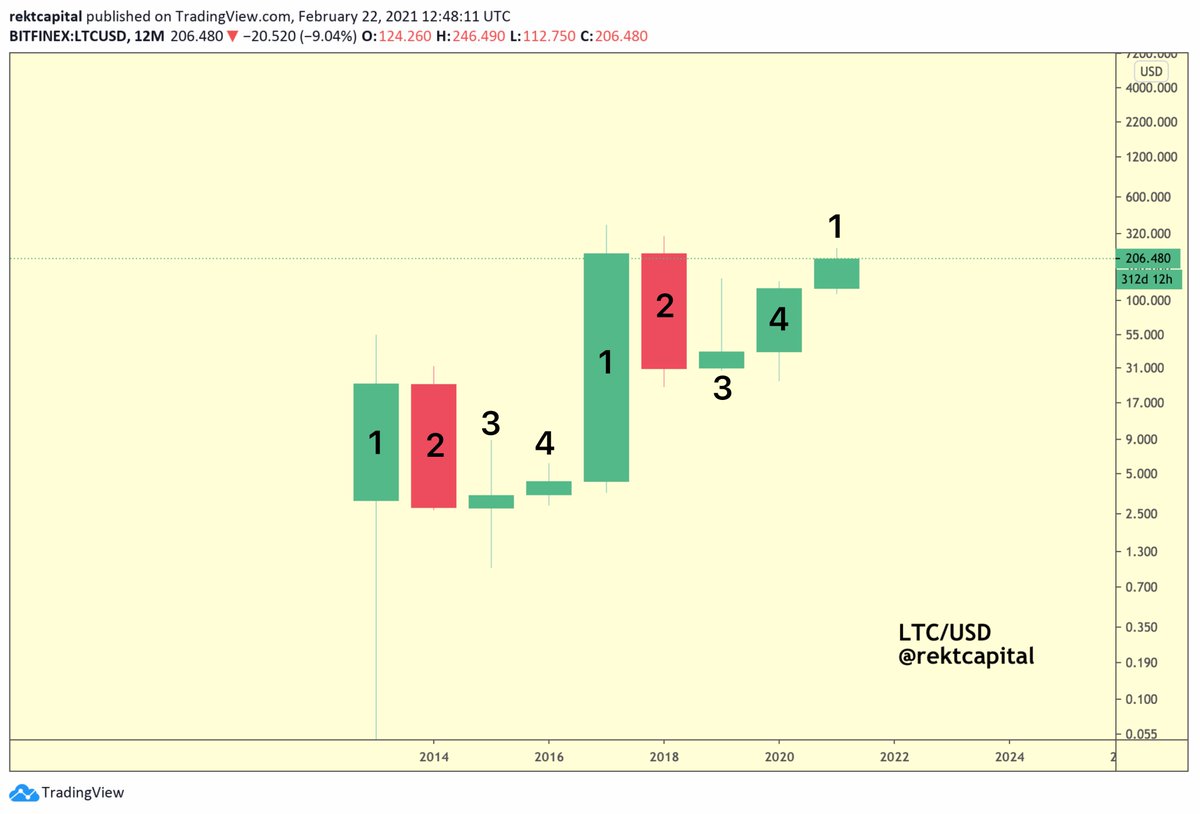

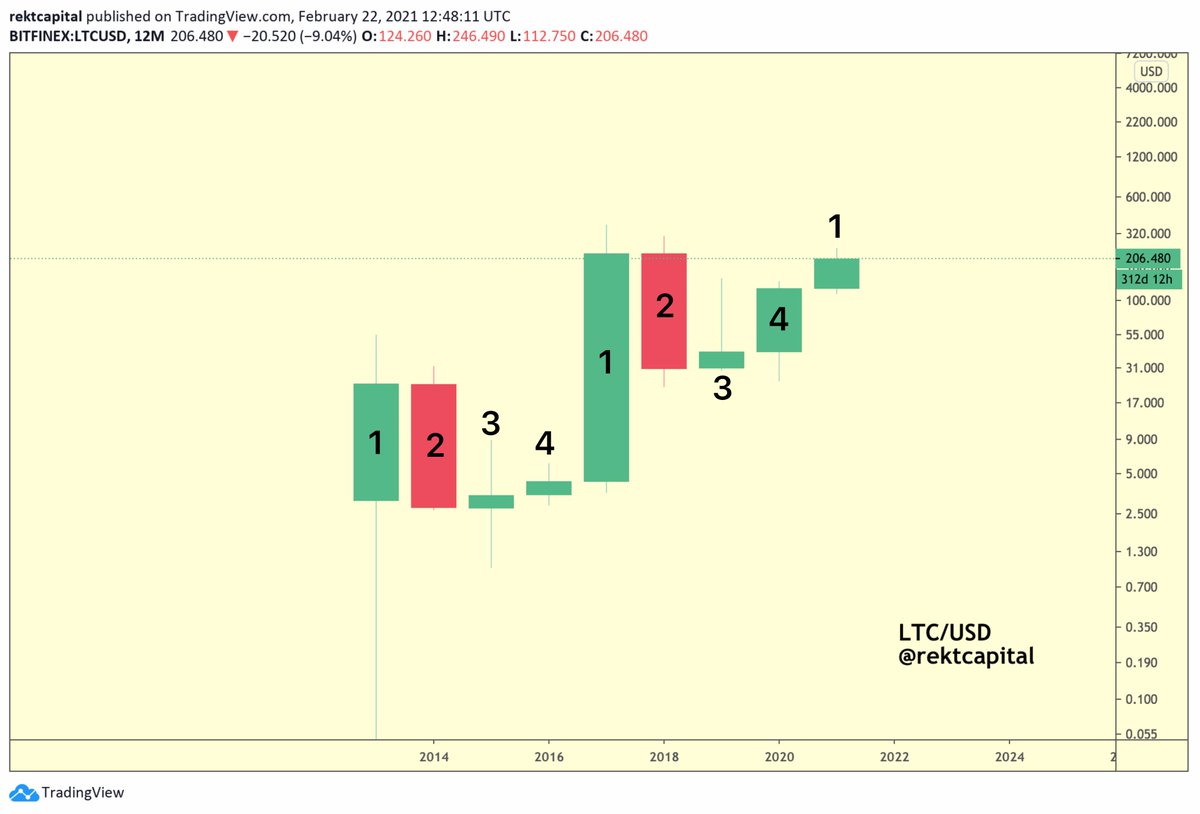

1. $LTC has only just begun a new Four Year Cycle

There is still so much more upside yet to come

Here's a thread on why...

#Litecoin

There is still so much more upside yet to come

Here's a thread on why...

