When I was asked to publish my trading journey, I thought that maybe my story could inspire many. And therefore, I have narrated my story in the form of 13 pointers (in a chronological order) for anyone who wishes to have a good read or wants to get inspired!

#trading #journey

#trading #journey

1) At the age of 19, I, like many others, started investing in stocks that most people invest in. Fortunately, since the markets did well in 2010, I profited on those investments.

2) After getting inspired by Warren Buffet in my prime, I did an internship to learn the basic valuation of companies only to realise that Fundamental Analysis was definitely not my cup of tea.

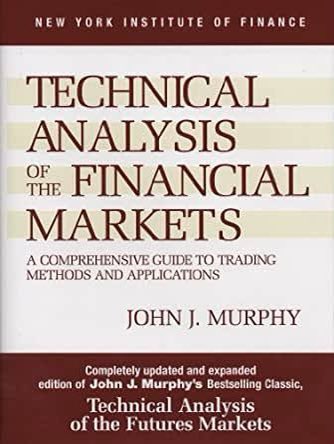

3)Since Fundamentals didn’t work for me, I moved to Technical Analysis & after learning it thoroughly, I thought I could predict the market. I began to over analyse stocks & took random trades but wasn’t making any consistent income.

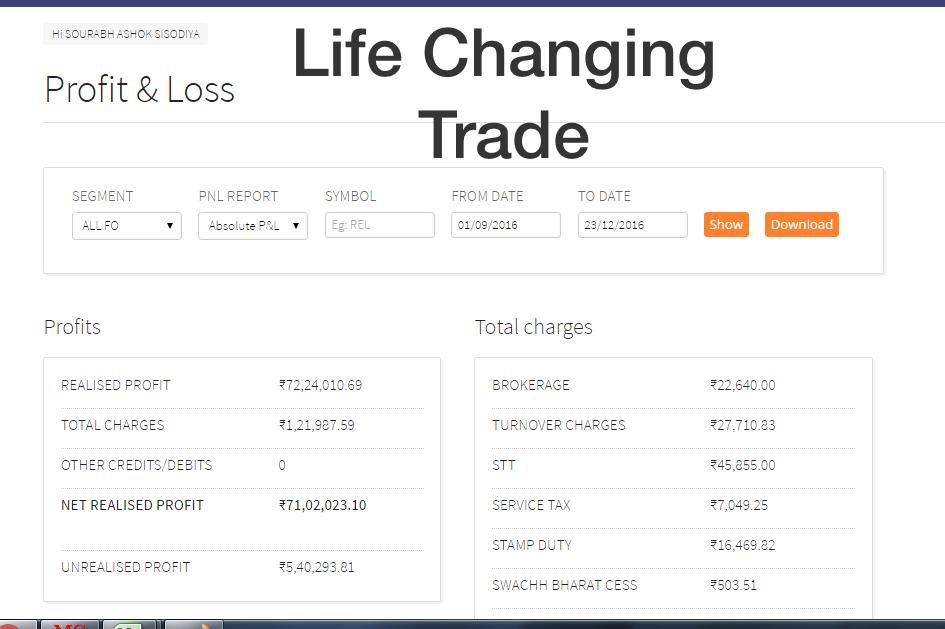

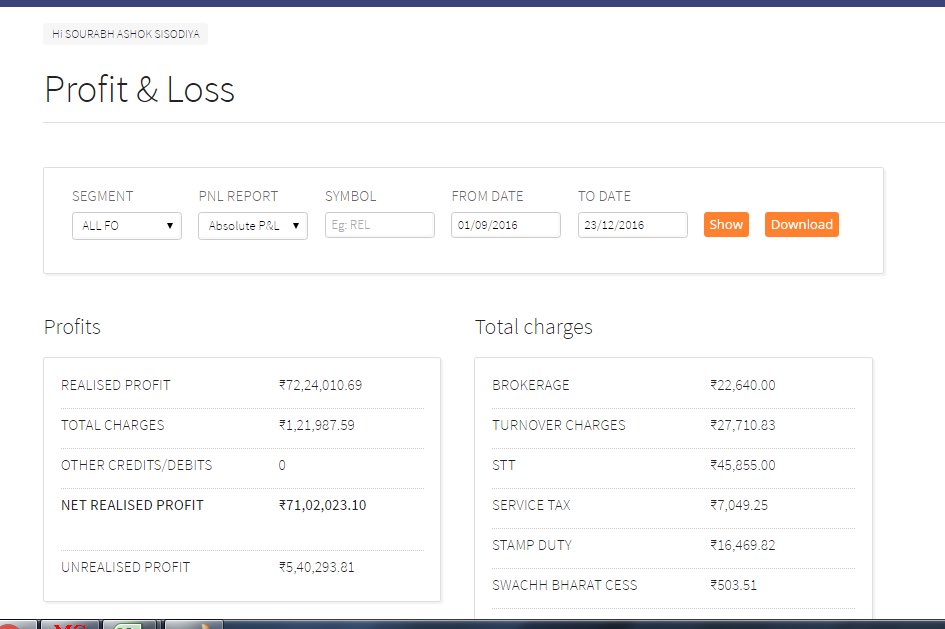

4) And then came a lucky & life changing moment for me!

