The Relativistically Adaptive Market Protocol

i.e. the RAMP.

It's an idea that incorporates lessons from complex systems and ecological adaptation into financial markets.

But before we get to the protocol itself, we should unpack The Big Lie...

And that's true, to a point...

- The trade (signal) carries real information about the processes underlying the asset.

- There remains a time symmetry between such signals and the "frame rate" at which trades are executed.

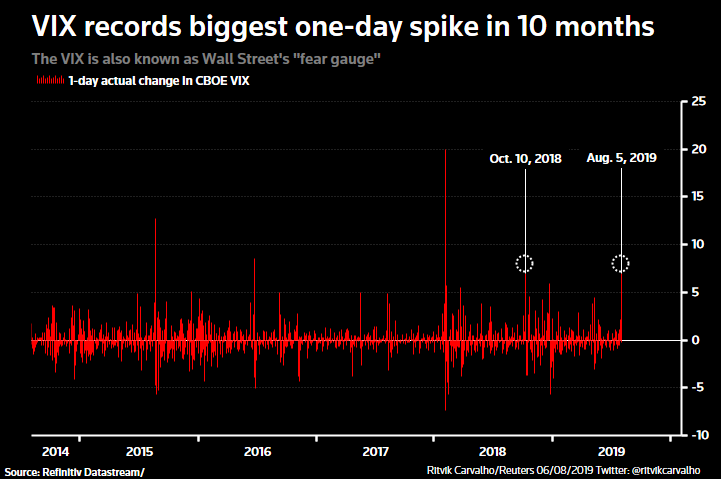

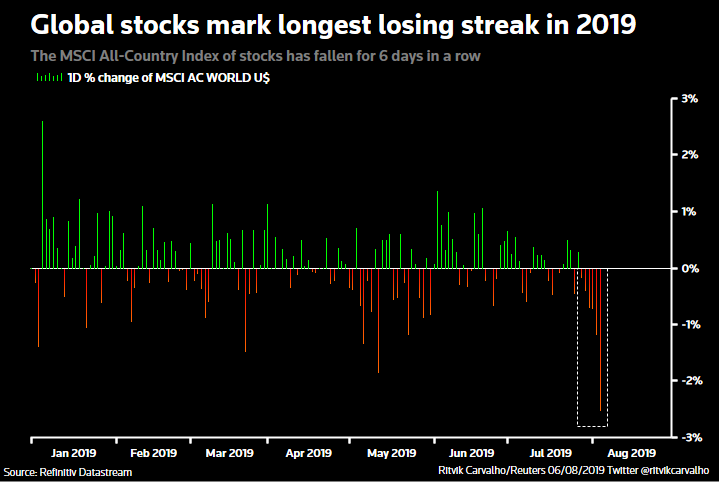

When either is false, things get hairy...

"Flash crashes" are a perfect example of this, wherein algorithms begin to "orbit" one another.

Yet fundamentally, this isn't just the algos...

So why don't we hear more about strategies for reigning in this volatility?

We're told that if we want the benefits of markets, we simply have to deal with insane volatility.

The more I've studied these systems, the more I believe it *is* a lie.

We *can* have the benefits of markets while also making them more resilient to parasitic speculation.

But to do so, we require better protocols...

Fundamentally, a RAMP-like protocol seeks to:

- Incentivize participation by those with high quality information.

- Resist the positive feedback introduced by parasitic speculation.

- Increase long term market health / resilience.

Relativistic.

As in, applying relativistic principles to market dynamics...

As it stands, the very concept of "discovery" implies a singular fixed-point attractor to which price theoretically converges.

Thus we are told that trading faster is always better...

Except it also encourages market participants to spend more time paying attention to market dynamics than to the underlying phenomenon the market is supposed to represent.

How to deal with this?

- Yay upside volatility!

- "Circuit breaker" on downside volatility.

But they're fundamentally linked, and in fact reinforce one another.

Thus we must cut the Gordian knot of self-referential positive feedback...

Enter relativistic trading windows...

When the incentive arises to pile into upside, or induce downside crashes, the protocol stretches time.

Thus one must be confident in their bets across time in proportion to *both* their magnitude and frequency.

This is better for all who seek healthy growth...

But won't parasites learn?

The protocol must itself take an adversarial stance.

It must Adapt, which brings us to the A in RAMP...

GANs involve multiple learning nets that react to one another, and whose reactions inform the learning process of their mutual adversary...

So in theory the RAMP protocol itself could identify / classify parasitic behavior within the market and parameterize its Relativistic tuning accordingly.

The more you try to parasitize, the more it fights you...

We transform them from sources of social pathology into highly adaptive social brains.

This is what advocates of Austrian economics should want.

But most importantly, this is what anyone who hopes to avoid much more heavy-handed centralized controls should want.

Because if we don't improve our market protocols, that's where we're headed.

If the above is wrong, I'd like to know.

But I suspect it's precisely the kind of trading protocol we require.