1. Don't lose your phone

2. Don't lose your phone

3. Don't lose your phone

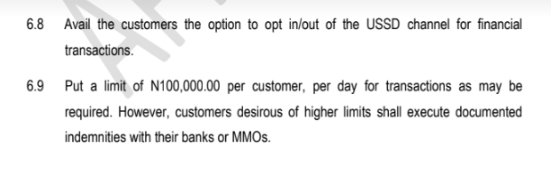

There are other things u can do but they're linked to protection from phone loss. This's why we ask the @cenbank to be tougher on banks who are in default of its guidelines

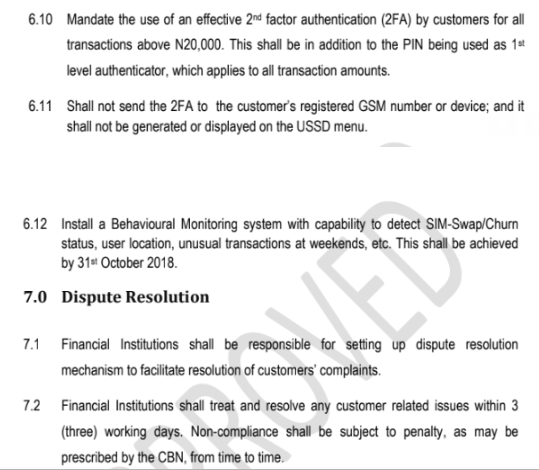

1. The bank MD. Corporate clients understand this. All letters are addressed to the MD. Once it's acknowledged at a branch, the MD can't claim he didn't see it

2. Send email copies of acknowledge letter to d compliant dept, CBN, CPC

*Wait 3 days & send reminder