Birmingham City’s 2019/20 financial results covered a season when they finished 20th in the Championship, narrowly avoiding relegation. Manager pep Clotet was replaced by Aitor Karanka in August 2020, since succeeded by Lee Bowyer. Some thoughts in the following thread #BCFC

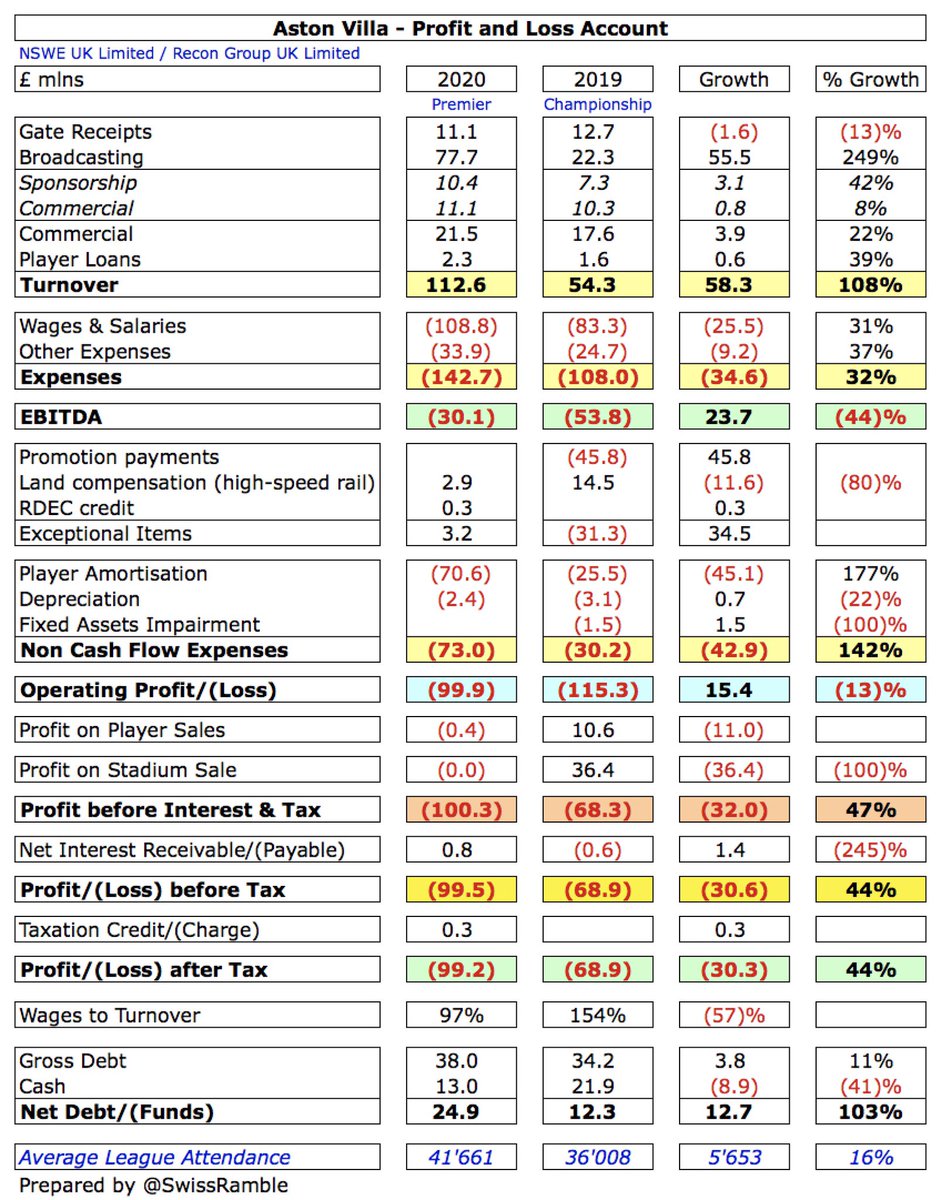

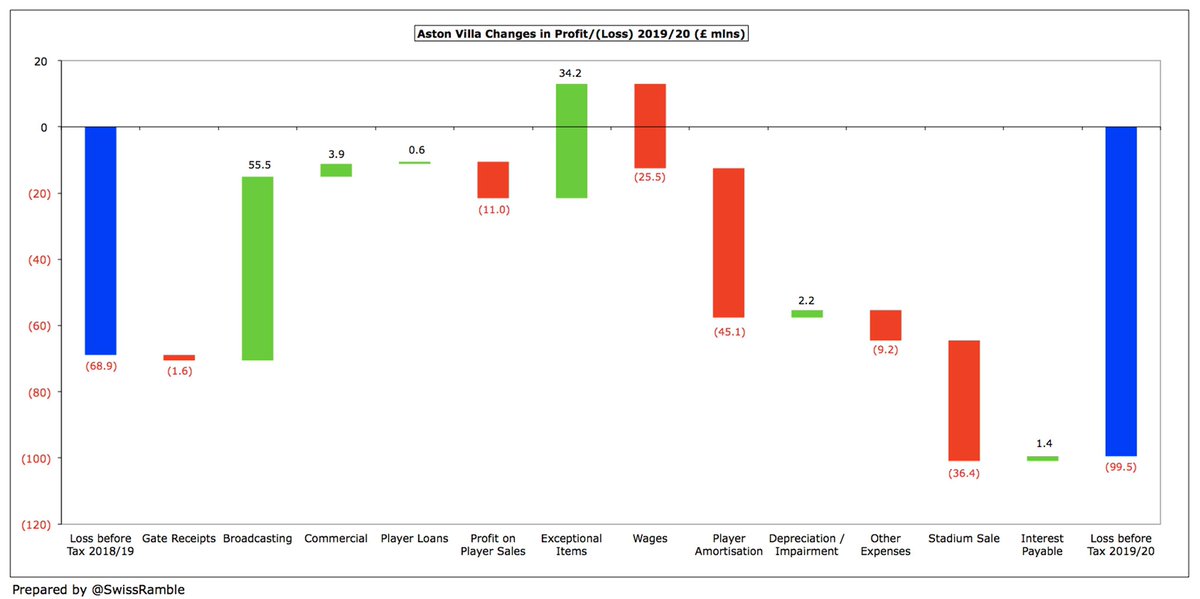

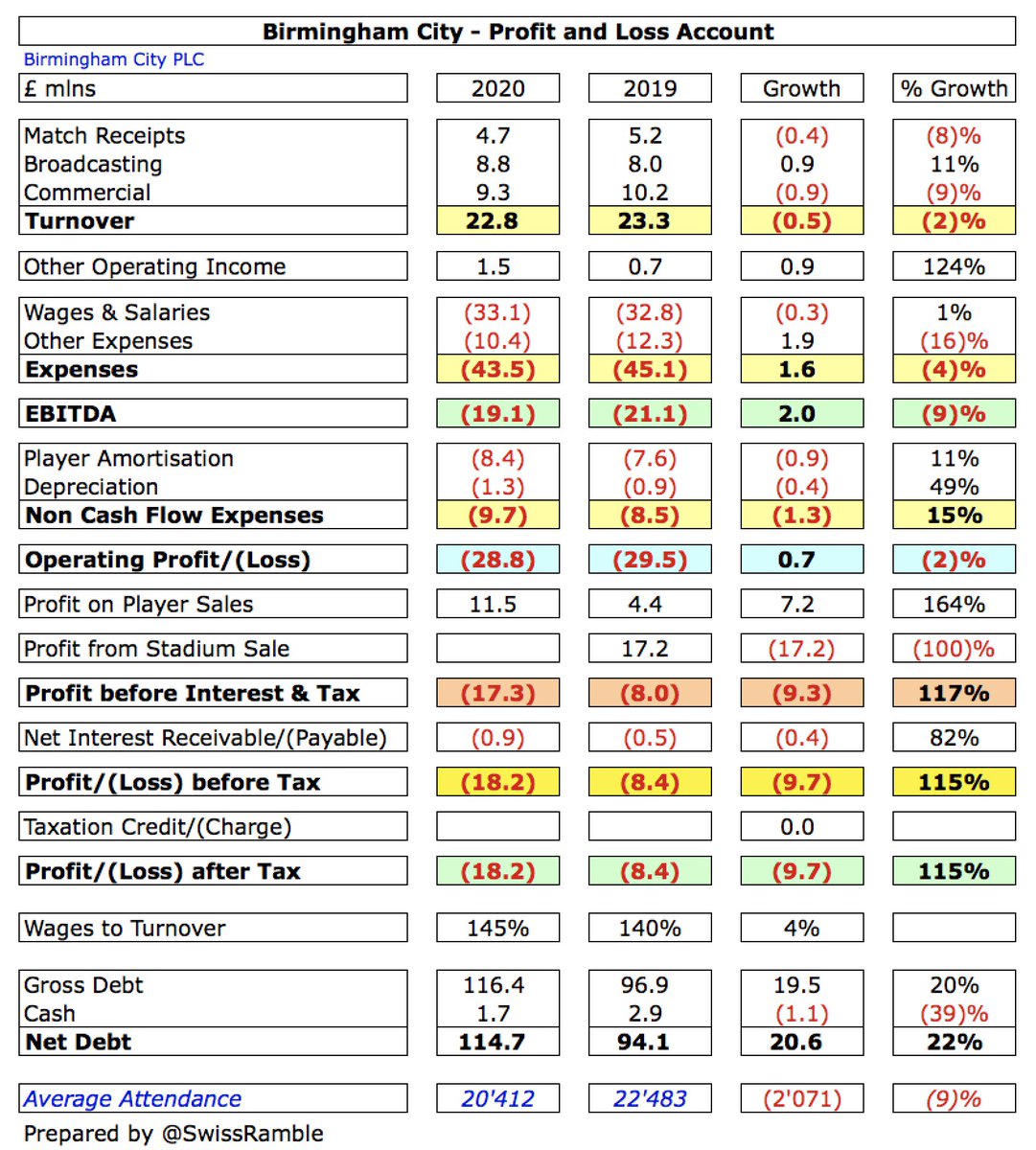

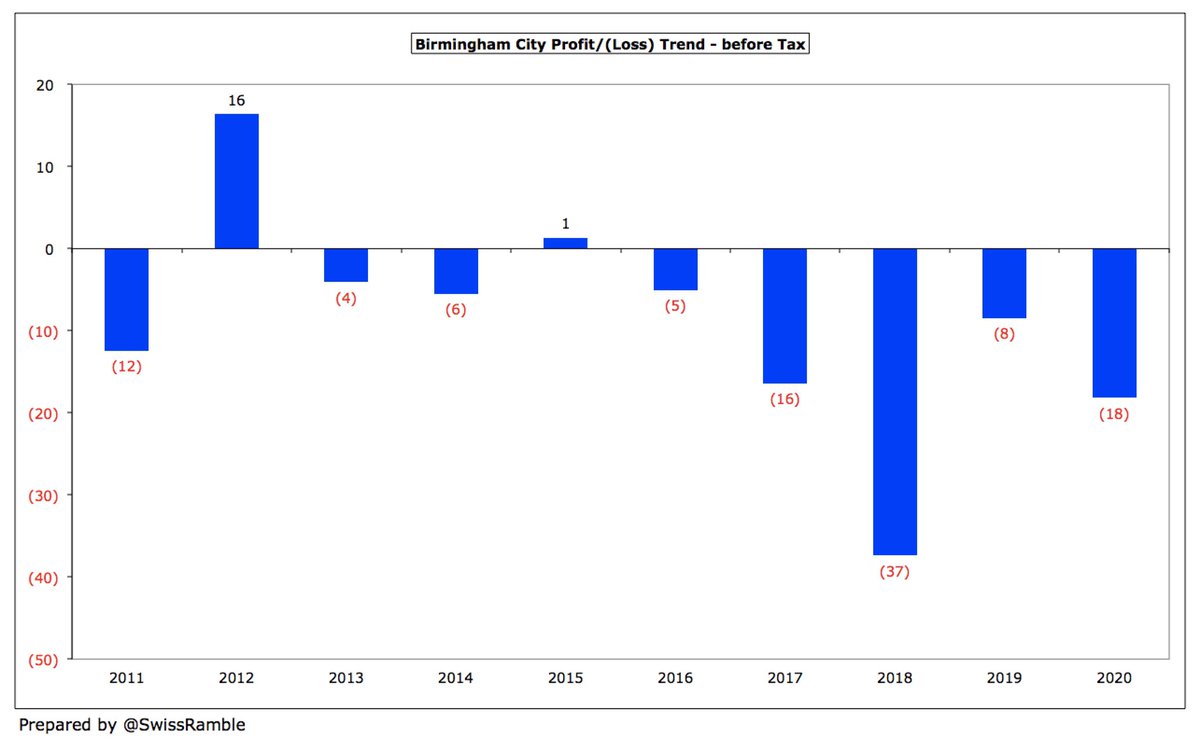

#BCFC loss increased from £8.4m to £18.2m, as prior year included £17m profit on the sale of the stadium, partly offset by profit on player sales rising £7m to £12m. Revenue fell £0.5m (2%) from £23.3m to £22.8m, while expenses were flat overall.