In August 2016, I did an extensive research on Justdial and found the stock to be extremely bearish.

Logic:

- Alexa rank was dropping

- SEC 13 F filing showed US based ETF exiting JD

In August 2016, I did an extensive research on Justdial and found the stock to be extremely bearish.

Logic:

- Alexa rank was dropping

- SEC 13 F filing showed US based ETF exiting JD

5) I was heavily short on JD and it dropped by almost 40% within months.

To my surprise, I made ~300% within 2 months :)

This trade completely changed my life and compelled me to start my journey as a trader !!

To my surprise, I made ~300% within 2 months :)

This trade completely changed my life and compelled me to start my journey as a trader !!

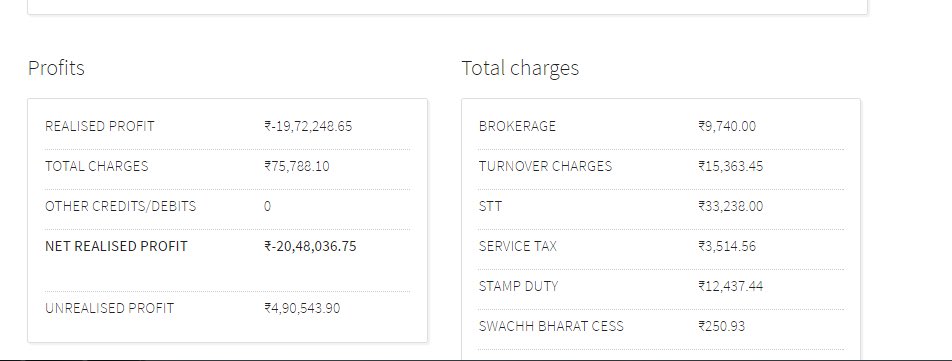

6) Ecstatic with my previous trade, I entered into full-time trading but with previous success, got complacent. I started taking random trades and gave most of the profits back.

I realised that I need more knowledge to be able to do this full time for a living.

I realised that I need more knowledge to be able to do this full time for a living.

