#Subex is setting the market abuzz with many brokers talking of relisting above 20 Rs - which is across a major 8 year breakout level of around 18.50

#CrunchMetrics #IDCentral #DigitalTrust #IoT #IoTSecurity

#CrunchMetrics #IDCentral #DigitalTrust #IoT #IoTSecurity

https://twitter.com/AmitMis93532571/status/1323636376936439808

Will be see a dream run in #Subex post relisting given fundamentals are fast improving for both business operations and balance sheet

See embedded thread for brief history of its turnaround.

#CrunchMetrics #IDCentral #DigitalTrust #IoT #IoTSecurity #CyberSecurity

See embedded thread for brief history of its turnaround.

#CrunchMetrics #IDCentral #DigitalTrust #IoT #IoTSecurity #CyberSecurity

https://twitter.com/AmitMis93532571/status/1319939105321439233

Typo-plz read “Will be” as “Will we”

I think we will 😊-next 2yrs at #Subex should be similar or better to what #TanlaPlatforms achieved in same time since #Karix acquisition in Aug2018

Cash books are ringing at Subex with good visibility

So watch this space for M&A/BuyBack!!

I think we will 😊-next 2yrs at #Subex should be similar or better to what #TanlaPlatforms achieved in same time since #Karix acquisition in Aug2018

Cash books are ringing at Subex with good visibility

So watch this space for M&A/BuyBack!!

Hi @SForStiletto

#Subex got decent relisting-traded at highs of 18.65/18.5 at BSE/NSE

Are you still following it?

Guess further technical guidance will b on weekly/monthly closing?

Time permitting plz have a look & comment

Btw, am expecting good YoY #Q2FY21 result on 9Nov

#Subex got decent relisting-traded at highs of 18.65/18.5 at BSE/NSE

Are you still following it?

Guess further technical guidance will b on weekly/monthly closing?

Time permitting plz have a look & comment

Btw, am expecting good YoY #Q2FY21 result on 9Nov

https://twitter.com/AmitMis93532571/status/1323636376936439808

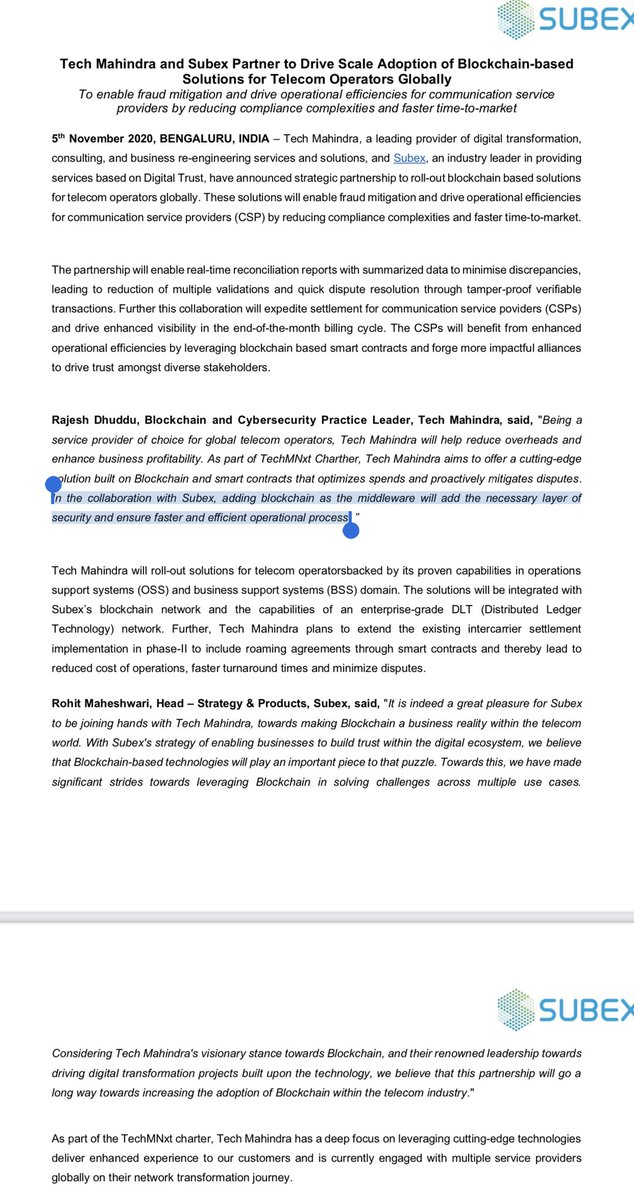

Hot from press-good stuff

There are so many positive implications of this deal at so many levels

Another major boost post Telefonica deal

#Subex #TechMahindra #Blockchain

Tech Mahindra, Subex partner on blockchain-based solutions for telecom operators

economictimes.indiatimes.com/tech/informati…

There are so many positive implications of this deal at so many levels

Another major boost post Telefonica deal

#Subex #TechMahindra #Blockchain

Tech Mahindra, Subex partner on blockchain-based solutions for telecom operators

economictimes.indiatimes.com/tech/informati…

#Subex #TechMahindra deal - this is second path breaking deal (on global basis) similar to Telefonica deal at end of September 2020 in terms of scale and impact.

