THREAD: Today's Retirement Income report has a long discussion about whether changes in the super guarantee are automatically passed through in offsetting change in wages. Here's the graph the report claims proves that workers pay for their own super through wage cuts: ...2

What that graph *actually* says is that something between 30% and 145% of changes in SG are reflected in offsetting changes in future wage growth. Yes, you read it right: it could be 145%: that is, if super goes up, your wages will fall by 1.45 times as much. Not clear why ...3

Our research last year found no evidence of a systematic wage/SG trade-off in historical macroeconomic data: futurework.org.au/abandoning_sup…. We said both wages & SG are determined by institutions, norms, & power. Whether they move together or apart depends on the balance of forces...4

Our report used real-world macro data (instead of large micro data sets with dozens of control variables to isolate & magnify small effects); so the govt disregards it as not being 'high quality'. It's like Animal Farm: micro good, macro bad. They just don't like our results...5

Govt also complains our confidence intervals were too wide (due to smaller data sets). Yet their favoured reports were hardly precise: estimates falling somewhere between 30% and 145%. But those findings are not visible in the real-world macroeconomy where people work & live...6

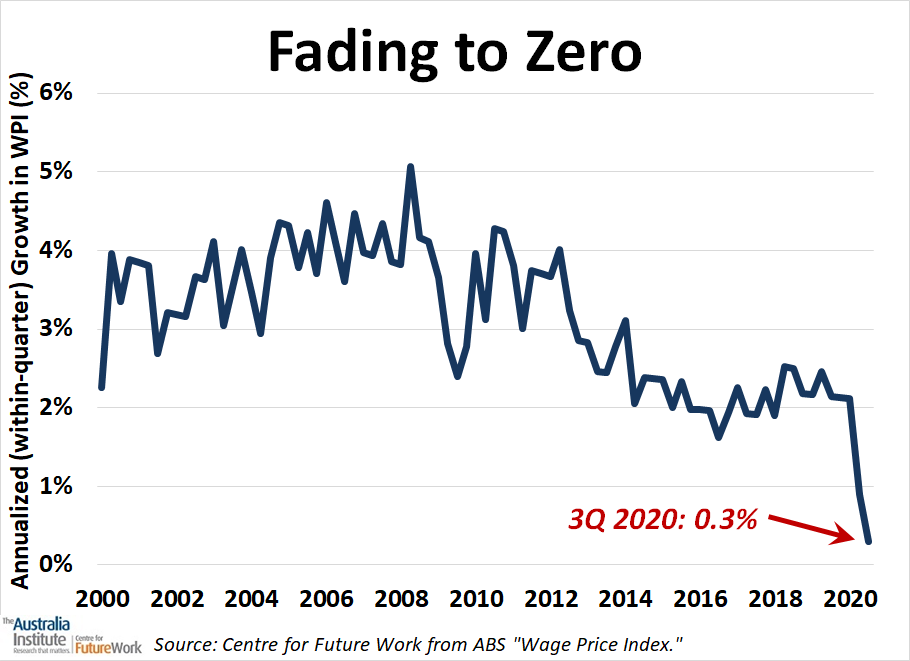

The real debate here is not about modeling methodology, it's about politics. The govt is setting the stage to defer or cancel the SG increases. It claims doing so will make wages grow faster. And it wants to distract attention from this ugly picture👇 ...7

Since 2013 (way before COVID) wage growth was weakest since WW2. Now it's zero. Thru this time SG was frozen. So giving up super won't win any wage increases. But if workers organise and fight, we can get what we deserve: healthy wages AND a good retirement. @unionsaustralia ...8

There's no "magic market formula" that automatically determines how fast wages grow, & whether or not SG changes are offset by higher or lower wages. Income distribution reflects who has power and who doesn't. These technocrats are trying to hide that reality. Don't believe them.

• • •

Missing some Tweet in this thread? You can try to

force a refresh