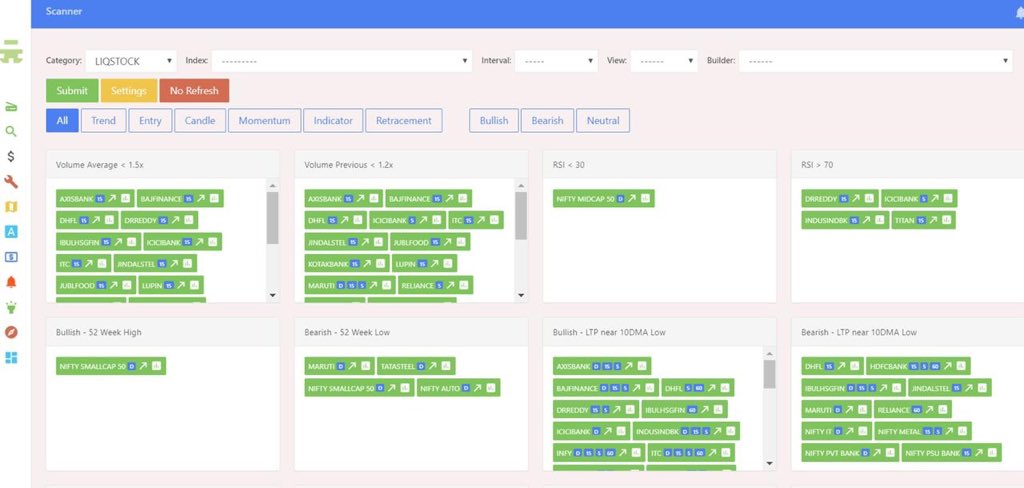

7) To learn more, I did a small stint with a Quantitative trading firm that made me realise the importance of systems & data driven trading.

This started my journey towards quantitative trading.

@hrishabhsanghvi @TechArque

This started my journey towards quantitative trading.

@hrishabhsanghvi @TechArque

8)I founded Quantify Capital quantifycapital.in a quantitative research & trading firm. We started trading with our own capital with quantitative & volatility based strategies.

9) Next, I successfully completed all levels of CFA, most respected designation in finance & gold standard in field of investments.

#CFA

#CFA

10) I launched “Finsense,” an initiative by Quantify Capital to spread Financial Literacy across the country. It’s mission is to help people be their own advisor and make independent investment decisions backed solely by data.

#financial #literacy #knowledge

#financial #literacy #knowledge

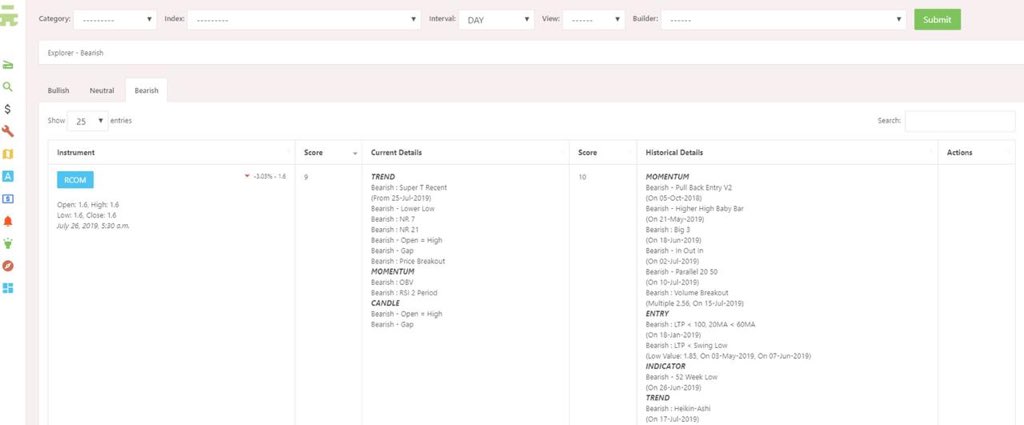

11) Started ‘The Trade Room’ (thetraderoom.in) with a vision to build a trading community, mentor budding traders & help them become more system driven.

