West Ham’s 2019/20 financial results covered an “unprecedented” season when they finished 16th in the Premier League with their finances significantly impacted by COVID-19. David Moyes replaced Manuel Pellegrini as manager in December 2019. Some thoughts follow #WHUFC

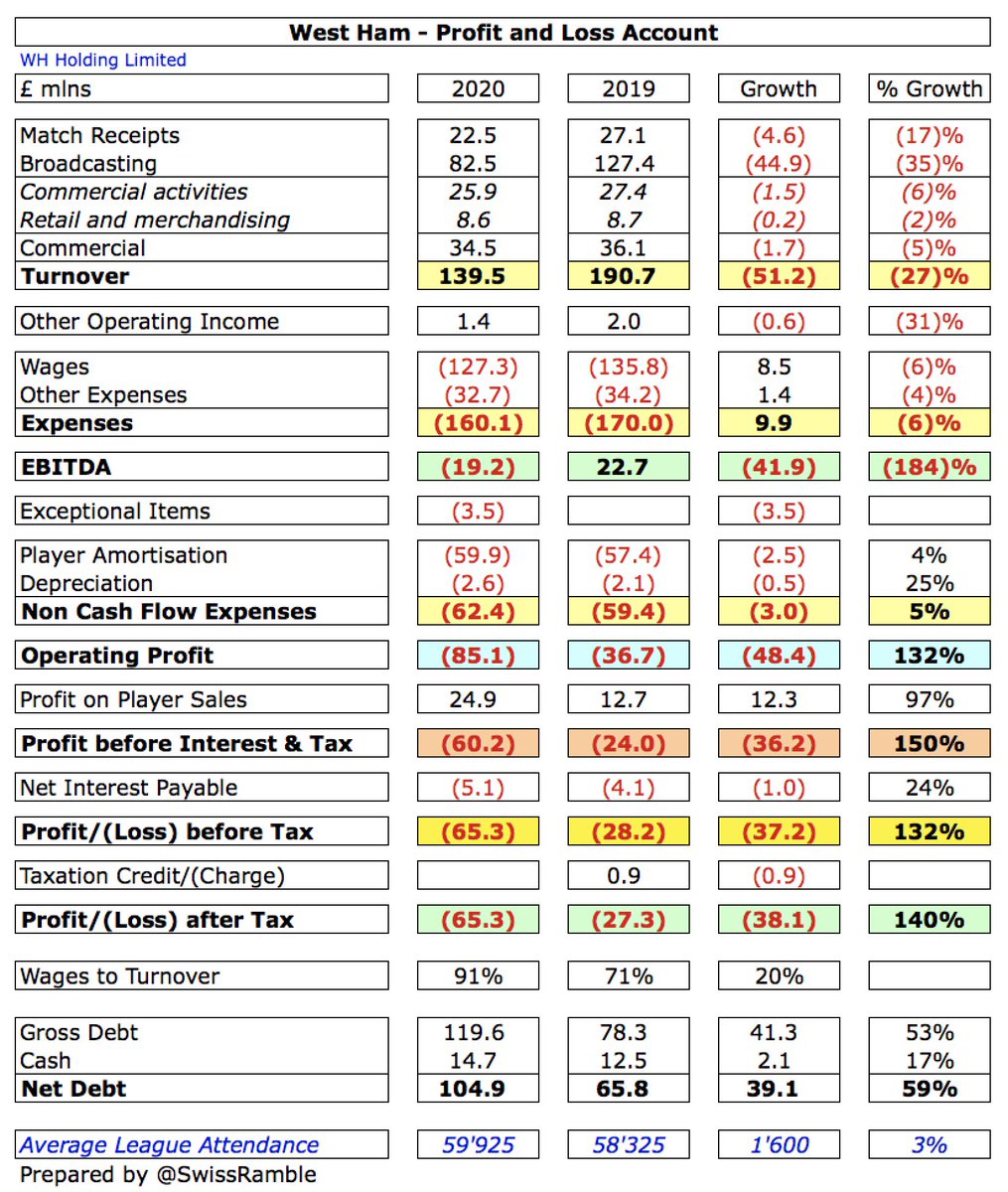

#WHUFC loss before tax loss widened from £28m to £65m, as revenue dropped £51m (27%) from £191m to £140m, offset by profit on player sales rising £12m to £25m and expenses falling £2m. Loss after tax increased from £27m to 65m.