https://twitter.com/subex/status/1324601496839729153

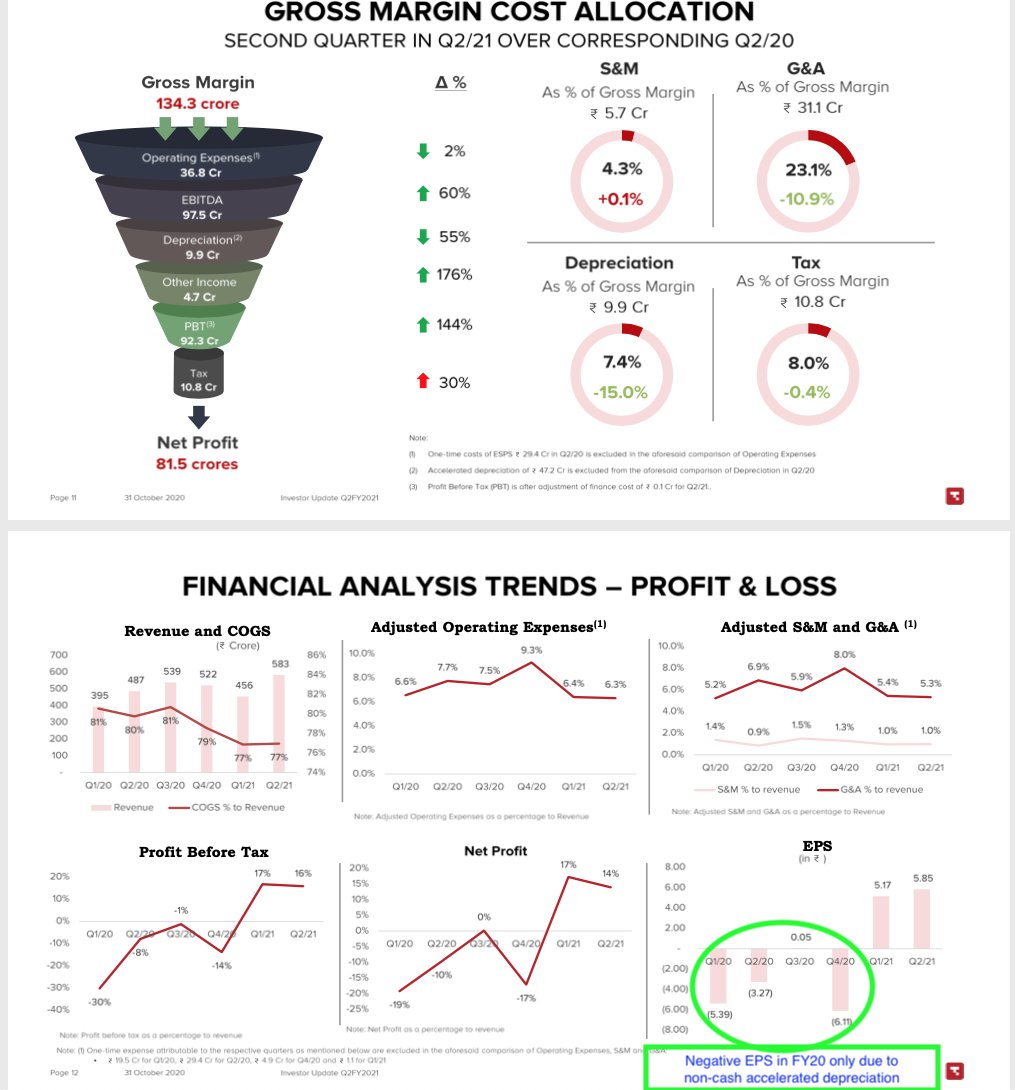

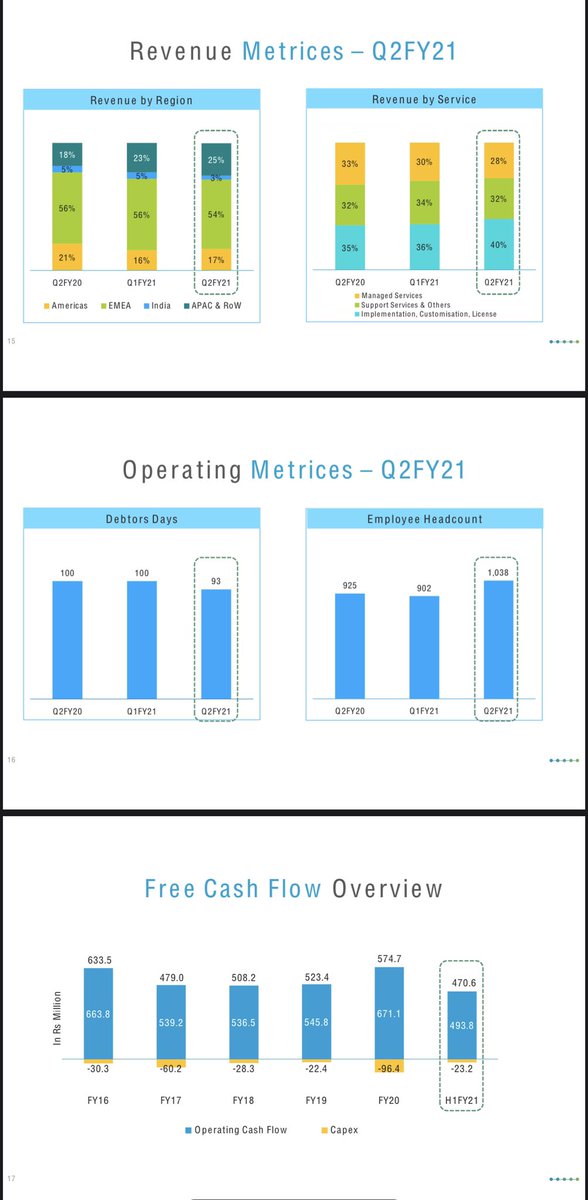

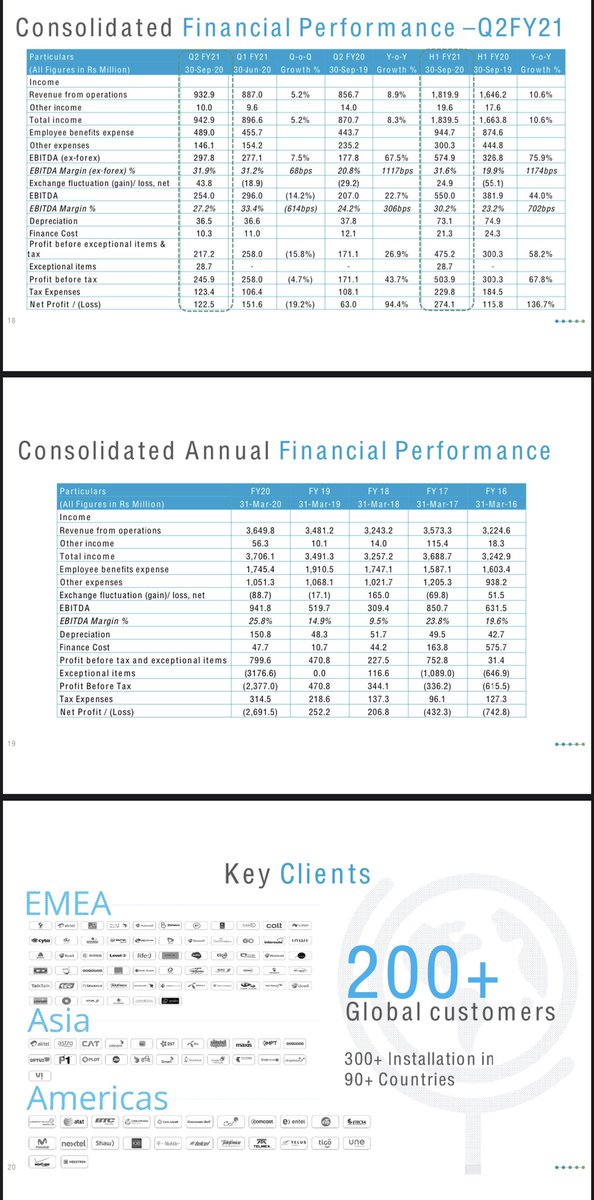

#Subex delivered very good #Q2FY21 numbers with YoY/QoQ growth-pics attached

Also impressive Half year growth

#H1FY21 vs #H1FY20

Rev

182/165

EBITDA(ex forex)~margins

58/33 ~31.9%/20%

PAT

27.4vs11.6

H2 is seasonally always better-watch this space

BSE: bseindia.com/xml-data/corpf…

Also impressive Half year growth

#H1FY21 vs #H1FY20

Rev

182/165

EBITDA(ex forex)~margins

58/33 ~31.9%/20%

PAT

27.4vs11.6

H2 is seasonally always better-watch this space

BSE: bseindia.com/xml-data/corpf…

https://twitter.com/AmitMis93532571/status/1319965659535601665

Quick summary on #Subex #Q2FY21 #H1FY21 results & Y-o-Y comparisone w #Q2FY20 #H1FY20

Given growth momentum w/ major deals getting signed, Subex should deliver stellar #H2FY21

Conference call is planned 10Nov 4:00 PM bseindia.com/xml-data/corpf…

BSE Result: bseindia.com/xml-data/corpf…

Given growth momentum w/ major deals getting signed, Subex should deliver stellar #H2FY21

Conference call is planned 10Nov 4:00 PM bseindia.com/xml-data/corpf…

BSE Result: bseindia.com/xml-data/corpf…

Apologies - typo in the table for Q1FY21 revenues in the above tweet - it is not 93.3 (which is Q2FY21 revenue) but 88.7 - updated table attached here:

#Subex

#Subex

over reaction by market close to Q2 results. #Subex has seen 2 LC in 2 days

But it had a vertical run since Sep’20 when it was trading at 9.xx, so some correction/consolidation was due.

hopefully this should stabilize around 17-18 range & give Nov monthly close above 8 yr BO

But it had a vertical run since Sep’20 when it was trading at 9.xx, so some correction/consolidation was due.

hopefully this should stabilize around 17-18 range & give Nov monthly close above 8 yr BO

#Subex #Q2FY21 #H1FY21 Investor Presentation is out - have a look.

Nice presentation clarifying few additional facts and numbers.

Investor conference call is today at 4:00 PM for discussing the results.

