Read & subscribe: stratechery.com

Pre-internet, you captured profits by controlling supply.

Post-internet, you capture profits by aggregating demand.

Internet made distribution free & transaction costs zero. making it viable for a distributor to integrate forward with end users at scale

0 Transaction costs means that adding 1 more customer is as simple as adding 1 more row in a database

Level 1: Supply Acquisition (e.g Netflix)

Level 2: Supply Transaction Costs (e.g. Uber)

Level 3: Zero Supply Costs

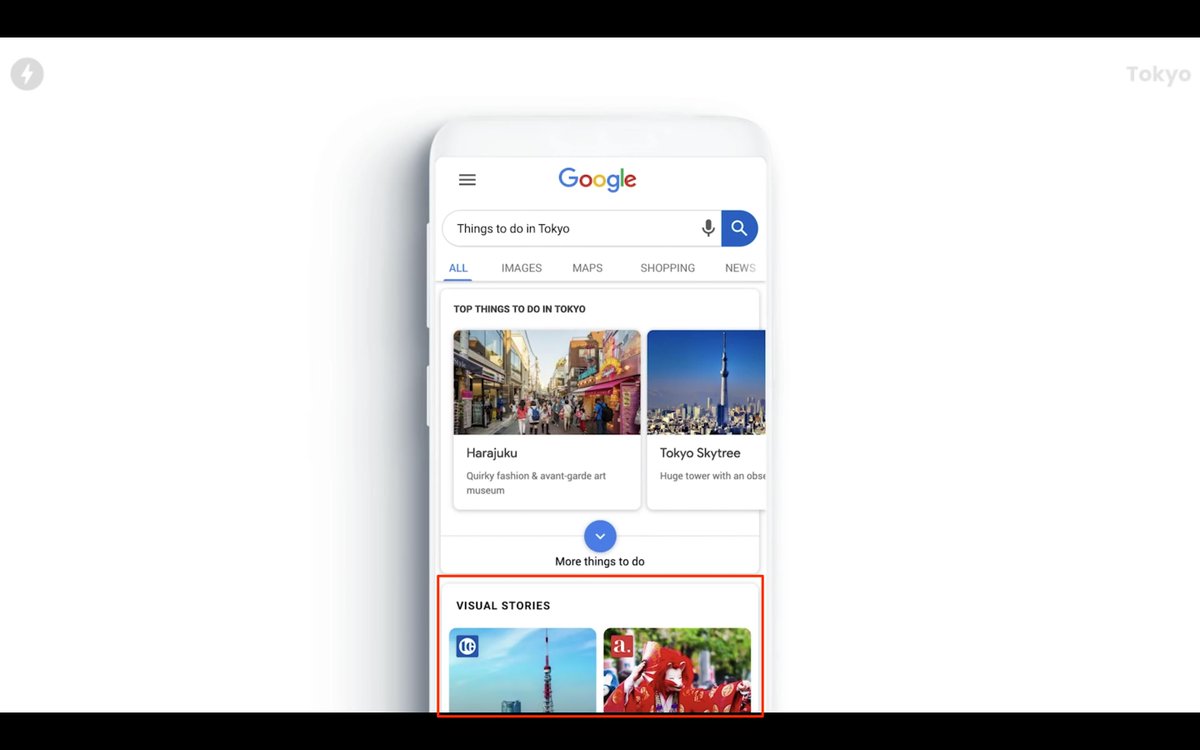

Level 4: Super Aggregators (Zero marginal costs w/ users & suppliers, advertisers (Fb, Google)

FB started as the best place to find friends & family, but over time evolved into being the best place to waste time period

Google & FB didn't create better newspapers, they reduced newspapers to any other type of content, and made it compete with all other content in the world.

Advertisers don’t care about readers; they care about identifying, reaching & converting potential customers

Niche businesses make money by maximizing revenue per user on a (relatively) small user base.

Scale businesses make money by maximizing the number of users they reach.

These strategies require diff approaches

Video has been increasingly differentiating itself on either quality (HBO) or exclusivity (ESPN)

The value of tech cos in each space is inversely proportional to value of the publishers

The challenge w/ Neither/New companies (e.g WeWork) end up with relatively low take rates combined w/ relatively mediocre margins.

stratechery.com/2019/neither-a…

Rather, it’s that they achieved their goal. There IS a computer on every desk & in very home, & nearly all of them run Microsoft software.

Now what?

I am skeptical that Microsoft’s antitrust issues were a major factor in Microsoft missing mobile; the company had the wrong approach, both in terms of product and business model.

Since finding PM-fit came so easily, Twitter still has no idea what their market actually is, and how they might expand it.

Twitter is the company-equivalent of a lottery winner who never actually learns how to make money, and now they are starting to pay the price.

Whereas Google is valuable because it knows what I want, when I want to get it, Facebook knows who I am, and who I know.

Twitter, on the other hand, knows exactly what I like and what I’m interested in.

It's a challenge to get ppl to re-try a product they have already dismissed.

In the meantime, they have to monetize the users they have

It was expensive to develop Windows, but Microsoft could reuse the software on all computers; every new computer sold was pure profit.

It was expensive to build Facebook, but the network can scale to two billion people and counting, all of which can be shown ads

Google builds the search engine and leaves the creation of web pages to be searched to the rest of the world

FB builds the infrastructure of the network, & leaves the content creation to its users

The Politicians that win inspire passion, stirring up a level of engagement that breaks through on a scale that far exceeds an ad buy.

Apple has high margins, Amazon says "your margins are my opportunity."

Apple is a product co that struggles w services, Amazon is a service co that struggles w product.

Multiple ways to be successful.

Barely scratching the surface here. There's TONS of stuff I'm not including.

Go spend some hours (or years) reading his work, from front-to-back. Perhaps the best tech MBA you can buy.

Curious for other favorite takeaways from Stratechery.