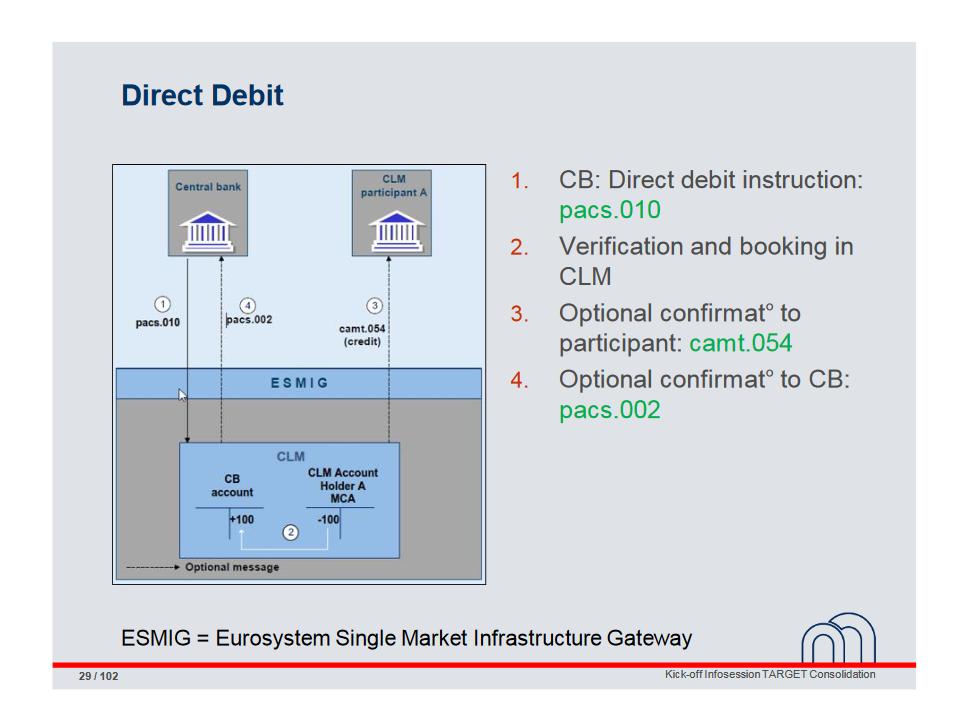

This test between 2 CB is HUGE!

