a) Fiscal spending rose 📈15%YoY & total financing rose 📈40% YoY in flow &📈 10.7% in stock;

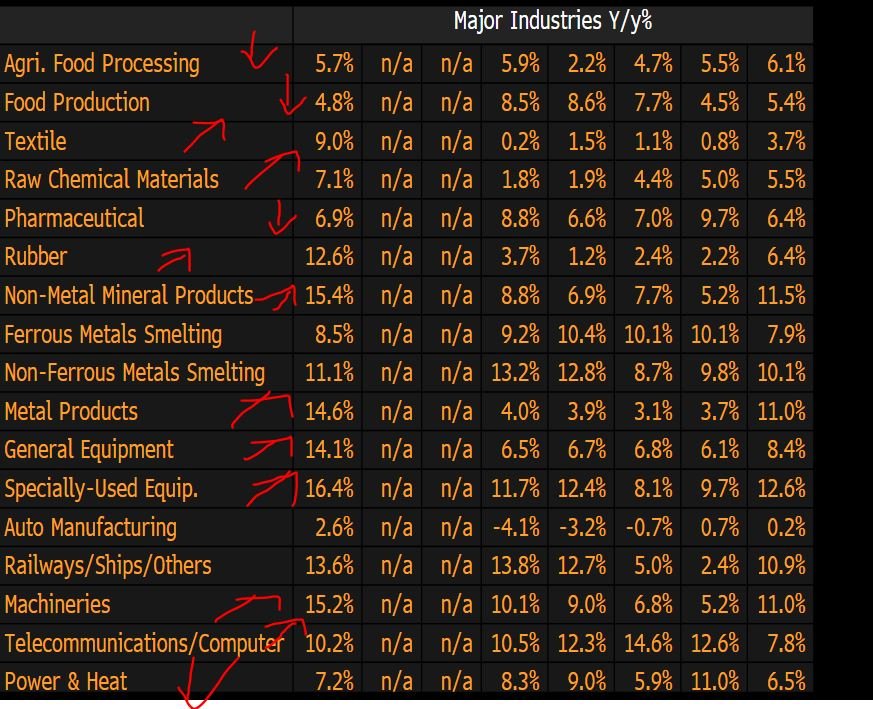

b) Retail sales rose📈 8.7% in March & IP just did a huge upturn to 📈8.5%;

