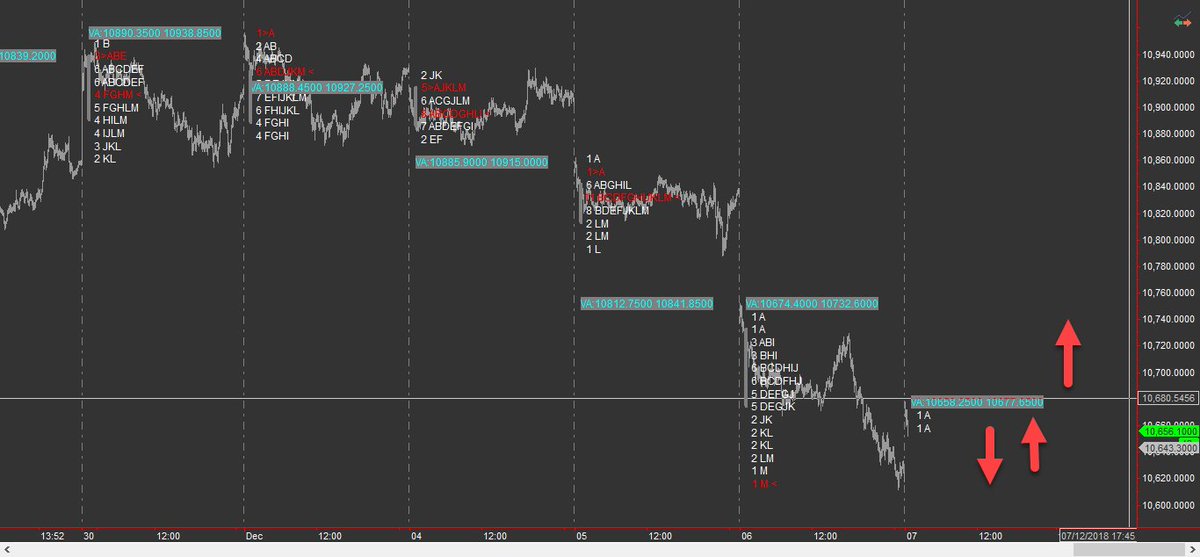

Excerpts, screenshots and my notes along with it #ForOwnReference

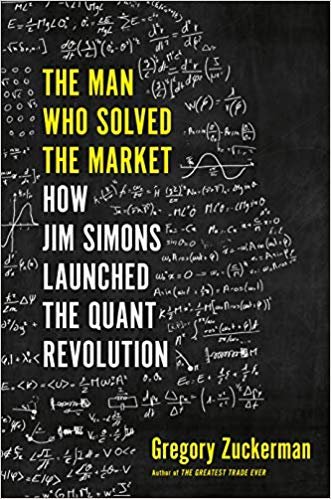

Actionable secrets? Are you kidding me? If you're looking for one then quit reading right here, I mean don't read any finance book like ever

Nuances & interesting tidbits? Plenty of them, Zuckerman did his research for sure.

Beware, it's a long thread

Note - Importance of pseudo-code before actual coding

Later he found his hedge fund and hired math professors from SBU (Later he donated a huge sum to the Univ)

Narrow, individual models, by contrast, can suffer from too little data"

" A consistent winner, for example, might automatically receive more cash, without anyone approving the shift or even being aware of it."