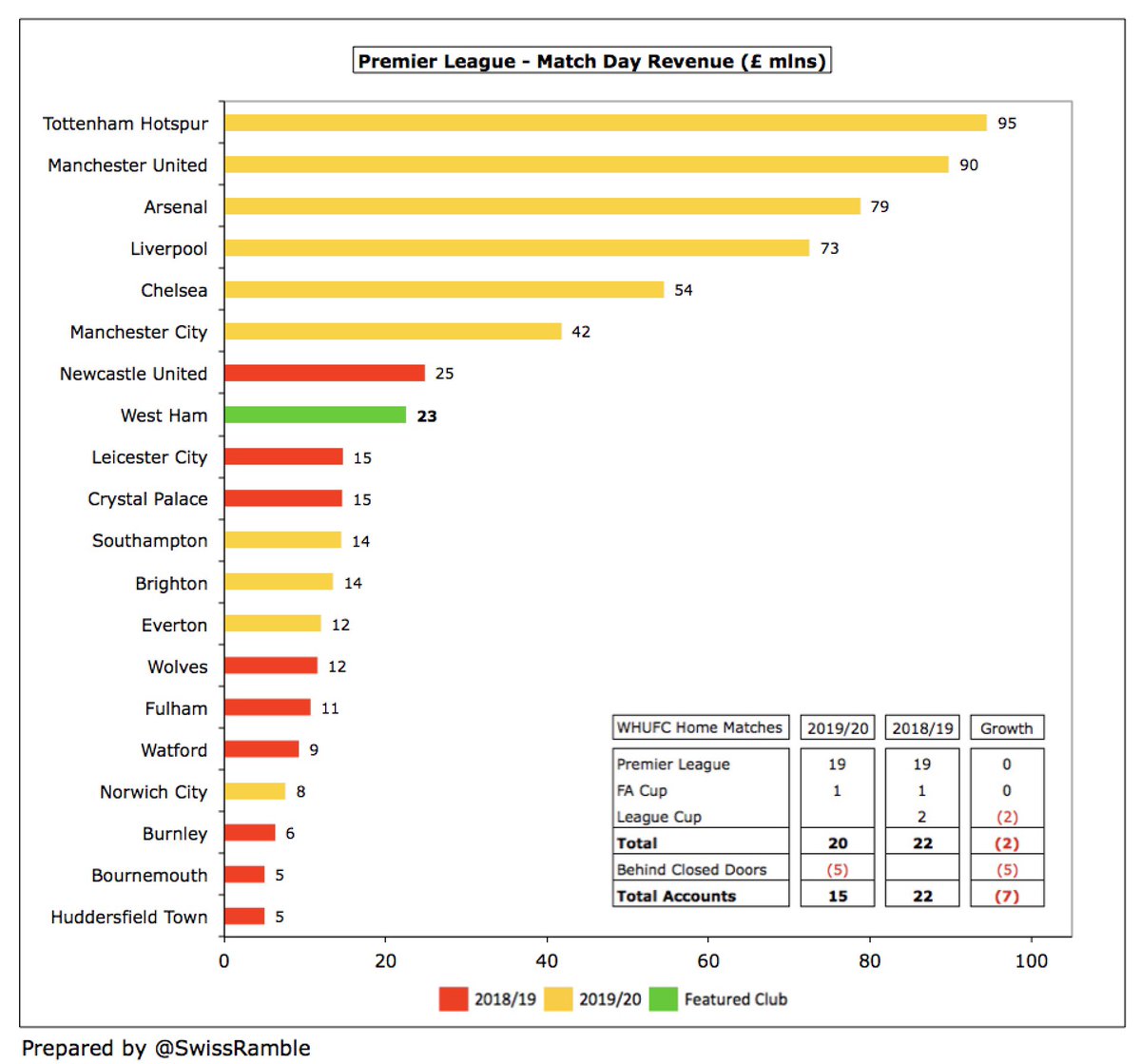

Impacted by COVID, the main driver of #WHUFC revenue decrease was broadcasting income, which dropped £45m (35%) from £127m to £82m, though there were also falls in match day, down £5m (17%) to £23m, and commercial, down £2m (5%) to £34m.

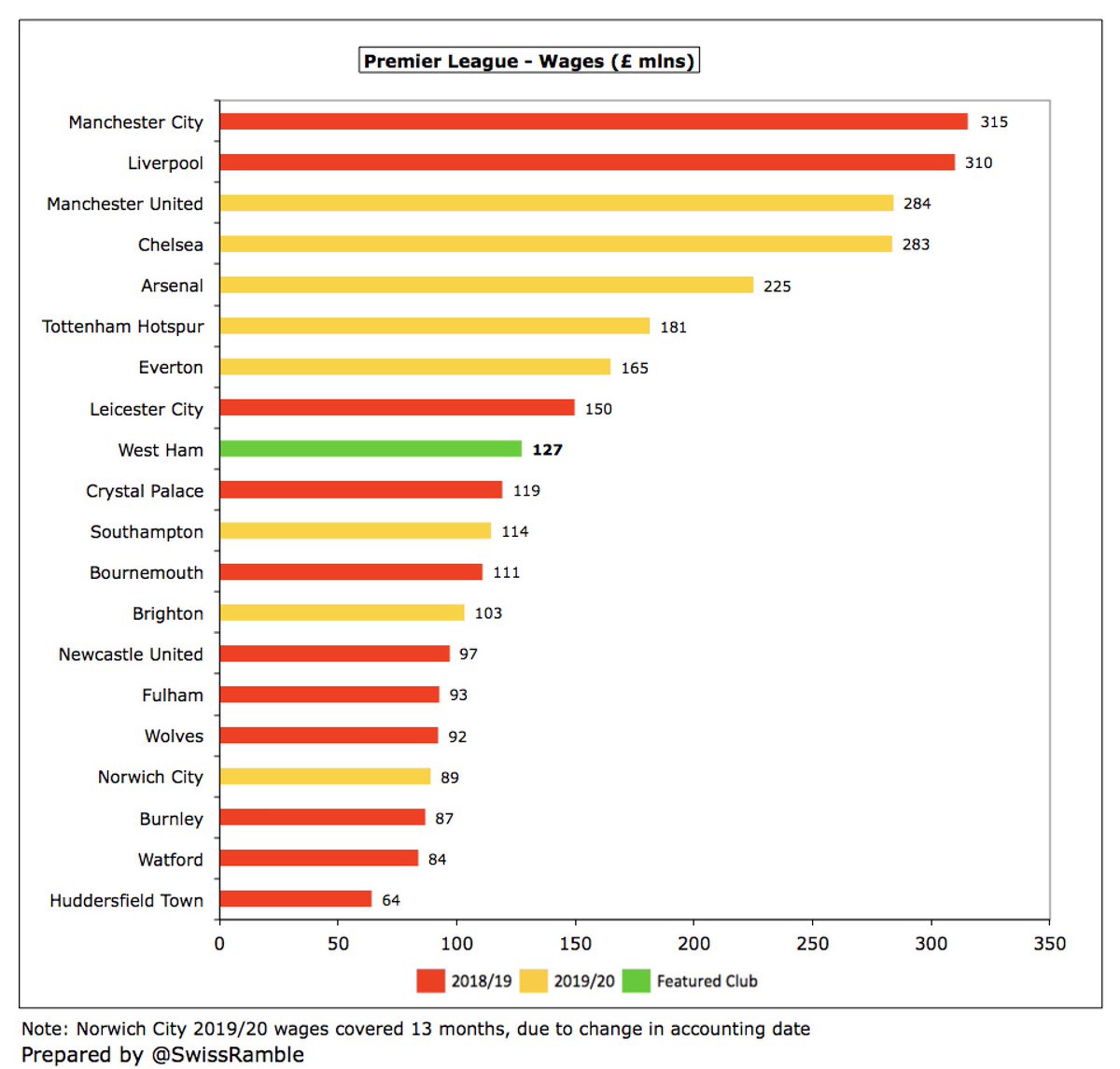

#WHUFC wage bill fell £8m (6%) to £127m, while other expenses were cut £1m (4%) to £33m. However, player amortisation increased £3m (4%) to £60m and net interest payable rose £1m to £5m, while there were £3.5m exceptional charges for Manuel Pellegrini’s sacking.