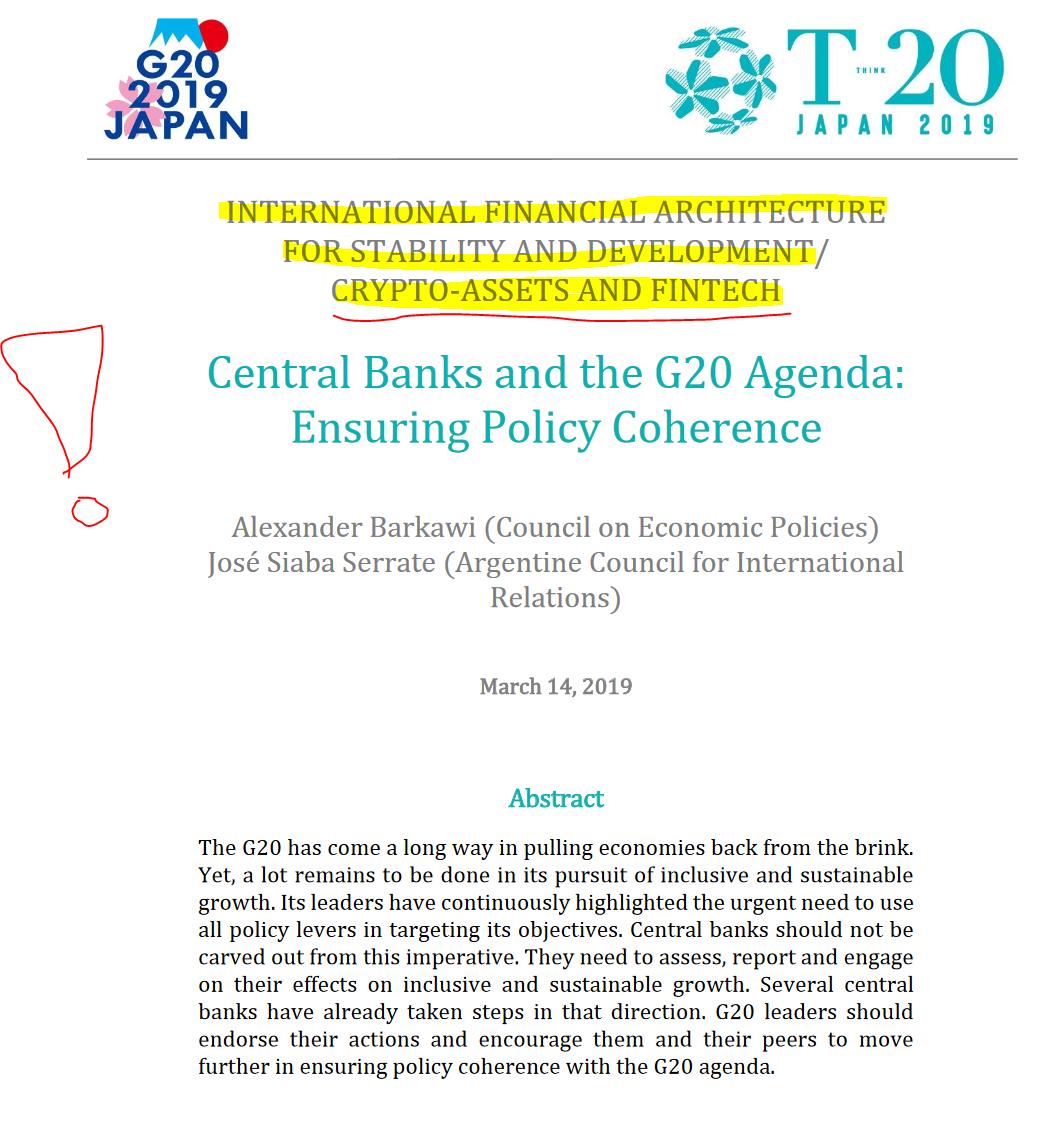

This make me stronger to believe that regulatory clearance will be given at the G20 in 🇯🇵

Q3 will be very interesting

We can have a glans of all the work being done before the G20 Top happens

Ones they figured out how and where to cut the cake, they will let unleash the DA into the world!

