The company issued no shares and took $0.

It’s the best I’ve ever felt about fundraising.

The cash we raised in prior rounds helped to get here, but this time @TransferWise got something perhaps even more valuable.

Thread.

It's really hard.

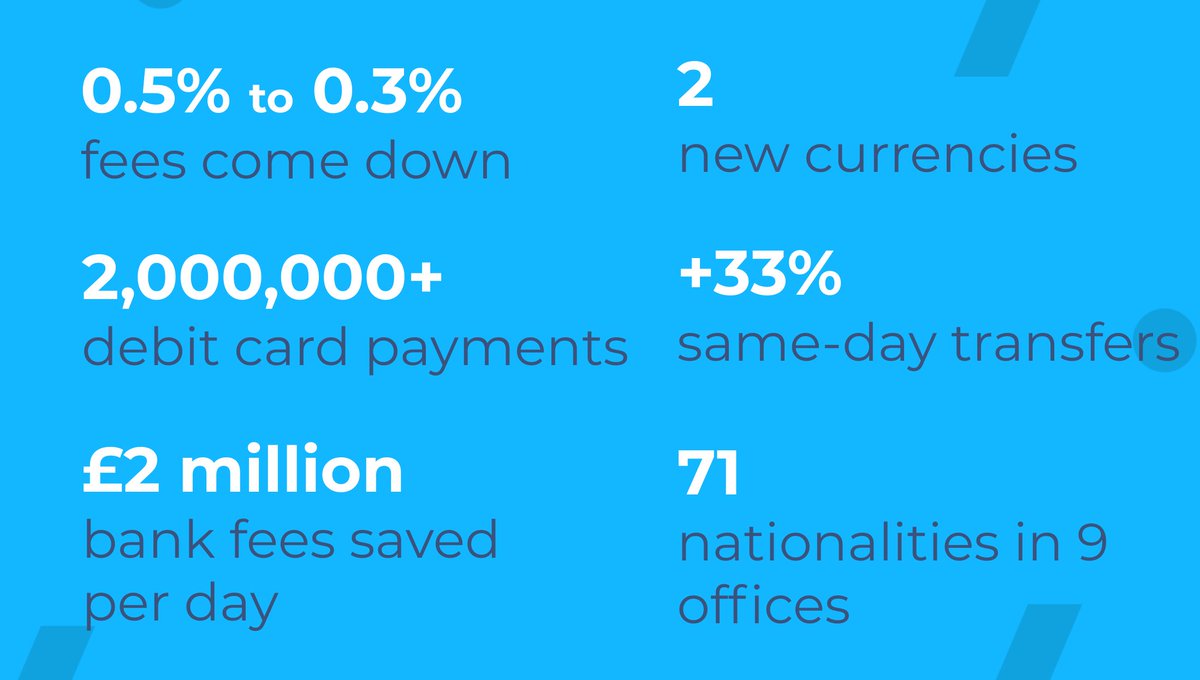

We’ve done a mere 0.5% of the journey.

But in the grand scheme, it's 19% of the mere 0.5% that go through TransferWise.

Going public too soon would be a distraction that may slow us down. Ack, $GOOG $AMZN are incredible counterexamples.

How to stay private longer?

If you need capital markets to fund your growth, you’ll have to go public. It makes capital cheaper.

We love having our customers fund our mission. It’s their mission too.

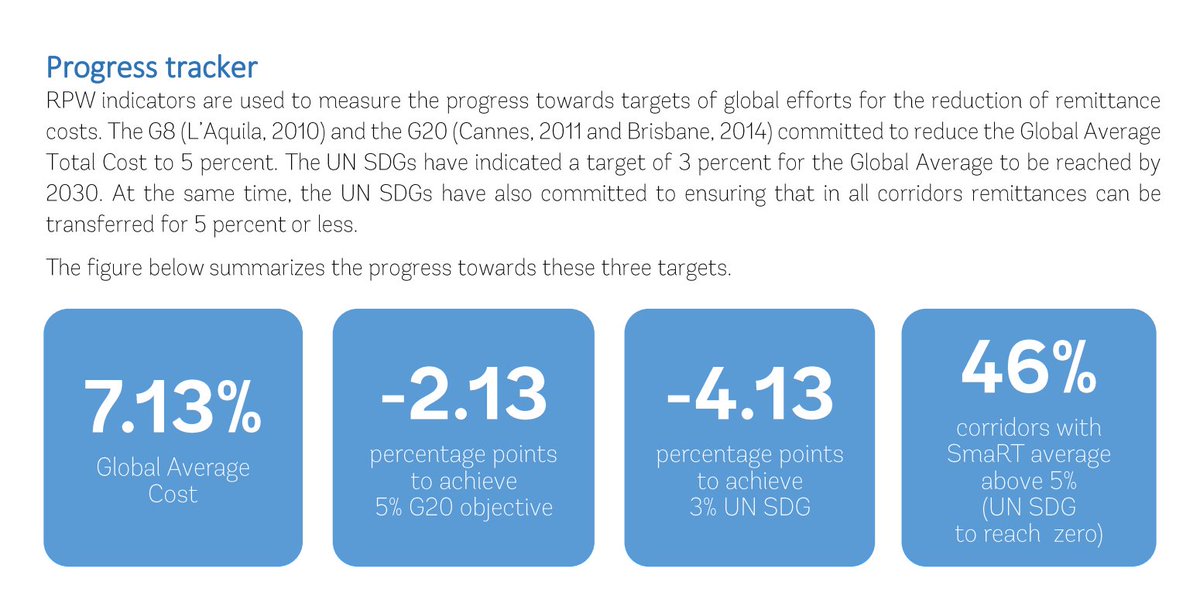

Investors love public companies because there’s info about them. Be public about your progress and open about your numbers. Do it regularly. Perhaps a quarterly mission update ...

After a while you’ll have a mix of shareholders with different time horizons, histories, expectations. They don’t need to buy and sell every day 9 to 5, but they will appreciate the opportunity once a year.

Every employee too.

Start your fundraising pitch with the hardest. For example, “we’ll keep dropping our fees as fast as we sustainably can”. Some will balk, other admirers of Amazon, Vanguard, Costco - you will love having them on board.

Such that it has the most positive impact for our users and our mission.

Fun fact: it will also translate to biggest outcomes for long-term shareholders.

forbes.com/sites/alexkonr…