#traders #mentor

#traders #mentor

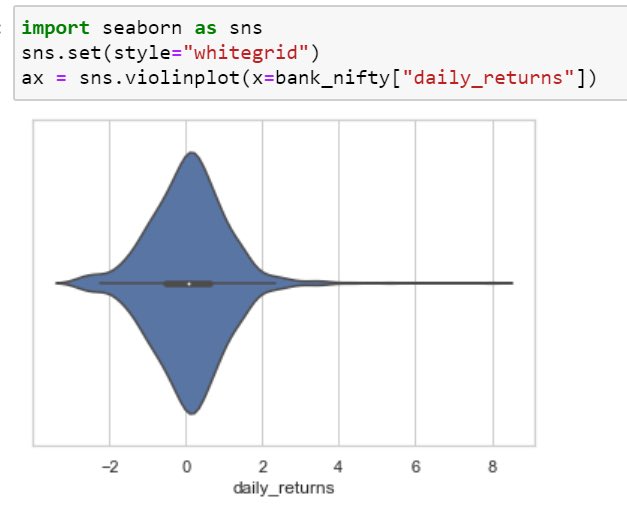

12) In order to fulfil my mission of FinSense, I kick-started my teaching career of educating people about quantitative trading at the top IITs and IIMs in the country.

#education

#education

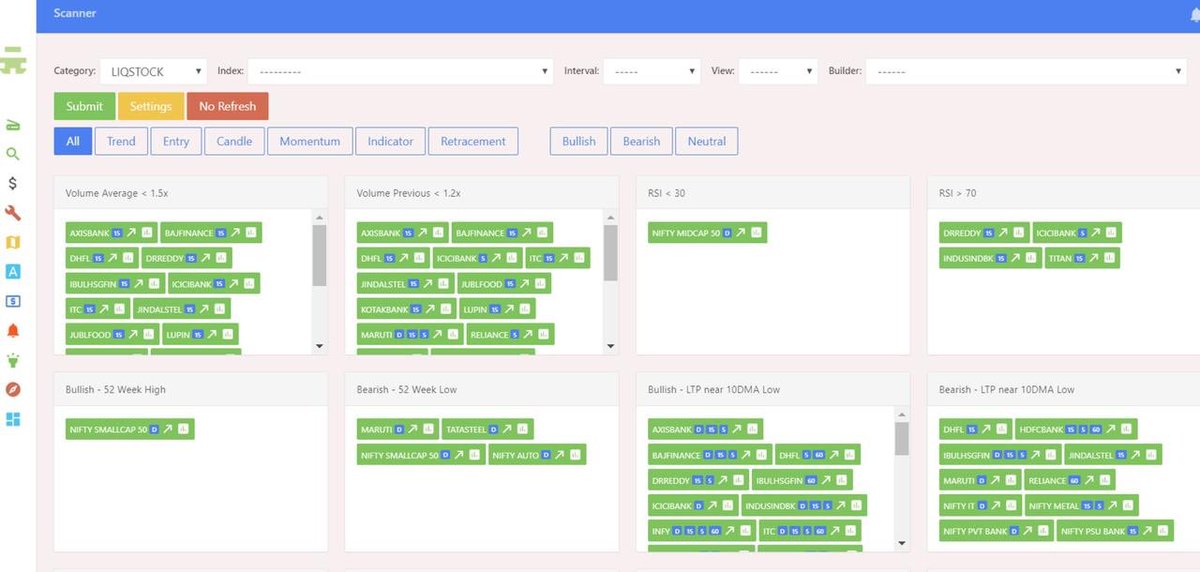

13) Built a top notch tech team, which handles & powers the extensive data driven research done at Quantify Capital.