BSE: bseindia.com/xml-data/corpf…

Nice presentation clarifying few additional facts and numbers.

Investor conference call is today at 4:00 PM for discussing the results.

BSE: bseindia.com/xml-data/corpf…

#Subex

#Q2FY21 #H1FY21 Concall key takeaways(1/n)

🔹Mgmt keen to use cash(H1 added 50Cr;total 140Cr) to grow thru both organic/inorganic routes-continue to invest in tech areas like #Blockchain #Cybersecurity #IoTSecurity #5G #Telecom to upgrade its #DigitalTrust offerings

#Q2FY21 #H1FY21 Concall key takeaways(1/n)

🔹Mgmt keen to use cash(H1 added 50Cr;total 140Cr) to grow thru both organic/inorganic routes-continue to invest in tech areas like #Blockchain #Cybersecurity #IoTSecurity #5G #Telecom to upgrade its #DigitalTrust offerings

https://twitter.com/LltTomar/status/1326157107582783488

#Subex

#Q2FY21 #H1FY21 Concall key takeaways(2/n)

🔹Such investments are meant for enhancing existing products & build new verticals organically. Mgmt is actively analyzing options for inorganic expansion 🚀

#5G #Telecom #IoTSecurity #Cybersecurity #BlockChain #DigitalTrust

#Q2FY21 #H1FY21 Concall key takeaways(2/n)

🔹Such investments are meant for enhancing existing products & build new verticals organically. Mgmt is actively analyzing options for inorganic expansion 🚀

#5G #Telecom #IoTSecurity #Cybersecurity #BlockChain #DigitalTrust

#Subex

#Q2FY21 #H1FY21 Concall key takeaways(3/n)

🔹Mgmt is bullish on prospects of recent pathbreaking deals(global basis)signed with #Telfonica (#IoTSecurity) and #TechMahindra (#BlockChain #CyberSecurity) which fits well in #Subex growing #DigitalTrust portfolio

#5G #Telecom

#Q2FY21 #H1FY21 Concall key takeaways(3/n)

🔹Mgmt is bullish on prospects of recent pathbreaking deals(global basis)signed with #Telfonica (#IoTSecurity) and #TechMahindra (#BlockChain #CyberSecurity) which fits well in #Subex growing #DigitalTrust portfolio

#5G #Telecom

#Subex

#Q2FY21 #H1FY21 Concall key takeaways(4/n)

🔹Revenue realization for #IoTSecurity from Telefonica should start immediately. And TechM will follow soon as it goes to its client with bundled Subex tech layer of #BlockChain #CyberSecurity

#DigitalTrust

#5G #Telecom

#Q2FY21 #H1FY21 Concall key takeaways(4/n)

🔹Revenue realization for #IoTSecurity from Telefonica should start immediately. And TechM will follow soon as it goes to its client with bundled Subex tech layer of #BlockChain #CyberSecurity

#DigitalTrust

#5G #Telecom

#Subex

#Q2FY21 #H1FY21 Concall key takeaways(5/n)

🔹Indian market contributes 5%of revenues-Subex is workin with all major Telcos.Mgmt is closely watching all developments related to #5G-can scale up easily.

#IoTSecurity #BlockChain #CyberSecurity

#DigitalTrust

#5G #Telecom

#Q2FY21 #H1FY21 Concall key takeaways(5/n)

🔹Indian market contributes 5%of revenues-Subex is workin with all major Telcos.Mgmt is closely watching all developments related to #5G-can scale up easily.

#IoTSecurity #BlockChain #CyberSecurity

#DigitalTrust

#5G #Telecom

#Subex

#Q2FY21 #H1FY21 Concall key takeaways(6/n)

🔹less travel costs resulted in high EBITDA margins(H1FY21~32%), which will reduce as intl travel eases off(FY20 margins were ~25%-no guidance from mgmt)

#IoTSecurity #BlockChain #CyberSecurity

#DigitalTrust

#5G #Telecom

#Q2FY21 #H1FY21 Concall key takeaways(6/n)

🔹less travel costs resulted in high EBITDA margins(H1FY21~32%), which will reduce as intl travel eases off(FY20 margins were ~25%-no guidance from mgmt)

#IoTSecurity #BlockChain #CyberSecurity

#DigitalTrust

#5G #Telecom

#Subex

#Q2FY21 #H1FY21 Concall key takeaways(n/n)

Company should upload the detailed call transcripts on BSE/NSE within a week - will post it here for information.

#Q2FY21 #H1FY21 Concall key takeaways(n/n)

Company should upload the detailed call transcripts on BSE/NSE within a week - will post it here for information.

#Subex

#Q2FY21 #H1FY21

Investor Conference Call transcripts r now uploaded on Subex website

Have a look-lot of good information for understanding of business & where it is heading.

subex.com/pdf/investors/…

#IoTSecurity #BlockChain #CyberSecurity

#DigitalTrust

#5G #Telecom

#Q2FY21 #H1FY21

Investor Conference Call transcripts r now uploaded on Subex website

Have a look-lot of good information for understanding of business & where it is heading.

subex.com/pdf/investors/…

#IoTSecurity #BlockChain #CyberSecurity

#DigitalTrust

#5G #Telecom

reminder that #Subex has increased its employees by 15% (902➡️1038) during #Q2FY21

this is a good pointer for growth anticipated in line with recent developments, new major deals & mgmt’s guidance of robust deal pipeline

#DigitalTrust #IoTSecurity #Blockchain #5G #CyberSecurity

this is a good pointer for growth anticipated in line with recent developments, new major deals & mgmt’s guidance of robust deal pipeline

#DigitalTrust #IoTSecurity #Blockchain #5G #CyberSecurity

https://twitter.com/AmitMis93532571/status/1332466150043598848

On lack of promoter queries, in add to below tweet, remember Chairman Mr Anil Singhvi’s holding 1.02Cr shares through his companies, Ican Invstmt Advisors & Anagha Advisors

Besides him,Subex Employee ESOPs trust has been massively buying since 2019 & holds now2.09Cr shares 3.72%

Besides him,Subex Employee ESOPs trust has been massively buying since 2019 & holds now2.09Cr shares 3.72%

https://twitter.com/AmitMis93532571/status/1325011068674998274

Good confident looking price action in #Subex ending the day with 20% Upper Circuit with significant rise in traded & delivered volumes.

Another good day of market action for #Subex - closed above 31 Rs with massive volumes of 6.8 Cr on NSE and BSE.

Subex has also notified today of analysts/investors meeting. Interesting. 😊

Subex has also notified today of analysts/investors meeting. Interesting. 😊

https://twitter.com/SForStiletto/status/1334051280134623233

Those who wants to hear the #Q2FY21 concall, please refer to the link in the below tweet from @SForStiletto - which is a part of very informative thread also - have a look.

https://twitter.com/SForStiletto/status/1335476175888547841

#Subex closes another good deal with its long standing client Saudi Telecom - it has many positive implications for its business, some are immediate in Horizon 1 segment & some will certainly open doors for Horizon 2 & 3 products.

bseindia.com/xml-data/corpf…

bseindia.com/xml-data/corpf…

https://twitter.com/AmitMis93532571/status/1324611309464268801

#Subex ’s other Telco clients(200+) wud be keenly looking 2 upgrade to iRAFM on Hadoop stack.

Next logical follow up wud be 4 STC to extend relationship to #IoTAnalytics & #IoTSecurity given Subex’s expertise & existing H1 deal, similar to Telefonica template.

Watch this space!

Next logical follow up wud be 4 STC to extend relationship to #IoTAnalytics & #IoTSecurity given Subex’s expertise & existing H1 deal, similar to Telefonica template.

Watch this space!

A very brief synopsis of #Subex as a reminder of its fundamental strengths.