#Litecoin

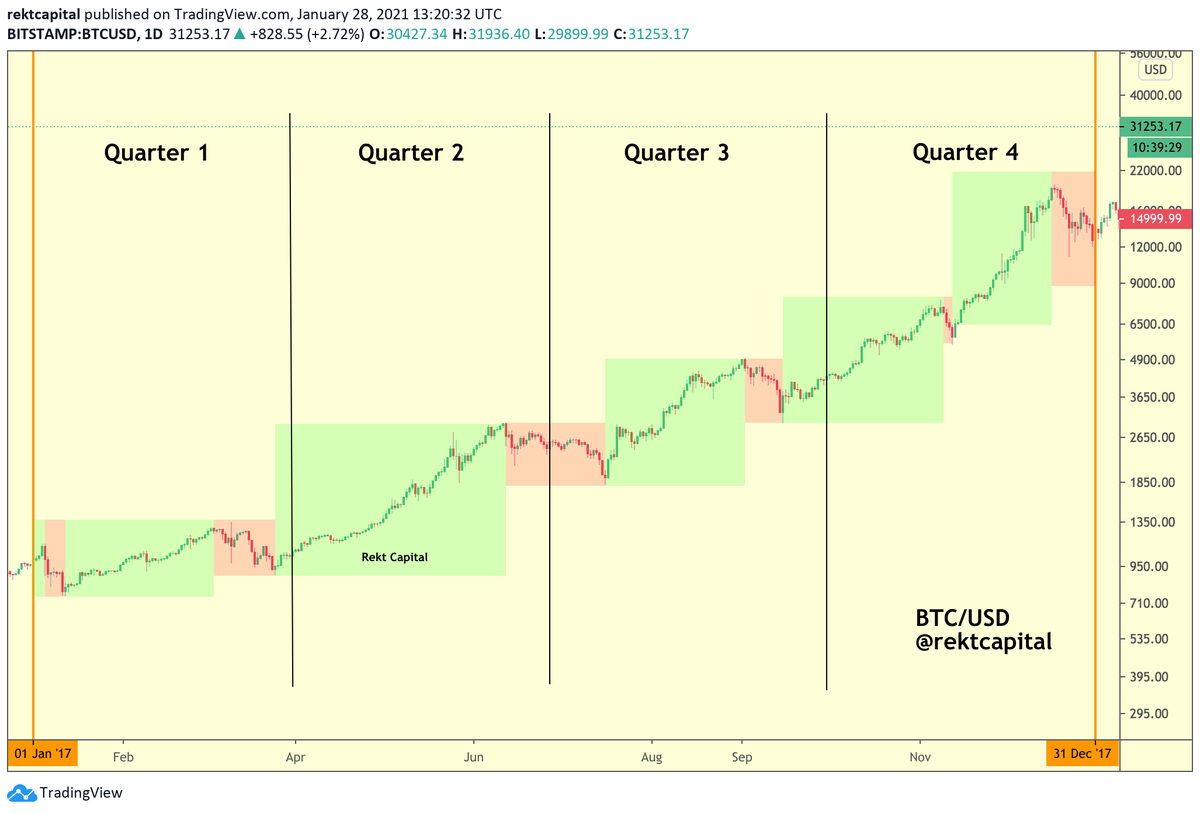

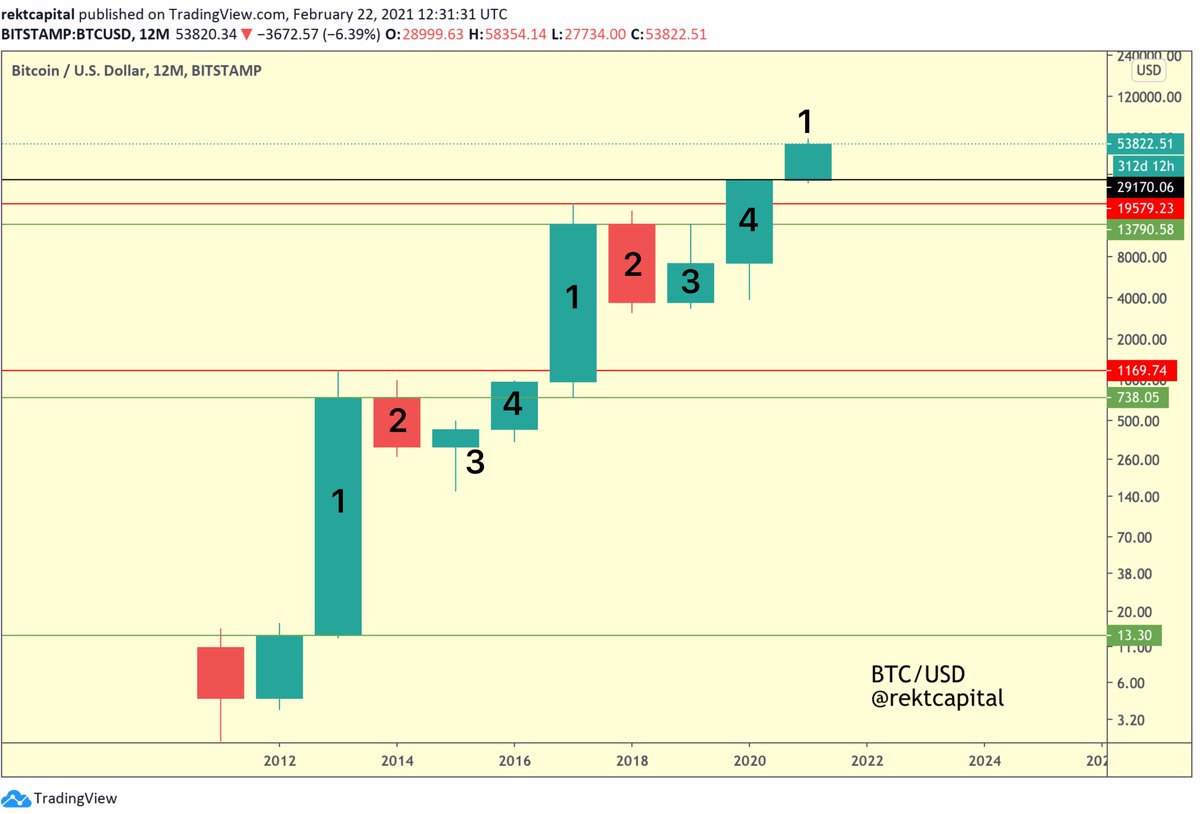

2. The $LTC Four Year Cycle is a mirror image of the Bitcoin Four Year Cycle

Of course, #BTC is a little further along in its new 4-Year Cycle

But that's because $LTC is lagging behind BTC in its own 4-Year Cycle…

(More on the BTC 4-Year Cycle here: rektcapital.substack.com/p/fouryearcycl…)