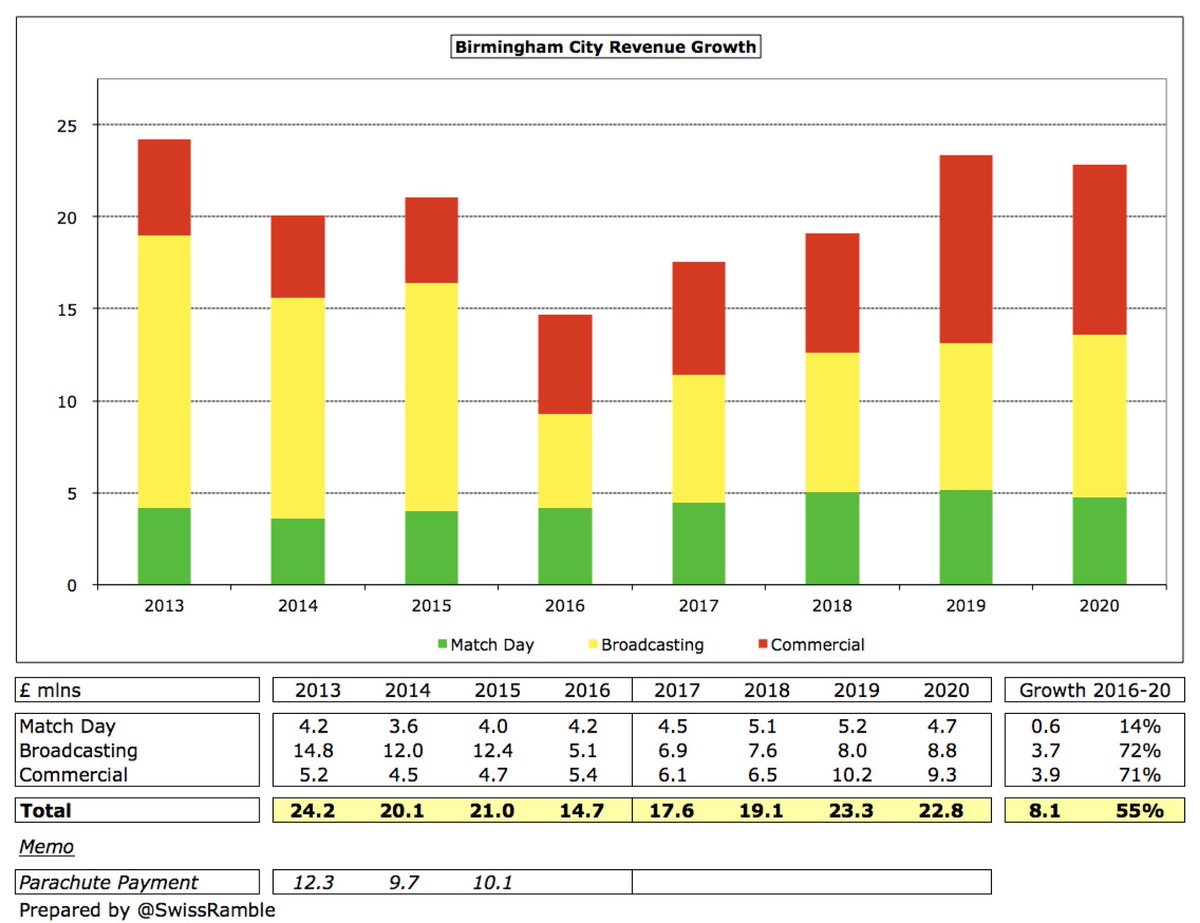

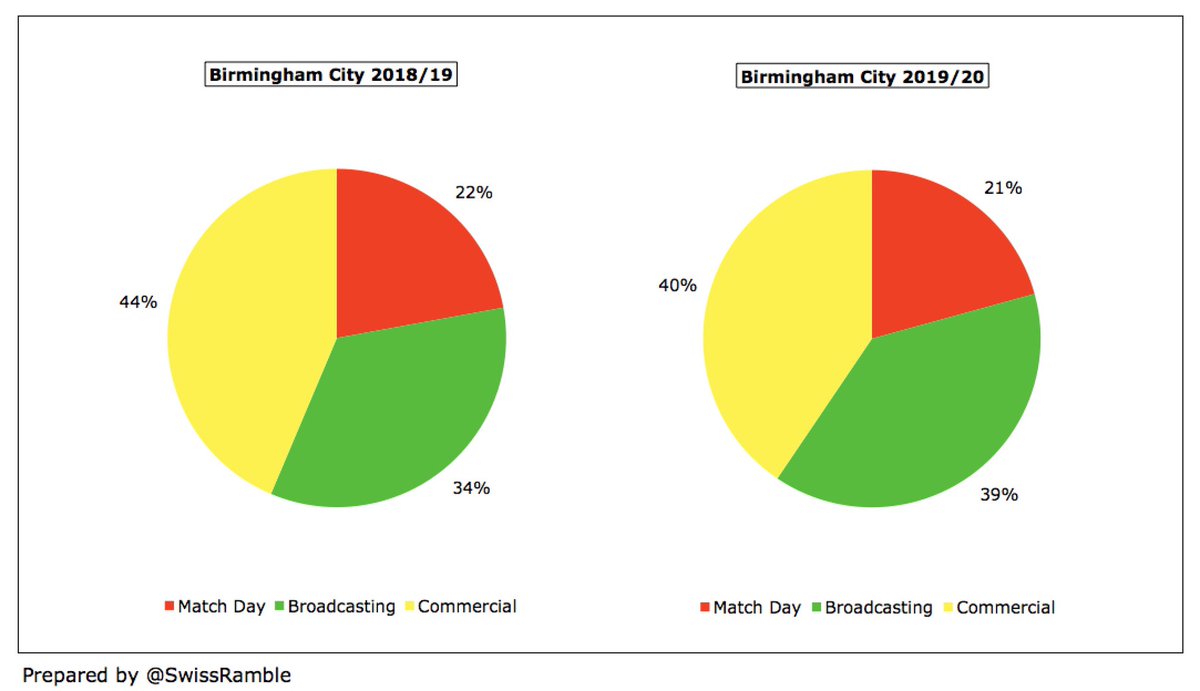

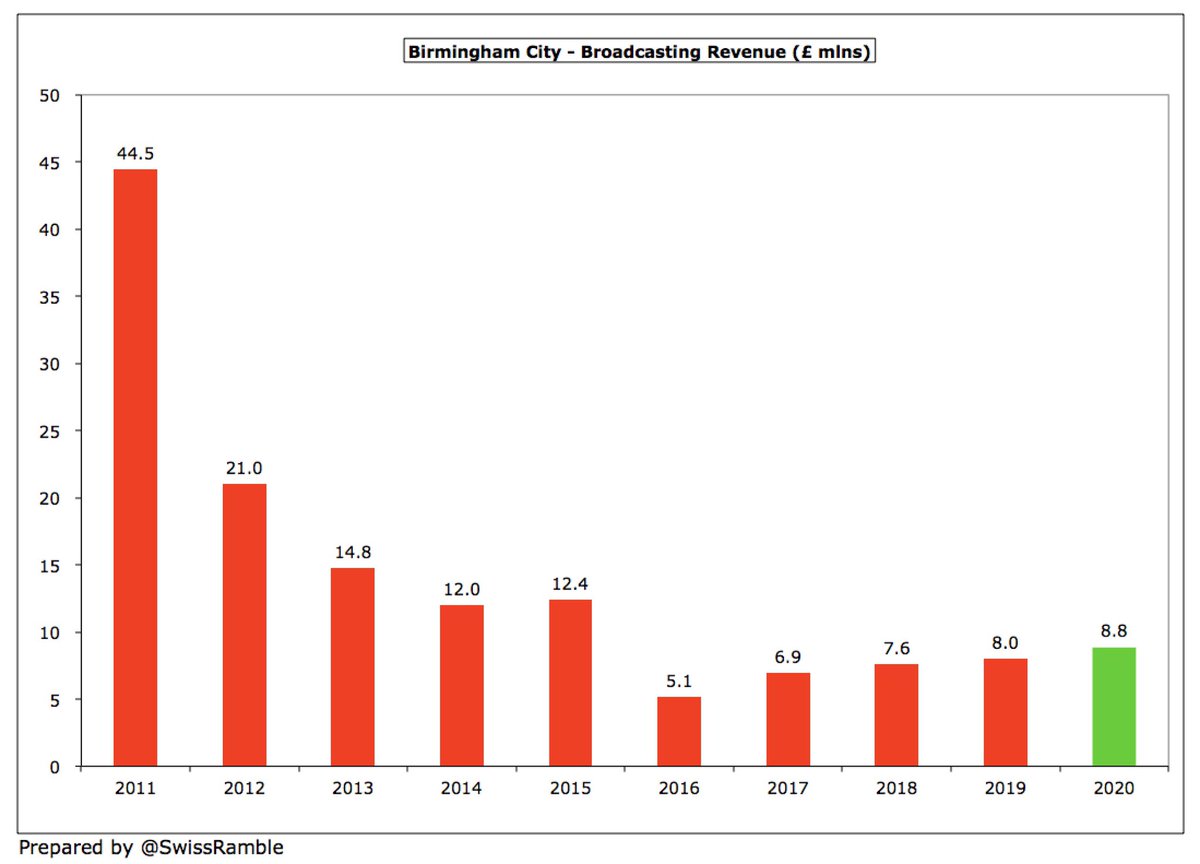

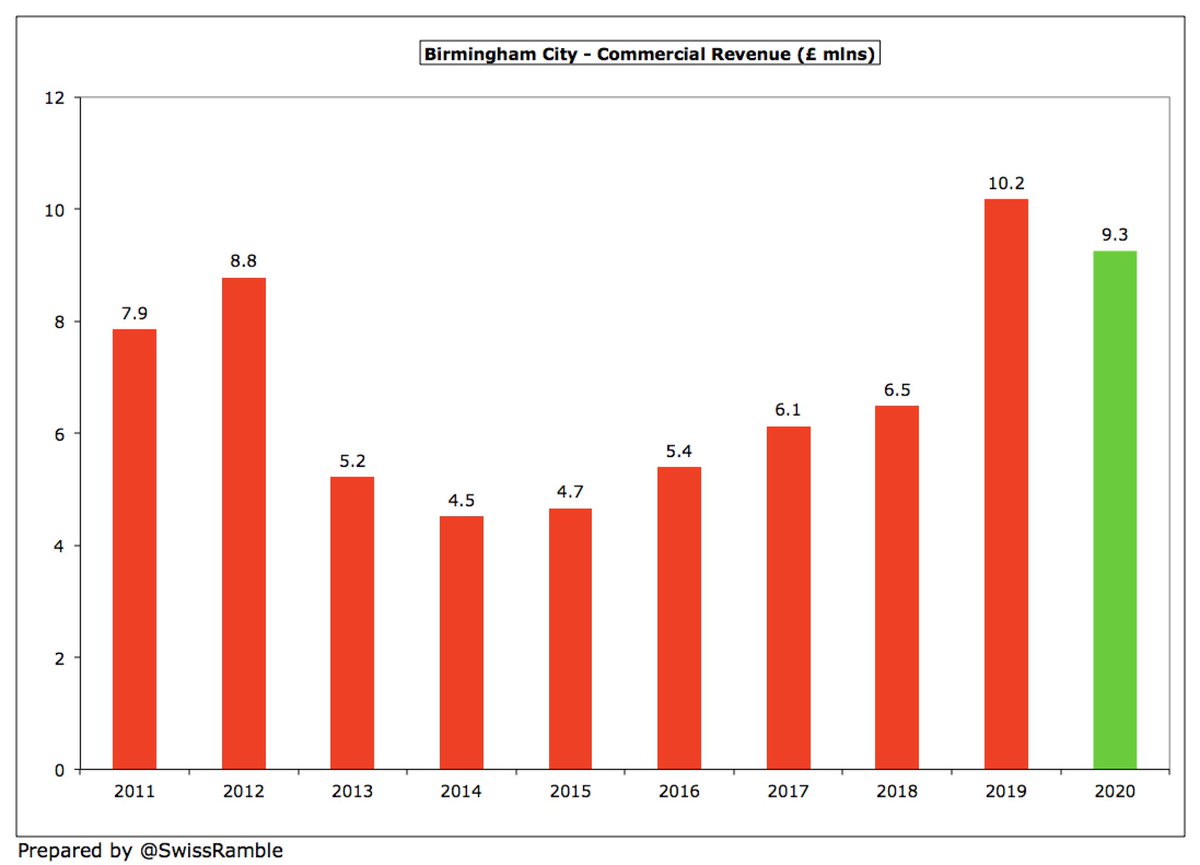

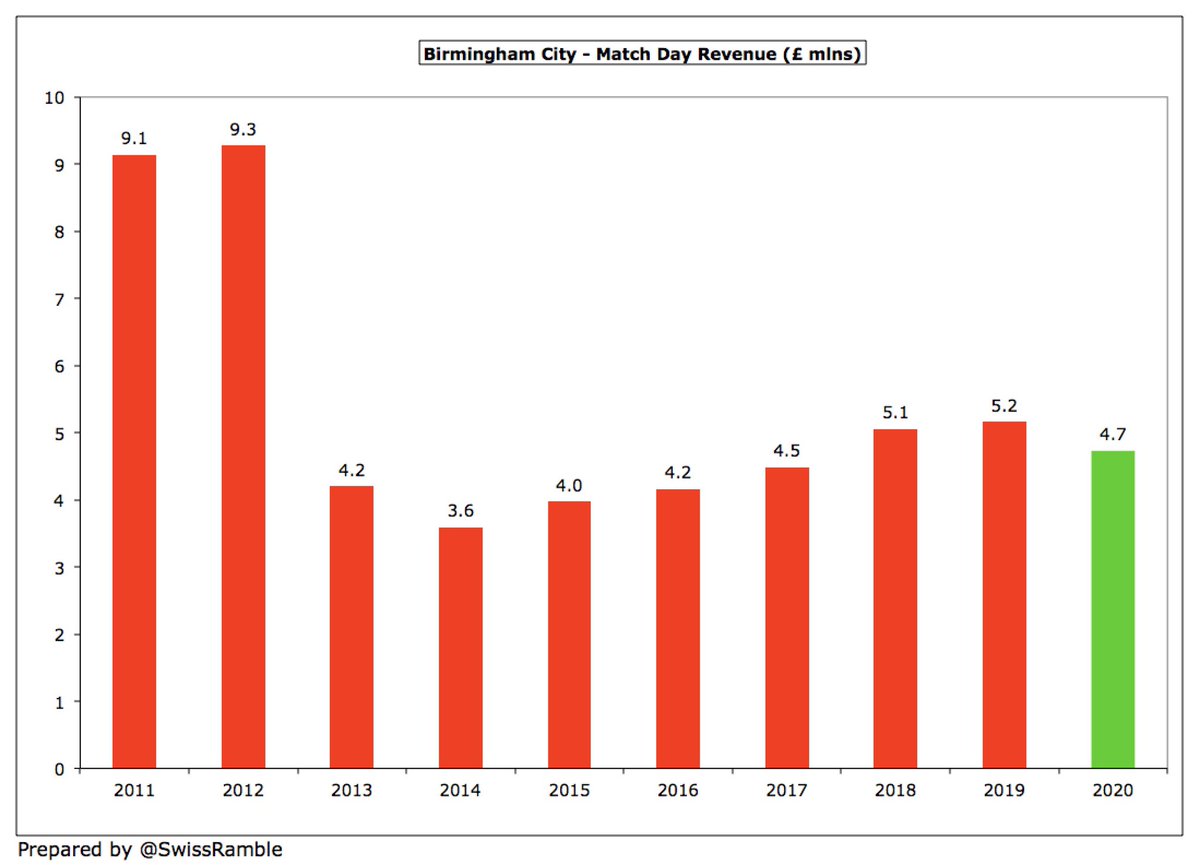

COVID-19 impacted #BCFC revenue with match receipts falling £0.4m (8%) to £4.7m, while commercial was down £0.9m (9%) to £9.3m. In contrast, broadcasting rose £0.9m (11%) to £8.8m, while other operating income increased £0.9m to £1.5m, including £819k COVID grant.

