Mises: "A stock market is crucial to the existence of capitalism and private property. For it means that there is a functioning market in the exchange of titles to the means of production”

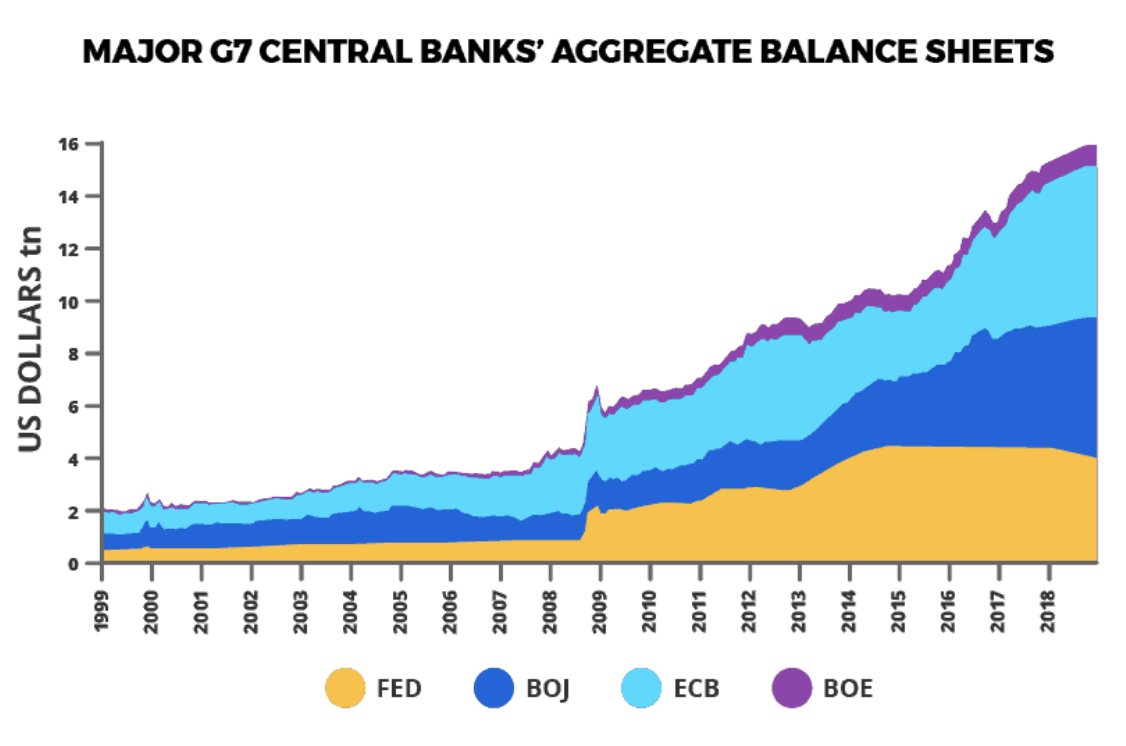

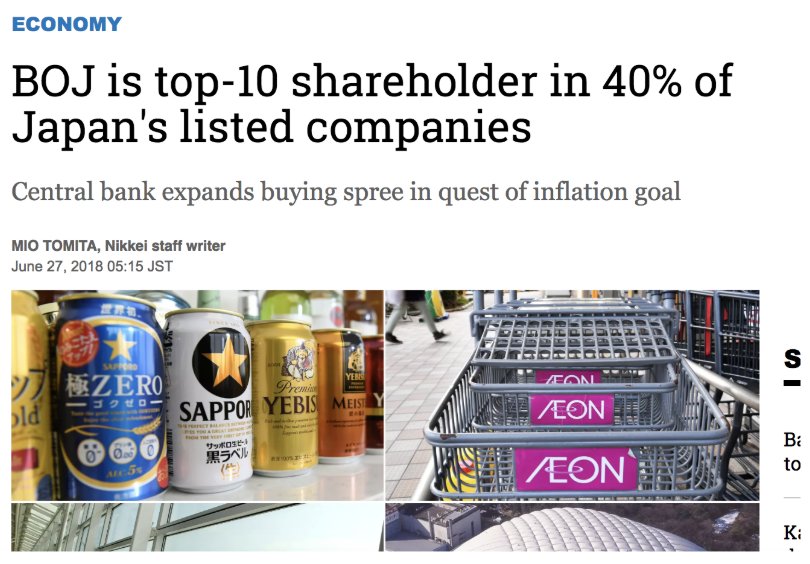

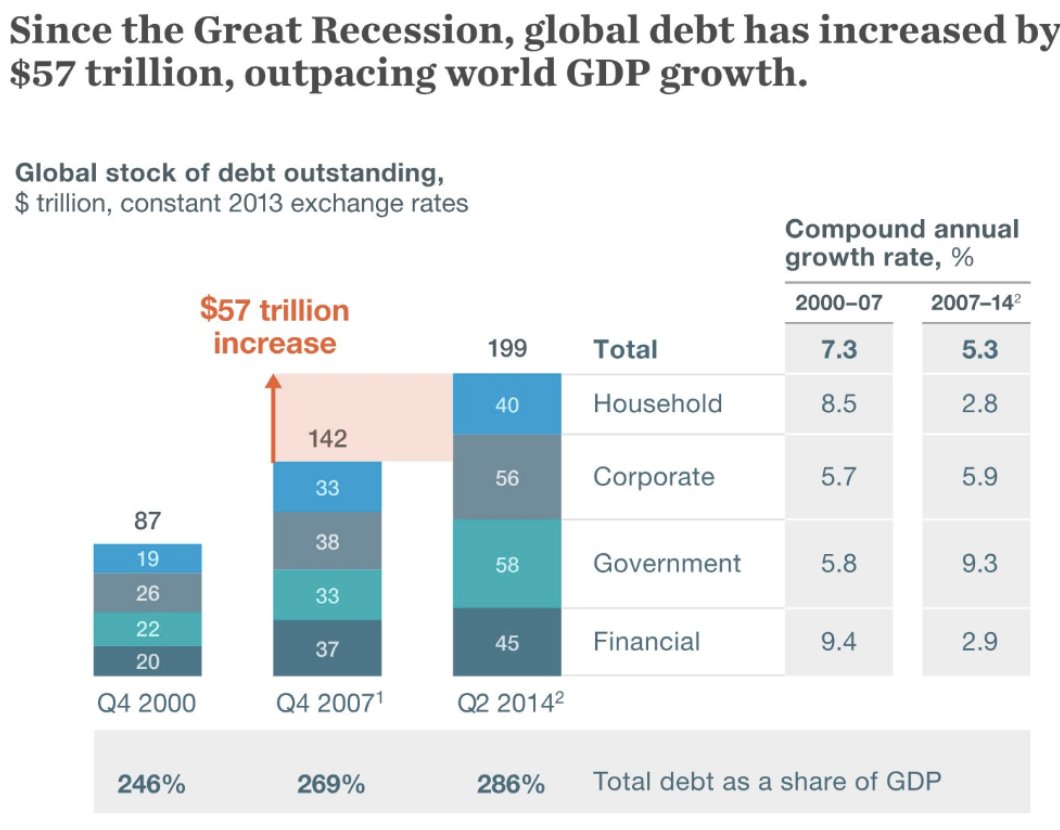

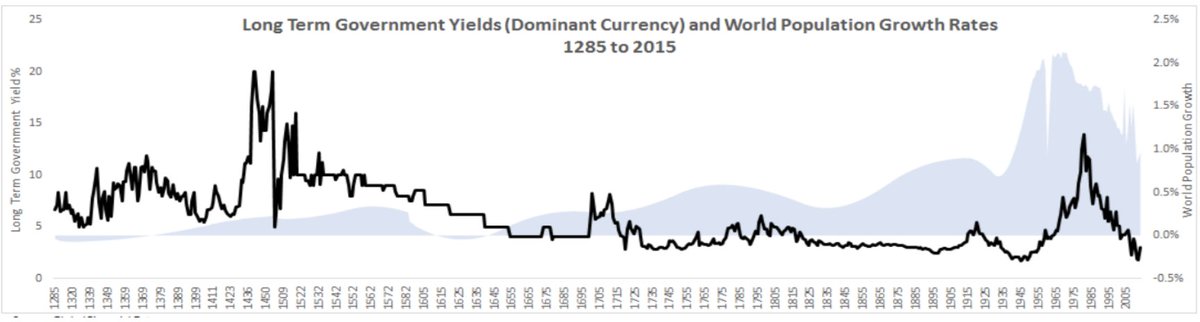

But, OTOH they can’t raise rates bc. of all the debt in the world and the massive increase in interest expense this will cause

It's like giving a cancer patient ecstasy instead of chemo.

While the volatility may be lower than ever, we've created the largest tail risk & fragility in history

Scarce assets will benefit tremendously.