Of course, #BTC is a little further along in its new 4-Year Cycle

But that's because $LTC is lagging behind BTC in its own 4-Year Cycle…

(More on the BTC 4-Year Cycle here: rektcapital.substack.com/p/fouryearcycl…)

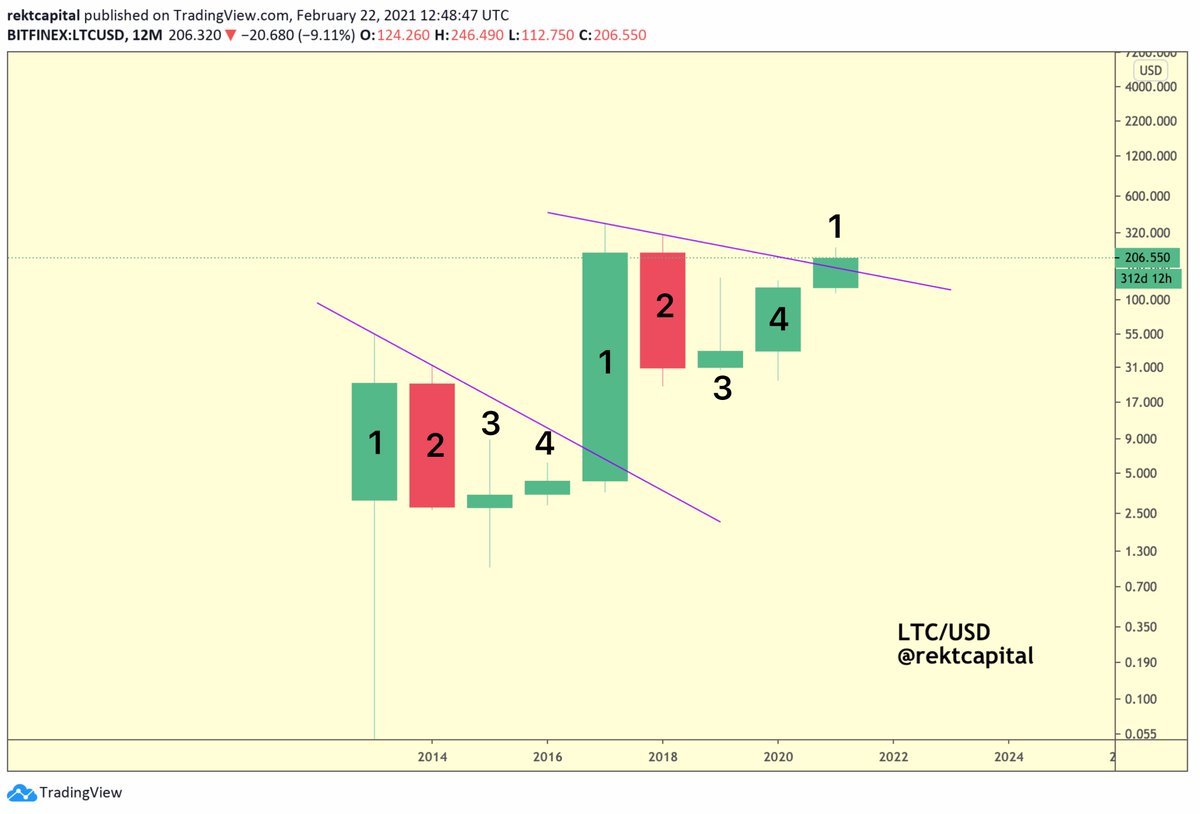

3. Let's dissect the #LTC Four Year Cycle:

• Candle 1 represents the most explosive growth in the cycle

• Candle 2 is a Bear Market retrace (-92% each time)

• Candle 3 showcases bottoming out

• Candle 4 highlights price recovery

#Litecoin

• Candle 1 represents the most explosive growth in the cycle

• Candle 2 is a Bear Market retrace (-92% each time)