c) GDP rose 📈6.4%

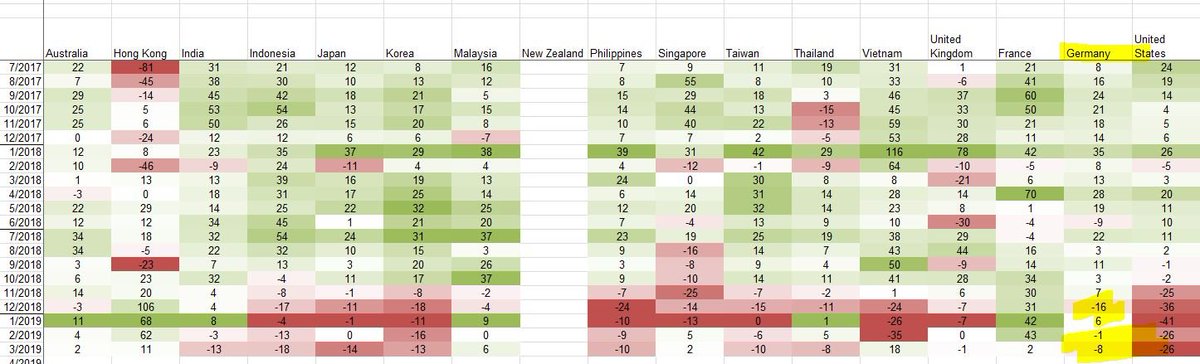

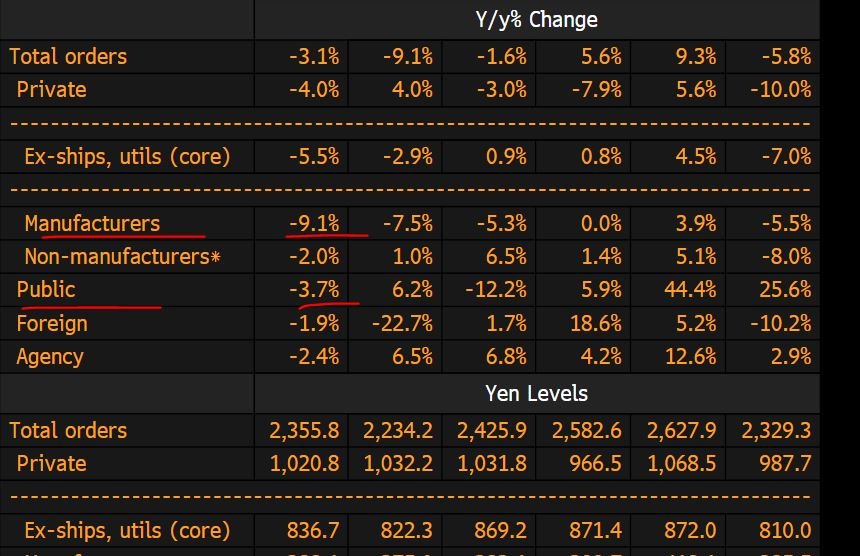

d) Imports contracted 📉-4.4% YoY & exports rose only 0.5% YoY📉

a) China growth driven by a spurt of IP & retail sales & mostly for domestic sectors (property & infra);

b) While the March YoY retail sales look good, the YTD figure shows slowdown (8.3% ytd vs 9.8% for '18;

Don't expect China📈to save rest of the world

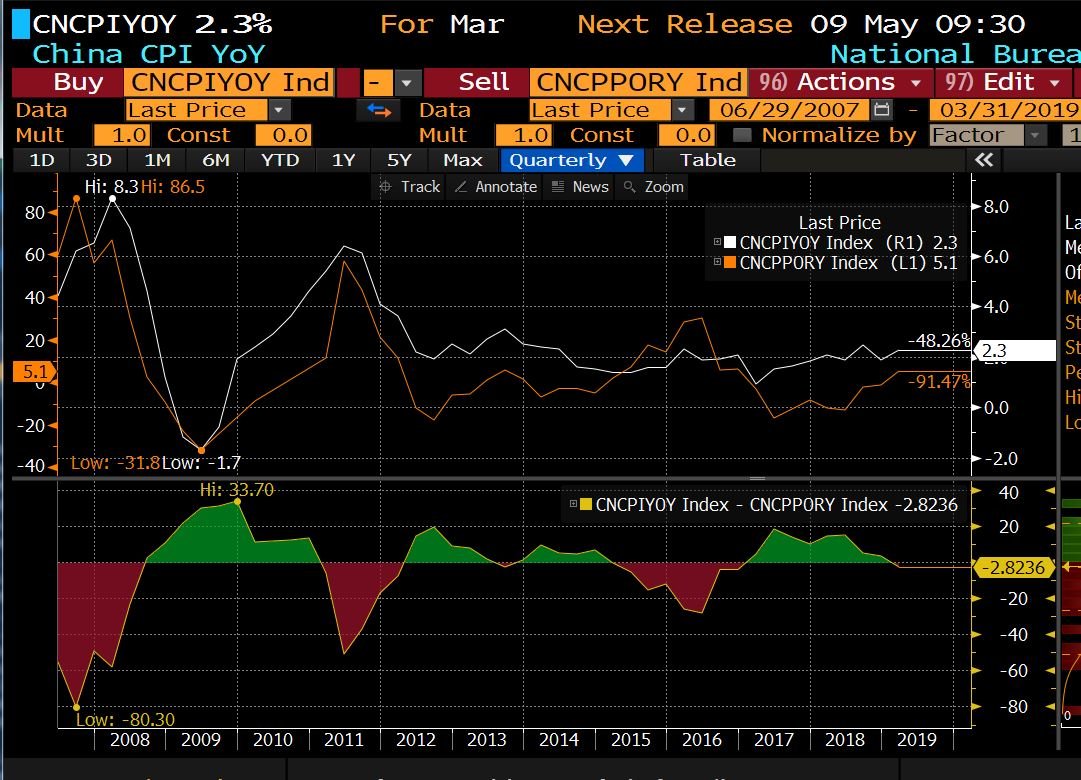

Chinese fixed income traders won't like this news & esp w/ this gang buster growth figures coming out.

Equities are also not happy either b/c strong eco = expectations of future stimulus dimmed 😬