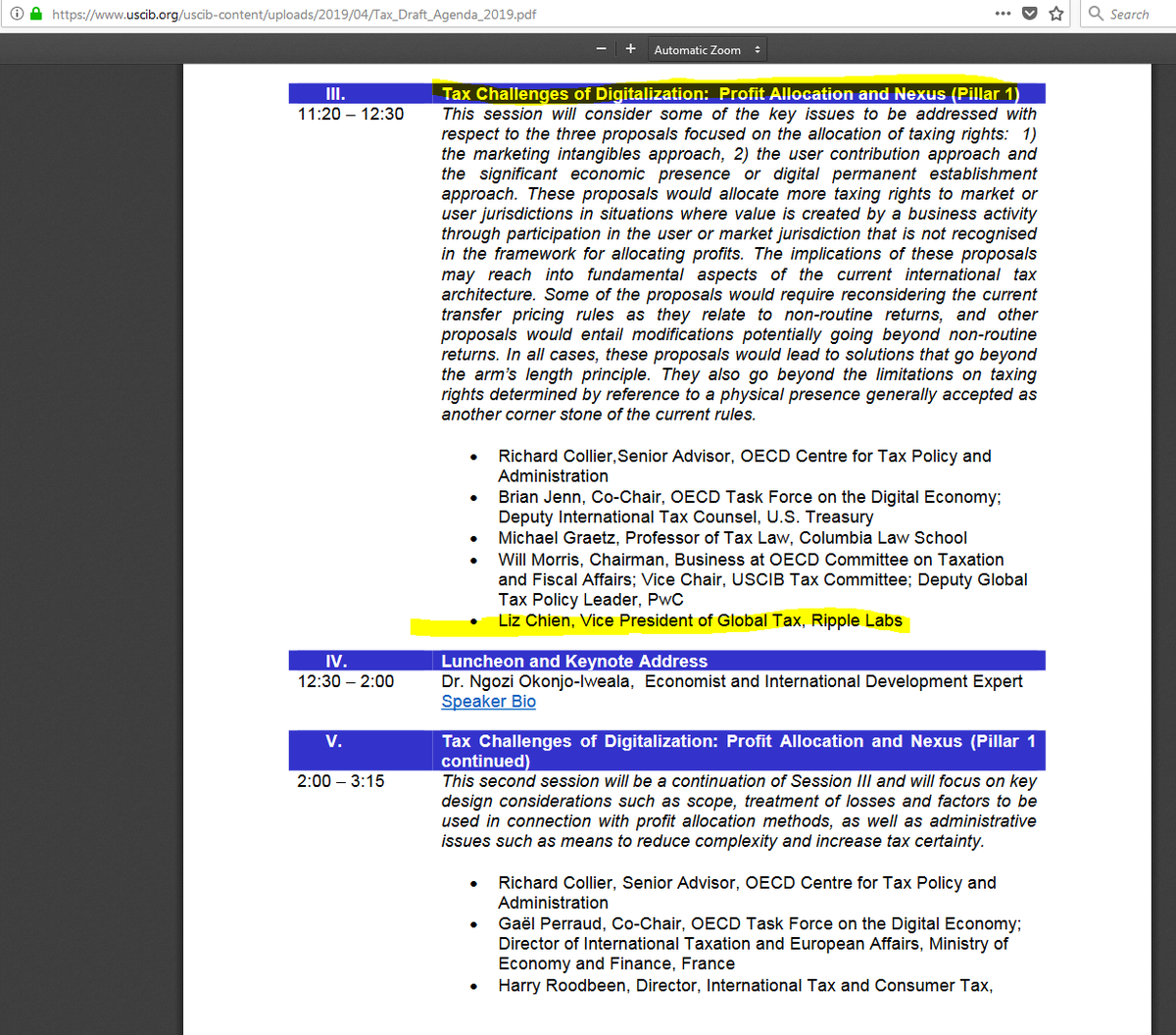

uscib.org/uscib-content/…