• Candle 3 showcases bottoming out

• Candle 4 highlights price recovery

#Litecoin

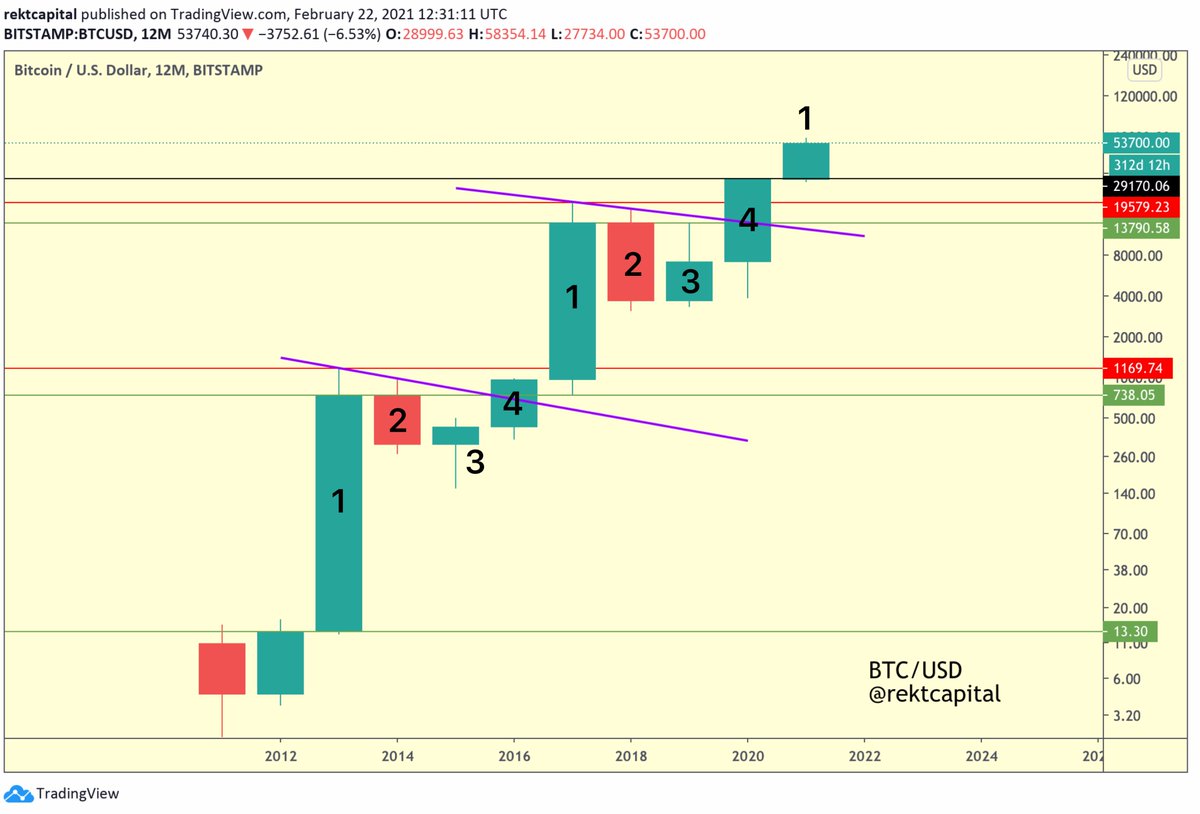

4. Here's how the $LTC 4-Year Cycle differs from Bitcoin's:

BTC endures a downtrend that lasts 3 years until Candle 4 breaks it

LTC's downtrending resistance lasts 4 years & is broken in Candle 1

#LTC is now on the cusp of breaking its multi-year downtrending resistance...

BTC endures a downtrend that lasts 3 years until Candle 4 breaks it

LTC's downtrending resistance lasts 4 years & is broken in Candle 1

#LTC is now on the cusp of breaking its multi-year downtrending resistance...

