- Why is building a company in the space so hard?

- Opportunities in consumer

- EMR

- One Medical for X

- Nurx for X

- Distribution

1/5 of the economy, multi trillion dollar industry, how come no $10b startups in last 10 yrs?

- heavily regulated by gov't. regulations usually serve incumbents.

- serving existing healthcare system (scraping pennies off of penny scrapers)

Misaligned incentives.

Through fee for service, doctors are incentivized to keep you in the hospital rather then get you out.

Consumers don't price shop b/c they're not paying for it. No price transparency. Principal agent problems abound.

So many middle men.

Enterprise = b2b

Consumer = b2c

Healthcare = b2b2R2Pc2P2c

Biopharma (Development) —> Regulator (FDA) —> Payer (insurance, employers, gov’t ) —> Channel (pharmacy) -> Provider (physicians, hospitals) —> customer (patient)

h/t a16z

It's like any startup, except everything is 10x harder:

Regulation is tighter, incumbents are more protected, customers move slower, and behaviors are harder to change.

And barely any early adopters to sell to!

Which is why many go full-stack.

medium.com/@malay/buildin…

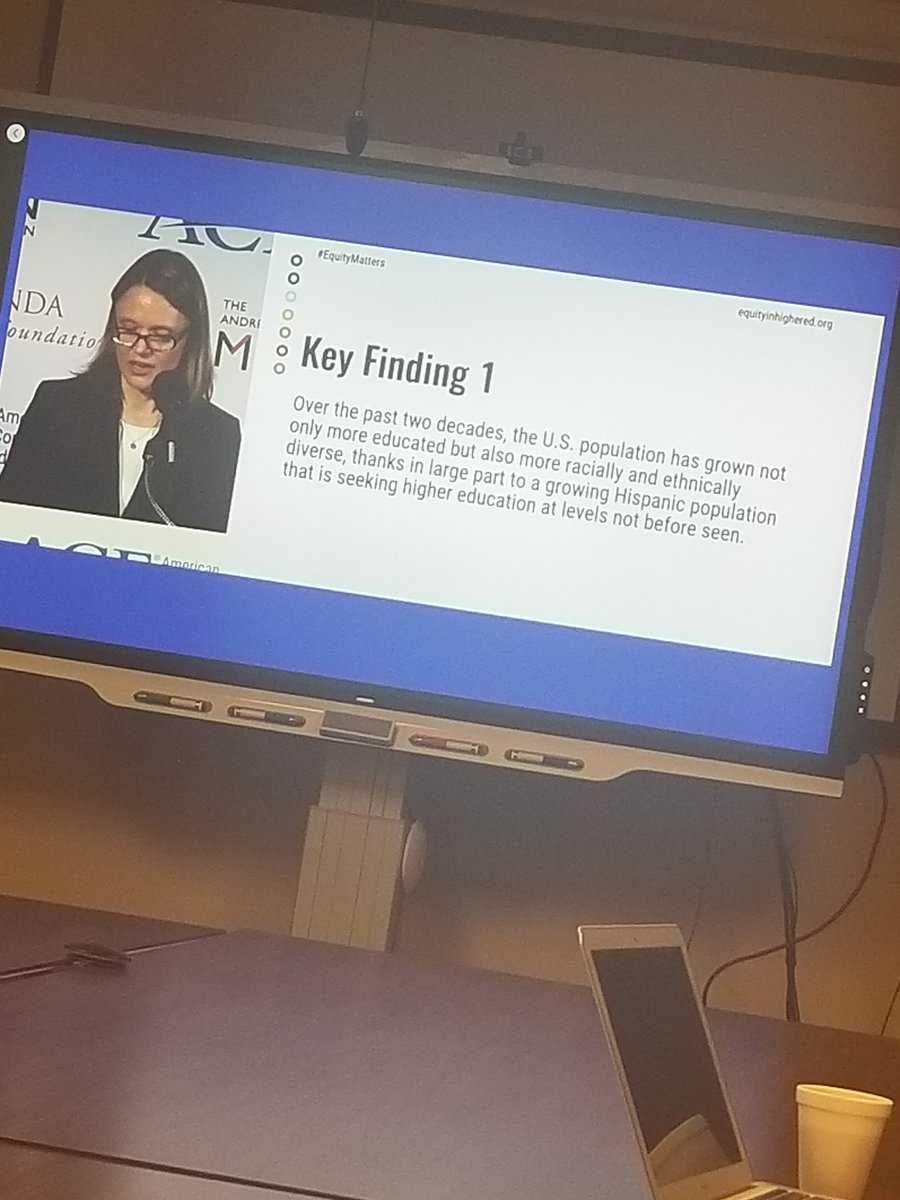

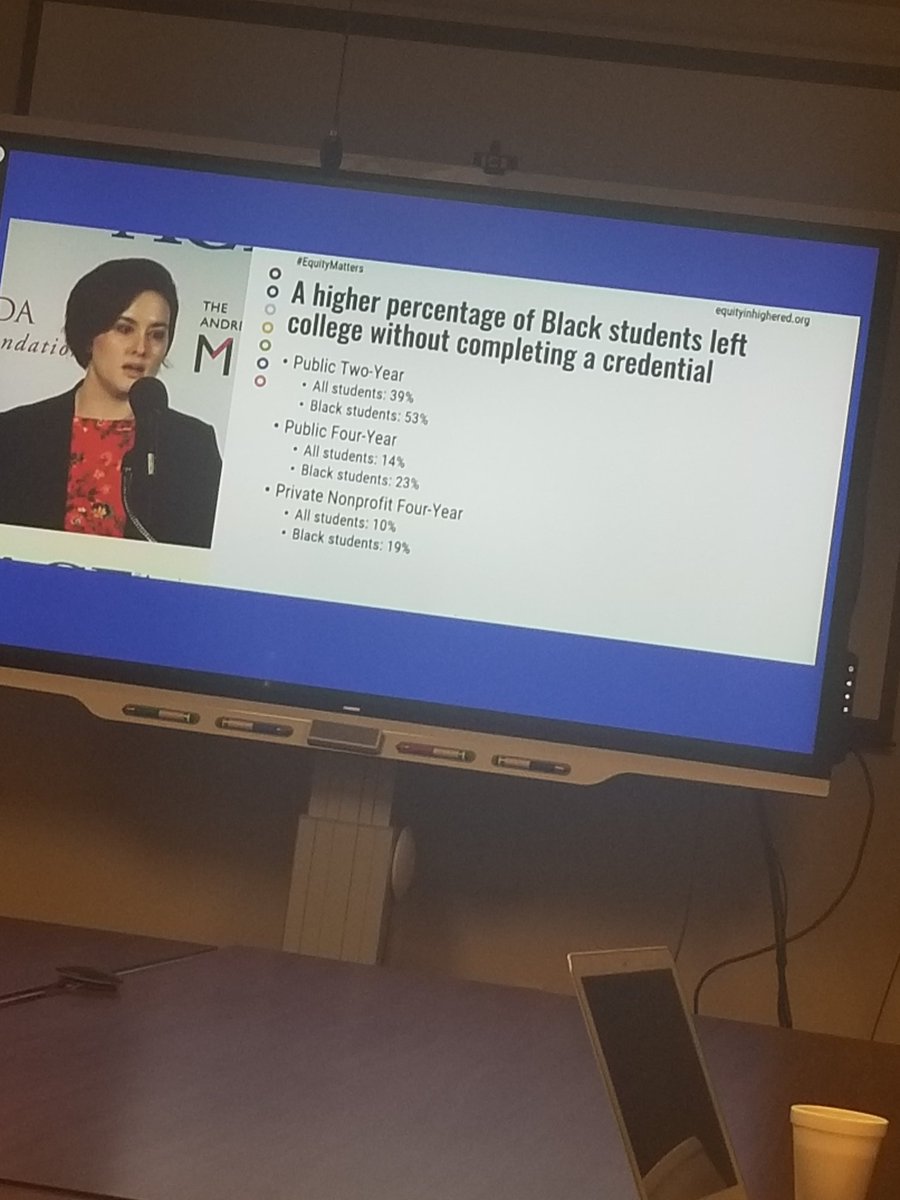

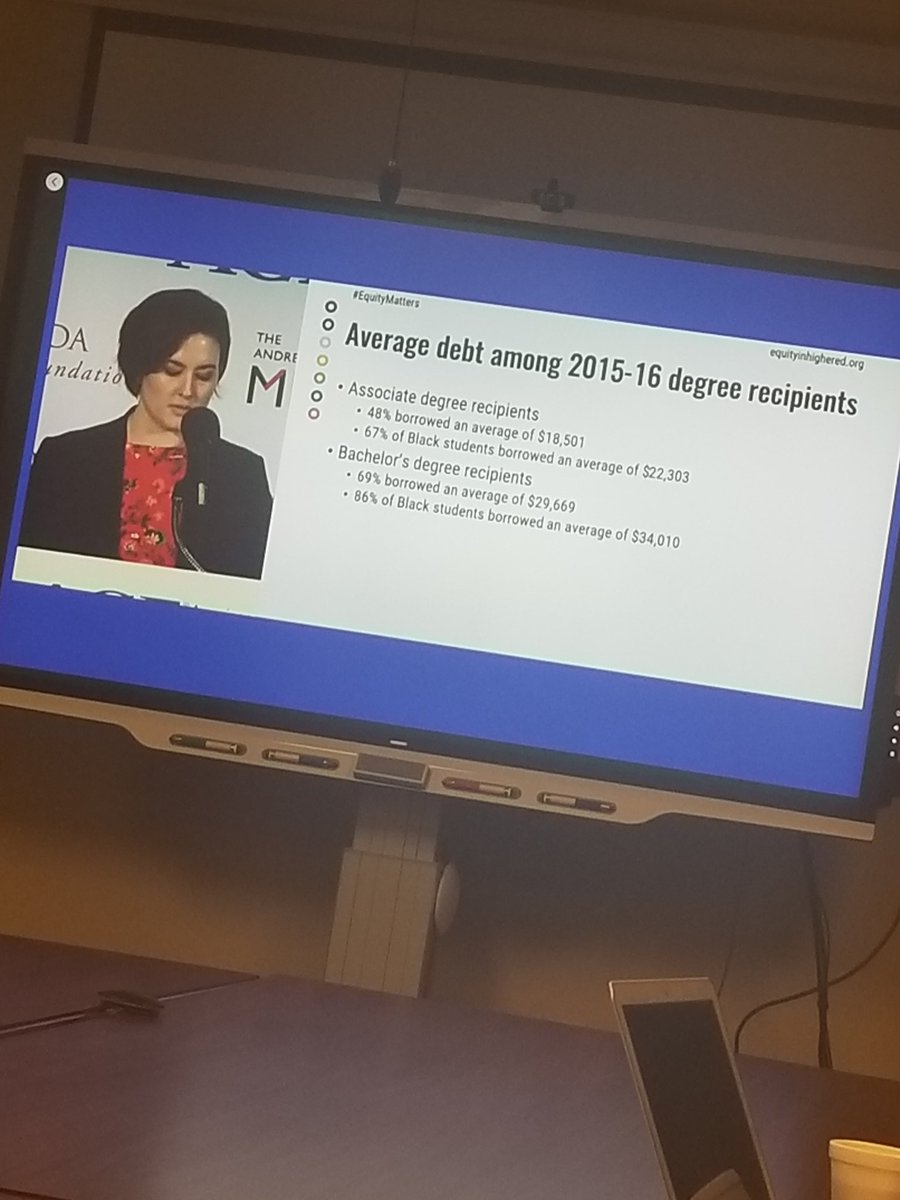

Companies need to own outcomes. See attached.

opportunities in every part of the value chain from drug discovery, clinical trials, commercialization, production, fulfillment, drug pricing, etc.

Next wave focusing on reimagining care from within or from inside out.

Still, more than 30% of costs flow through hospitals. Can unbundle.

- Most expensive part of healthcare is labor.