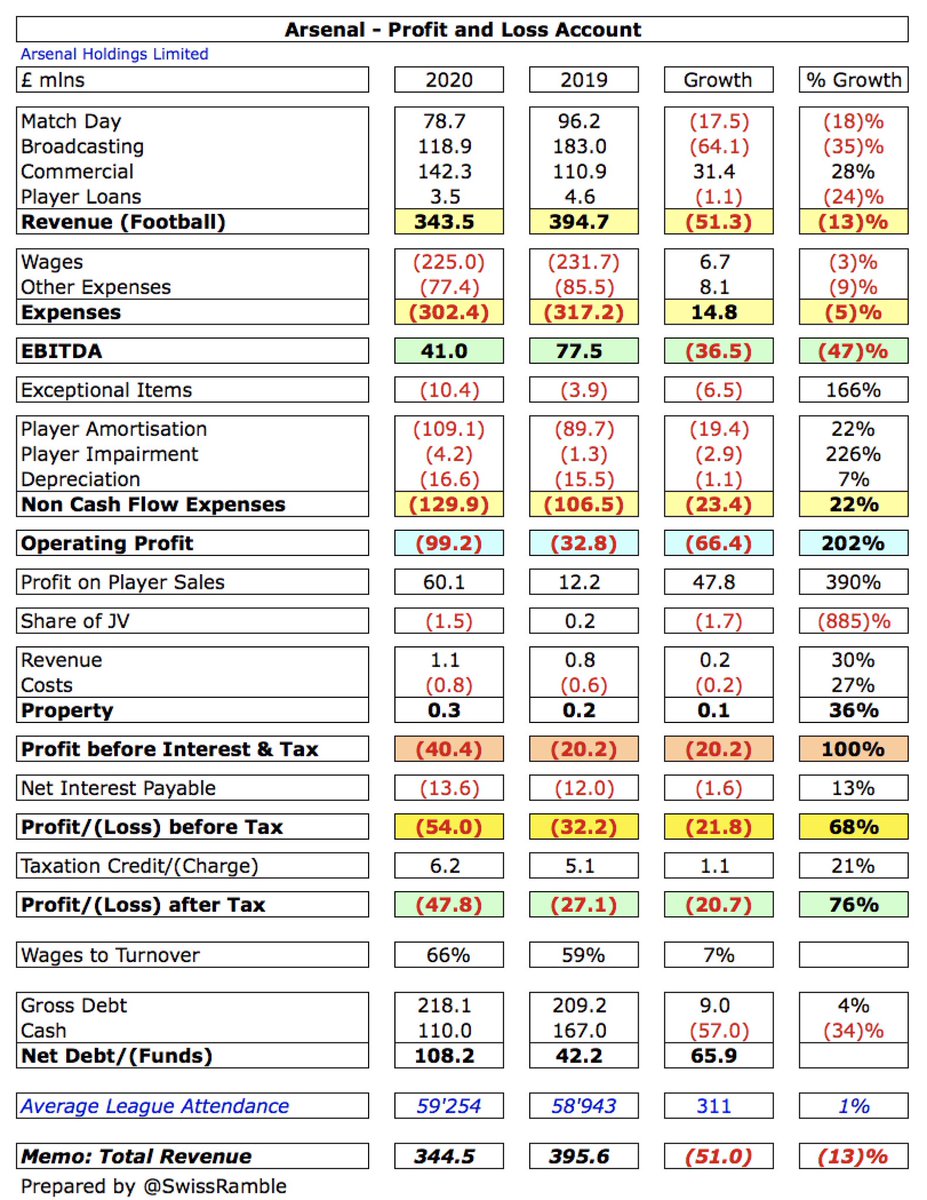

As the club stated, “the financial effect of COVID has been significant for all PL clubs and #WHUFC is no exception”. In fact, 4 clubs have already posted larger losses than West Ham’s £65m, namely #EFC £140m, #SaintsFC £76m, #THFC £68m and #BHAFC £67m, while #AFC were £54m.

Excluding COVID, #WHUFC revenue would have been £42m higher, as £26m broadcasting deferred to 2020/21 and £16m lost (match day £10m, TV £6m). Offset by £2m cost savings, giving a net £40m impact. However, would still have made a £25m loss, similar to prior season.

#WHUFC loss would have been even higher without £25m profit on player sales (including £2m player loans), significantly up from prior year £13m, mainly Arnautovic to Shanghai SIPG, Hernandez to Sevilla, Fernandes to Mainz, Obiang to Sassuolo and Perez to Alaves.

#WHUFC have posted losses two years in a row, amounting to a combined £94m deficit, though they made profits in 4 of the previous 5 years. 2019/20 is the highest loss since £37m in 2008 (including £26m fine for rules breach for the transfers transfers of Tevez and Mascherano).