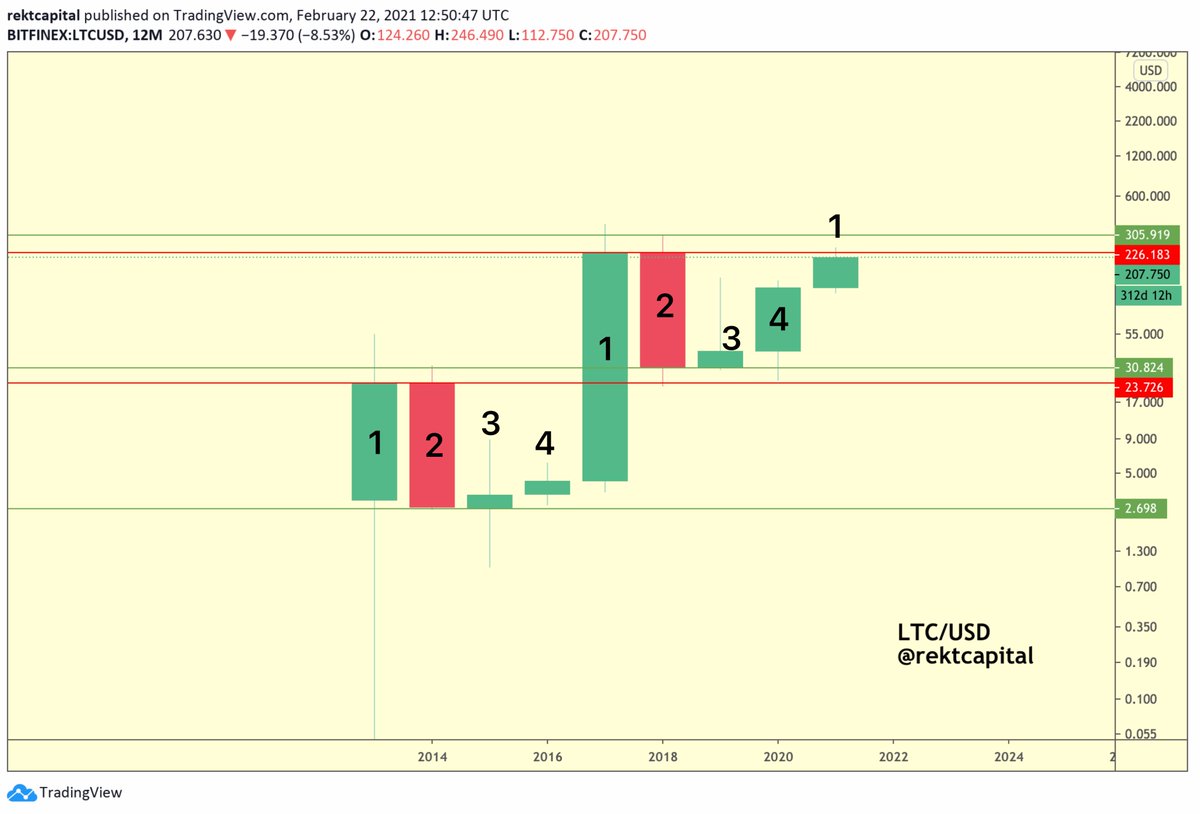

5. Let's now look at key 4-Year Cycle levels for $LTC:

Notice how the $2.69 level (green) in the first 4-Year Cycle is now the analogous price level for $30.82 in the previous 4-Year Cycle

• #LTC tends to hold a multi-year support at green levels before trend reversing upwards

Notice how the $2.69 level (green) in the first 4-Year Cycle is now the analogous price level for $30.82 in the previous 4-Year Cycle

• #LTC tends to hold a multi-year support at green levels before trend reversing upwards

6. Any historically recurring themes in $LTC's price action?

• Candle 3 tends to form a Lower High to Candle 4

• Candle 4 forms a Higher Low to Candle 3

• Candle 4 turns the top of Candle 3 into new support

• Candle 1 turns the top of Candle 4 into new support

#Litecoin

• Candle 3 tends to form a Lower High to Candle 4

• Candle 4 forms a Higher Low to Candle 3

• Candle 4 turns the top of Candle 3 into new support

• Candle 1 turns the top of Candle 4 into new support

#Litecoin

7. Right now, $226 (red) and $305 (green) are the two main 4-Year Cycle resistances that $LTC needs to break to enjoy an explosive Candle 1 and new All Time Highs

