Trade and macro economist, policy-researcher, commentator, and failed squash star in Manila. Views expressed are mine, not my employer's.

How to get URL link on X (Twitter) App

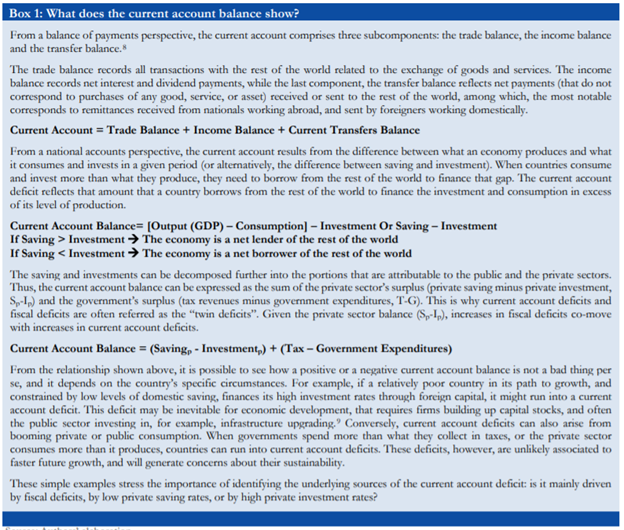

https://twitter.com/gonwei/status/1516274444997730306?s=20&t=Za89qP00QHuGOQKJTaB5uA1\ The usual: CAD results from a macro imbalance (Saving too low relative to investment, so foreign saving needed (borrowing) (CAD is the mirror image of borrowing from the rest of the world (financial account of BOP)). Fixing the CAD takes increasing saving (cool off demand).

https://twitter.com/YousufNazar/status/1523253234881613826Figure 2 in the article is built from a careful analysis combining micro-level *data* from all listed firms in Pakistan, & effective rates of protection (calculated based on FBR data on import duties and the latest input output *data* from IFPRI. It conveys the key message. 👇

1\ #exports grew by 24.8% in the first 9 months of FY22 w.r.t. same period of FY21, reaching 23.7 bn for goods and 5.2 bn for services.

1\ #exports grew by 24.8% in the first 9 months of FY22 w.r.t. same period of FY21, reaching 23.7 bn for goods and 5.2 bn for services.

https://twitter.com/IslamabadScene/status/1397435895612014601We have recently estimated #Pakistan's export potential at about US$88 billion. The untapped portion of that is close to US$61 billion.

https://twitter.com/AliKhizar/status/1198466300126912512Pakistan moved into a current account surplus after years of a deficit. There seems to be a debate on whether that’s a good or a bad thing. Are CAD “bad”? As with everything in economics, the answer is ‘it depends’. #PakThink 1/n