#DigitalTrust #Telecom #5G #IoTSecurity #IoTAnalytics #IoT #CyberSecurity #DigitalIdentity #IDCentral #CrunchMetrics #AI #BlockChain

#DigitalTrust #Telecom #5G #IoTSecurity #IoTAnalytics #IoT #CyberSecurity #DigitalIdentity #IDCentral #CrunchMetrics #AI #BlockChain

#Subex official handle’s tweet on #STC deal 👍🏼

Deal momentum has been very good since end Sep’20 - hoping more successes in coming months 😌

Deal momentum has been very good since end Sep’20 - hoping more successes in coming months 😌

https://twitter.com/subex/status/1336965760598515712

Livemint article on #Subex key highlights:

*#AI #ML based #CrunchMetrics (crunchmetrics.ai (FinTech,Ecommerce) may see deals soon-POCs already done in EU/APAC

*Big growth from H2&H3 in next 2-3yrs-SaaS Model

*New platform early 2021

*Zero debt

livemint.com/companies/news…

*#AI #ML based #CrunchMetrics (crunchmetrics.ai (FinTech,Ecommerce) may see deals soon-POCs already done in EU/APAC

*Big growth from H2&H3 in next 2-3yrs-SaaS Model

*New platform early 2021

*Zero debt

livemint.com/companies/news…

#NewDeals

#Subex will be deploying its latest #ROC #FraudManagement for #Telefonica’ #LatinAmerica operations covering Argentina, Chile, Colombia, Ecuador, Mexico, Peru, Uruguay & Venezuela.

Press release: bseindia.com/xml-data/corpf…

#BigData #AI #ML

#Subex will be deploying its latest #ROC #FraudManagement for #Telefonica’ #LatinAmerica operations covering Argentina, Chile, Colombia, Ecuador, Mexico, Peru, Uruguay & Venezuela.

Press release: bseindia.com/xml-data/corpf…

#BigData #AI #ML

#Subex MD & CEO, Mr Vinod Kumar, provided details on recent deals & future outlook on CNBC

Besides highlighted points in pic, he advised growth as:

-niche business 5-10%

-IoT Security in multiples⚡️

Overall very confident & reassuring

#IoTSecurity #RAFM #CyberSecurity #Telecom

Besides highlighted points in pic, he advised growth as:

-niche business 5-10%

-IoT Security in multiples⚡️

Overall very confident & reassuring

#IoTSecurity #RAFM #CyberSecurity #Telecom

https://twitter.com/Nigel__DSouza/status/1339807125283848192

Telefonica & STC quantum is very good-each represents ~6-9% of current FY21 revenue estimates,to b realized in 12-18 mths, annuity service component is separate

& this is w/o TechM #BlockChain #CyberSecurity deal.

Good signs for #Subex back on growth path,deal pipeline is good.

& this is w/o TechM #BlockChain #CyberSecurity deal.

Good signs for #Subex back on growth path,deal pipeline is good.

Came across this article penned by Rajiv Singh (Global Head – Enterprise Security & Risk Management, Tech Mahindra).

TechM’s push on #CyberSecurity solutions in various applications in 5G setups- recent deal with #Subex should be in focus.

cio.economictimes.indiatimes.com/news/digital-s…

TechM’s push on #CyberSecurity solutions in various applications in 5G setups- recent deal with #Subex should be in focus.

cio.economictimes.indiatimes.com/news/digital-s…

https://twitter.com/AmitMis93532571/status/1324252228031447040

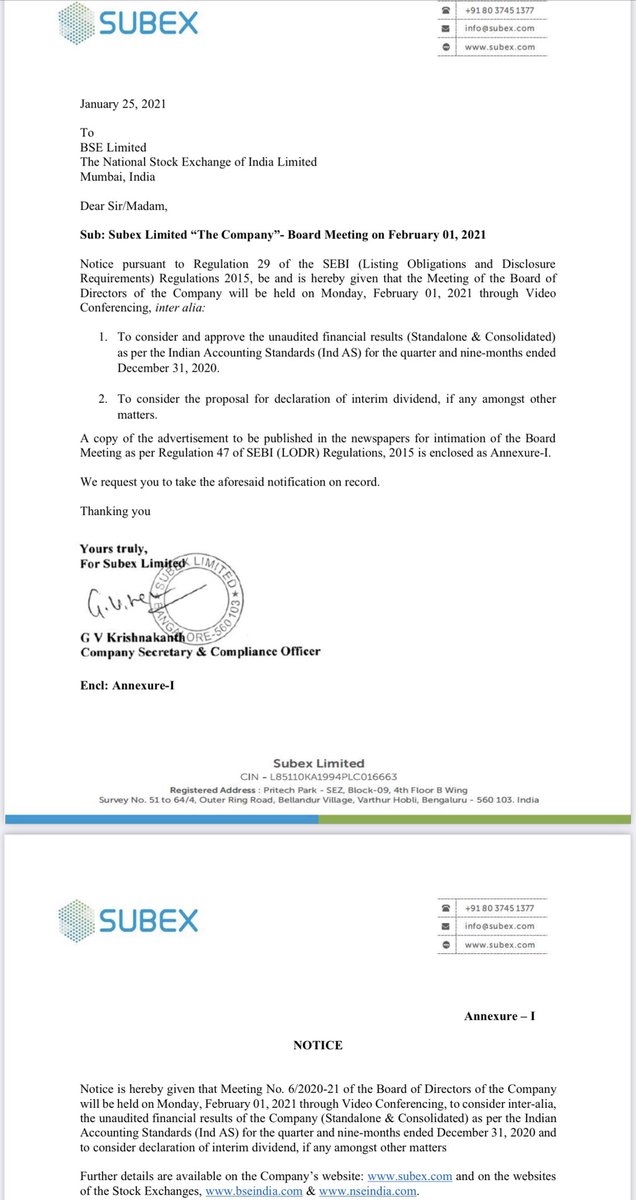

#Subex announced board meeting on 1 Feb 2021 for

1) #Q3FY21 #9MFY21 Results

&wait for it..

2) Interim #Dividend

to put things in perspective,last dividend was announced in 2007-so +ve surprise-stock reacted well too

bseindia.com/xml-data/corpf…

#Q3Earnings

#IDCentral #CrunchMetrics

1) #Q3FY21 #9MFY21 Results

&wait for it..

2) Interim #Dividend

to put things in perspective,last dividend was announced in 2007-so +ve surprise-stock reacted well too