#Litecoin

#Litecoin

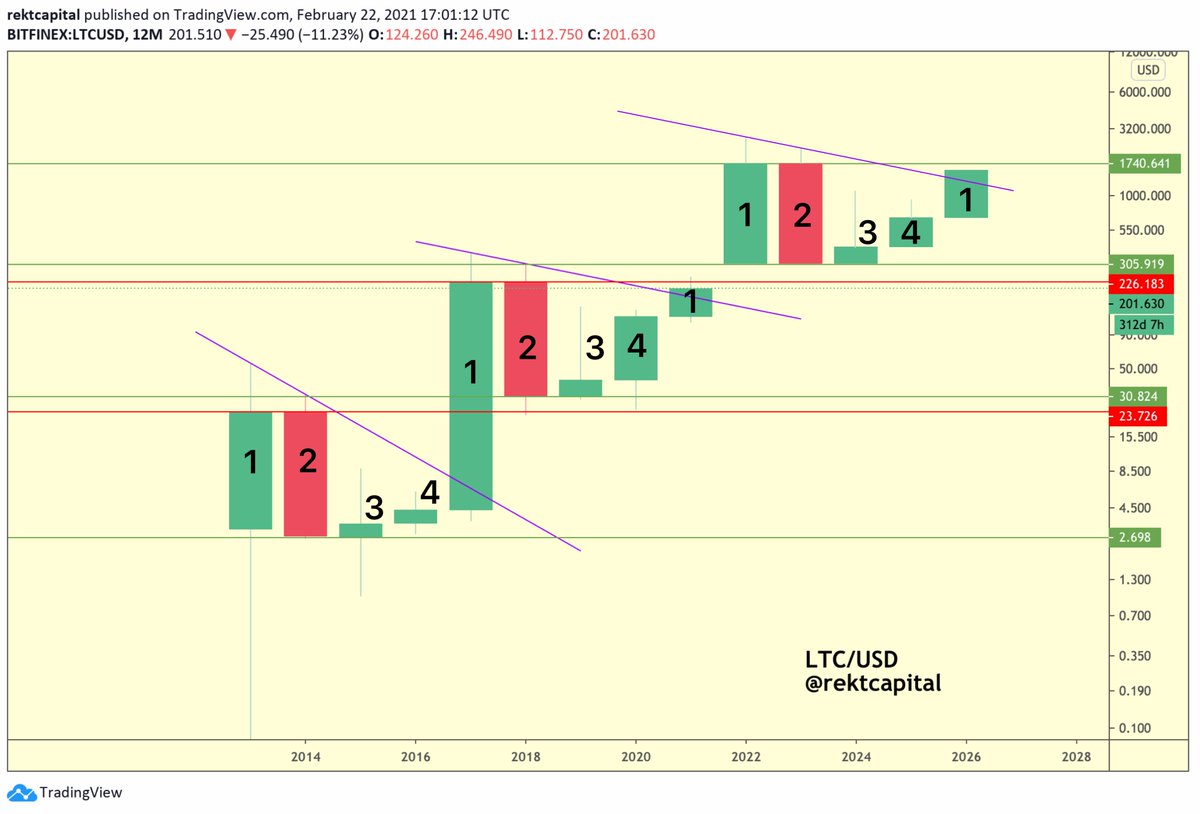

8. So what could the next $LTC Four Year Cycle look like?

If we bear in mind all of #LTC's historically recurring price tendencies as well as a potential rate of diminishing returns in new Candle 1s...

Then LTC could still experience considerable explosive upside this year...

If we bear in mind all of #LTC's historically recurring price tendencies as well as a potential rate of diminishing returns in new Candle 1s...

Then LTC could still experience considerable explosive upside this year...

9. If history repeats, here's what the next $LTC Four Year Cycle could look like:

• New All Time & exponential uptrend in 2021

• Around a -90% Bear Market in 2022

• Followed by a multi-year bottoming out process before yet another Four Year Cycle begins in 2025

#Litecoin

• New All Time & exponential uptrend in 2021

• Around a -90% Bear Market in 2022

• Followed by a multi-year bottoming out process before yet another Four Year Cycle begins in 2025

#Litecoin

10. If you liked this thread...

You should check out my newsletter which is dedicated to unbiased cutting-edge #Crypto insights

Feel free to sign-up:

rektcapital.substack.com/p/litecoinfour…

You should check out my newsletter which is dedicated to unbiased cutting-edge #Crypto insights

Feel free to sign-up:

rektcapital.substack.com/p/litecoinfour…

• • •

Missing some Tweet in this thread? You can try to

force a refresh