Slight (1%) increase in #BCFC wage bill from £32.8m to £33.1m, but player amortisation rose £0.9m (11%) to £8.4m, while depreciation was up £0.4m to £1.3m and net interest payable was £0.4m higher at £0.9m. Largely offset by a £1.9m (16%) cut in other expenses to £10.4m.

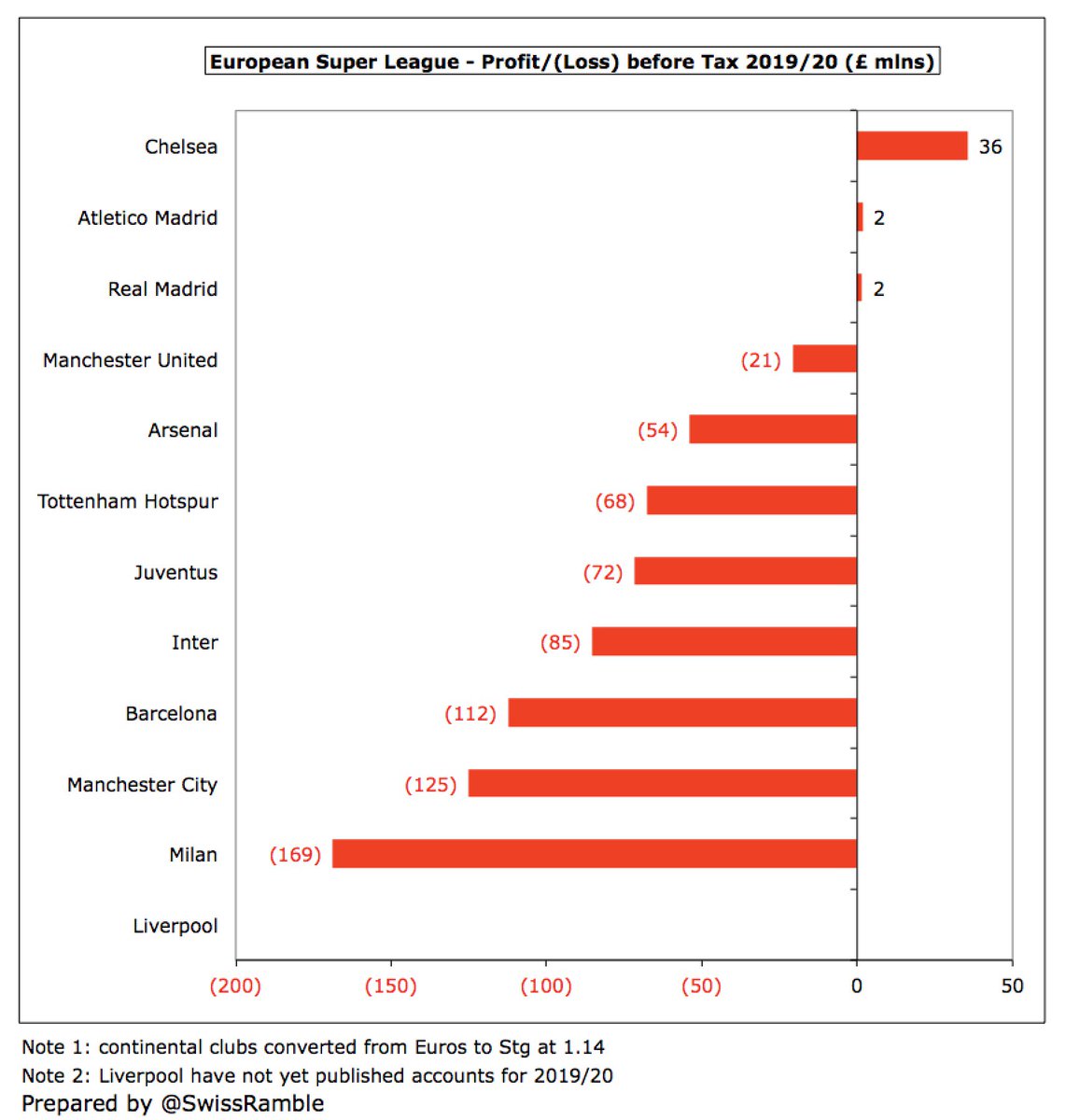

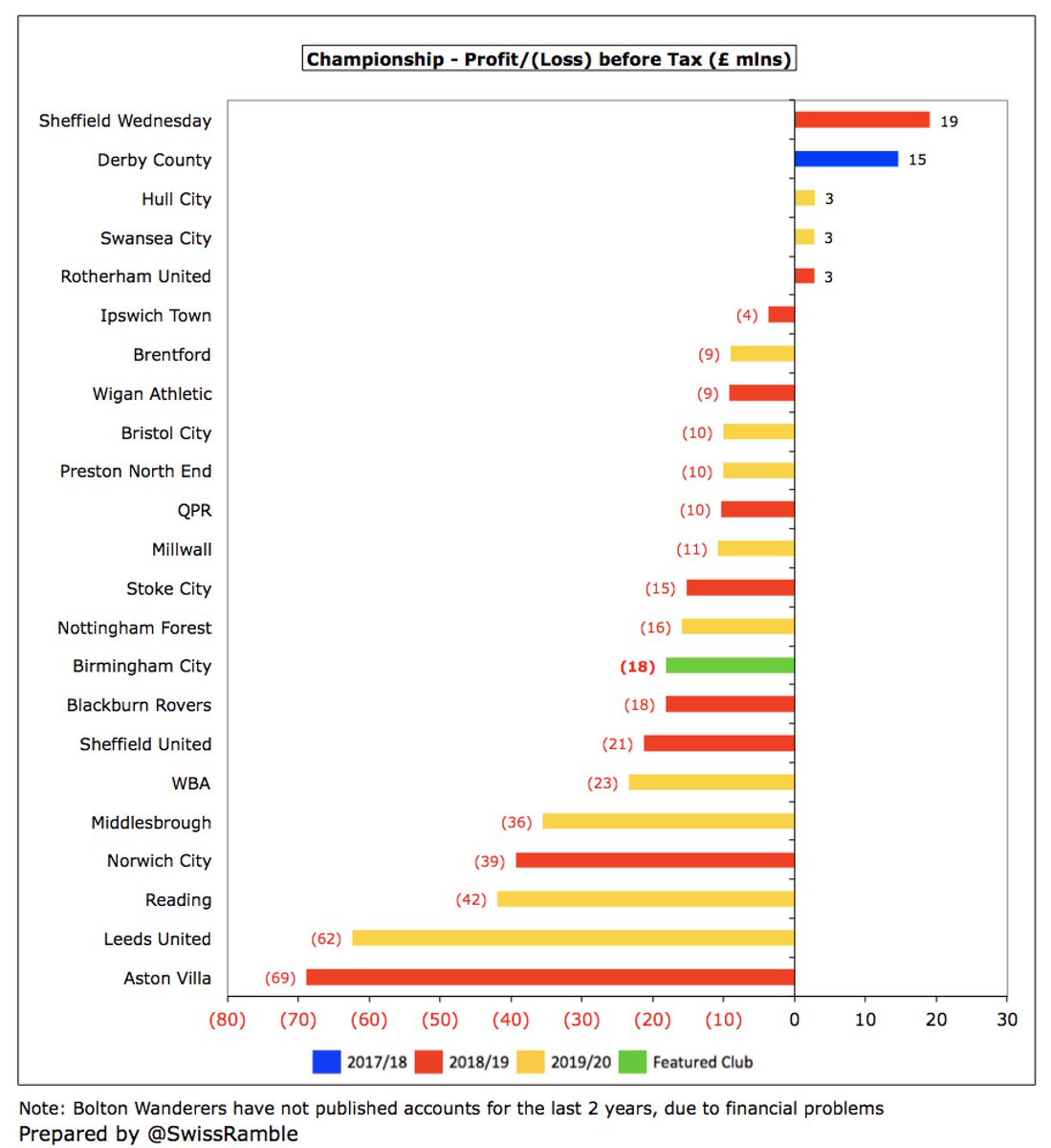

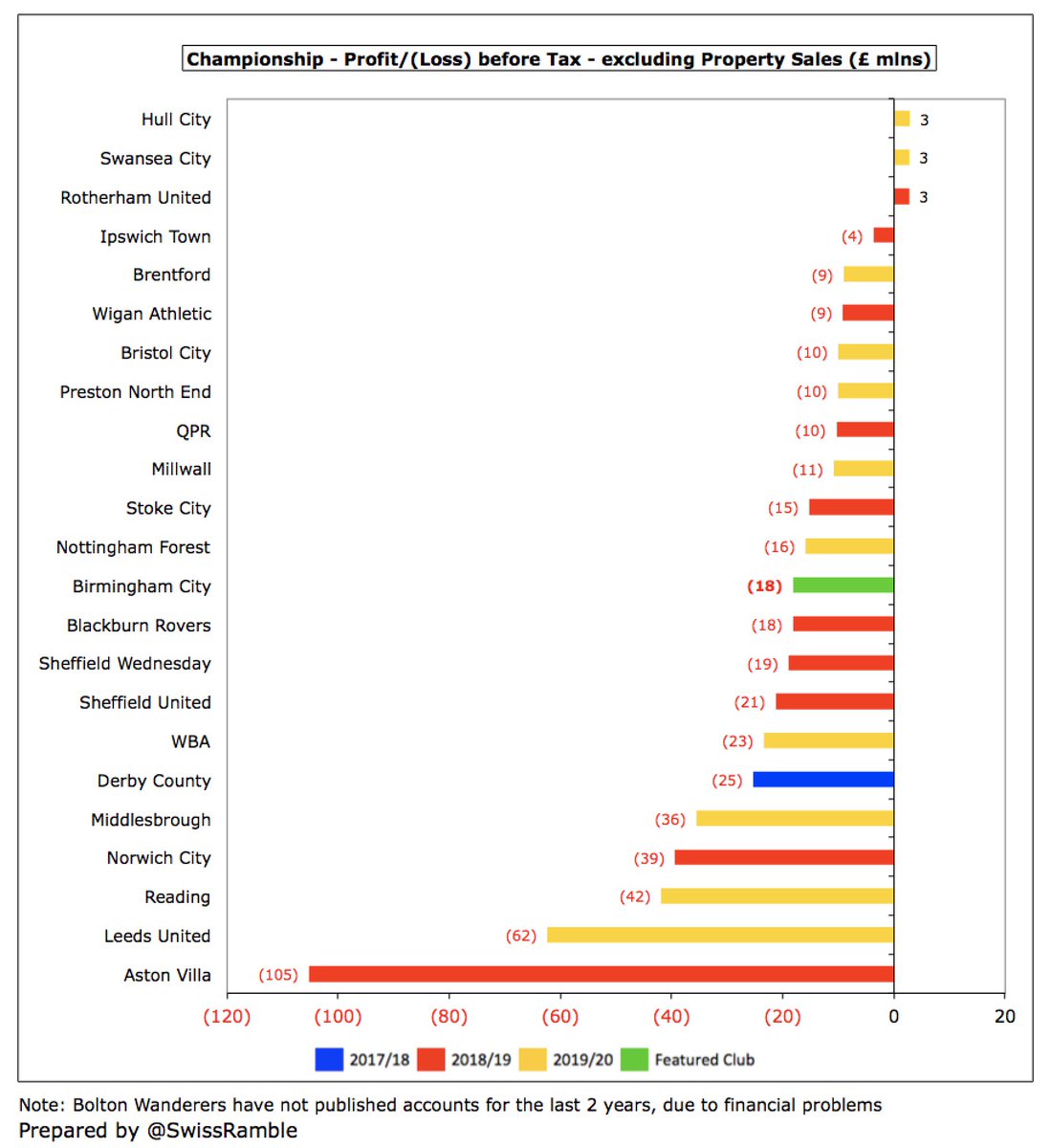

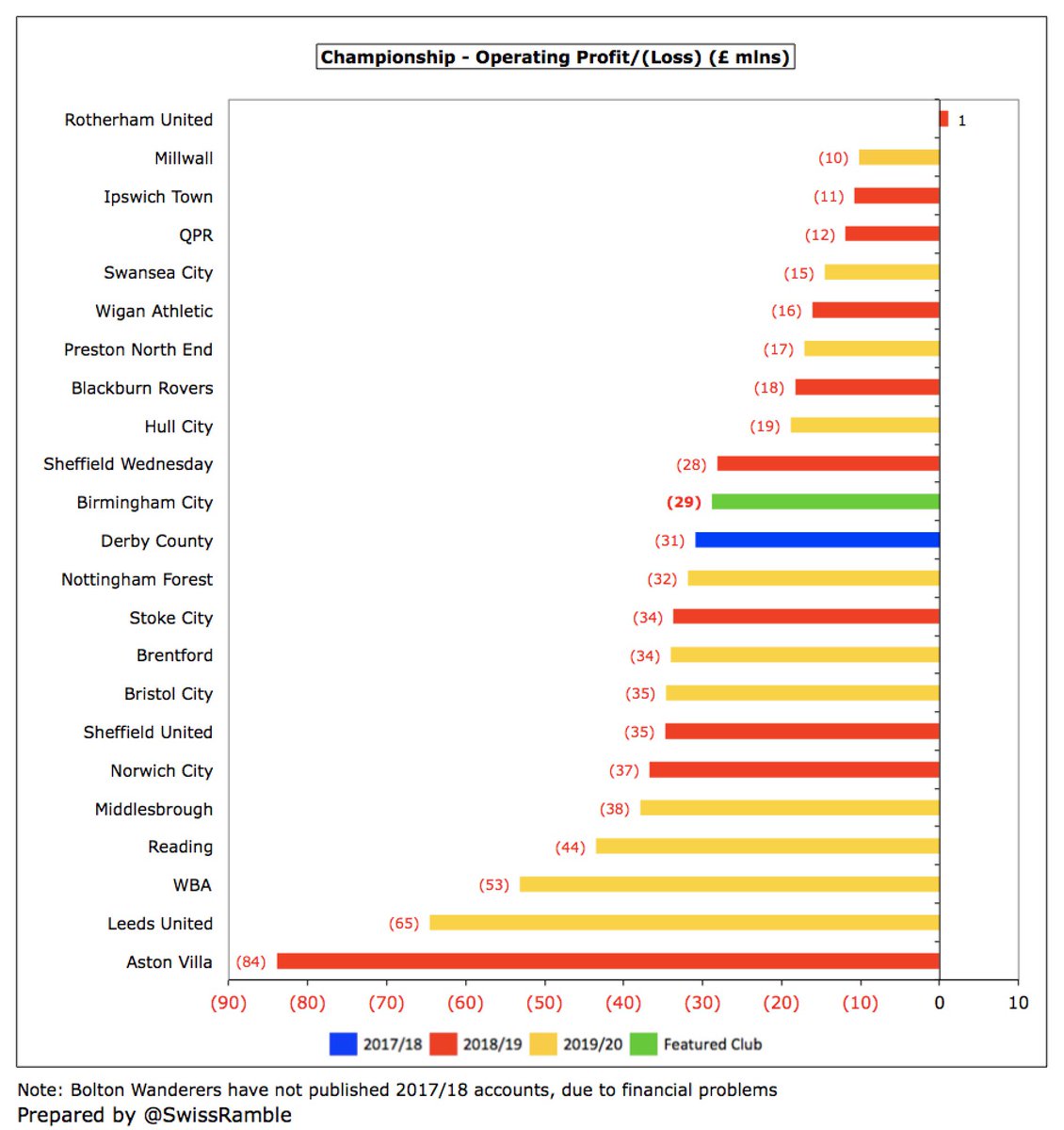

Following the decline, #BCFC loss of £18m is firmly in the bottom half of the Championship, though many other clubs have posted higher losses, even before the pandemic. In 2019/20 these include Leeds United £62m, Reading £42m, Middlesbrough £36m and WBA £23m.