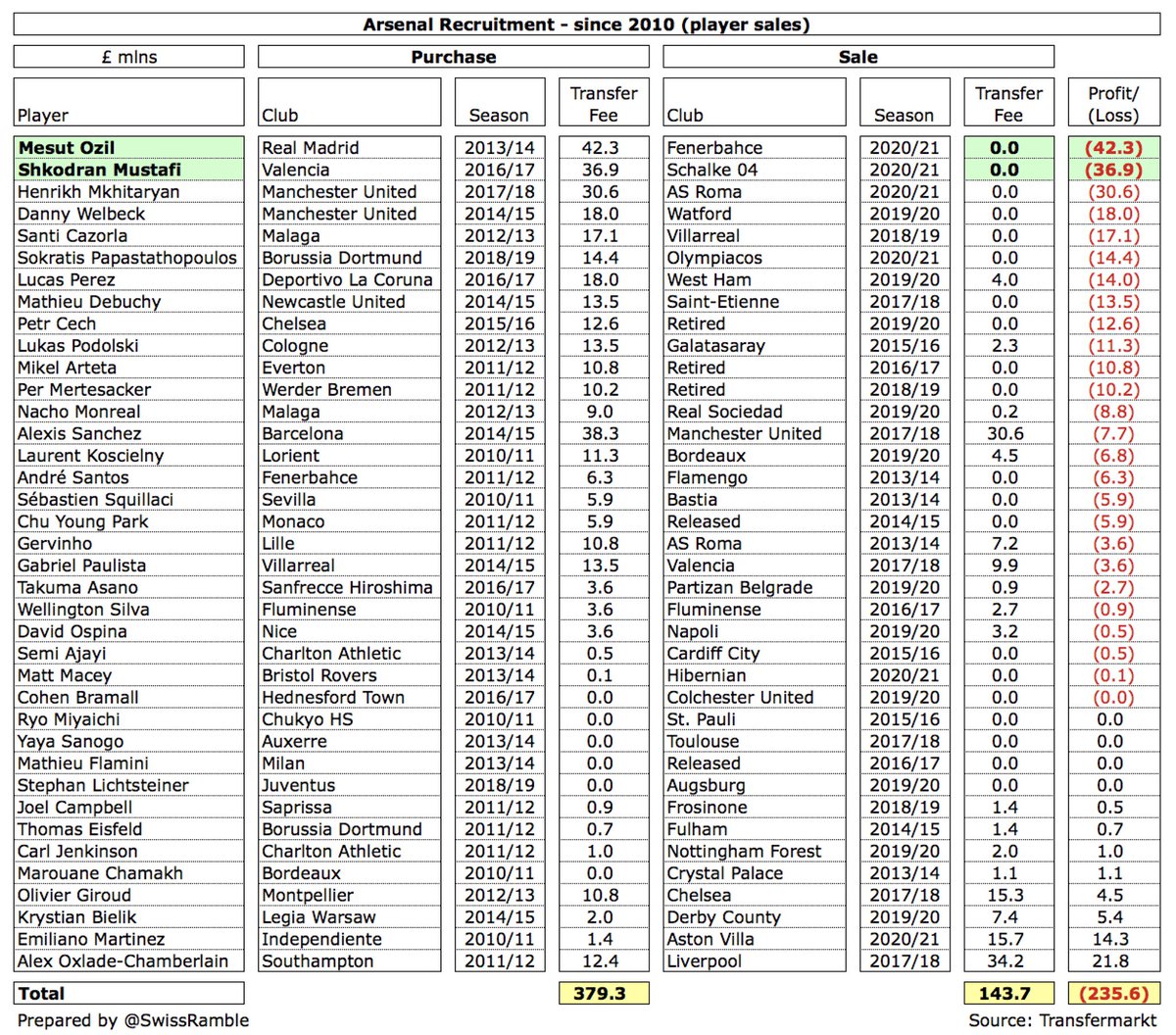

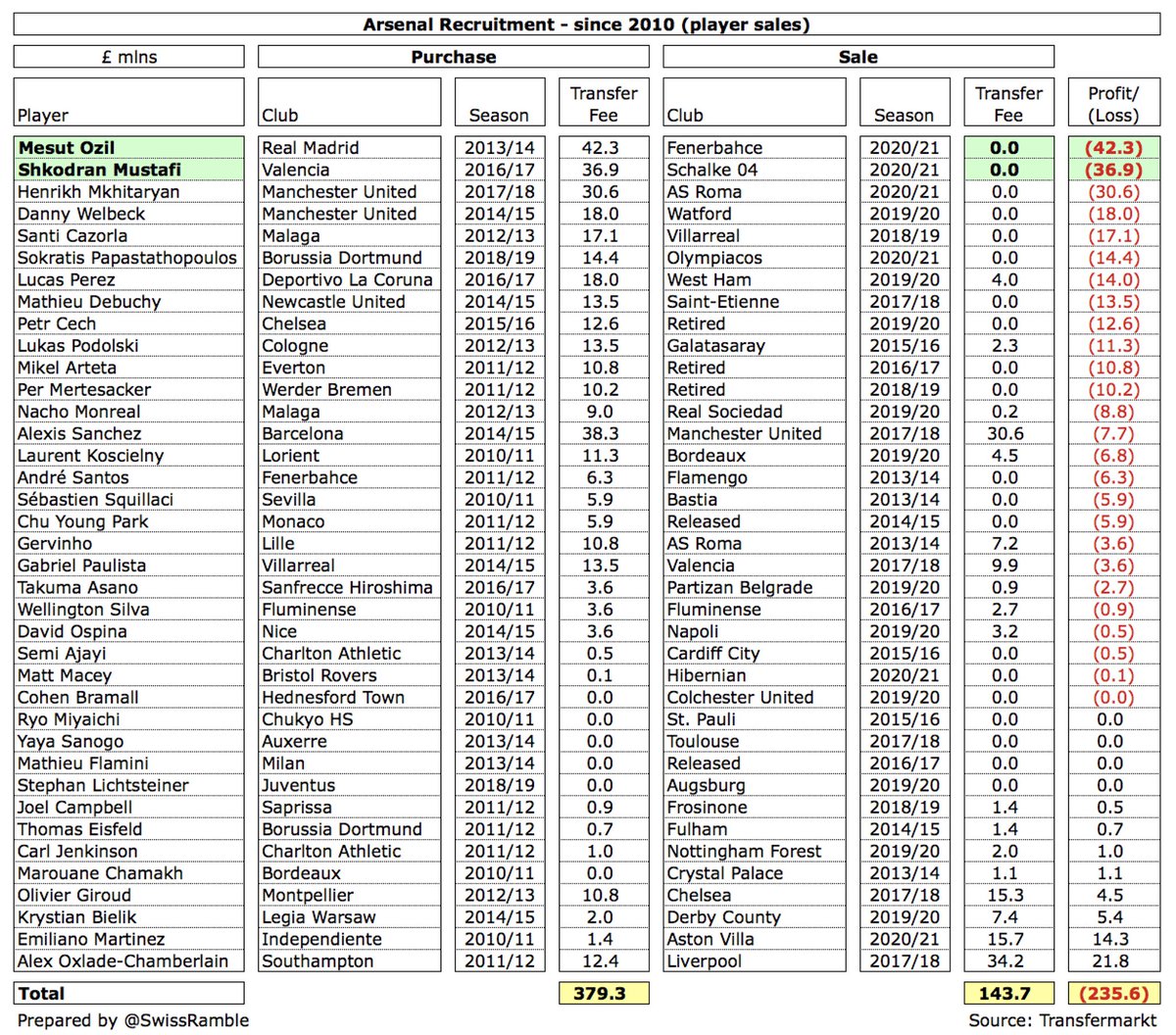

Like many clubs, #WHUFC have become increasingly reliant on player sales, averaging £24m a season over the last 4 years. This season will benefit from the sale of Grady Diangana to WBA, though the transfer of Sebastian Haller to Ajax was at a loss.

The adverse impact of many exceptional items that have historically hit the #WHUFC accounts is largely a thing of the past, though 2019/20 included a £3.5m pay-off for Pellegrini. The 2017/18 accounts benefited from an £8.7m profit from the sale of the Boleyn Ground.

#WHUFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), which strips out player sales and exceptional items, fell from £23m profit to £19m loss. This is actually the worst in the Premier League, though may be beaten when other clubs publish 2019/20 accounts.

#WHUFC operating loss (excluding player sales and interest) more than doubled from £37m to £85m, though other clubs had even higher losses: #EFC £175m, #CFC £112m, #AFC £99m and #SaintsFC £87m. Only PL club to make an operating profit in 2019/20 is #NCFC with just £3m.

#WHUFC said, “the club has seen strong turnover growth over the last five years”, but this is only £19m (16%), much lower than the Big 6. In fairness, this year will look better, due to deferred TV revenue (plus more money for better league position), offset by loss of match day.

#WHUFC £140m revenue is down to 12th highest in the Premier League, though this is partly because their accounts close relatively early on 31st May, so more revenue has been deferred to the 2020/21 accounts than others whose accounts close on 30th June or 31st July, e.g. #CPFC.

All Premier League clubs’ revenue is down in 2019/20, due to the impact of the pandemic, though #WHUFC 27% reduction is the highest in the Premier League (larger clubs are more in absolute terms). #EFC small 1% decrease is due to once-off £30m for stadium naming rights option.

As a result of the steep revenue fall, #WHUFC dropped from 18th to 26th in the Deloitte Money League, which ranks clubs globally by revenue, their lowest ranking since 2013. That said, they are still ahead of recent Champions League semi-finalists Ajax.

#WHFC broadcasting income fell £44m (35%) from £127m to £83m, due to revenue from 9 games slipping to 2020/21 accounts £26m, rebate to broadcasters £6m and lower merit payments after dropping from 10th to 16th £12m. Others will see similar falls when they publish 2019/20 accounts

However, #WHUFC broadcasting income could be around £40m higher in 2020/21. It will include £26m revenue deferred from 2019/20, as season extended beyond 31st May accounting close, plus higher merit payment (worth £1.9m a place, so extra £17m if finish 7th) less £2m rebate.

#WHUFC would also benefit if they managed to qualify for Europe this season. As an example of what they could earn, English Champions League representatives received an average of £72m in 2019/20. It’s far less lucrative in the Europa League, but clubs still averaged £20m.

