brookings.edu/opinions/afric…

documents.worldbank.org/curated/en/370…

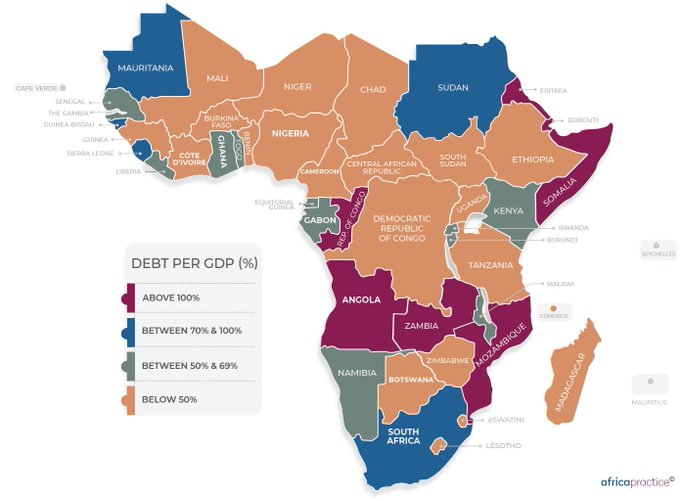

▪️15 African countries spent more on ext. debt service than on their public health sys

▪️#COVID19 fiscal stimulus in high-income countries is 8% of GDP, in Africa it is 0.8% 6/n

economist.com/middle-east-an…

A grant will be provided to these countries to cover their IMF debt obligations for 6 months to create fiscal space to tackle #COVID19 imf.org/en/News/Articl…

This moratorium is worth ~$20 billion, covers *only* bilateral debt

The 76 countries are low & lower-middle-income, eligible for IDA 7/n

ft.com/content/5f296d…

g20.org/en/about/Pages…

bloombergquint.com/business/afric…

The group represents 25 asset managers & institutions

African countries are asking for suspension of $44 bn in debt payments this year to channel scarce resources to fight #covid19. 11/n

bloombergquint.com/onweb/private-…

The Africa Private Creditor Working Group, which represents over 25 asset managers & fin. institutions, instead calls for a "case-by-case" approach to debt relief 12/n

reut.rs/2WRFuVC

theconversation.com/moratorium-on-… via @TC_Africa

Details are scanty on beneficiary countries and the timeframe for the moratorium on debt servicing. 14/n voanews.com/east-asia-paci…

brook.gs/3e08qm1 via @BrookingsInst

worldbank.org/en/topic/debt/…

af.reuters.com/article/idAFKB…

According to government figures, these tax exemptions amounted to $5.03 billion or 6% of GDP in 2018 21/n

reuters.com/article/us-ken…

ifw-kiel.de/fileadmin/Date…

chinaafricarealstory.com/2020/04/is-chi…

- offered debt write-offs only for zero-interest loans.

- cancelled ~$3.4bn of debt

- restructured/refinanced $15bn of debt 26/n

sais-cari.org/event-details/…