bseindia.com/xml-data/corpf…

#Q3Earnings

#IDCentral #CrunchMetrics

https://twitter.com/AmitMis93532571/status/1319965659535601665

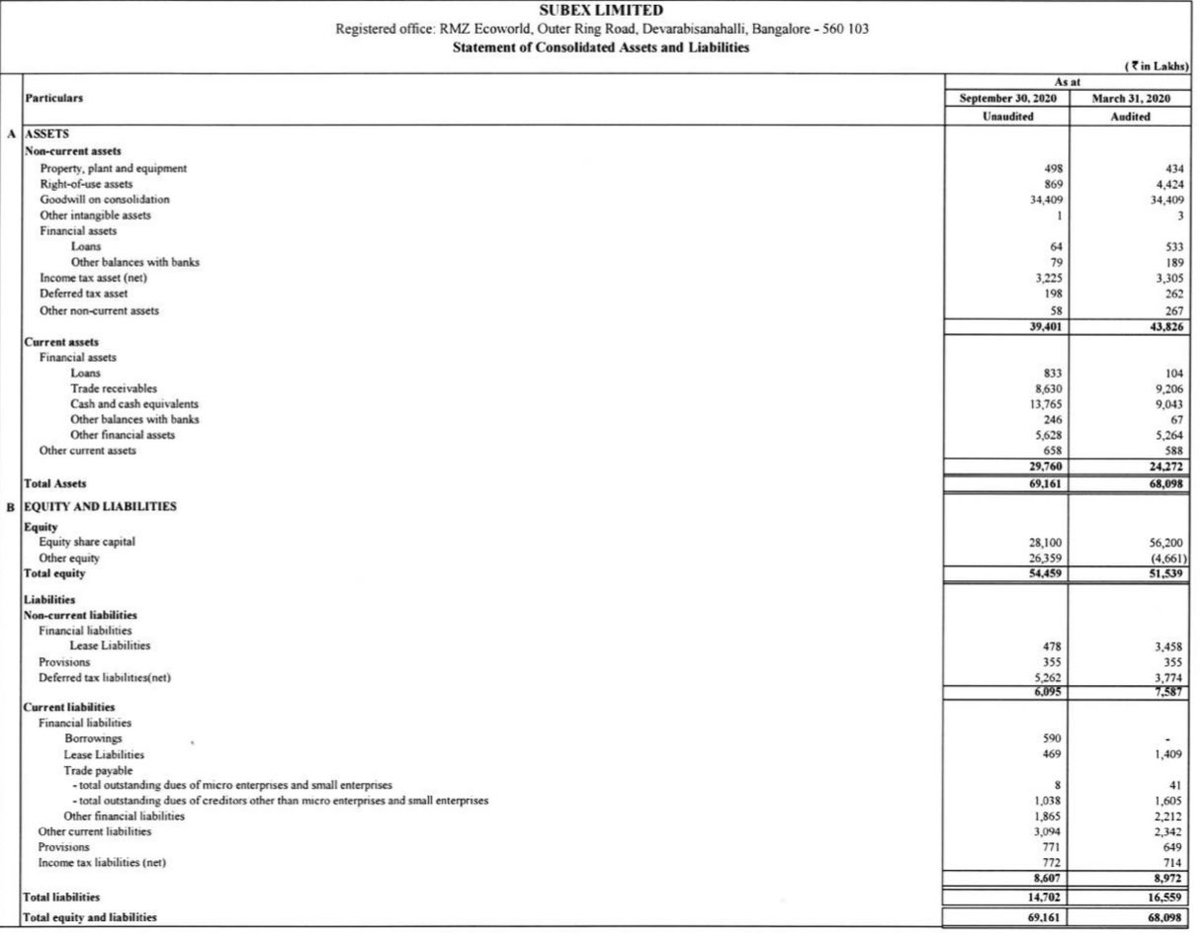

In context of #Subex announcement for (consideration of) Interim #Dividend, summarising the trend of some cash parameters in recent years.

Massive growth in #H1FY21 as compared to full year numbers in past!

#SubexSecure #CrunchMetrics #IDCentral

#Q3FY21 #9MFY21 #Q3Earnings

Massive growth in #H1FY21 as compared to full year numbers in past!

#SubexSecure #CrunchMetrics #IDCentral

#Q3FY21 #9MFY21 #Q3Earnings

👆🏼trends show tht #Subex shud end up w/ 200+ Cr Cash/Eq by #Q4FY21 end

So, Subex is well placed to give decent #dividend (interim+final) in #FY21 while board will surely find balance w/ its WC, R&D exp & inorganic growth aspirations

Even buyback could also b on cards in #FY22🤞🏼

So, Subex is well placed to give decent #dividend (interim+final) in #FY21 while board will surely find balance w/ its WC, R&D exp & inorganic growth aspirations

Even buyback could also b on cards in #FY22🤞🏼

Buyback is equally good if not more given total shares are 56Cr

Recently concluded Share Capital reduction in 2020 gives good enough reasons to believe that mgmt is quite serious & will do more to address large equity base.

Spoilt for choices😊-interesting times ahead at #Subex

Recently concluded Share Capital reduction in 2020 gives good enough reasons to believe that mgmt is quite serious & will do more to address large equity base.

Spoilt for choices😊-interesting times ahead at #Subex

#Subex #Q3FY21/#9MFY21 results r announced today

mixed bag really,while revenue growth isn't there QoQ & marginal YoY, this quarter was still exceptionally good in terms of strategic deals(some were announced already-Telefonica,STC,TecM,etc) which r opening up huge growth areas.

mixed bag really,while revenue growth isn't there QoQ & marginal YoY, this quarter was still exceptionally good in terms of strategic deals(some were announced already-Telefonica,STC,TecM,etc) which r opening up huge growth areas.

#Subex #Q3FY21/#9MFY21 results

After 14 long years, board has announced interim #dividend (10%=0.5Rs)-represent 28.1 Cr Rs cash outgo, signifying healthy cash situation-very positive.

BSE Result link: bseindia.com/xml-data/corpf…

Earning call is tomorrow-more updates after that.

After 14 long years, board has announced interim #dividend (10%=0.5Rs)-represent 28.1 Cr Rs cash outgo, signifying healthy cash situation-very positive.

BSE Result link: bseindia.com/xml-data/corpf…

Earning call is tomorrow-more updates after that.

As promised, #Q3FY21 #Concall summary for #Subex -lot of good stuff in it-have a look

Broadly, mgmt is quite confident about future & continuously getting success in newer areas which r highly scalable and will be growth engines for Subex

#IDCentral #CrunchMetrics #IoTSecurity

Broadly, mgmt is quite confident about future & continuously getting success in newer areas which r highly scalable and will be growth engines for Subex

#IDCentral #CrunchMetrics #IoTSecurity

Thanks @BradKhosla for replugging this article👍🏼

#ConnectedCars is another area where #Subex has leveraged its expertise last few yrs in #CyberSecurity & #DataAnalytics-all hard work is getting paid off w/recent engagements w/auto companies

#IoTSecurity #ElectricVehicles #EV

#ConnectedCars is another area where #Subex has leveraged its expertise last few yrs in #CyberSecurity & #DataAnalytics-all hard work is getting paid off w/recent engagements w/auto companies

#IoTSecurity #ElectricVehicles #EV

https://twitter.com/BradKhosla/status/1357010968883027968

Nice advertisement from #Subex for the exciting new product-a game changer in fact 👍🏼

Those who read con-call notes posted👆🏼in this thread would b able to understand the product & its capabilities 😉

#AIRevolution #SubexAILabs #DigitalTrust

#AI #5G #Cloud #API

#Platform #SaaS

Those who read con-call notes posted👆🏼in this thread would b able to understand the product & its capabilities 😉

#AIRevolution #SubexAILabs #DigitalTrust

#AI #5G #Cloud #API

#Platform #SaaS

#Subex featured yesterday in National #AI Portal of India @OfficialIndiaAI in the top slot - very good read.

Thanks @LltTomar for the share 👍🏼

indiaai.gov.in/article/why-th…

#DigitalTrust #IoTSecurity #5G #CyberSecurity

#IDCentral #CrunchMetrics

#AugmentedAnalytics #Platforms

Thanks @LltTomar for the share 👍🏼

indiaai.gov.in/article/why-th…

#DigitalTrust #IoTSecurity #5G #CyberSecurity

#IDCentral #CrunchMetrics

#AugmentedAnalytics #Platforms

https://twitter.com/LltTomar/status/1364952171834454017

To understand #IDCentral platform & its scalable potential, one doesn't need to look any further than this BlackSwan interview of #Subex COO Mr. Roddam

bswan.org/idcentral.asp

#Q3FY21 Concall provided updates on IDCentral progress-see brief notes👇

bswan.org/idcentral.asp

#Q3FY21 Concall provided updates on IDCentral progress-see brief notes👇

https://twitter.com/AmitMis93532571/status/1332466150043598848?s=20

#Subex opens a new chapter in its turnaround journey by joining prestigious O-RAN Alliance.

Multiple positive implications being part of this future tech,aimed to revolutionize RAN industry.