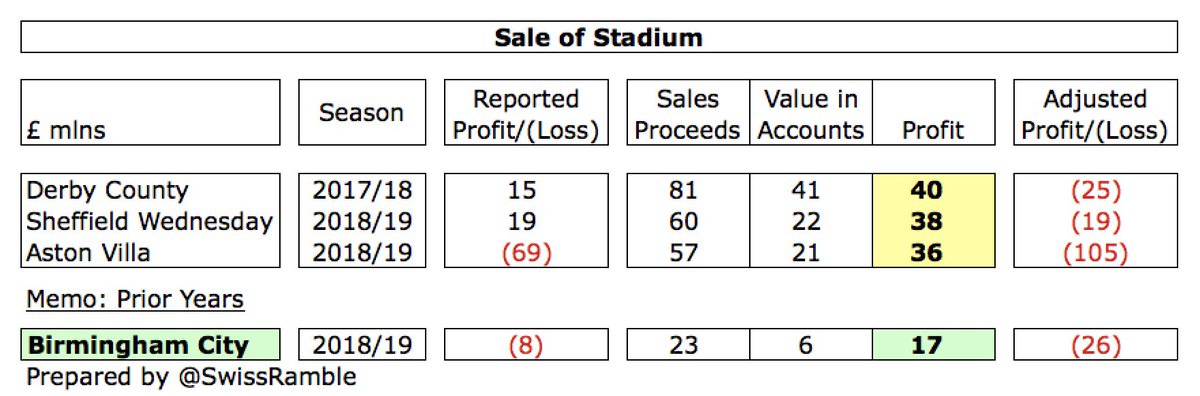

It is worth noting that some clubs’ figures were boosted by the sale of stadiums, training grounds and land, especially #DCFC £40m, #SWFC £38m and #AVFC £36m, so underlying numbers were even worse. #BCFC prior year included £17m from stadium sale (proceeds £23m, book value £6m).

Excluding property sales, only 2 Championship clubs are profitable in 2019/20 to date (#HCAFC and #Swans, with £3m apiece). Very few clubs manage to make money in this ultra-competitive division, though largest losses often from promoted clubs – including hefty promotion bonuses.

#BCFC have not quantified the effect of COVID-19, though they did state that “revenue streams have been profoundly impacted by the temporary cessation of football”, but they did “significantly reduce operational costs” and took advantage of government support schemes.

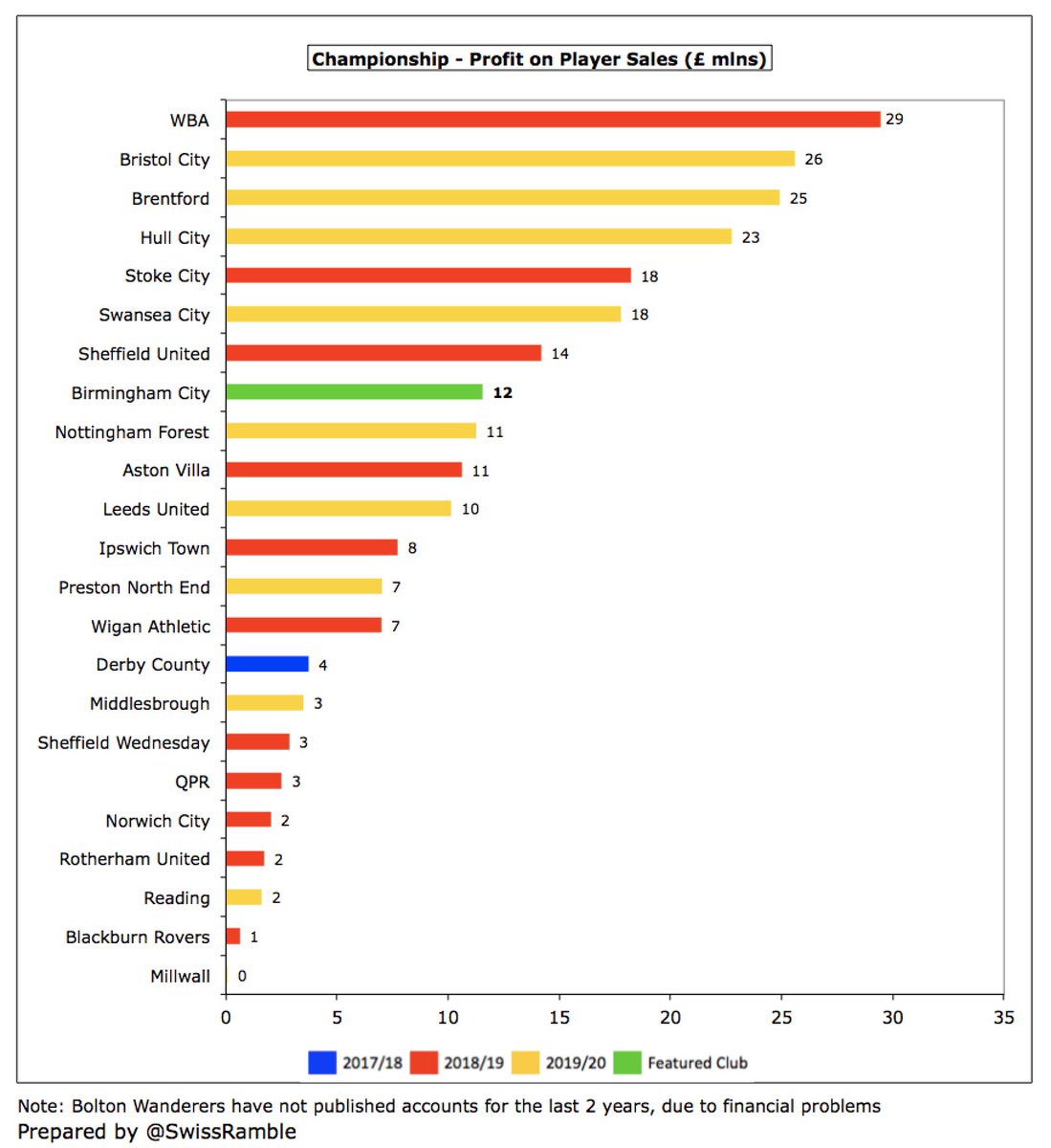

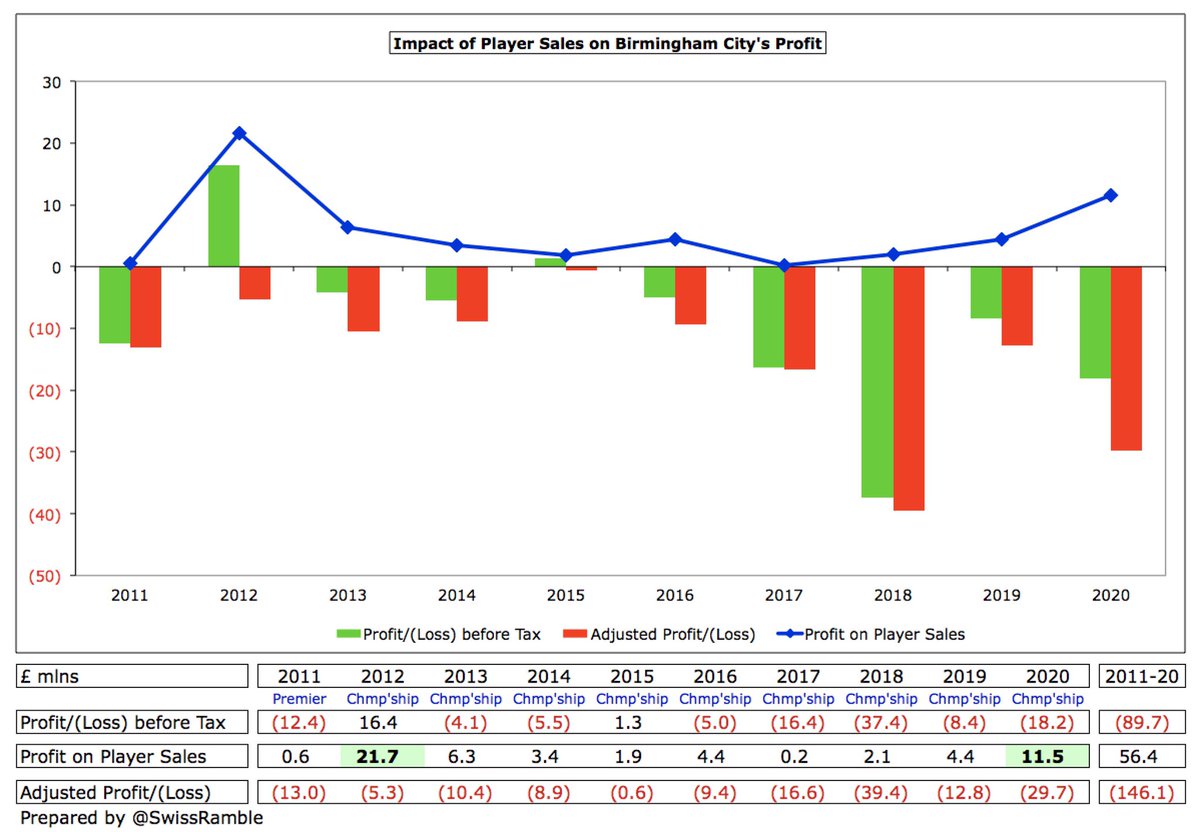

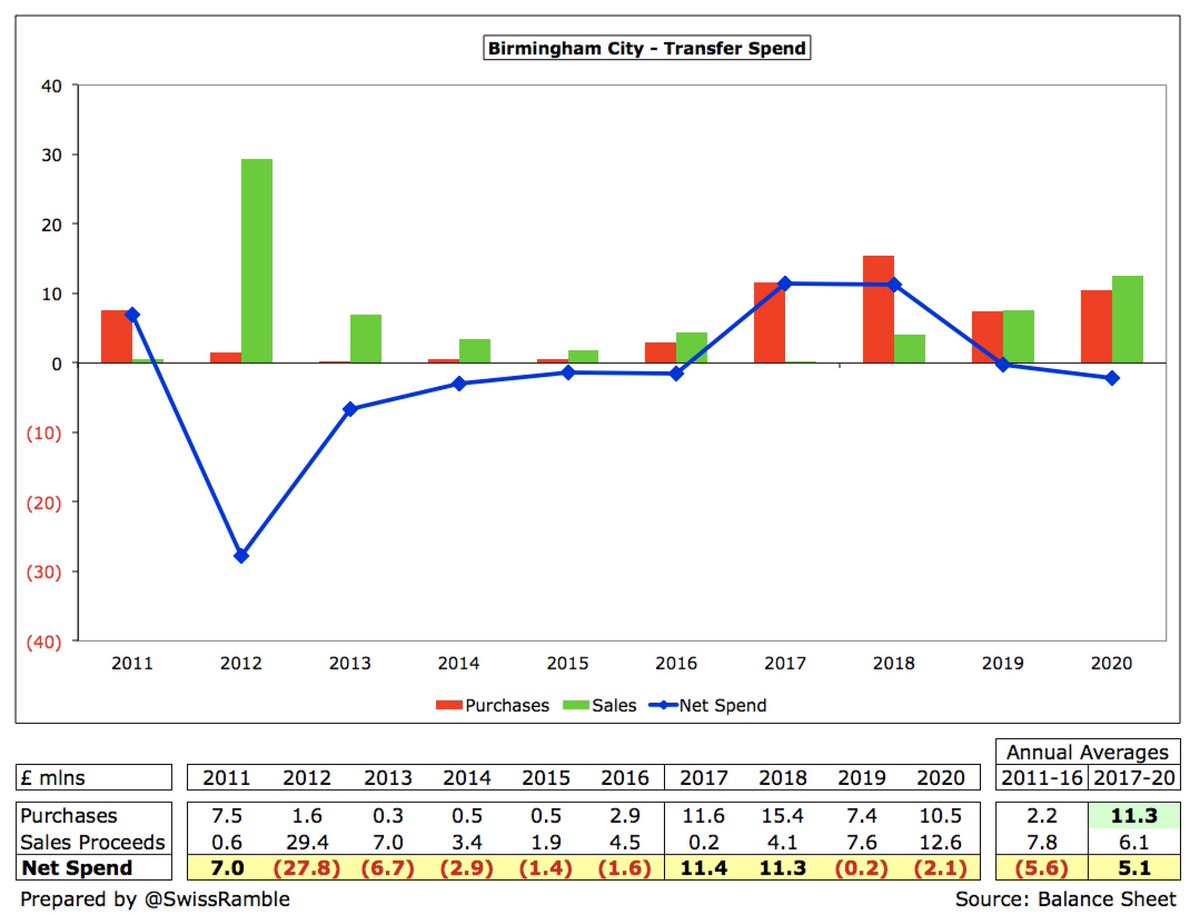

#BCFC profit on player sales increased from £4.4m to £11.5m, largely from the transfer of Che Adams to Southampton. That was pretty good, but still a fair bit lower than Bristol City £26m, Brentford £25m and Hull City £23m.

