LOW FREE FLOAT SalesProfitGrowthCashFlow&Safety

2nd Up - 25Sep2020

📌#LowFreeFloat is Now a days #Moat for some good Quality Companies. Here is #stocks to chose from !

#investment

Read Criteria & Details in below #THREAD👇

@ms89_meet

@AdityaD_Shah

1/8

2nd Up - 25Sep2020

📌#LowFreeFloat is Now a days #Moat for some good Quality Companies. Here is #stocks to chose from !

#investment

Read Criteria & Details in below #THREAD👇

@ms89_meet

@AdityaD_Shah

1/8

📌Free Float = Public Float(DII+FII+ MF+ Corporate+HNI+Retail)

So,

No. of Shares publicly traded which we buy/sell from exchange in everyday life.

📌For simplicity I assumed non-promoters shares though custodians & locked in shares should also be excluded.

2/8

So,

No. of Shares publicly traded which we buy/sell from exchange in everyday life.

📌For simplicity I assumed non-promoters shares though custodians & locked in shares should also be excluded.

2/8

📌High Free-Float = Good Governance(In general). Promoters less influence & other shareholders can exercise their rights.

📌Low Free-Float = More Promoter influence can easily manipulate stock price for their gain.

3/8

📌Low Free-Float = More Promoter influence can easily manipulate stock price for their gain.

3/8

📌LOW FREE-FLOAT stocks with LOW INSTITUTION holding - GOOD for us (RETAIL)

Why ?

If Institutions holding 80-90% of Free Float, valuations will be High (low supply, stock price rise high). If they sell Price will drop drastically.

Smaller the Float Higher the Volatility.

4/8

Why ?

If Institutions holding 80-90% of Free Float, valuations will be High (low supply, stock price rise high). If they sell Price will drop drastically.

Smaller the Float Higher the Volatility.

4/8

Low free-float prices move higher quickly even if it gains attention of few investors.

Prime Candidate for de-listing.

Criteria for filter -

Low-free float is considered < 2 Cr

5/8

Prime Candidate for de-listing.

Criteria for filter -

Low-free float is considered < 2 Cr

5/8

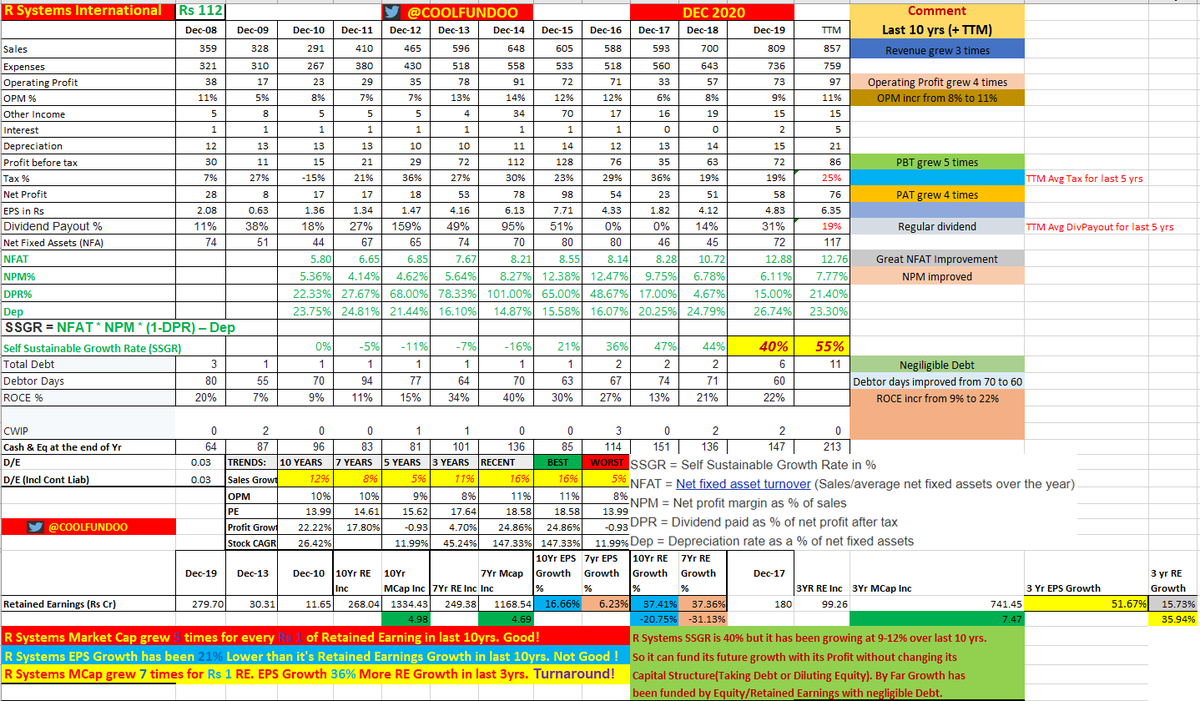

📌Quality Checks for-

ROE, ROCE, ROA, Sales Growth, Profit Growth, Liquidity Ratio, Asset Turnover Ratio

Excluded Too much Fluctuating Sales+Profit Growth

Declining Debtor Days

+ive Operating & Free Cash Flow

Great Cash from Operations (latest) Vs Equity Capital

6/8

ROE, ROCE, ROA, Sales Growth, Profit Growth, Liquidity Ratio, Asset Turnover Ratio

Excluded Too much Fluctuating Sales+Profit Growth

Declining Debtor Days

+ive Operating & Free Cash Flow

Great Cash from Operations (latest) Vs Equity Capital

6/8

Stable Promoter Holding.

Manageable Debt determined by Interest Coverage Ratio, Debt+Contingent Liabilities & Debt Capacity.

Manageable Inventory Turnover Ratio.

7/8

Manageable Debt determined by Interest Coverage Ratio, Debt+Contingent Liabilities & Debt Capacity.

Manageable Inventory Turnover Ratio.

7/8

Previous Update Link for the #screener

8/8

https://twitter.com/Coolfundoo/status/1269169378697904129?s=20

8/8

• • •

Missing some Tweet in this thread? You can try to

force a refresh