Check out details:

o-ran.org/membership

BSE press release: bseindia.com/xml-data/corpf…

Multiple positive implications being part of this future tech,aimed to revolutionize RAN industry.

Check out details:

o-ran.org/membership

BSE press release: bseindia.com/xml-data/corpf…

Impressive PR frm #Subex 4 launch of their upcoming platform,aimed 2 democratize #AI &ease #EnterpriseAI adoption

Watch the adrenal pumping video

“Everybody can do #AI”

Mark ur calendars-14 Apr 2021 is the date😊

#AIRevolution #SubexAILabs #DigitalTrust

Watch the adrenal pumping video

“Everybody can do #AI”

Mark ur calendars-14 Apr 2021 is the date😊

#AIRevolution #SubexAILabs #DigitalTrust

https://twitter.com/AmitMis93532571/status/1363779580880855046

#Subex has now also formalized the subject of release AI automation platform for #Enterprises

Watch this space 👀😊

BSE link: bseindia.com/xml-data/corpf…

#AI #AIRevolution #SubexAILabs #DigitalTrust #AugmentedAnalytics #EnterpriseAI

Watch this space 👀😊

BSE link: bseindia.com/xml-data/corpf…

#AI #AIRevolution #SubexAILabs #DigitalTrust #AugmentedAnalytics #EnterpriseAI

Anagha of Anil Singhvi,sold 25lakh shares

Both Anagha&Ican r his family ventures & owned 1Cr shares-now holding 75lakhs post this sell,which cud b due 2 personal commitments

I’m not reading too much into it as fundamentally all looking good, but plz draw ur own conclusions🙏🏼

Both Anagha&Ican r his family ventures & owned 1Cr shares-now holding 75lakhs post this sell,which cud b due 2 personal commitments

I’m not reading too much into it as fundamentally all looking good, but plz draw ur own conclusions🙏🏼

Thanks Patrick-agree in general-but sell could be for variety of reasons

So,I go back 2first principles & look at business-which remains solid w/good potential to grow-so all good😊

This table though isn’t clear 2me so far-hope it’s correct-wud b nice to hv these institutions🤞🏼

So,I go back 2first principles & look at business-which remains solid w/good potential to grow-so all good😊

This table though isn’t clear 2me so far-hope it’s correct-wud b nice to hv these institutions🤞🏼

https://twitter.com/PatrickPmathias/status/1369436419924590594

Thanks to team @nimishshp @SudzzBTS @BeatTheStreet10 for this informative video on #Subex 👍🏼