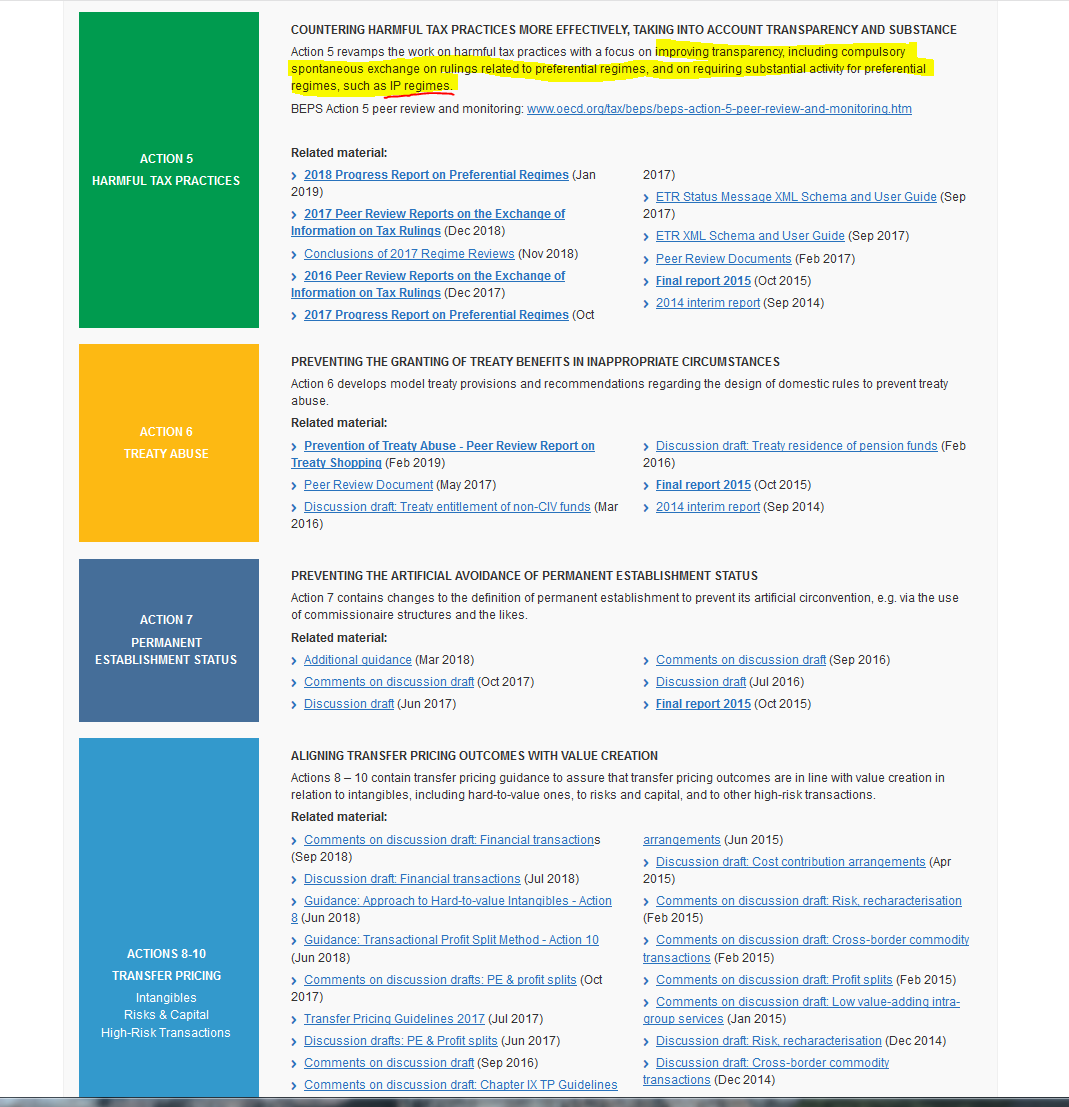

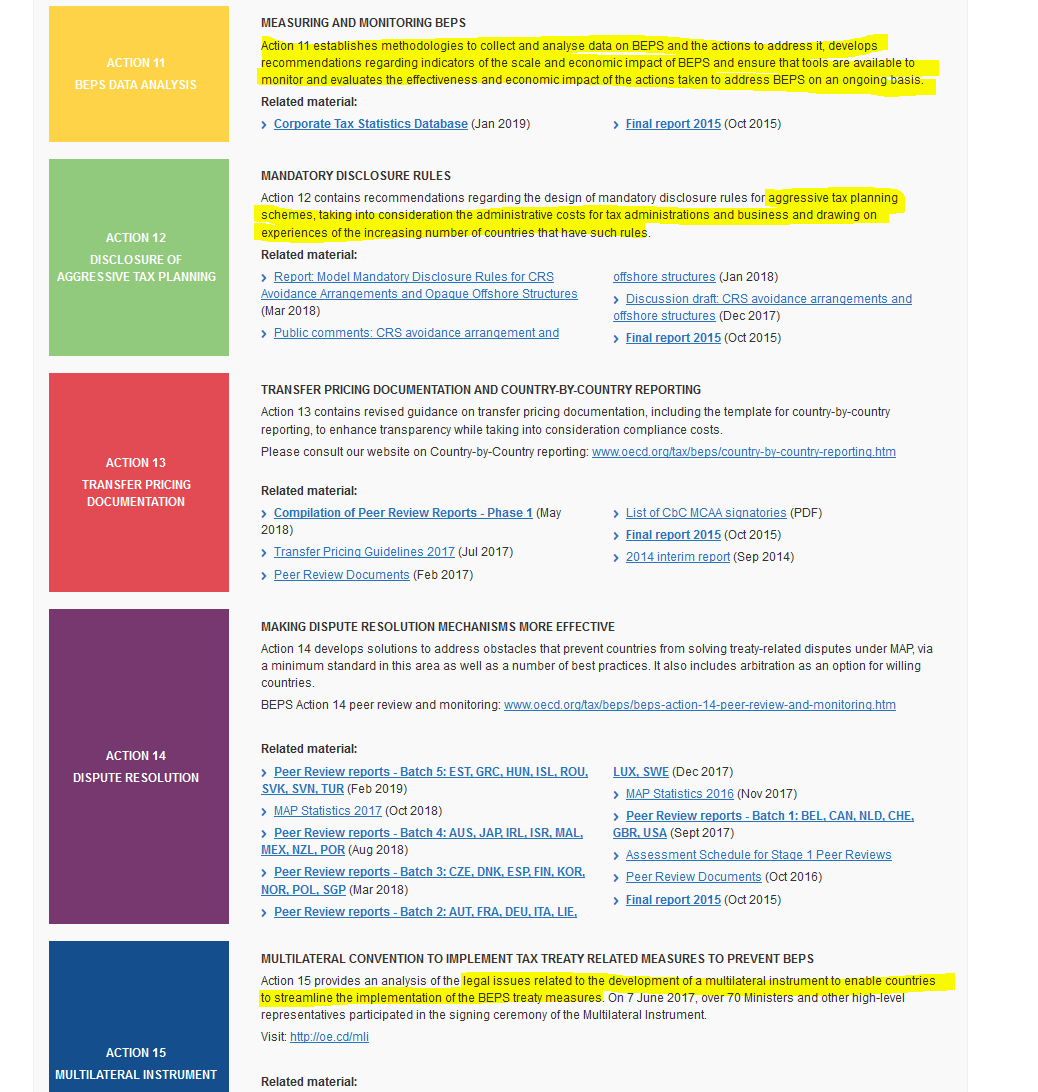

They want to share a lot of Info with each other, so that every person /company pays his/her share of TAX