- Find ways for physicians to get out of hospitals and closer to patients (e.g. handle back-office, create lower-cost models of running an office)

Either doctors will go sell to major hospital systems.

Or they'll go w/ insurance companies & cut value based deals.

Big opportunity to help doctors do the latter.

Also: Virtual clinics (virtual fertility, mental health, pain)

- 10% of patients account for >50% of costs

- Don't have updated provider networks

- Tough time managing fraud

- Don't have advanced way to do risk segmentation

Are notoriously tough customers so have to make sure can integrate easily w/ existing way of doing things.

When are we going to see something that combines telemedicine, wearables, and at home diagnostics so you can properly triage patients and then escalate them properly to the right domain of care for that level of severity?

When are we gonna get indexed health data?

When are we going to see a d2c company that genetically tests you when you’re born and then focuses on optimizing your well-being, mental cognition, and physical abilities for the rest of your life?

Imagine taking genomic data & lab data and combining it with information from your Apple Watch or another wearable and some app telling you that your blood sugar is low or that you're dehydrated or that you haven't slept enough or that you need to eat X.

It's optimized for acute care (when you're sick, or something's broken), not preventive care.

In theory, apps like Foursquare (food), Strava (exercise) & Tinder (relationships) should be tied to our health profiles.

You either have to be:

1) full stack (take on the entire vertical of pharmacy, clinical trials, insurance, etc.)