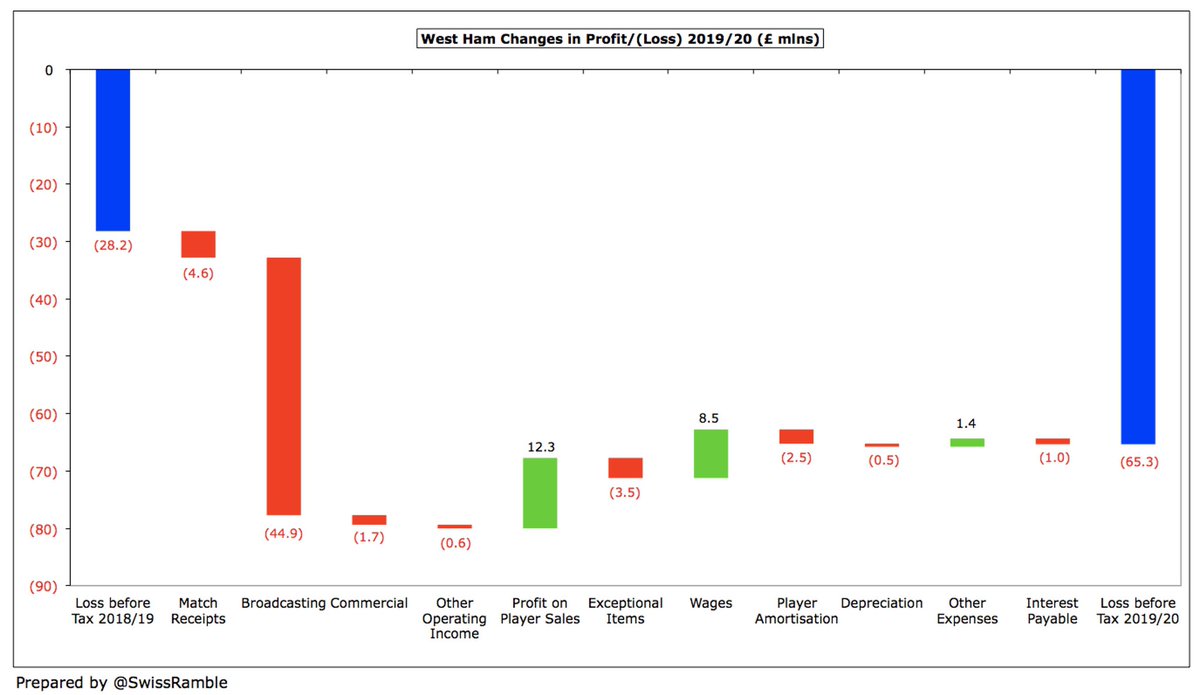

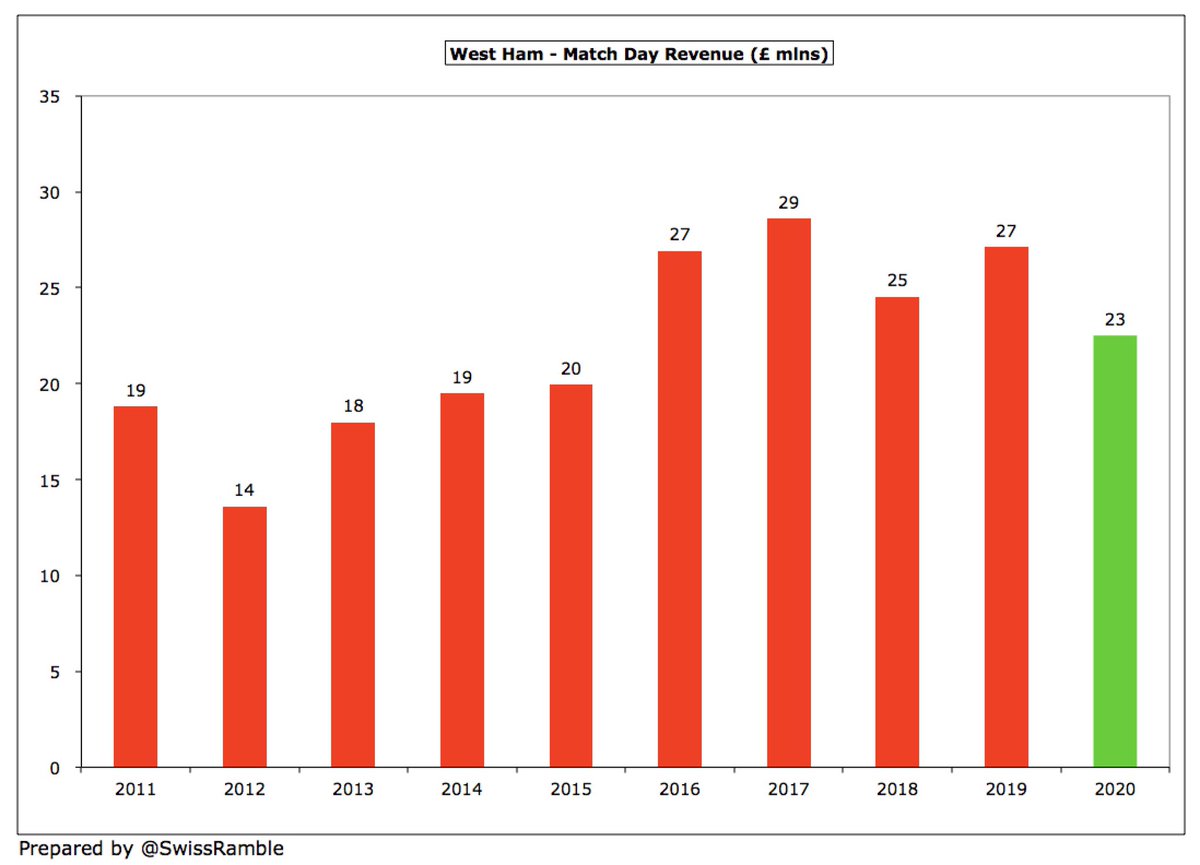

#WHUFC match day income fell £4m (17%) from £27m to £23m, as they staged 2 fewer home games and then played 5 games behind closed doors due to COVID. Income is 8th highest in the Premier League, less than a quarter of #THFC £95m after their move to the new stadium.

#WHUFC average attendance rose from 58,325 to 59,925 (for those games played with fans), which is second highest in the Premier League, only beaten by #MUFC 72,726. Capacity increased to 60,000 in 2019.

However, the move to London Stadium has not exactly been a money-spinner, partly due to competitive pricing, which has restricted revenue growth: £27m in 2018/19 (pre-COVID) was the same as last season at Boleyn, though a better comparative might be £20m in a “normal” season.

#WHUFC commercial revenue fell £2m (5%) from £36m to £34m, comprising £26m commercial activities and £9m retail and merchandising, due to closure of outlets. In last 5 years, growth of £13m (58%), but significantly outpaced in absolute terms by Big Six, e.g. #THFC £102m.

#WHUFC commercial income of £34m is 8th highest in England, a long way behind the Big Six (the lowest of which is #AFC £142m, i.e. four times as much). #EFC £76m was boosted by £30m once-off option for stadium naming rights.

#WHUFC £10m Betway shirt sponsorship is the 7th highest in Premier League, though still £25m lower than 6th placed #THFC. Umbro kit supplier deal of £4m has been extended, reportedly for £6m to 2025, while sleeve sponsor switched this season from Basset & Gold to Scope Markets.

#WHUFC wage bill fell £9m (6%) from £136m to £127m (excluding Pellegrini £3.5m pay-off), due to “significant” deferrals (reportedly 30%) for first team players and senior management. This means that wages have grown £32m in the last 3 years, while revenue has fallen £44m.