#BCFC have consistently lost money, only reporting a profit once in the last eight years – and that was just £1m in 2015. Since then, the club has accumulated £85m of losses – or £102m if the stadium sale is excluded.

The only year that #BCFC reported a sizeable profit recently was £16m in 2012, due to £22m of player sales. 2020’s £12m is the first double-digit profit from this activity since then. but this season will be boosted by Jude Bellingham’s big money move to Borussia Dortmund.

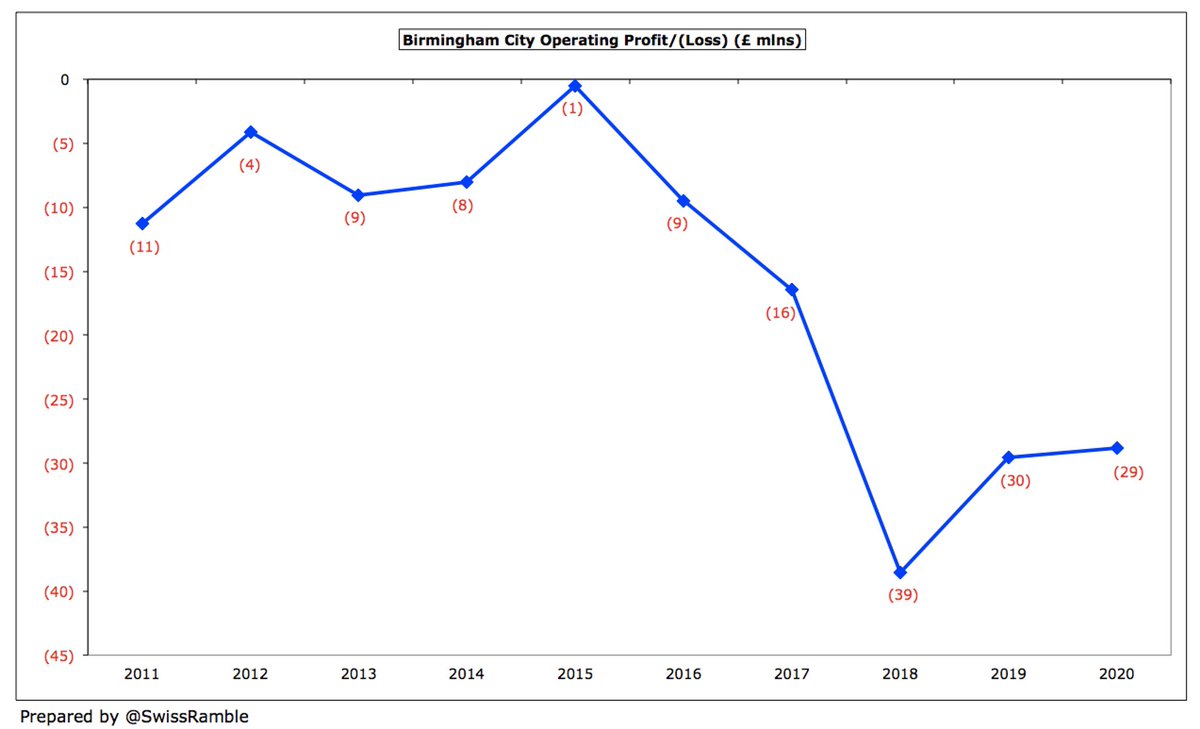

#BCFC underlying profitability is poor, as shown by their operating loss (i.e. excluding player sales and exceptional items). This has been consistently negative, though slightly improved in 2020 from £30m to £29m. In fairness, only one Championship club made an operating profit.

Despite small fall in 2020, #BCFC have done well to grow revenue by £8.1m (55%) in last 4 years. In fact, their £22.8m revenue is higher than the last year when they had a parachute payment in 2015. Highest growth came in commercial, which is the largest revenue stream (40%).

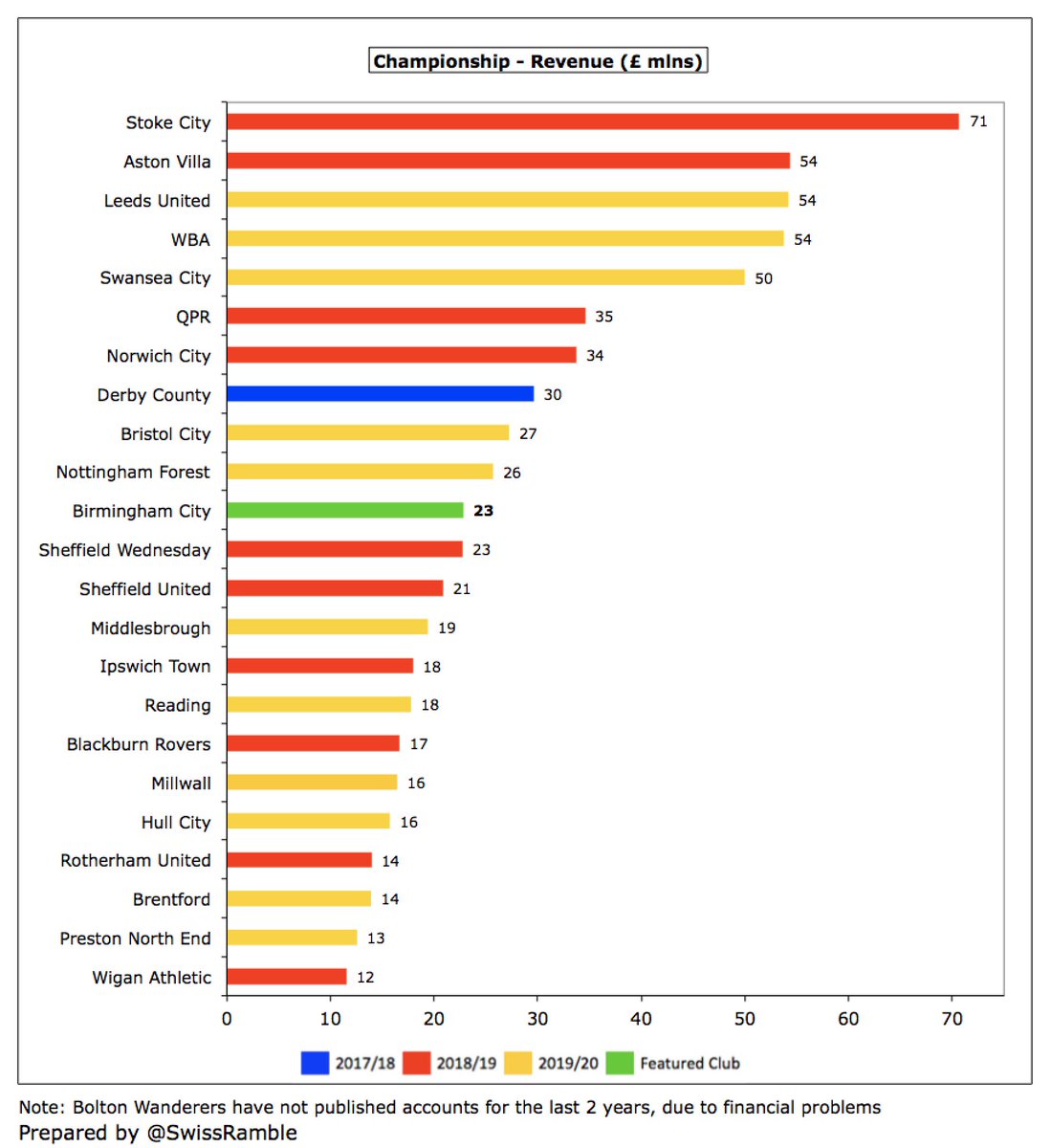

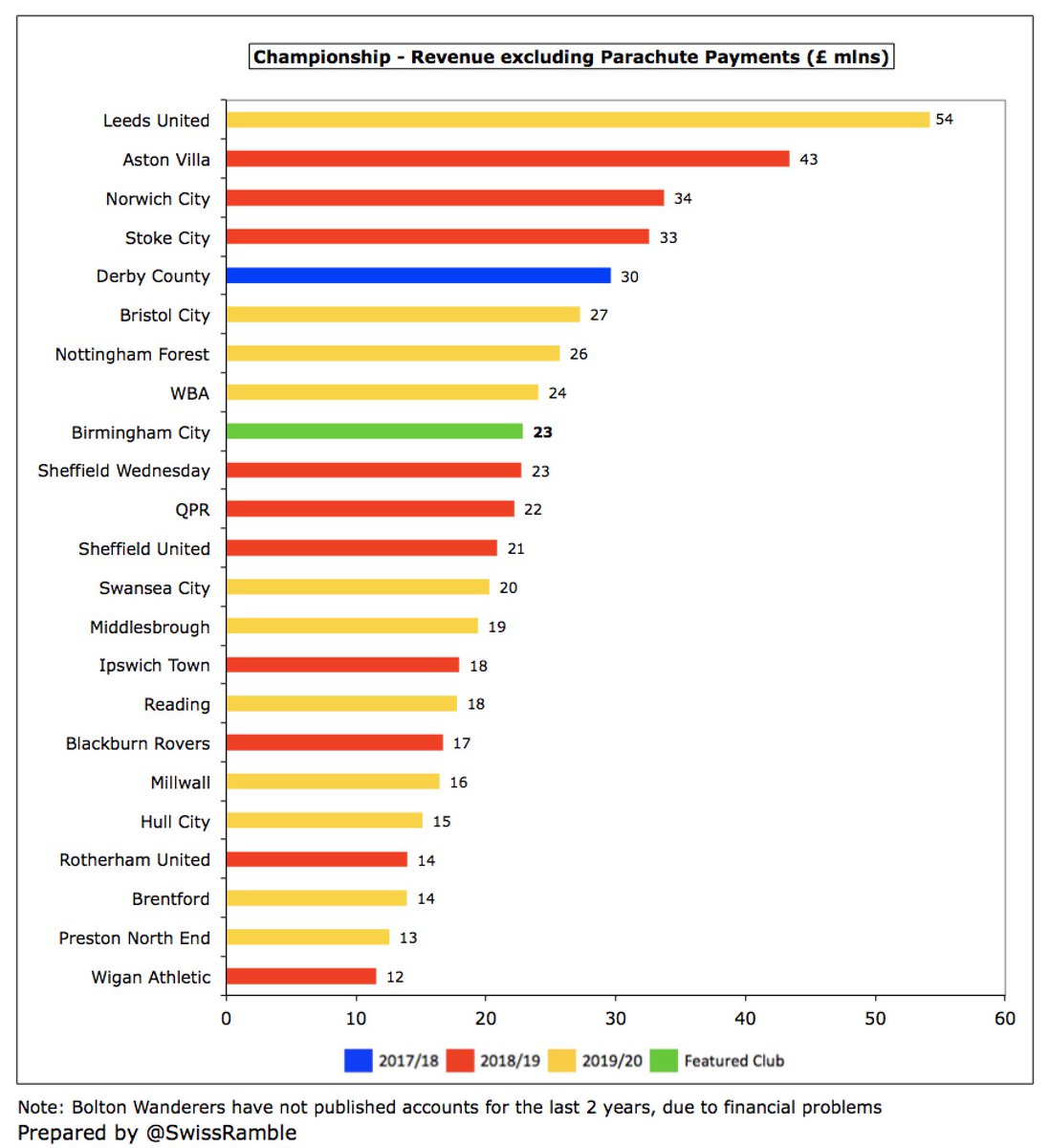

#BCFC £23m revenue is mid-table in the Championship, significantly below those clubs in receipt of parachute payments following relegation from the Premier League, but also behind clubs like Bristol City £27m and #NFFC £26m.

