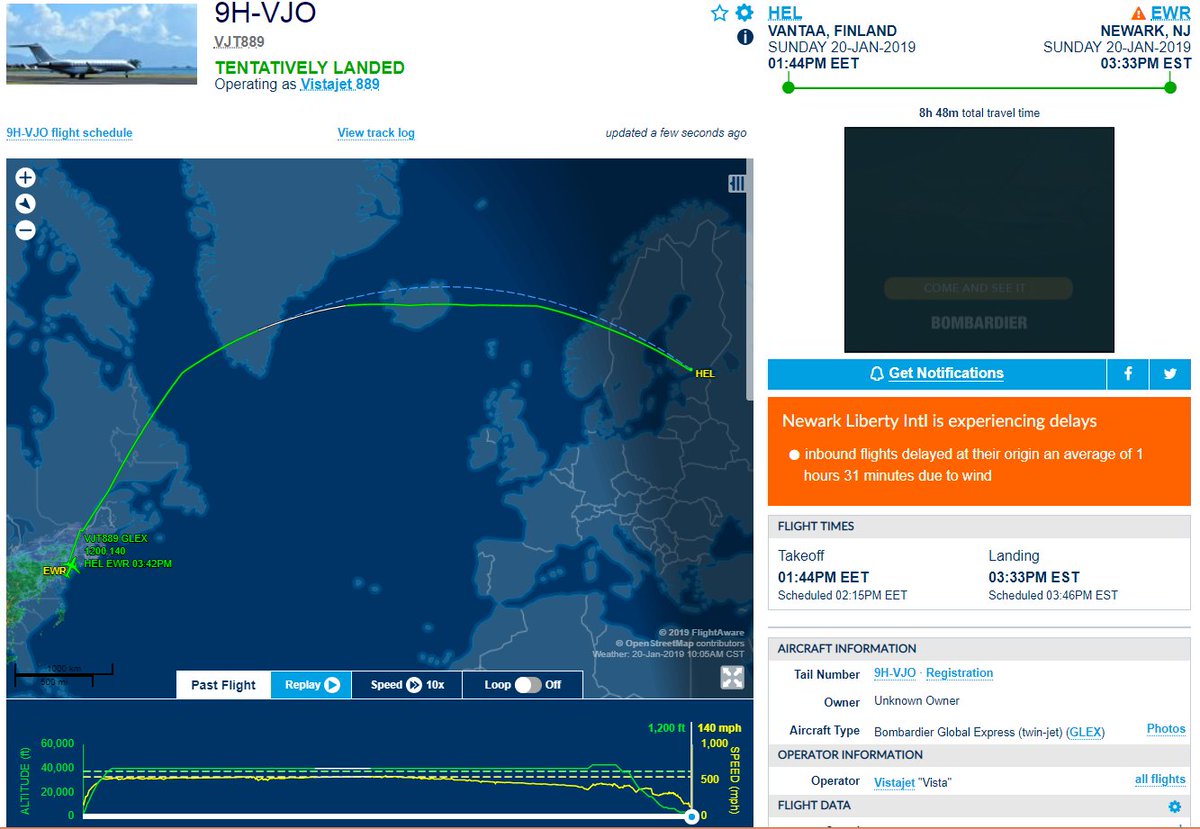

The problem they're attempting to solve is "Professionals who are good credit risks are priced out of homeownership by down payment requirements in SFBA/etc due to $$$ houses."

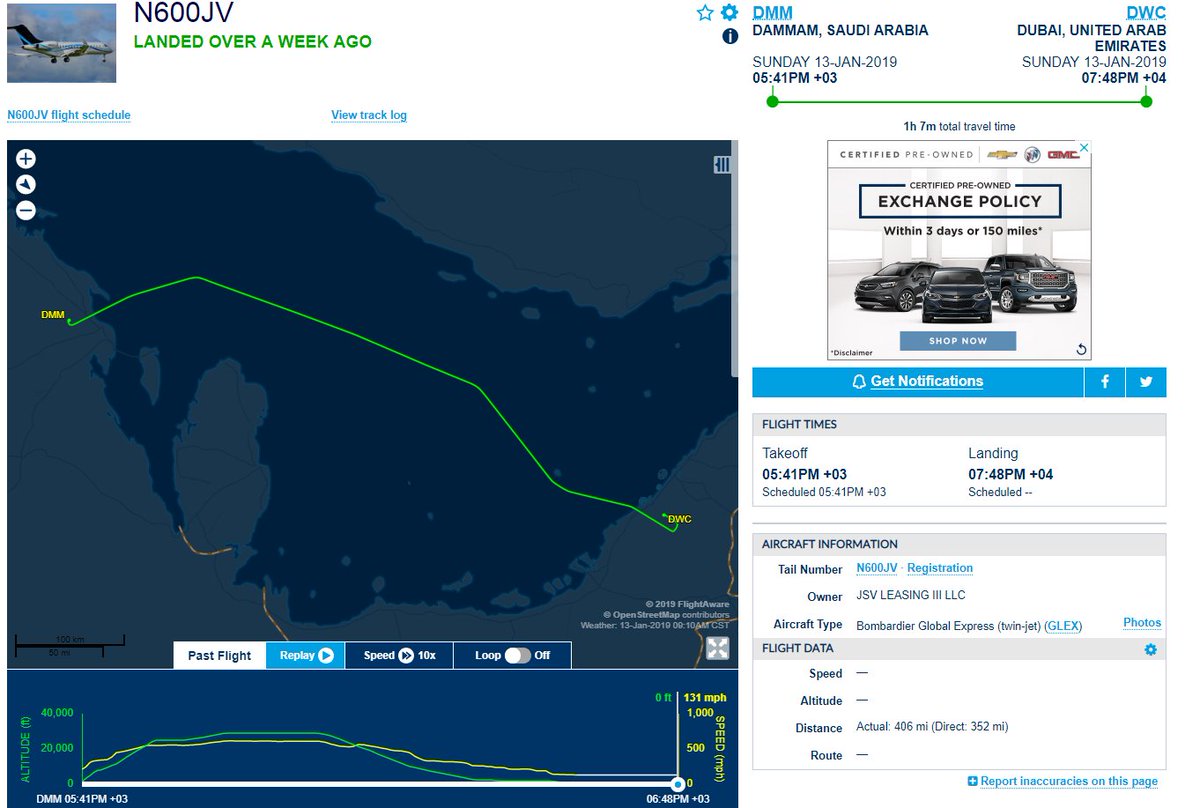

The real estate fund, which has cost-of-capital and return requirements which are *very different* from the tech company, is where most of the action very probably is.

So how would you assemble that portfolio, if you believed in it?

But they just take the traditional bundle of rights that get subdivided by contract and statute and allocate them a bit differently.

Well traditionally "If you are an investor in a firm which exists to go long real estate and real estate prices decline, you are going to lose money" but it isn't obvious to me that this functions in that fashion, which is fascinating.

An interesting fact you'll learn if you enjoy reading bank annual reports: First Republic, which is effectively a community bank in Silicon Valley/etc, suffered a total of zero mortgages defaulting during the dot com bust.

*Zero.*