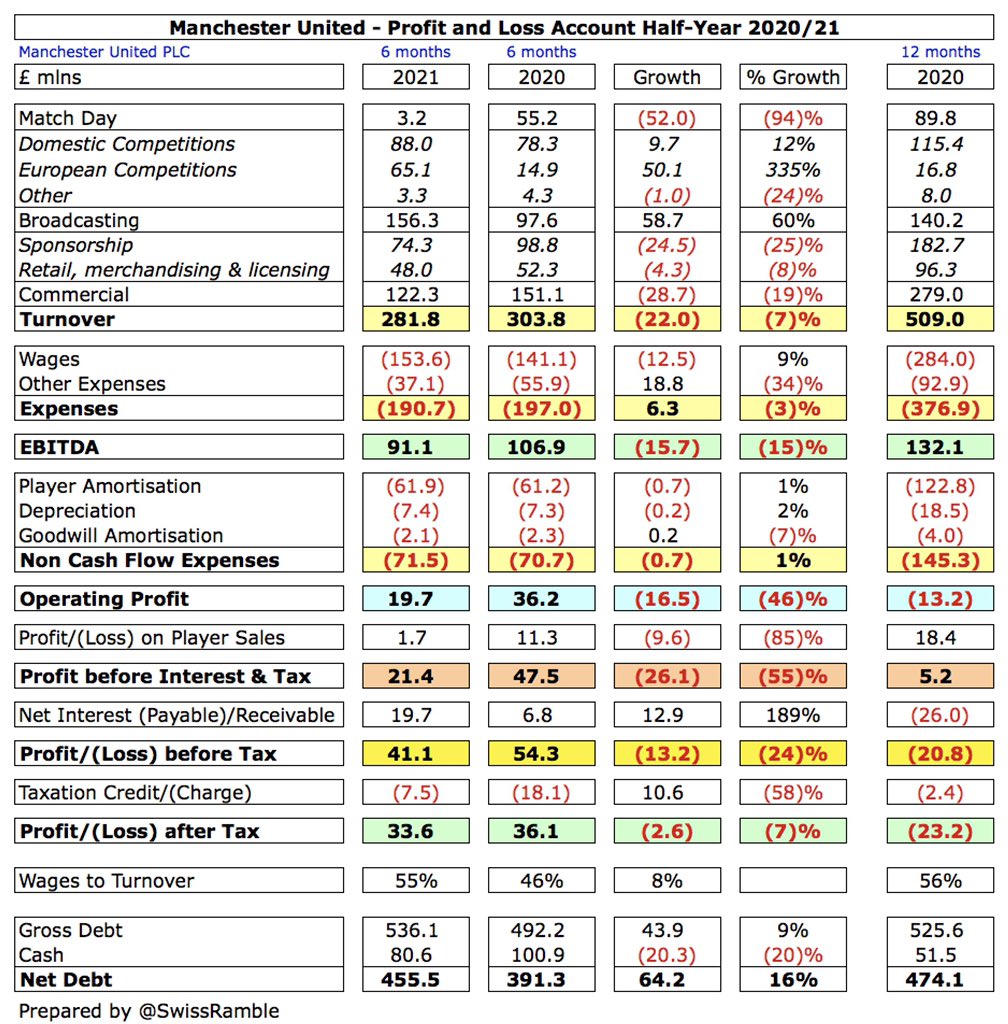

#WHUFC £127m wage bill is around mid-table in the Premier League, though £38m below 7th placed #EFC £165m. This is less than half of the highest wages reported in the Premier League to date for 2019/20, namely at #MUFC £284m and #CFC £283m.

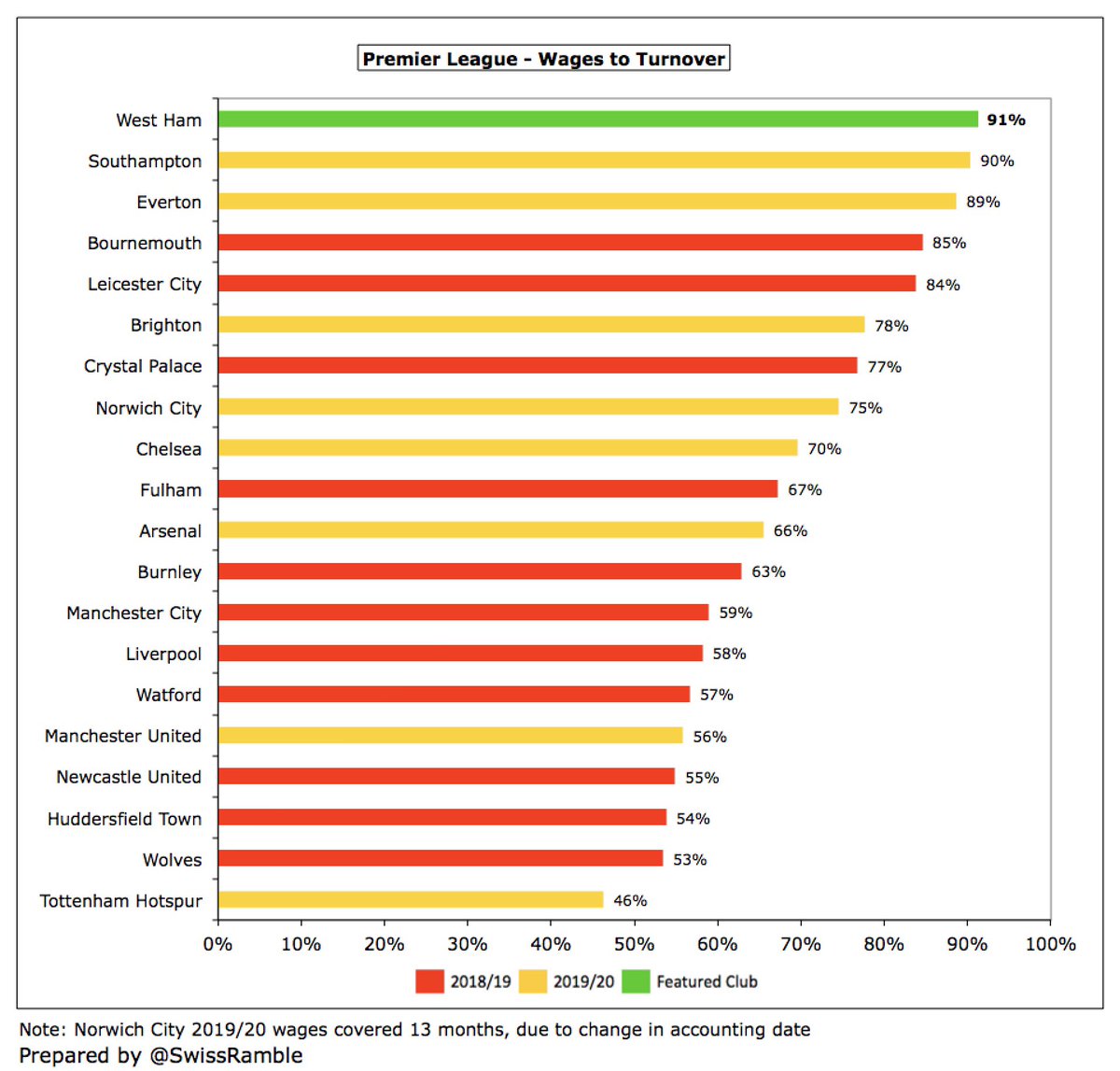

#WHUFC reported wages to turnover ratio is 94%, but falls to 91% if severance payment excluded, which is up from 52% in 2017. Either way, highest in Premier League to date in 2019/20 and worst since QPR’s 129% in 2013. Would have been 73% without COVID revenue loss.

