Wanted to analyze #Pakistan's #export performance, benchmarking with structural and aspirational countries, along 4 dimensions - #growth, #diversification, #quality, #survival. Thread below: 👇👇👇

1/n Since the turn of the century, #Pakistan has become a more inward oriented economy, with exports/GDP falling from 16 to 10%.

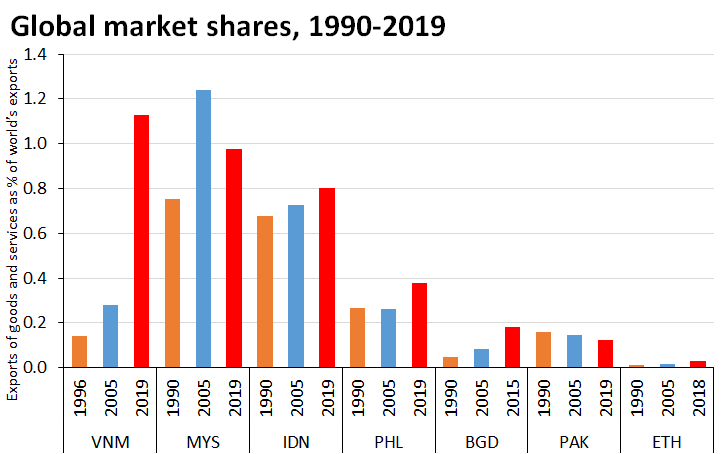

2/n As a result, #Pakistan's share of world markets fell from 16USD to 12USD out of every 1000USD traded between 1990 and 2019. #Bangladesh moved from 5 to 18USD in the same period. #Vietnam from 14 to 113USD!!!

3/n But not all is doom. Some sectors did pretty well: food products, animal, vegetables and #IT and #IT enabled #services. They gained market shares and built a comparative advantage. Textiles and apparel has been losing out.

4/n But even within textile and apparel, some subsectors are doing better than others. #Pakistan's #Apparel has been gaining market share (above red line), #Textiles and #cotton have been losing market shares in the last decade.

5/n Diversification: #Pakistan's #exporters have been reaching fewer destinations (197) with fewer products (2894) than a decade ago (202 and 3167 respectively). Let's look at it in more detail...👇👇

6/n For a given product #Pakistan exports, it only reaches about 10% of the possible destinations (#China reaches 85%, #Germany 69%). But the #trend here is #positive - they reached only 7.9% in 2009.

7/n Some sectors do well in reaching many markets w/their products. Not surprisingly, #Textiles & #Apparel out of #Pakistan reach 182 markets, most of their products reach 40+ markets. But foodstuffs, perhaps a rising star, has space to grow. Only 10 products reach 40+ mkts.

8/n But overall some challenges. In #Pakistan 437 products were exported in 2009, but discontinued today. And while churning is good, only 146 new products were introduced between 2009 and now. In net, less products. Points to #innovation challenges.

9/n #Quality: difficult to measure, but let's look at the relative #price fetched by #Pakistani exporters in global markets, compared to competitors. Very good story on #rice. Not so much on #textiles. Probably because #Pakistan competes on the lower end segment.

10/n Survival of export flows: An export flow out of #Pakistan that starts today shows a 48% probability of surviving past one year. Exporting is a risky business. Here in comparative terms, #Pakistan is half-table.

11/n Part of the survival story is that there's low entry and exit into exporting compared with others.

12/12 - Overall - some challenges ahead for #Pakistan's #exports. Not getting into drivers of this performance. Hopefully these indicators will trigger some debate and we can better understand solutions through constructive debate!

• • •

Missing some Tweet in this thread? You can try to

force a refresh