@SForStiletto

@SForStiletto

https://twitter.com/BeatTheStreet10/status/1370056046232838145

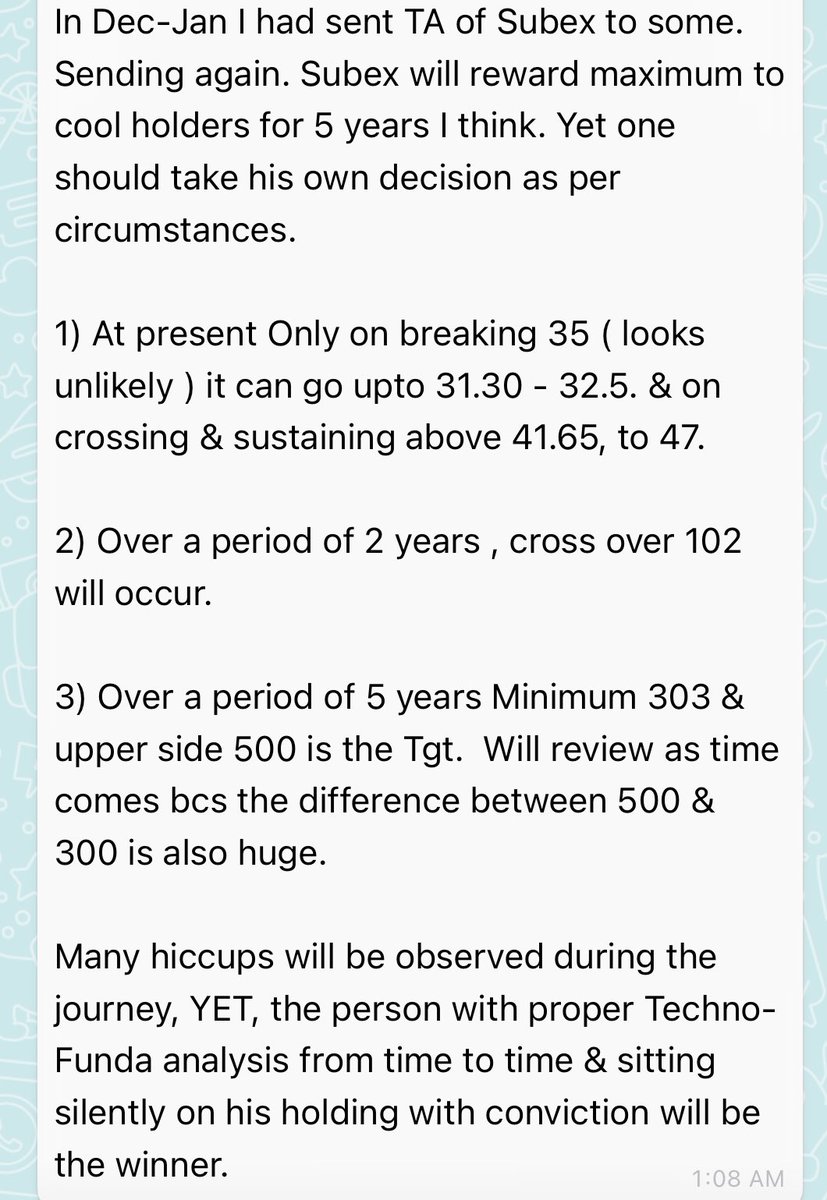

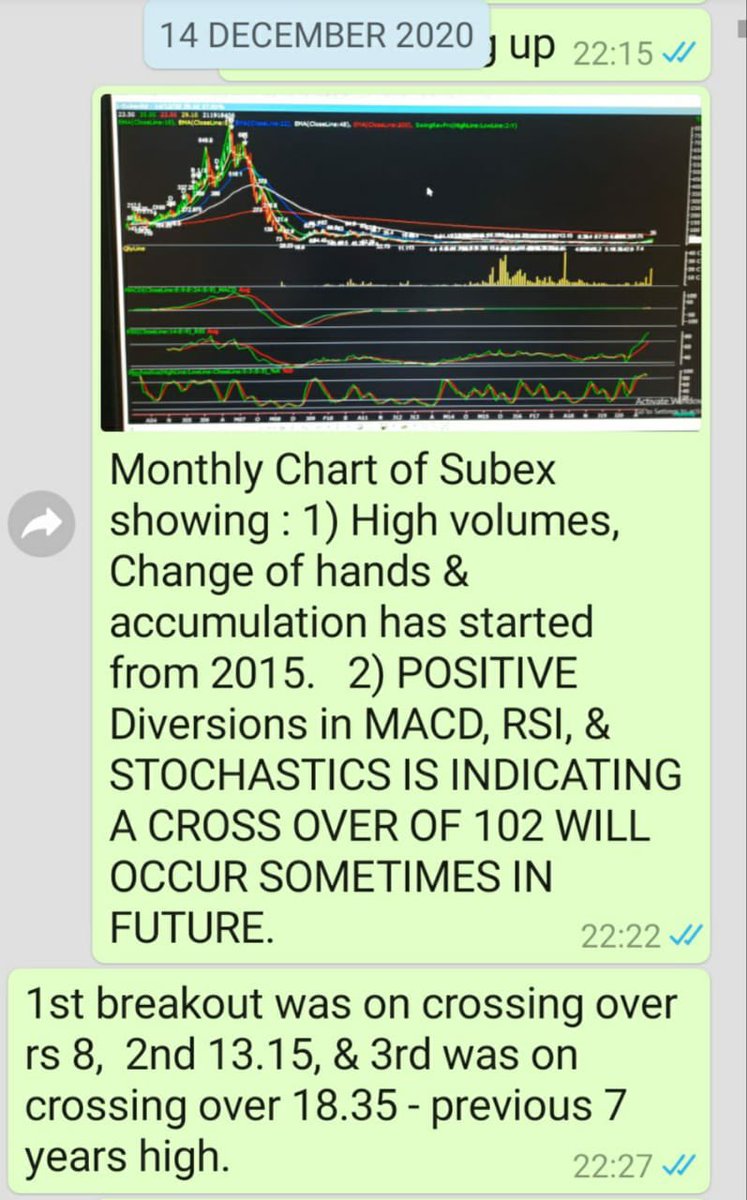

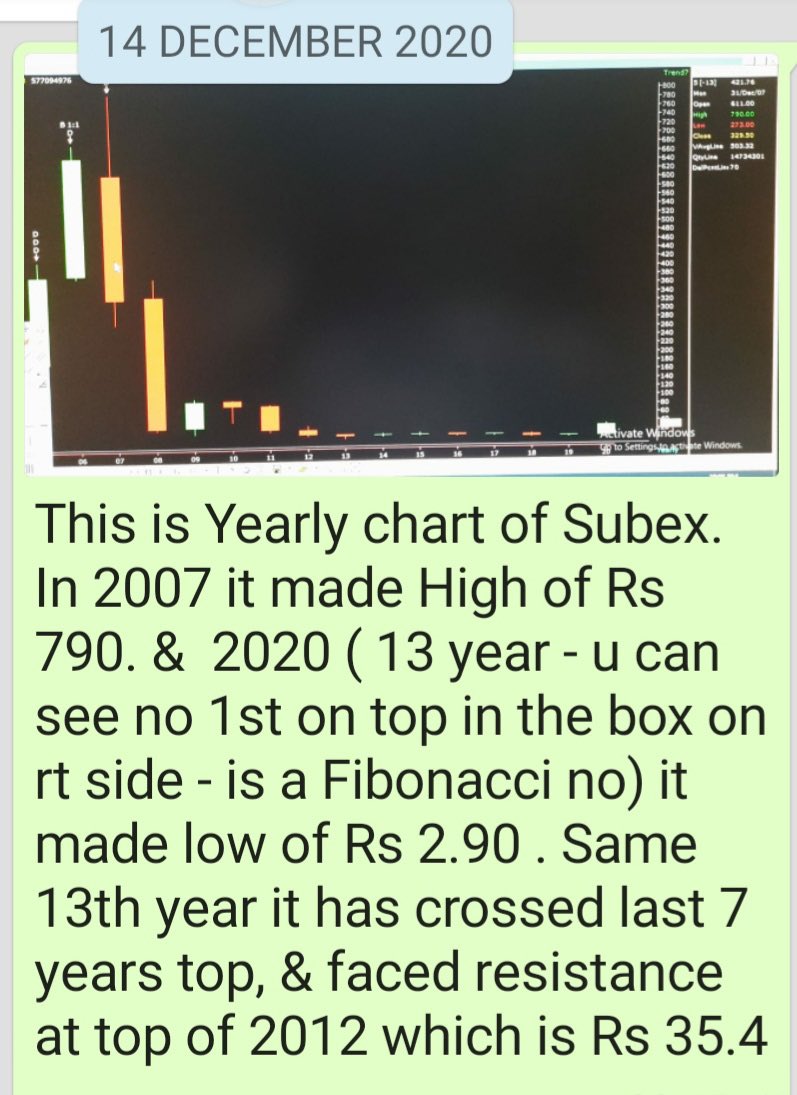

#Subex TA by Dr Laxmichand Gada @LaxmichandDr in below pics👇🏼

Further text for 4th pic

“38.2% correction of 13 years top & bottom( 790-2.9) is 303 & 61.8% correction of the same is 489”

It’s 4education purposes-do ur own due diligence🚨

@SForStiletto @van_daswani @PD_rockz

Further text for 4th pic

“38.2% correction of 13 years top & bottom( 790-2.9) is 303 & 61.8% correction of the same is 489”

It’s 4education purposes-do ur own due diligence🚨

@SForStiletto @van_daswani @PD_rockz

#Subex #NewDeals

Another strategic partnership-this time w/ #SkyLab 2 jointly offer #CyberSecurity solutions & services to cater massive #Maritime industry

Growth potential is huge given increasing cyberattacks on shipping companies as noted in notice👇🏼

#IoT #OT #DigitalTrust

Another strategic partnership-this time w/ #SkyLab 2 jointly offer #CyberSecurity solutions & services to cater massive #Maritime industry

Growth potential is huge given increasing cyberattacks on shipping companies as noted in notice👇🏼

#IoT #OT #DigitalTrust

https://twitter.com/subex/status/1372127193287954434

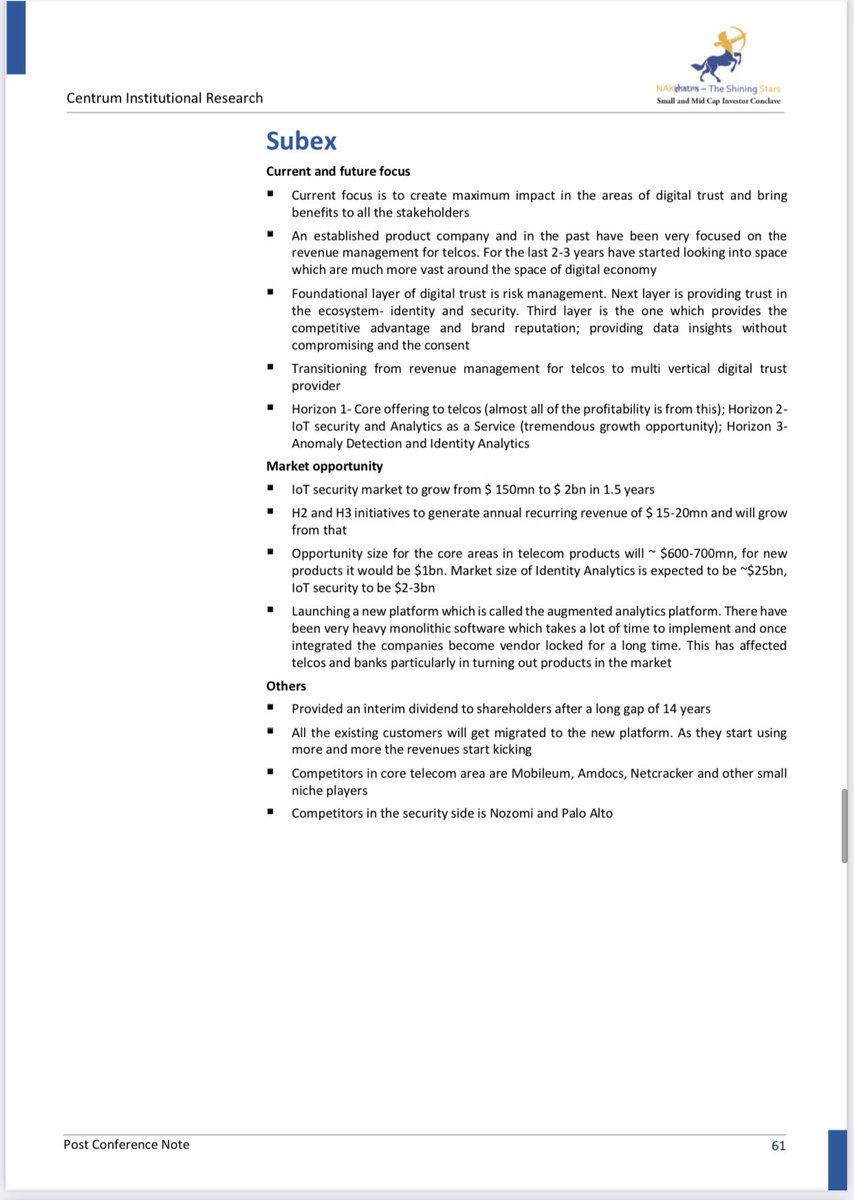

#Subex was part of Centrum Broking’s Small/Mid Cap Investor Conclave (Nakshatra-The Shining Stars)-was attended by 70 fund houses👍🏼

brief notes on Subex👇🏼by them in post conference notes

#DigitalTrust #5G #AugmentedAnalytics #AI #IDCentral #CrunchMetrics #IoTSecurity #Analytics

brief notes on Subex👇🏼by them in post conference notes

#DigitalTrust #5G #AugmentedAnalytics #AI #IDCentral #CrunchMetrics #IoTSecurity #Analytics

