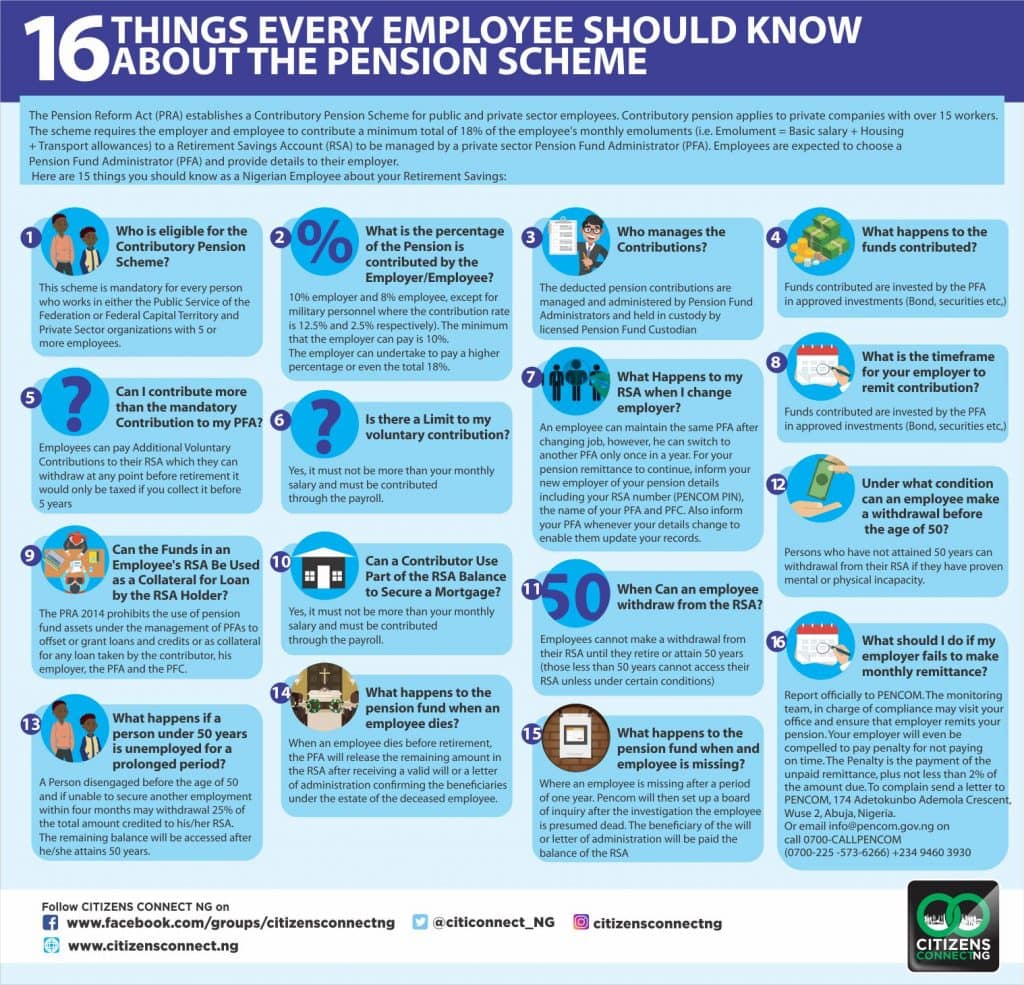

The Pension Reform Act (PRA) set rules&standards for the payments of retirement benefits to ensure that every person who worked in either Public Service&private sector @TutuAbbey @AbdulMahmud01 @monye_morris

2. Contributory pension applies to private companies with over 15 workers.

3. The Employer and the employee contribute a percentage of the employees’ salary to the scheme every month.

5.Employees are expected to choose a Pension Fund Administrator (PFA) and provide details to their employer

#PensionScheme

7. An employee can maintain the same PFA after changing job,however, he can switch to another PFA only once in a year.

9. Funds contributed are invested by the PFA in approved investments (Bond, securities etc)

#PensionScheme

#PensionScheme

12. The programmed monthly or quarterly withdrawals is calculated on the basis of an expected lifespan

14. A Person disengaged before the age of 50 and is unable to secure another employment within four months may withdrawal 25% of the total amount

15. An employee shall not have access to his RSA or have any dealings with the Pension Fund Custodian with respect to the RSA except through the Pension Fund Administrator. #PensionScheme

#PensionScheme #RSA

#PensionScheme #RSA

#PensionScheme #RSA