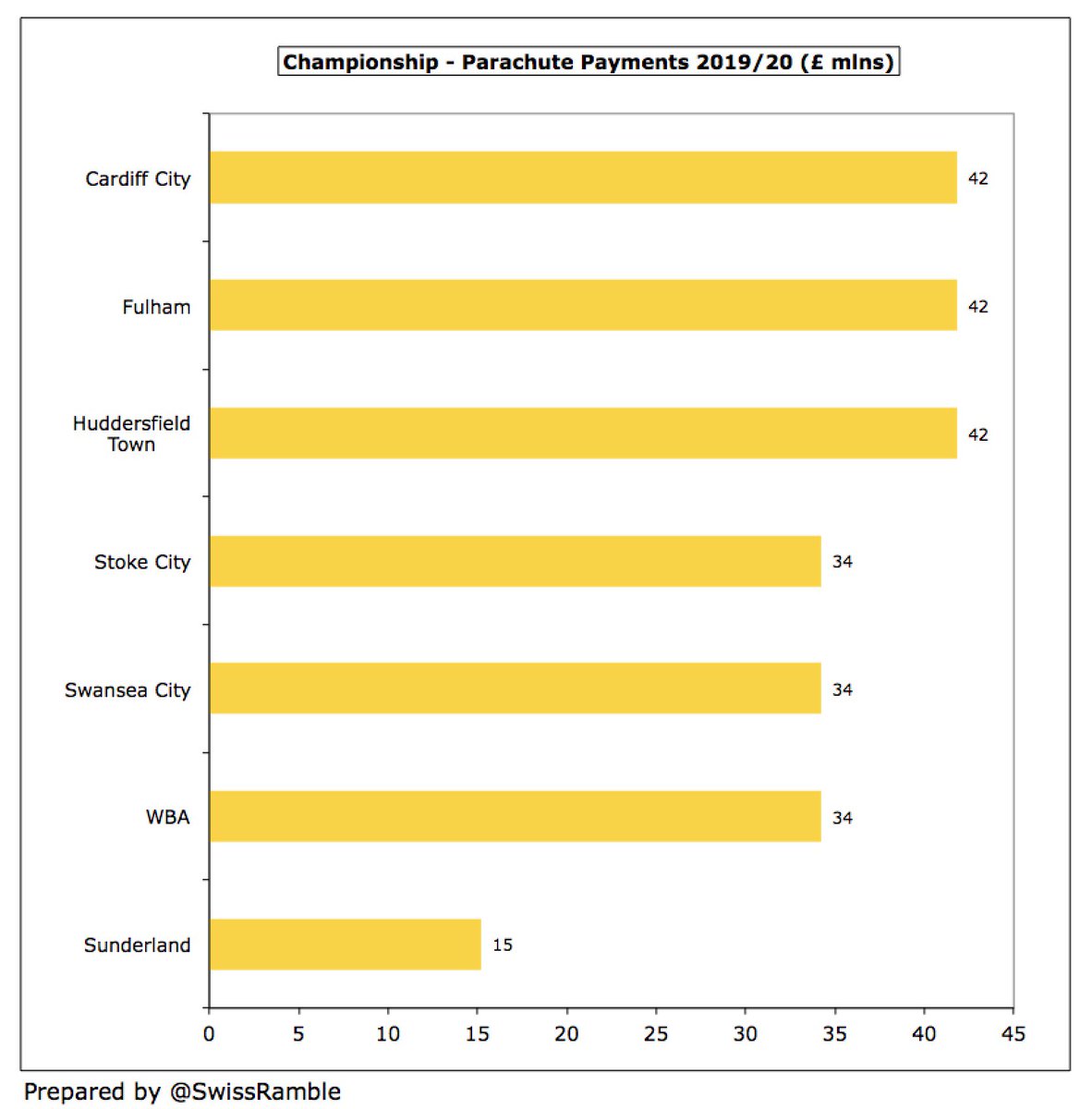

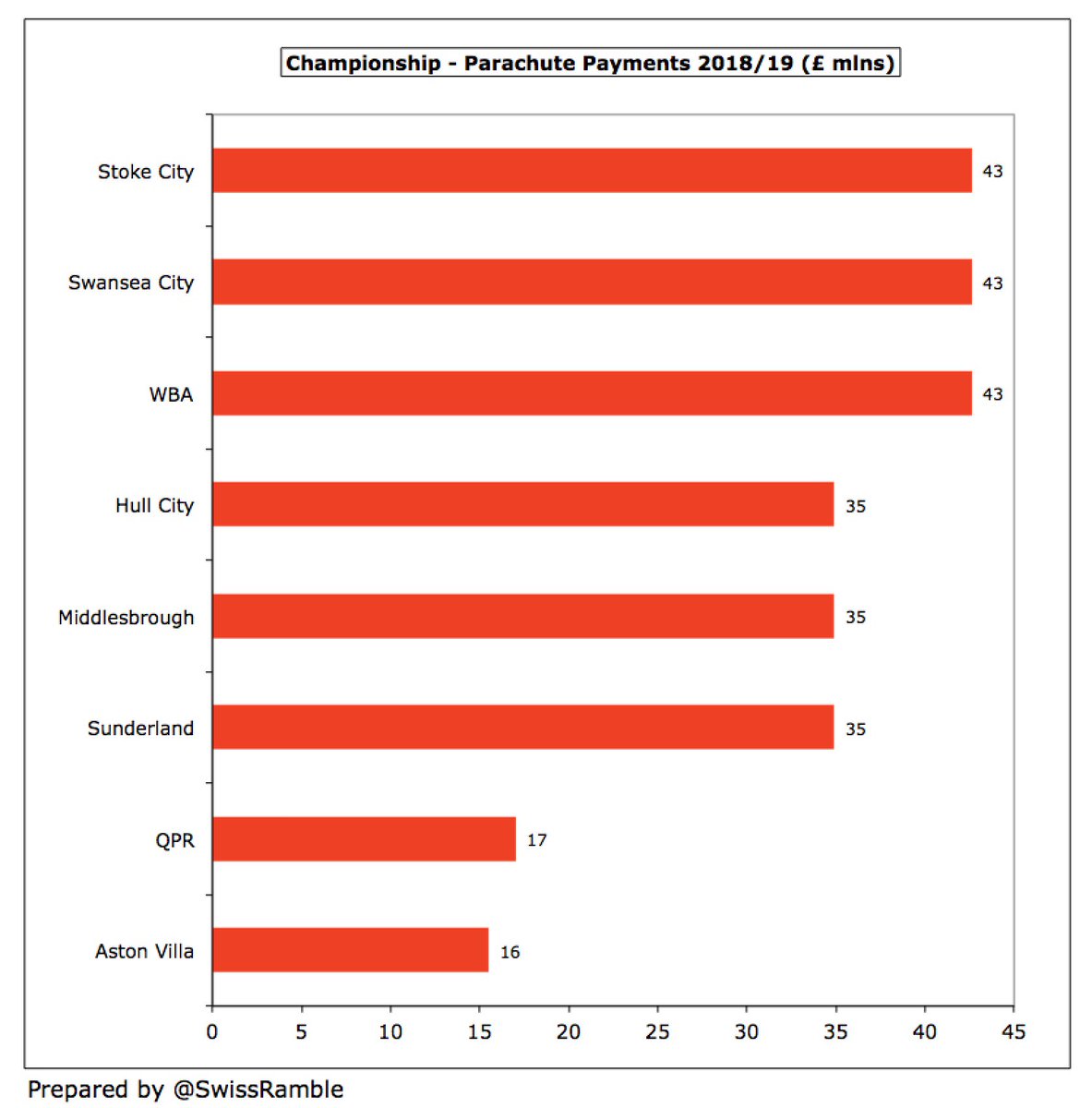

Championship revenue is hugely influenced by Premier League parachute payments, making it difficult for clubs like #BCFC to compete. Seven clubs benefited from these in 2019/20, led by Cardiff City, #FFC and #HTAFC (£42m), followed by Stoke City, Swansea City and WBA (£34m).

If parachute payments were excluded, #BCFC £23m would have the 9th highest revenue in the Championship. They would still be a fair way below the leading clubs, though the gap to the highest placed Leeds United would be reduced to “only” £31m.

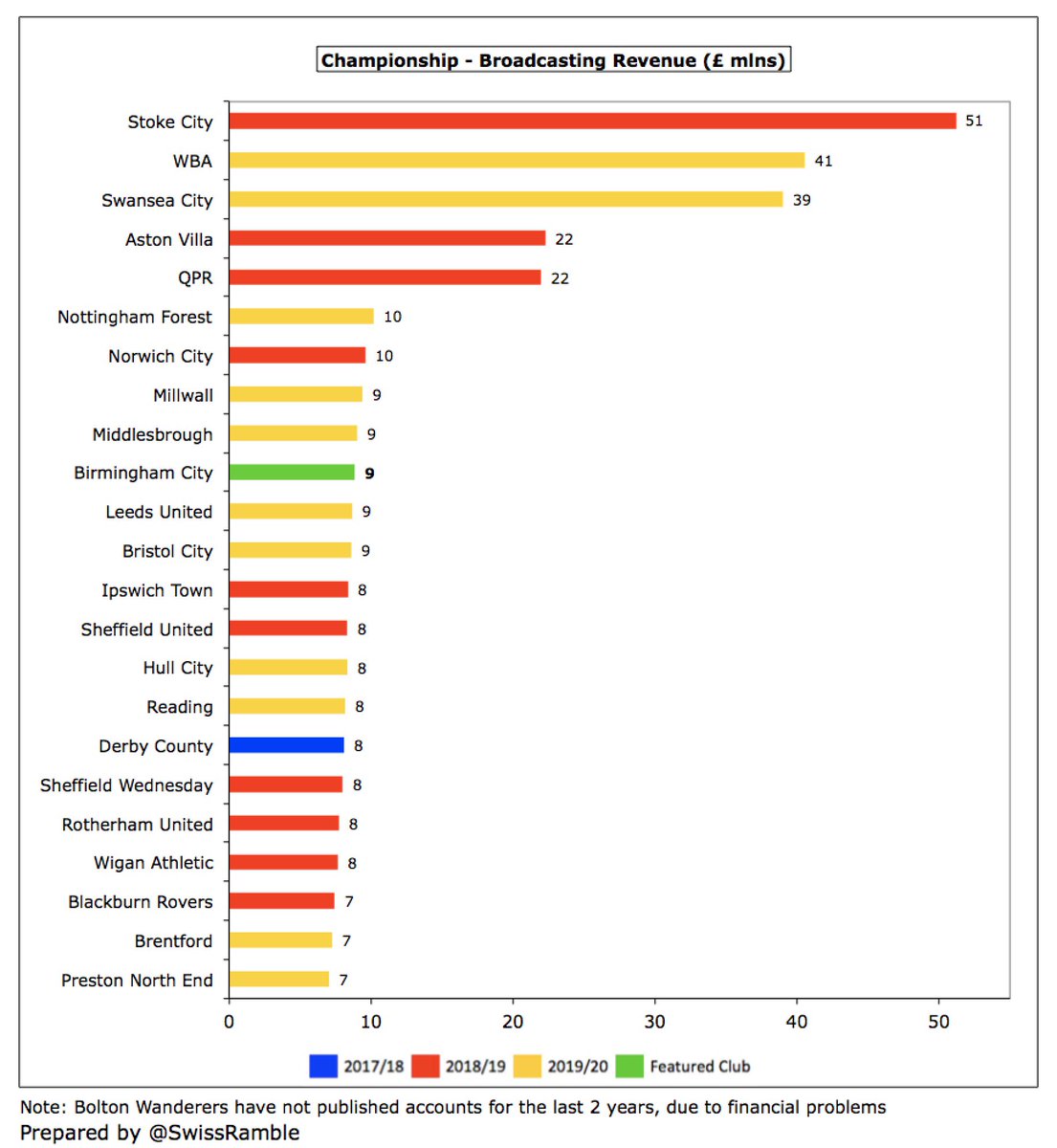

#BCFC broadcasting income rose £0.9m (11%) to £8.8m. Most Championship clubs earn between £8m and £10m in TV money, but there is a big gap to the clubs with parachute payments (over £50m for clubs in their first season following relegation).

#BCFC commercial income fell £0.9m (9%) from £10.2m to £9.3m, though this is still third best ever for club, partly due to owners Trillion Trophy naming rights for St Andrews stadium and training facility (deals expire in 2021). Up to 7th highest in the Championship.

#BCFC had a new shirt sponsor from 2019/20 in the form of Irish bookmakers Boyle Sports, who replaced 888sport with a two-year deal. The kit supplier was Adidas, since replaced by Nike in a four-year deal from the 2020/21 season onwards.

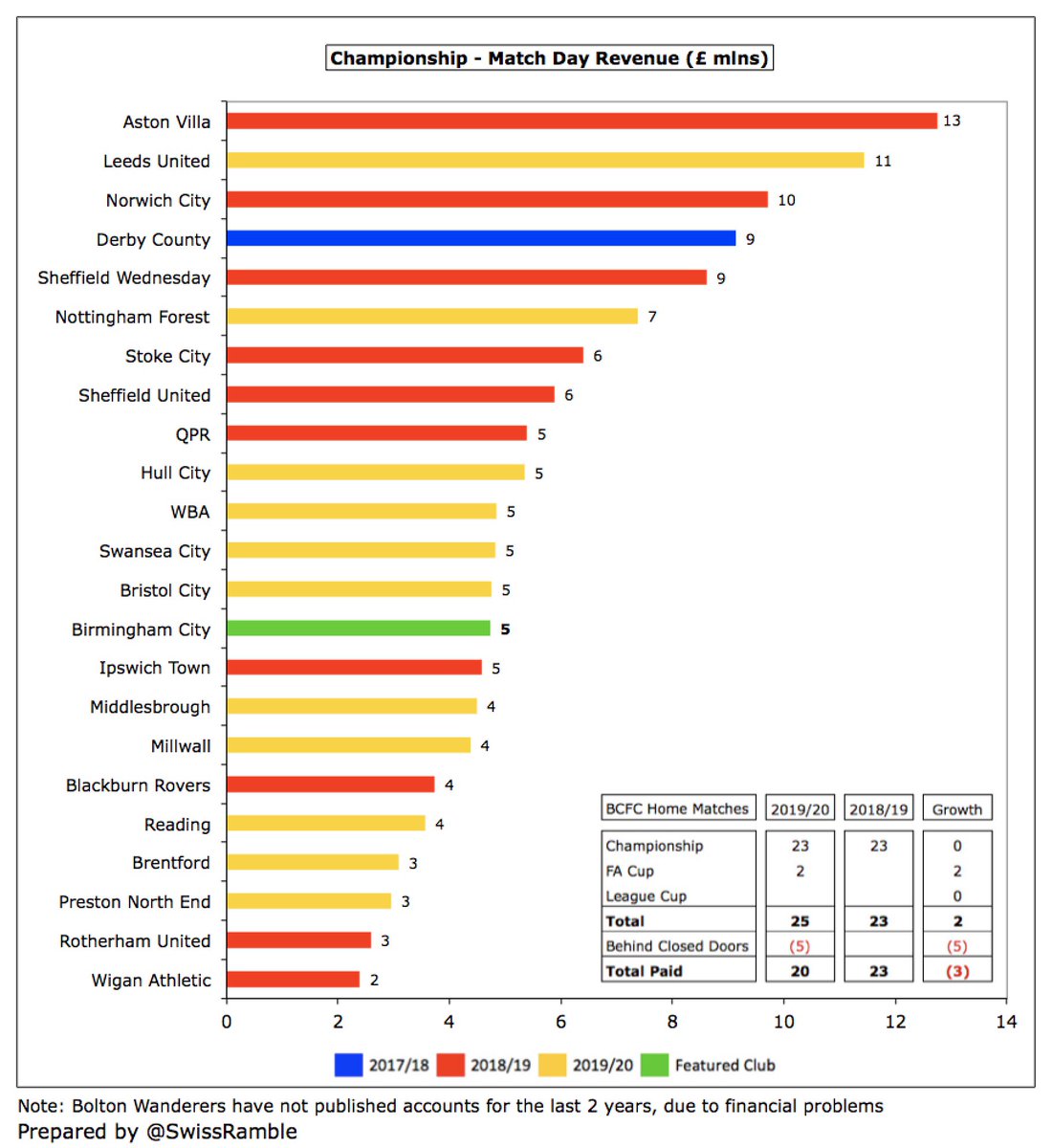

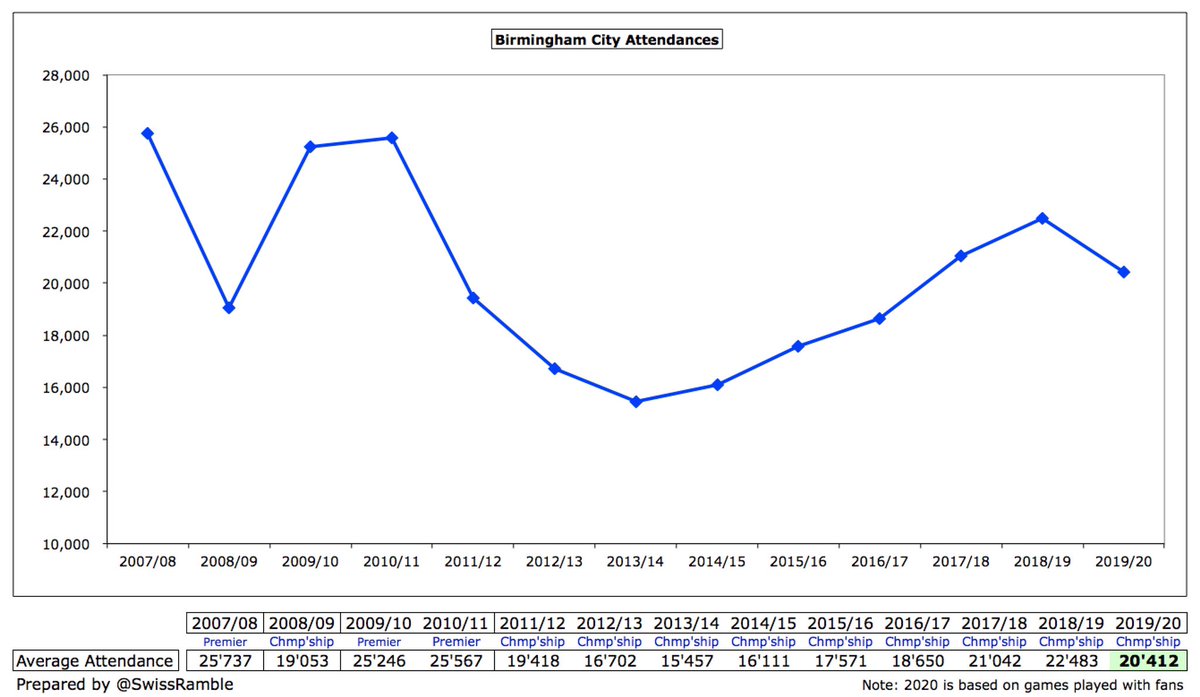

#BCFC match day income fell £0.5m (8%) to £4.7m, despite 2 more FA Cup games, largely due to playing 5 home games behind closed doors because of the pandemic. Revenue is firmly in the lower half of the Championship, less than half #LUFC £11m.