or 2) barely touching the existing healthcare system

Framework h/t @nikillinit:

if you want to do insurance, you have to get into care itself.

if you want to be in the clinical trial space, you have to be someone that runs the clinical trial itself"

either in primary care (one medical, nurx etc.) which doesn't have to touch the existing system unless it absolutely needs to, which means it can build its own systems in house"

Either you commit to going through heavy amounts of proof building (clinical trials, pilots, publishing in peer reviewed journals) OR you go direct to consumer and gather millions of users like any other consumer app. Both brutally hard.

- One Medical worked b/c it was a great perk for employers to offer their employees.

- Consumers won't pay for any commodity specialist. It has to be something where there's high variance in quality (e.g diabetes, musculoskeletal, mental health, dental)

Traditional mail order pharmacy brands haven't innovated on distribution. They don't have direct relationship w/ consumers.

New brands are segmenting against category as a result (Hims & ED, Brightside & mental health, Nurx & women's health)

Epic will continue to dominate for a long time b/c hard to rip out (exception here is primary care)

Standard value of Epic is not to make a doctor's life easier. It's to do revenue cycle management properly.

Big demand from consumers, a lot of it is snake oil.

A company can solve for access, quality, and guidance.

So many great products fail in healthcare b/c no one cares.

It must fit within an existing budget item or reimbursement code that they provide to the market around the service.

Self-insured employer channel is crowded