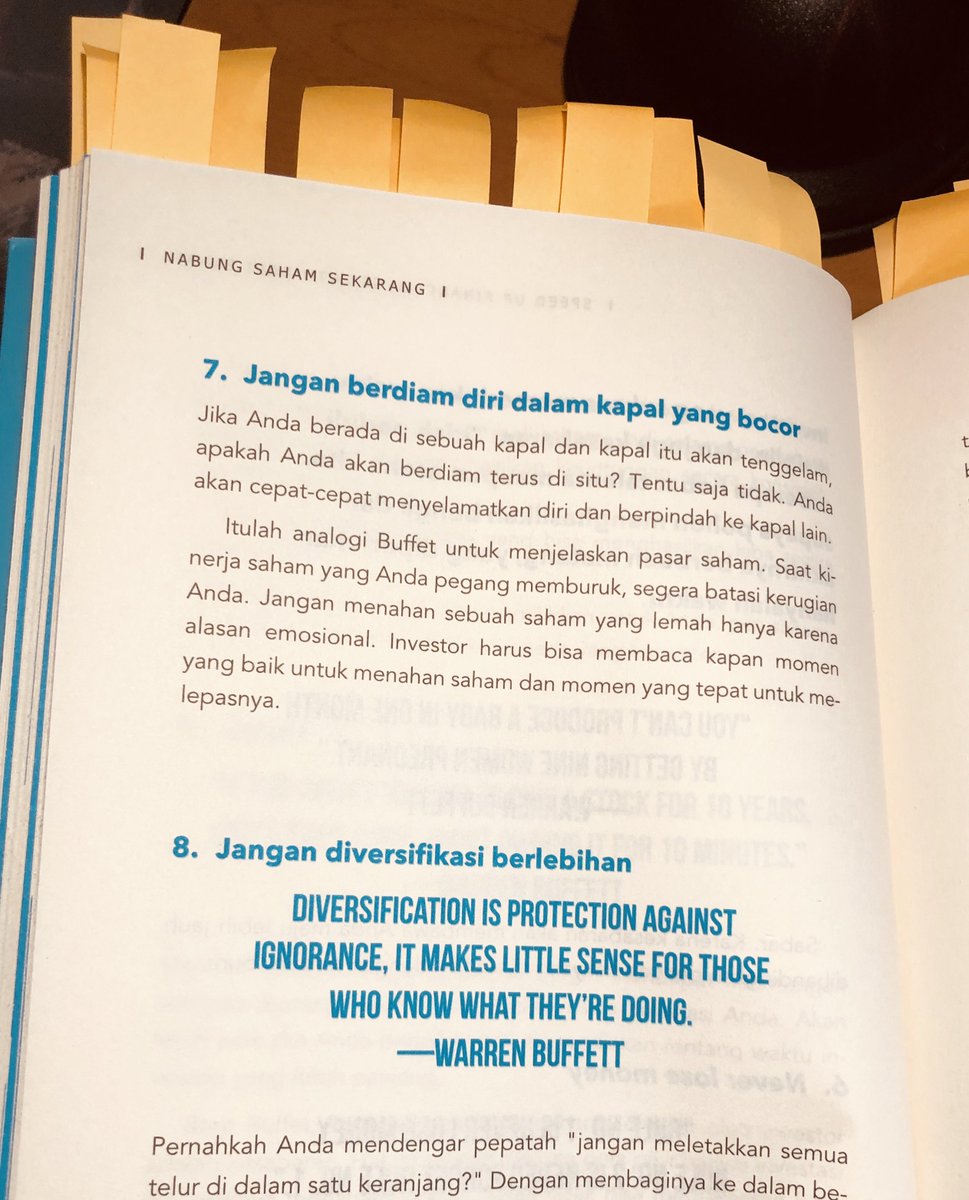

You can't understand why he is such a great capital allocator if you don't understand the previous sentence.

"The economic value of any asset is the present value… of all the future streams of cash going in or out of the business." buffett.cnbc.com/video/1994/04/…

Warren Buffett 1994 Annual Meeting

In terms of the capital that is generated above that, that that’s our job." Buffett

"If we’re keeping $1 bills that would be worth more in your hands than in ours, then we’ve failed to exceed our cost of capital.” Warren Buffett

"After ten years in the job a CEO whose company retains earnings equal to 10% of net worth, will have been responsible for the deployment of more than 60% of all capital."

Buffett

Managing a business ≠ allocating capital.

The skills required for each role ≠ the same.

Common common allocation error.

covestreetcapital.com/wp-content/upl…