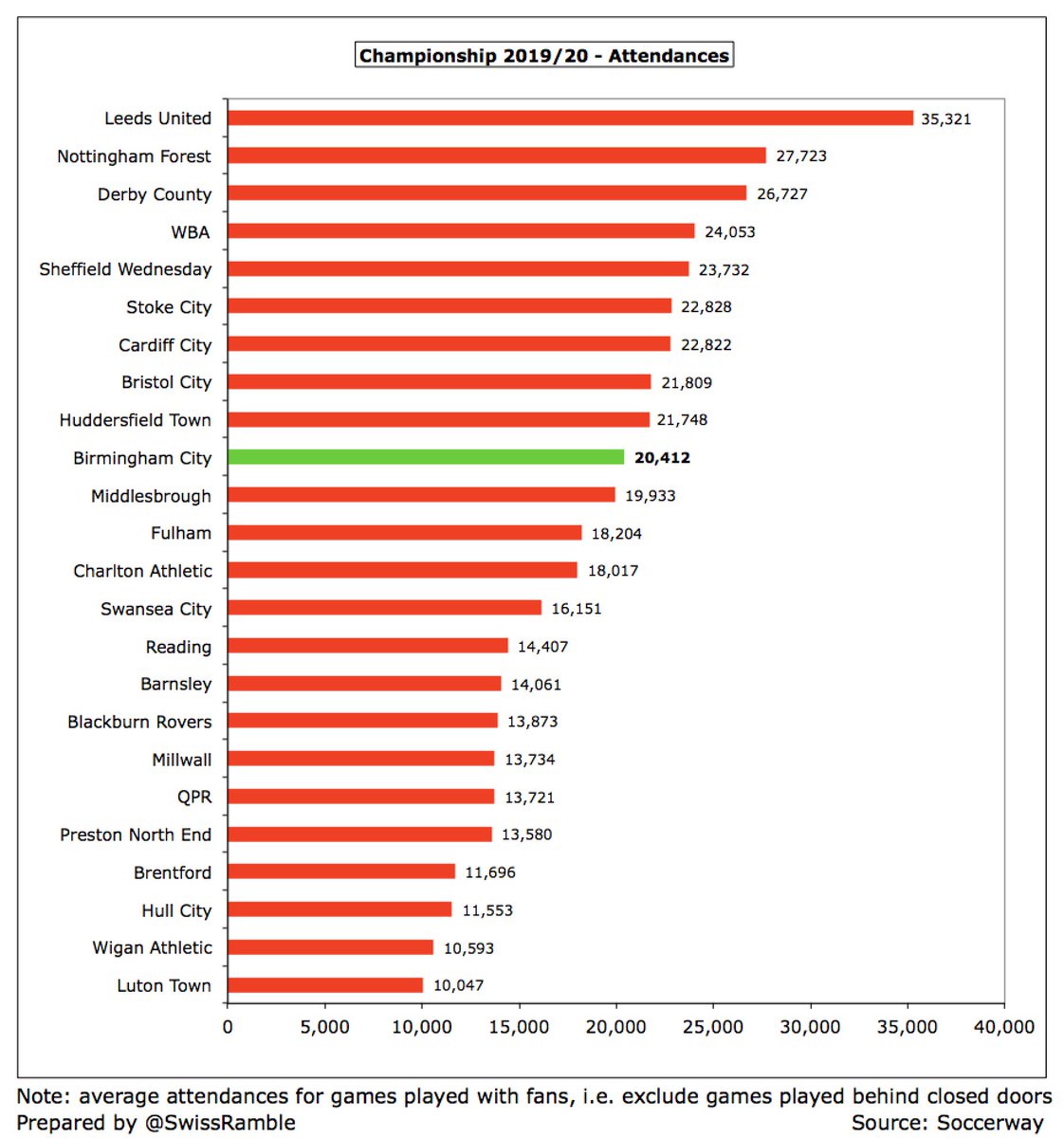

After rising 5 years in a row, #BCFC average attendance (for games played with fans) dropped 9% from 22,483 to 20,412, but this was still in the top ten in the Championship. Season ticket prices were frozen in 2019/20 for the seventh successive season.

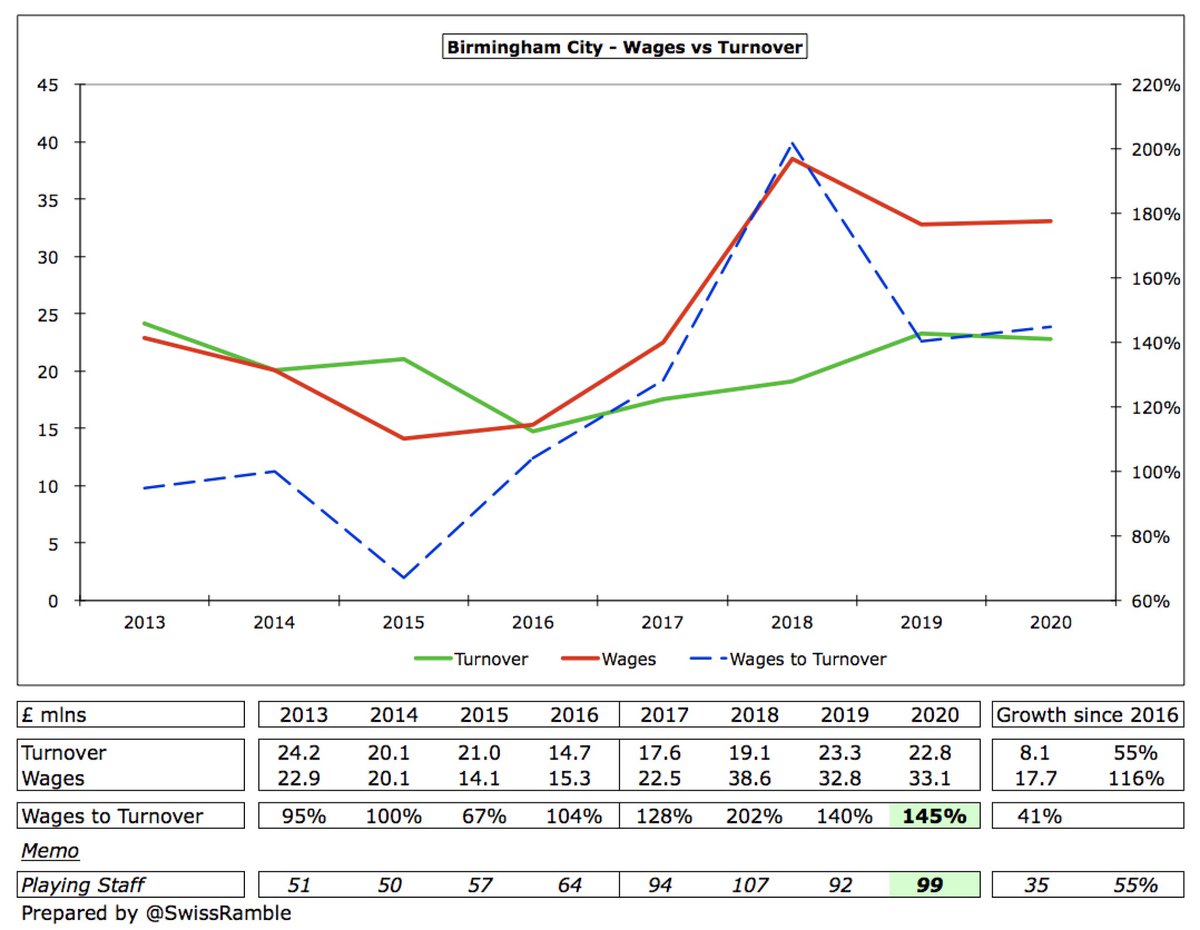

#BCFC wage bill rose slightly (1%) from £32.8m to £33.1m, as playing staff increased from 92 to 99, while there were wage deferrals during football lockdown. This is more than twice as much as £15m four years ago in 2016. In the same period revenue has only grown £8m (55%).

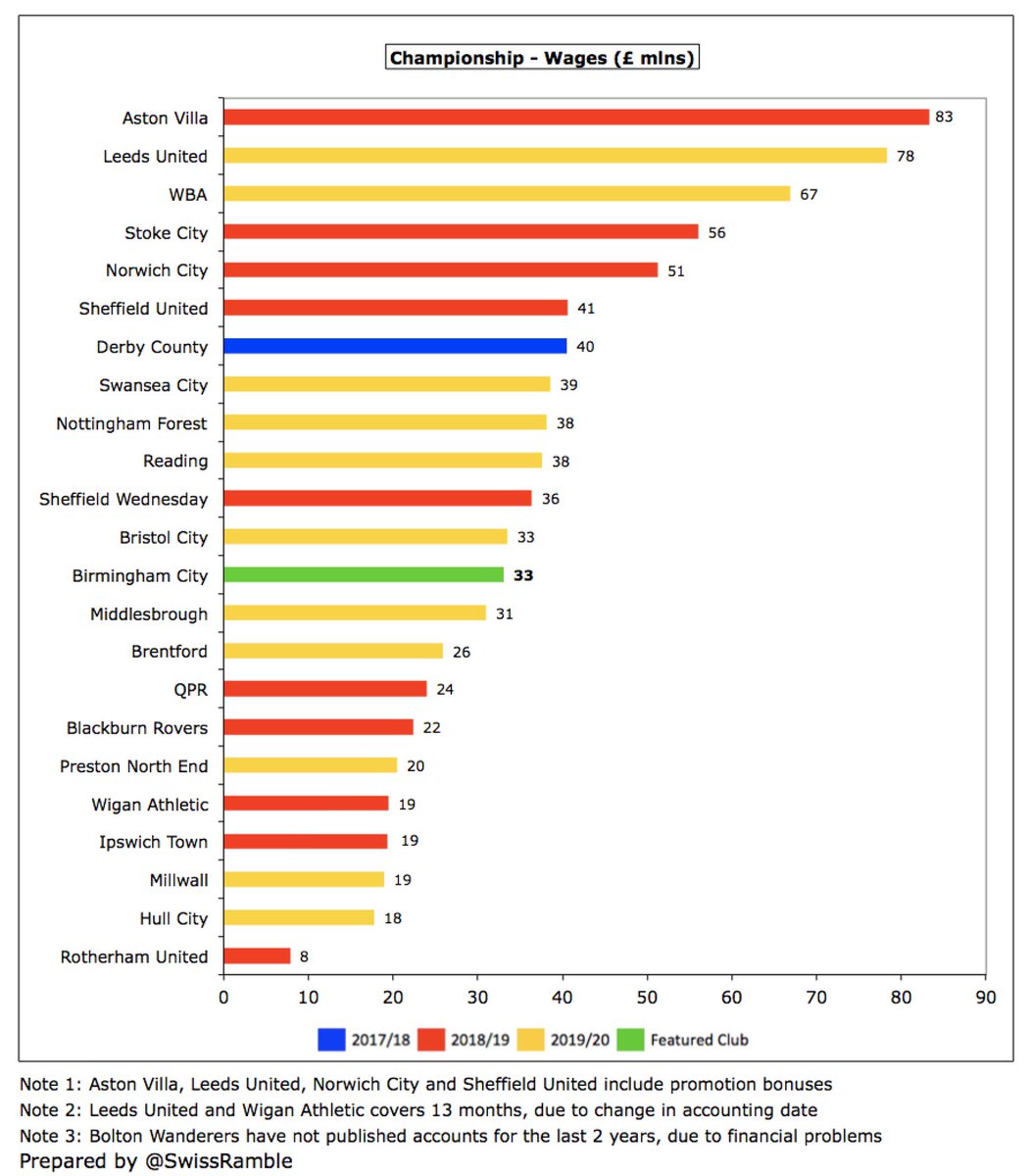

#BCFC £33m wage bill is around mid-table in the Championship, a long way below the likes of #LUFC £78m and WBA £67m, though they both included promotion bonuses (estimated at £20m and £16m respectively).