After Gartner’s listing of #Subex as Sample Provider for #AugmentedAnalytics,below report “Global AI and Analytics Systems Market Growth (Status andOutlook)2020-2025” lists Subex among global biggies!

What a turnaround! 👍🏼👏🏼

Some observations below👇🏼👀

ksusentinel.com/2021/04/15/glo…

What a turnaround! 👍🏼👏🏼

Some observations below👇🏼👀

ksusentinel.com/2021/04/15/glo…

https://twitter.com/AmitMis93532571/status/1319409378131279872

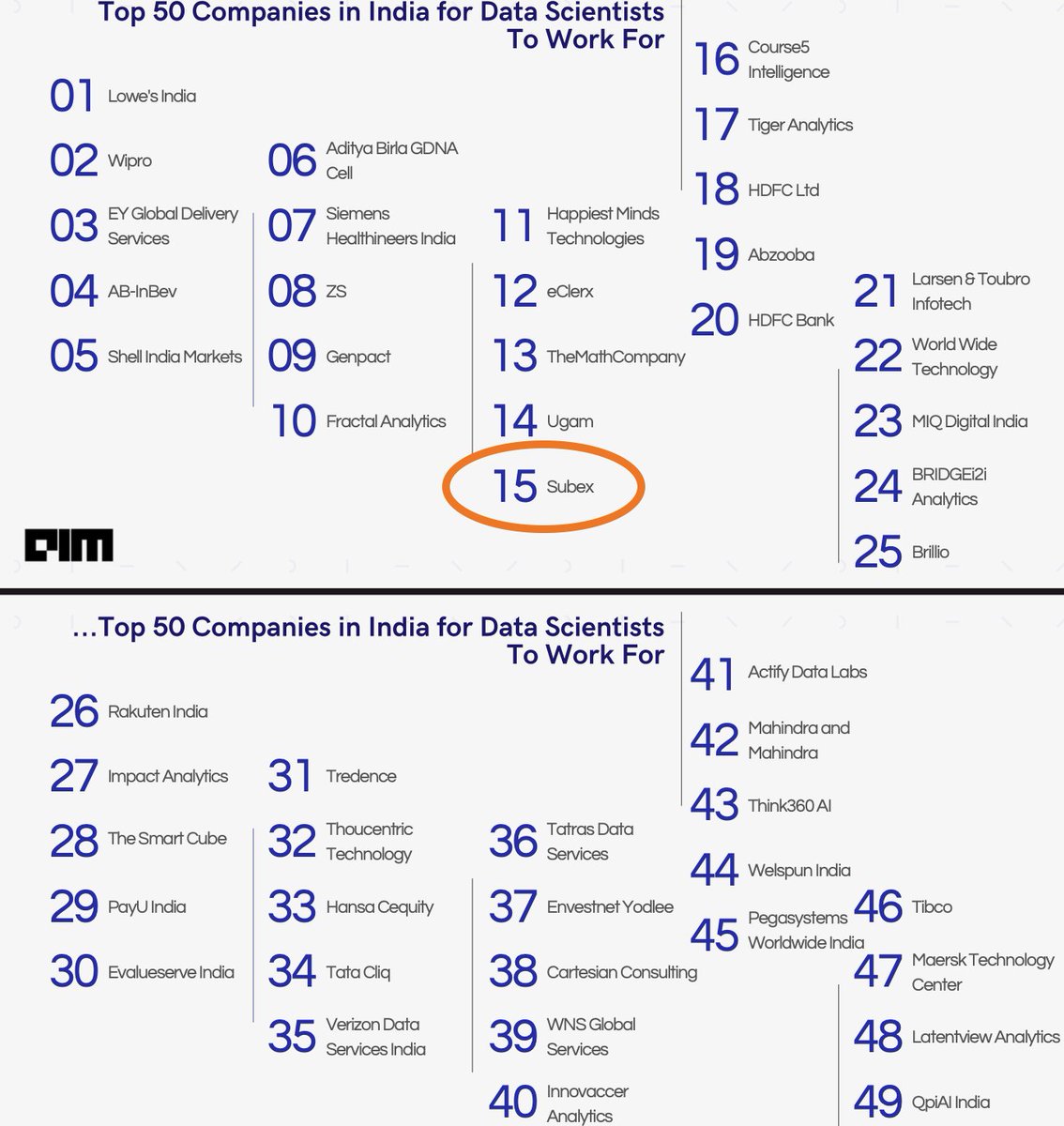

Analytics India Magazine @Analyticsindiam lists #Subex in "50 Best Firms In India For Data Scientists To Work For – 2021"

analyticsindiamag.com/50-best-firms-…

Congrats team Subex 👍👏

#Data #DataScience #Analytics #AugmentedAnalytics

analyticsindiamag.com/50-best-firms-…

Congrats team Subex 👍👏

#Data #DataScience #Analytics #AugmentedAnalytics

https://twitter.com/Analyticsindiam/status/1384004649124986883?s=20

#Subex is in really good company here - see👇names of companies in the list-some very big names in there from the industry👍👏

#SubexSecure #IDCentral #CrunchMetrics

#Data #DataScience

#Analytics #AugmentedAnalytics #CyberSecurity

#AI #ML #Blockchain

#5G

#SubexSecure #IDCentral #CrunchMetrics

#Data #DataScience

#Analytics #AugmentedAnalytics #CyberSecurity

#AI #ML #Blockchain

#5G

https://twitter.com/subex/status/1384087355410161666?s=20

Big news in Digital ID verification domain-#MasterCard 2 buy #Ekata for $850 Million

thanks @RakeshTraveller 4 sharing it.

Shows potential of #Subex’s #IDCentral platform(H3 product) in its #DigitalTrust portfolio👍🏼🚀

details on IDC in embedded tweet👇🏼

mobile.reuters.com/article/amp/id…

thanks @RakeshTraveller 4 sharing it.

Shows potential of #Subex’s #IDCentral platform(H3 product) in its #DigitalTrust portfolio👍🏼🚀

details on IDC in embedded tweet👇🏼

mobile.reuters.com/article/amp/id…

https://twitter.com/amitmis93532571/status/1365903982250528768

#NewDeal

#Subex has signed a multi-year with a Tier – 1 Customer in APAC region for supply of #ROC Business Assurance (BA) solutions (Horizon 1 product)👍

NSE weblink archives.nseindia.com/corporate/SUBE…

If interested visit Subex's BA webpage - plenty of good info subex.com/business-assur…

#Subex has signed a multi-year with a Tier – 1 Customer in APAC region for supply of #ROC Business Assurance (BA) solutions (Horizon 1 product)👍

NSE weblink archives.nseindia.com/corporate/SUBE…

If interested visit Subex's BA webpage - plenty of good info subex.com/business-assur…

• • •

Missing some Tweet in this thread? You can try to

force a refresh