oecd-ilibrary.org/docserver/9789…

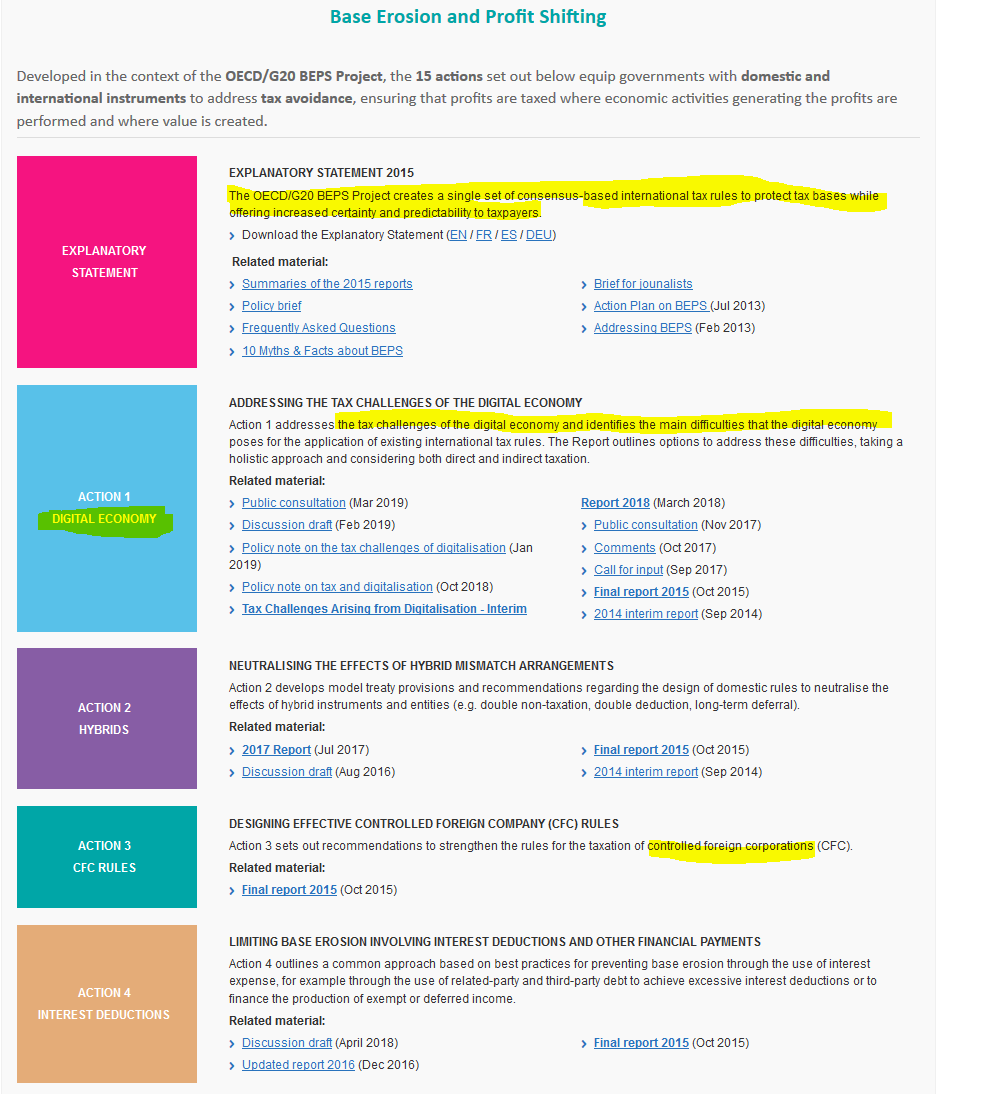

oecd.org/tax/beps/beps-…

BIG BROTHER IS GETTING BIGGER

And is being created in front of our eyes.

The FULL bull run of utility might take some time, before they all agree in how to collect/share the taxes on a global scale.