#tech #team #data #science

#tech #team #data #science

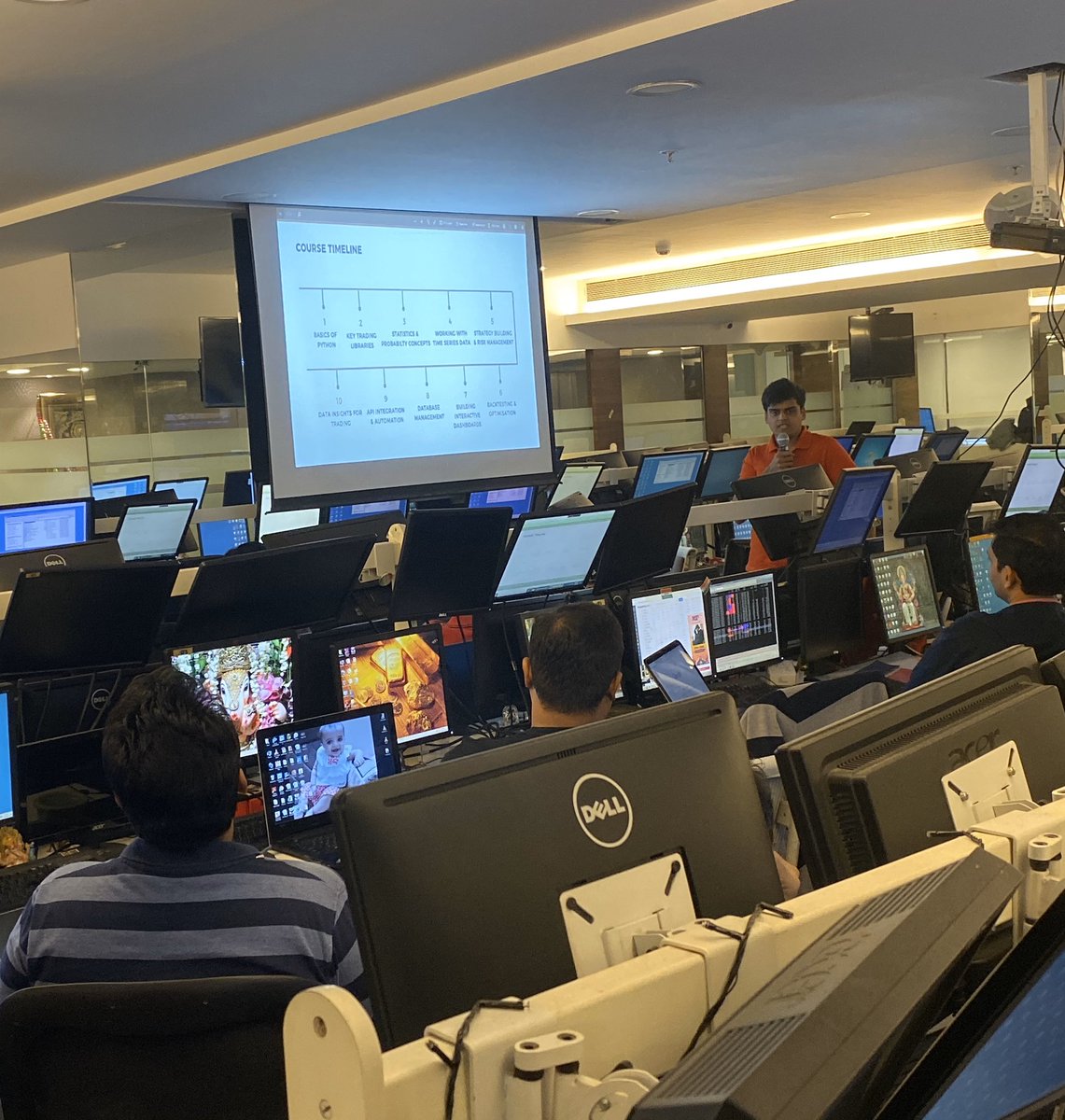

14)Approached by large multi-million dollar trading firms to train their traders and therefore, I started training the largest trading desks of the country on system driven & algorithmic trading.

#trading #desk

#trading #desk

15) Youngest member on the Panel “Disruptive Innovation in Finance”

The panel included the who’s who of the investment industry.

Extremely humbled to be invited on this panel

The panel included the who’s who of the investment industry.

Extremely humbled to be invited on this panel

16)

Future Plans

- Build a successful broking business

- Take Trade Room online to reach more traders

- Provide tech support & backtesting infra to retail traders

- Start my own blog & youtube channel

- Start a quant driven Wealth Management fund under Quantify

End

Future Plans

- Build a successful broking business

- Take Trade Room online to reach more traders

- Provide tech support & backtesting infra to retail traders

- Start my own blog & youtube channel

- Start a quant driven Wealth Management fund under Quantify

End

• • •

Missing some Tweet in this thread? You can try to

force a refresh