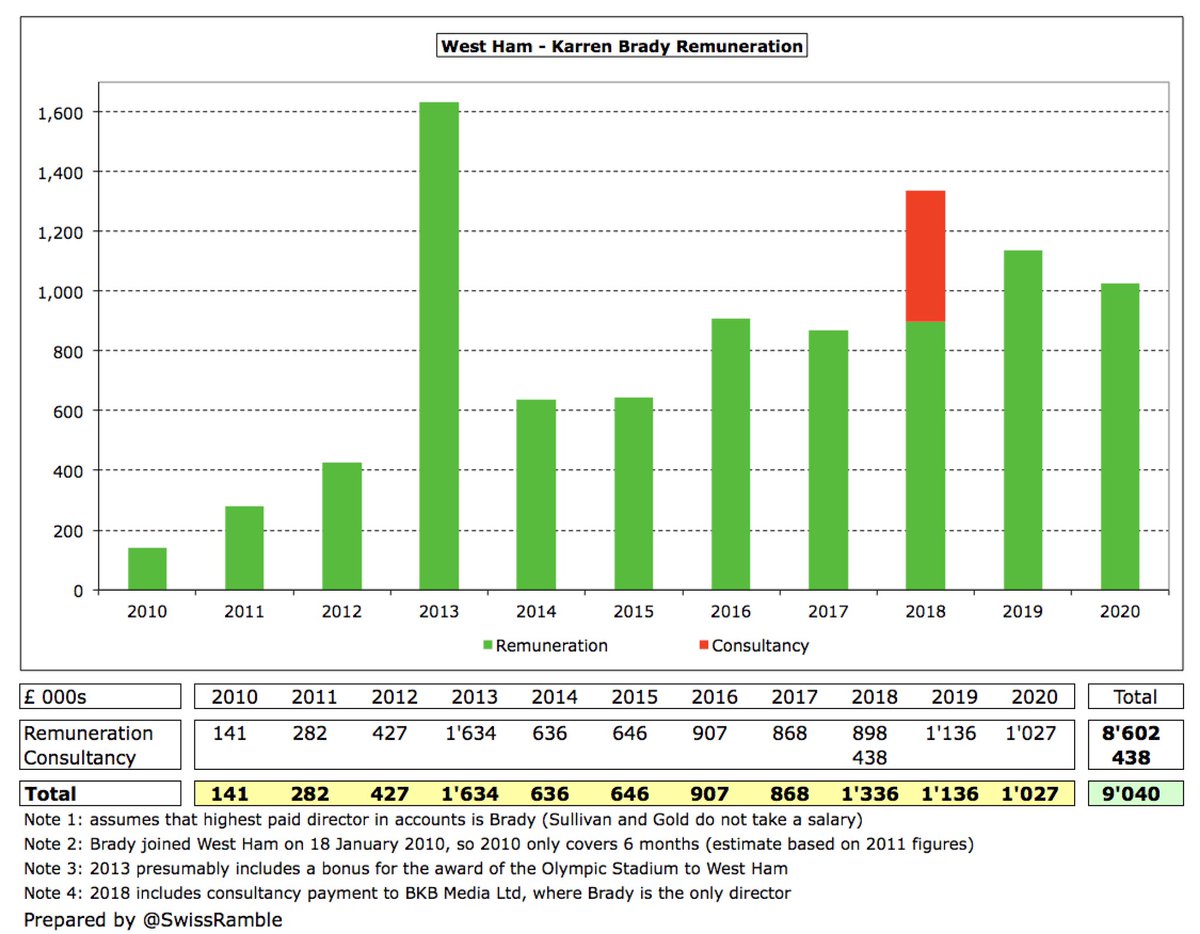

Vice-chairman Karren Brady saw her remuneration cut by 10% from £1.136m to £1.027m, which is around mid-table in the Premier League. That said, I estimate that she has pocketed around £9m since arriving at #WHUFC in January 2010, which is not too shabby.

#WHUFC player amortisation, the annual charge to expense transfer fees over a player’s contract, rose £3m (4%) to £60m, which means this has nearly tripled in last 5 years from £22m in 2015. Mid-table in PL, still less than half of big spending clubs like #CFC, #MCFC and #MUFC.

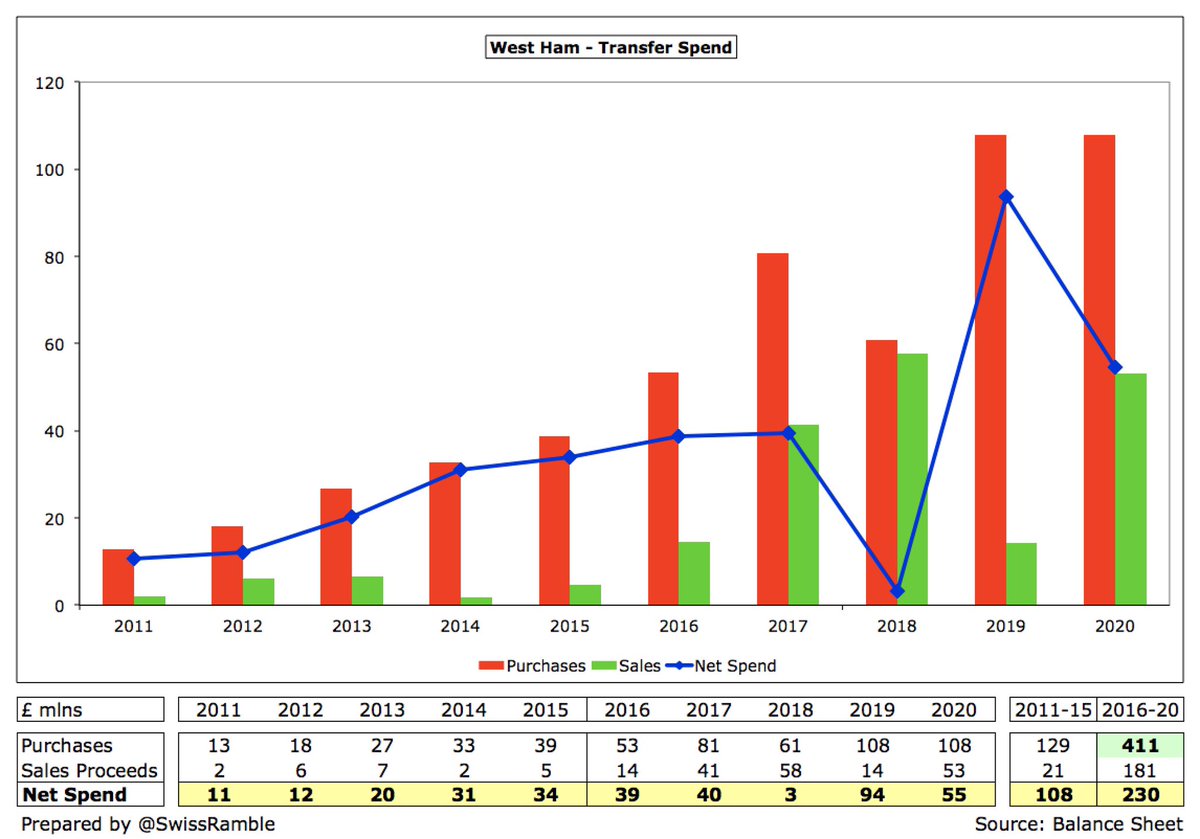

However, #WHUFC have been no slouches in the transfer market, making £108m player purchases in 2019/20, the same as previous season. This was mainly Haller, Fornals, Bowen, Ajeti and Randolph. In addition, Soucek arrived on loan with purchase completed in the 2020/21 books.

