What is the value of the position you are carrying? When we say value, it has nothing to do with margin, risk, where your stop loss is, etc. When we are talking about the world of cash equities, this is quite clear. The importance

Let us say we are buying 1000 shares of XYZ Ltd. For Rs. 500/- a share. The exposure totals to Rs.500 (The price)

Now let us assume this same position was in futures instead of

= 20% of 5,00,000/-

= 1,00,000/-

The moment we are buying a future, now there arises the question of leverage and exposure, and the dimension of position sizing starts becoming important.

To understand the risk above with the future, we can also think of it like buying shares in the

Why is sizing important here. The reason is that once exposed to futures i.e. where the possibility of leverage is more than 1,

If one had a capital of Rs.5,00,000/- and bought this 1 lot of future, he or she now has a leverage of 1 because the value of position is equivalent

With options, the leverage factors can increase tremendously, and hence even more is the important of position sizing.

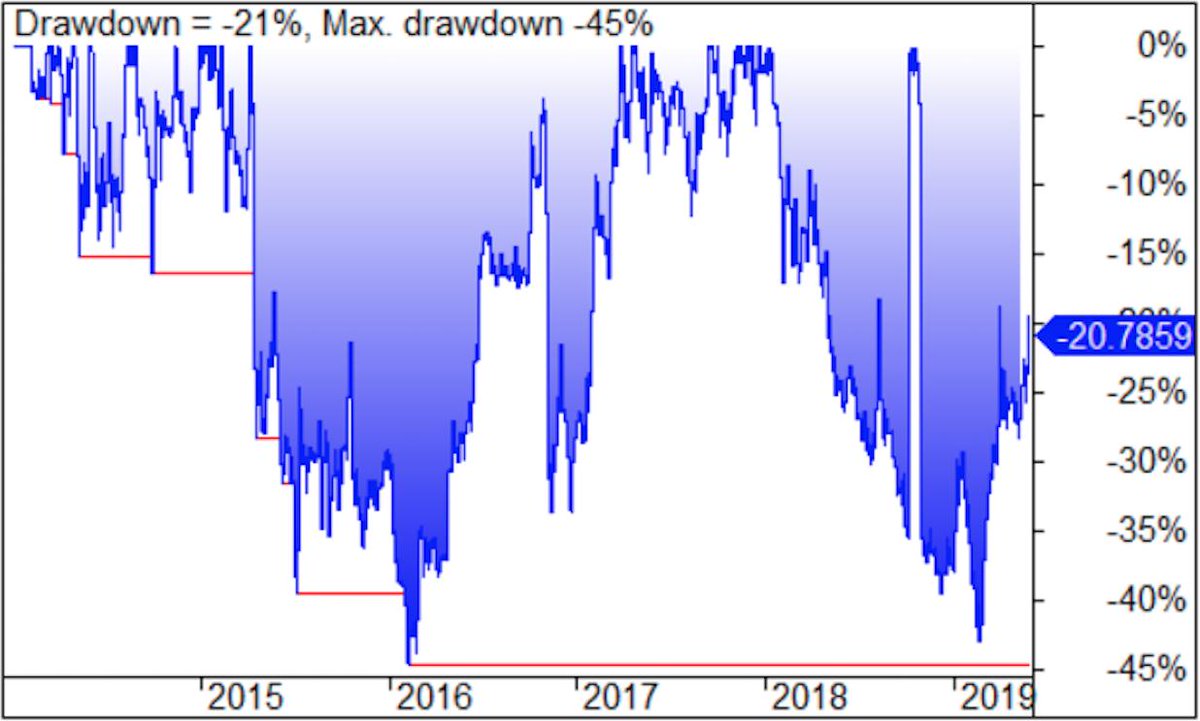

How is all this linked to Trading Performance. Whatever system one follows, theoretical (i.e. system) profits v/s realised (actual) profits have a lot to do with the position sizing used.

So getting the right position size is so very important to

To find a Method in the Madness, work on your position size. It will pay off manifold.

Apparently 30% to 40% importance for any systematic trading is this less talked about but most important aspect