Digitization you gotta love it

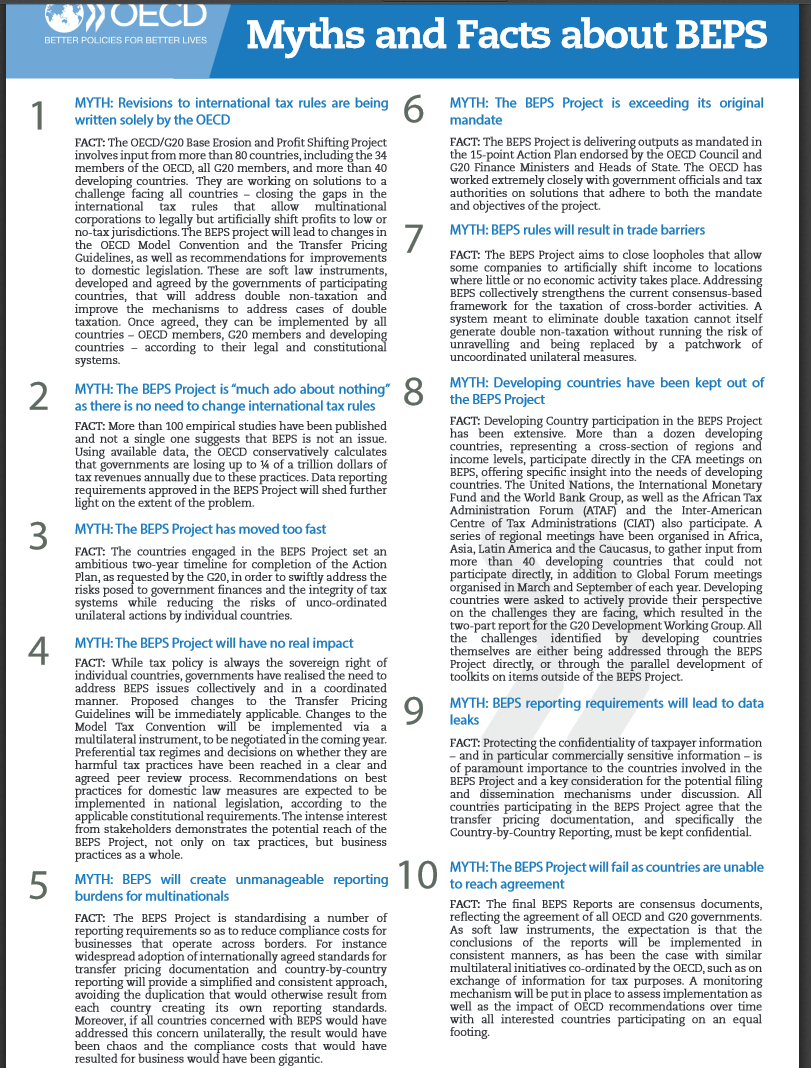

What are the facts?

oecd.org/ctp/myths-and-…

1 of 10

FACT:

The OECD/G20 Base Erosion and Profit Shifting Project

involves input from more than 80 countries, including the 34

members of the OECD, all G20 members, and more than 40

developing countries.

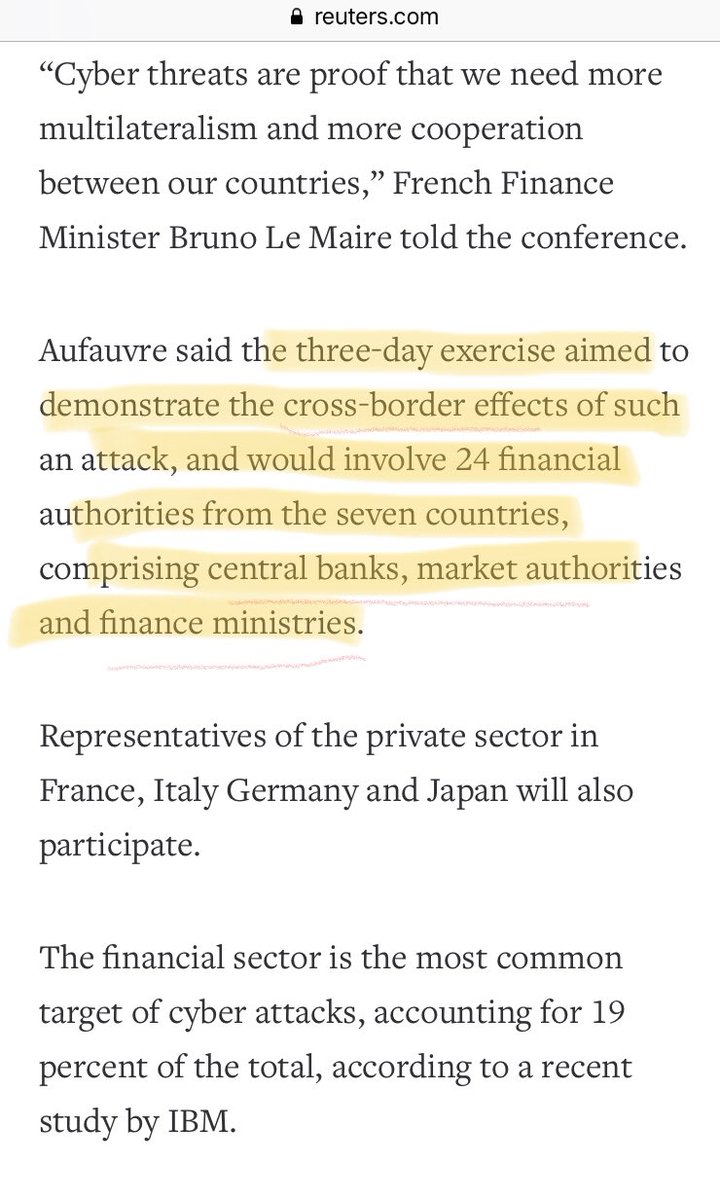

So the G7 (the smaller&stronger group of the G20) are doing some cross border testing.

reuters.com/article/us-g7-…

#0doubt #XRPTheBase #ripple #XRPtheStandard