It is clear that #WHUFC have really ramped up their transfer activity “to provide funds for the new manager in line with his requirements to enhance the squad.” This contributed to gross spend rising to £411m in last 5 years, compared to only £129m in preceding 5-year period.

In the 5 years up to 2019, #WHUFC had the 7th highest net transfer spend in the Premier League with £209m, only below the Big Six and #EFC, though a fair way behind all of them. They were 8th highest in terms of gross spend, also below #LCFC.

#WHUFC gross debt up from £78m to £120m. Shareholder debt fell £1m to £54.5m after David Gold was repaid £1m, leaving £44m from Sullivan and Gold at 4% interest and £9.5m interest-free from J Albert Smith), but external loans rose £42m to £66m (mainly Rights & Media).

In August 2020 Rights & Media facility renewed at £55m and £20m overdraft agreed with Barclays, both expiring in July 2021. In addition, new £120m 5-year loan provided by MSD Holdings in February 2021 to repay ST loans and cover cash shortfalls caused by the pandemic.

MSD Holdings Ltd is Michael Dell’s investment firm, which has already provided loans to other football clubs like Burnley, Derby County, Southampton and Sunderland. Some of those loans are at a high 9% interest rate, but the #WHUFC rate has not been divulged.

Following the increase, #WHUFC debt of £120m is 8th largest in the Premier League, though miles below #THFC £831m (stadium), #MUFC £526m (Glazer’s leveraged buy-out) and #AFC £218m (stadium). #EFC £409m and #BHAFC £306m debt is very largely in the form of “friendly” owner loans.

#WHUFC interest payment fell from £6.8m to £3.6m, but was still 4th largest in the top flight in 2019/20, including £1m paid to Sullivan and Gold in August 2019. The owners are not paid a salary or dividend, but they have received a lot of interest on their loans.

In light of the pandemic, Sullivan and Gold deferred their £1.8m interest in 2020, but they have trousered around £18m interest on their loans to date, which is in sharp contrast to more benevolent owners, who often provide loans interest-free and convert debt to equity.

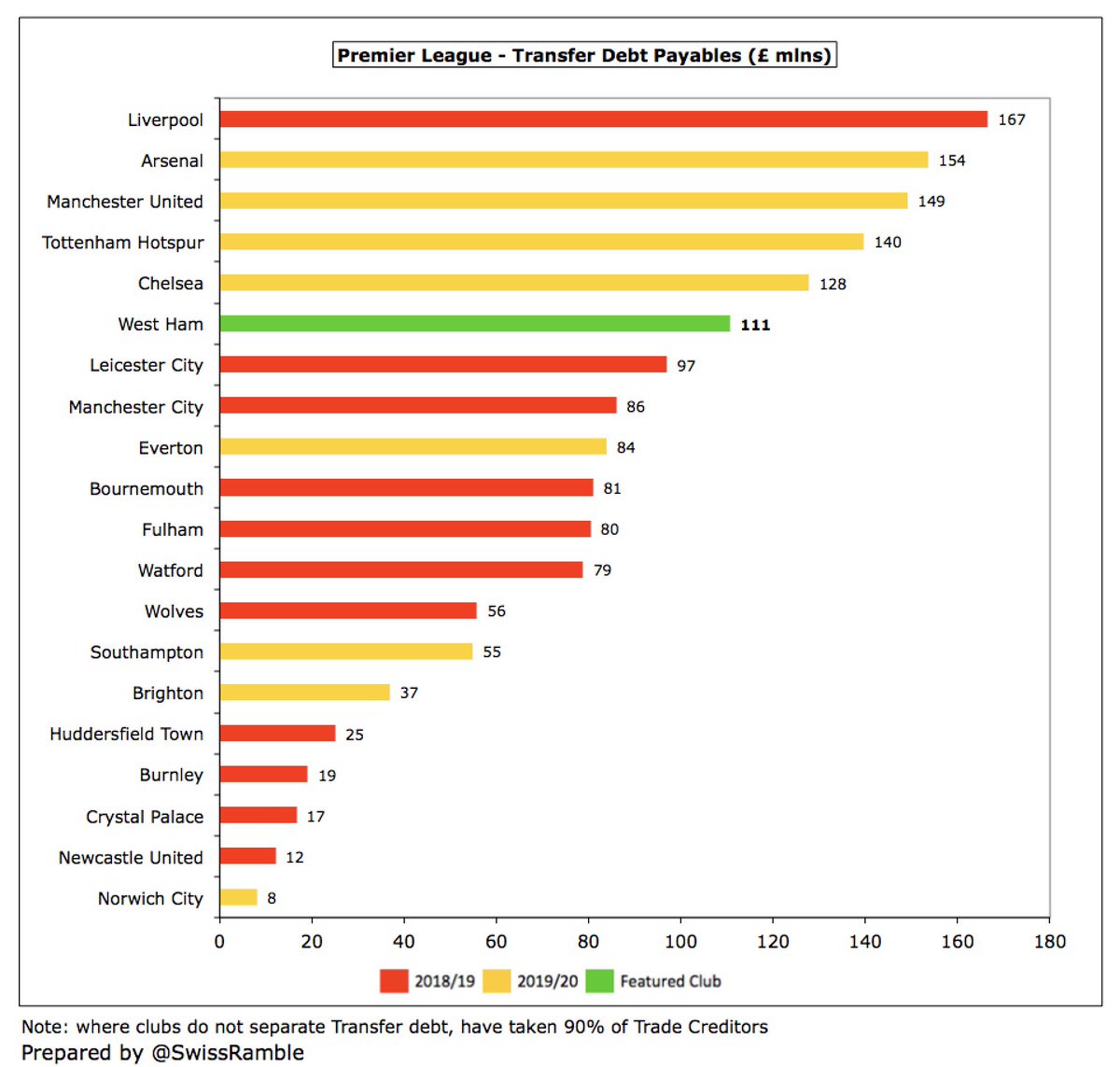

#WHUFC player purchases have been partly funded by transfer debt, up from £87m to £111m, one of the highest in the Premier League. West Ham are owed £16m by other clubs, so net transfer payable is £94m. Remaining Haller debt to Eintracht Frankfurt deferred to September 2022.

#WHUFC operating cash flow was just £1m, but they then spent £35m (net) on player purchases, £2m on infrastructure, £4m tax and £1m repayment of David Gold loan. This was funded by a net £43m increase in external loans, resulting in £2m cash inflow.

Since 2010 majority of cash has come from #WHUFC operations £217m, supplemented by £84m financing from shareholders (£58m loans and £26m share capital) plus £29m from Boleyn Ground sale. Most (£257m) was spent on new players, £44m on interest payments and £29m on capex.

#WHUFC cash balance increased from £13m to £15m, but this was firmly in the bottom half of the table in the Premier League. However, since these accounts the shareholders (mainly Sullivan and Gold) have invested £30m via a rights issue to support the club during the pandemic.

#WHUFC finances have been severely impacted by COVID, but they have taken steps to cover short-term requirements via the capital injection and new loan (albeit at a chunky interest rate). If they do manage to qualify for Europe, that would help move the needle.

• • •

Missing some Tweet in this thread? You can try to

force a refresh