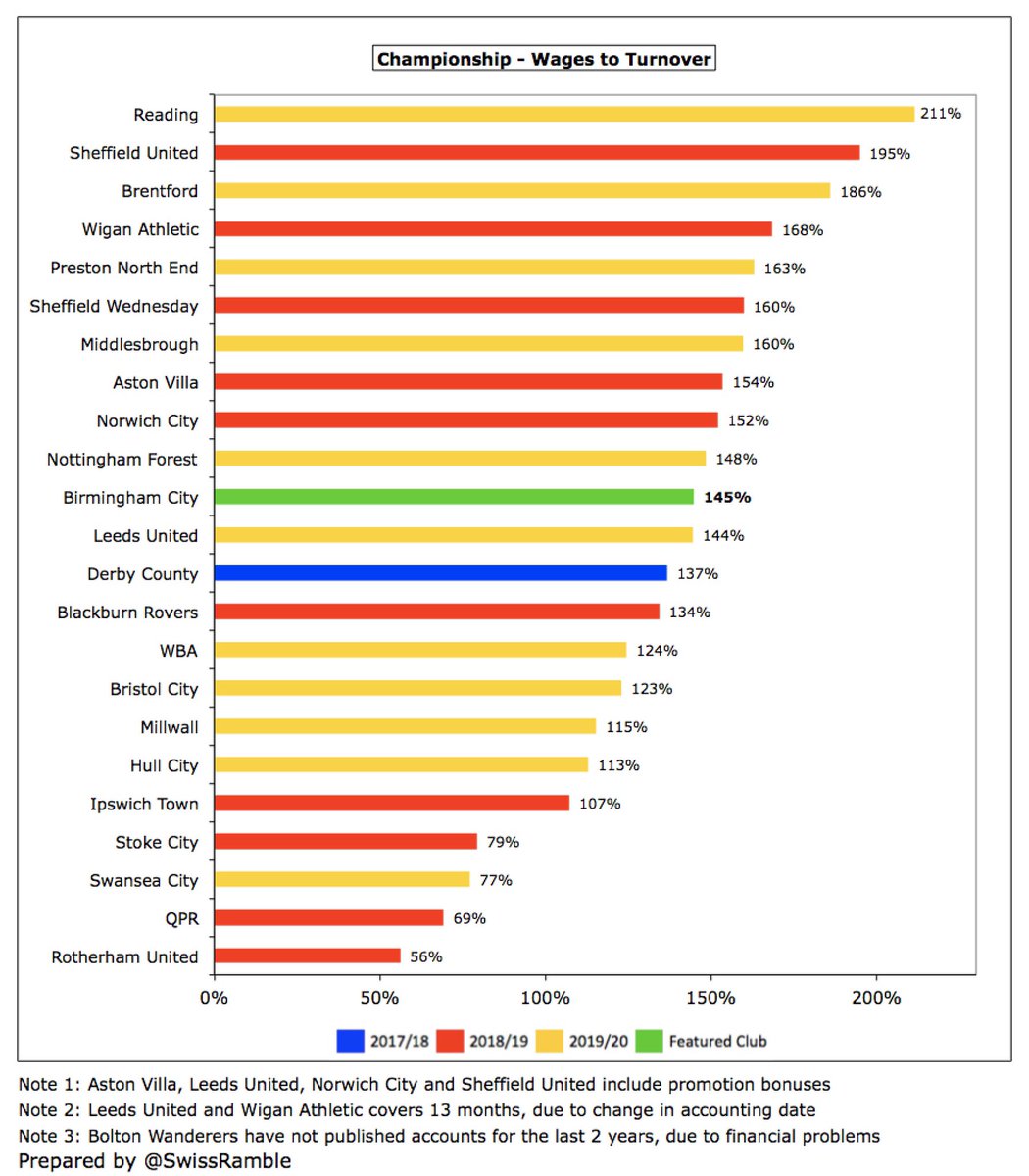

#BCFC wages to turnover ratio increased from 140% to 145%. This is far from ideal, but pretty much par for the course in the Championship, where 19 clubs are above 100%, much worse than UEFA’s recommended 70% upper limit. More than twice as much as 67% they reported in 2015.

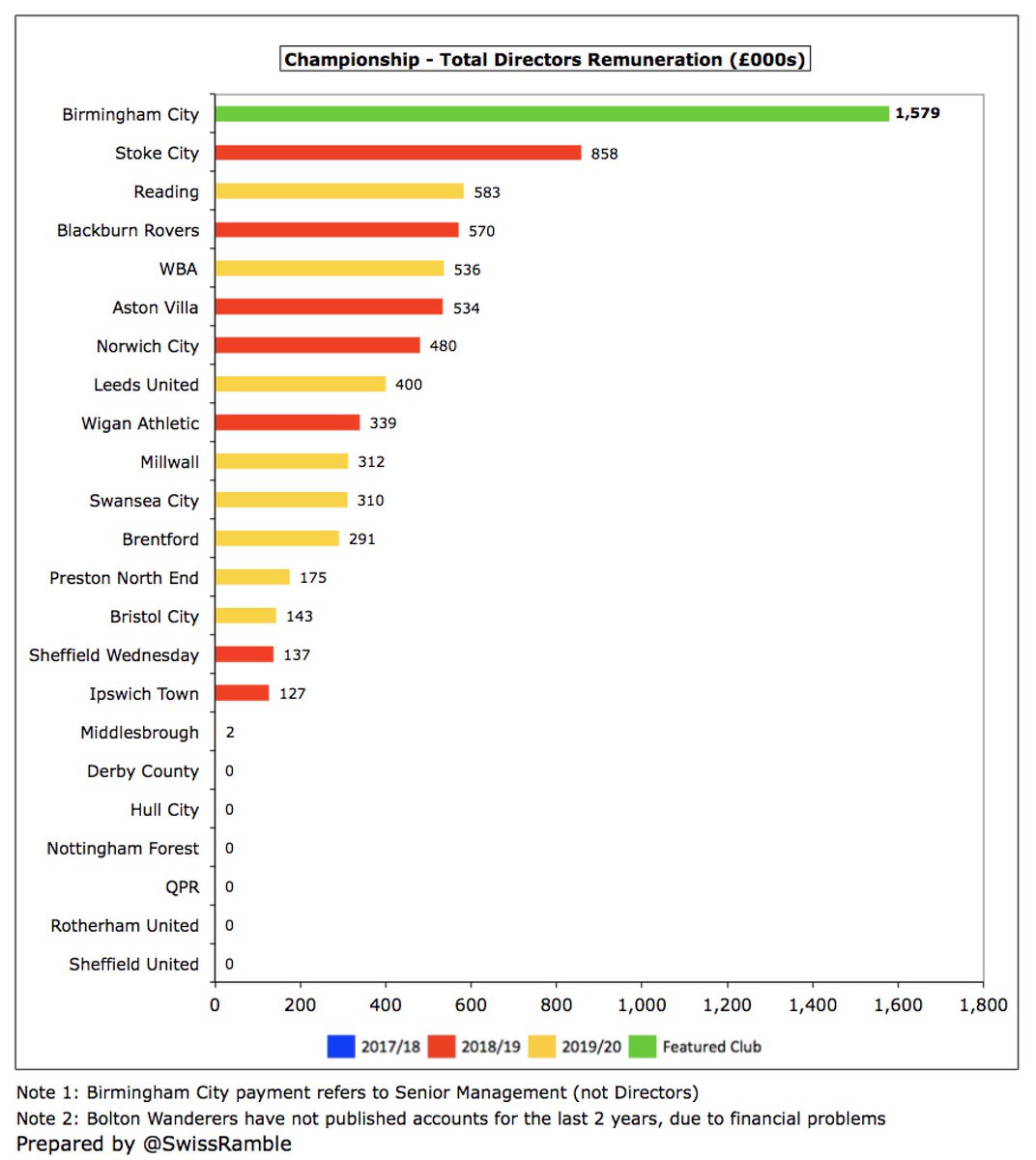

There were again no payments made to #BCFC directors, though remuneration to senior management increased by 69% from £932k to £1.6m, partly due to the club reclassifying who is considered to be senior management.

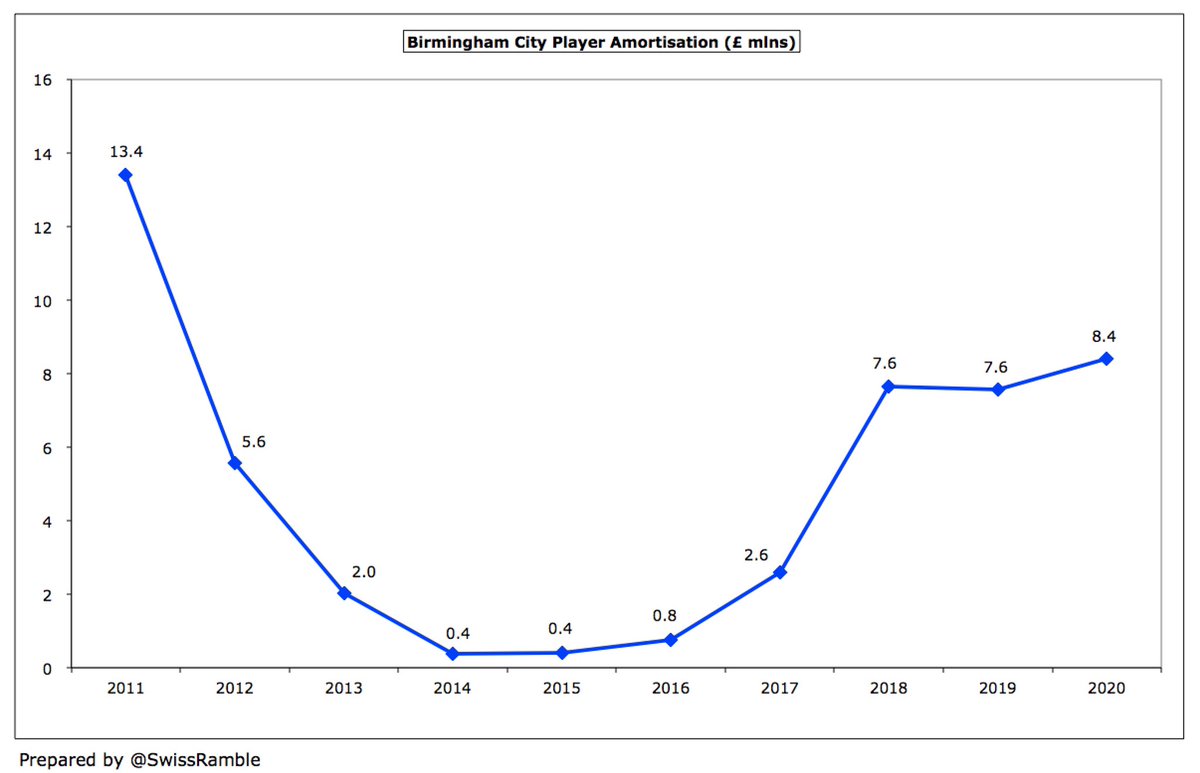

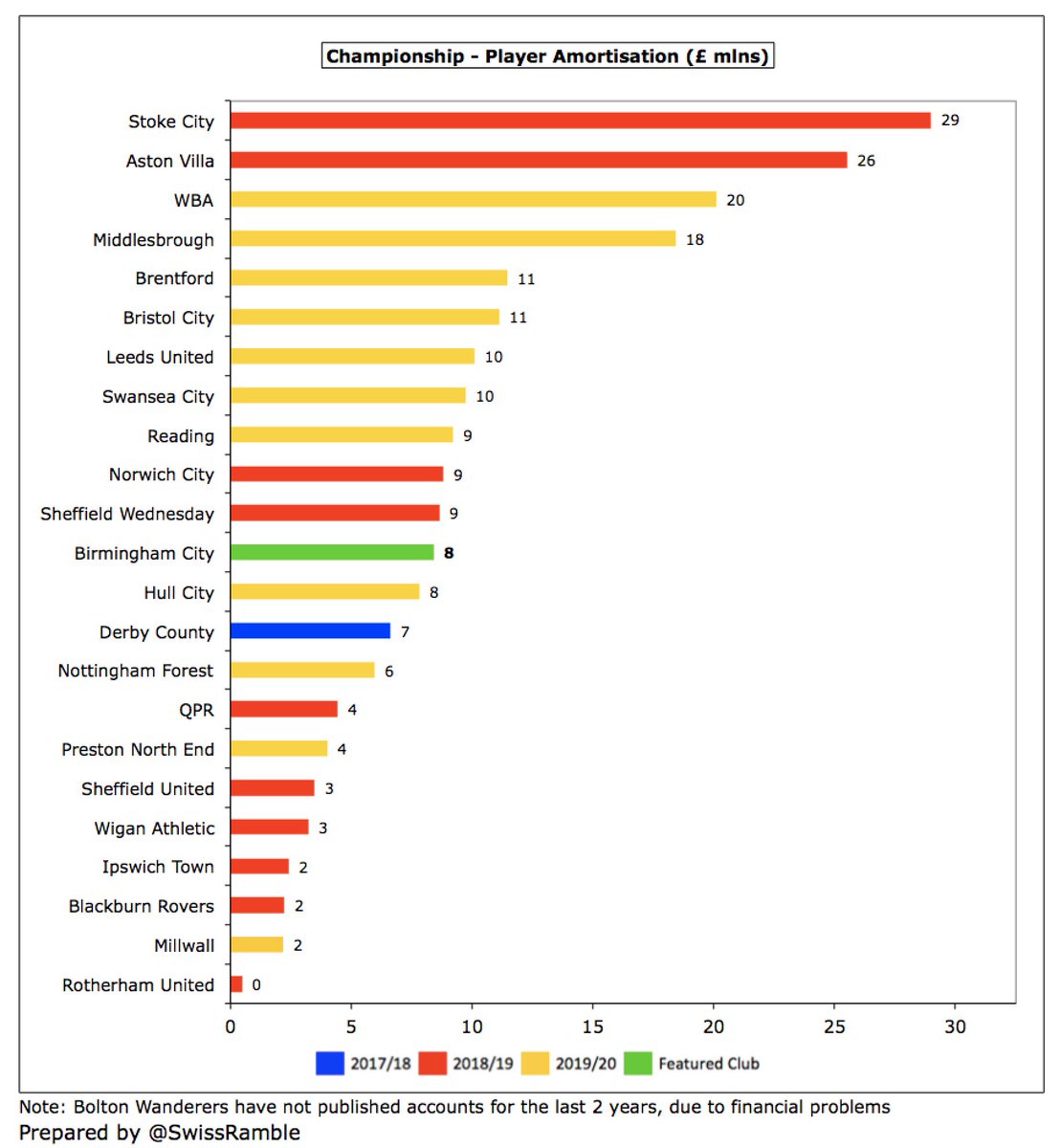

#BCFC player amortisation, the annual charge to write-off transfer fees over a player’s contract, rose £0.8m (11%) from £7.6m to £8.4, the club’s highest since 2011, though only mid-table in the Championship, a fair way below the really big spenders.

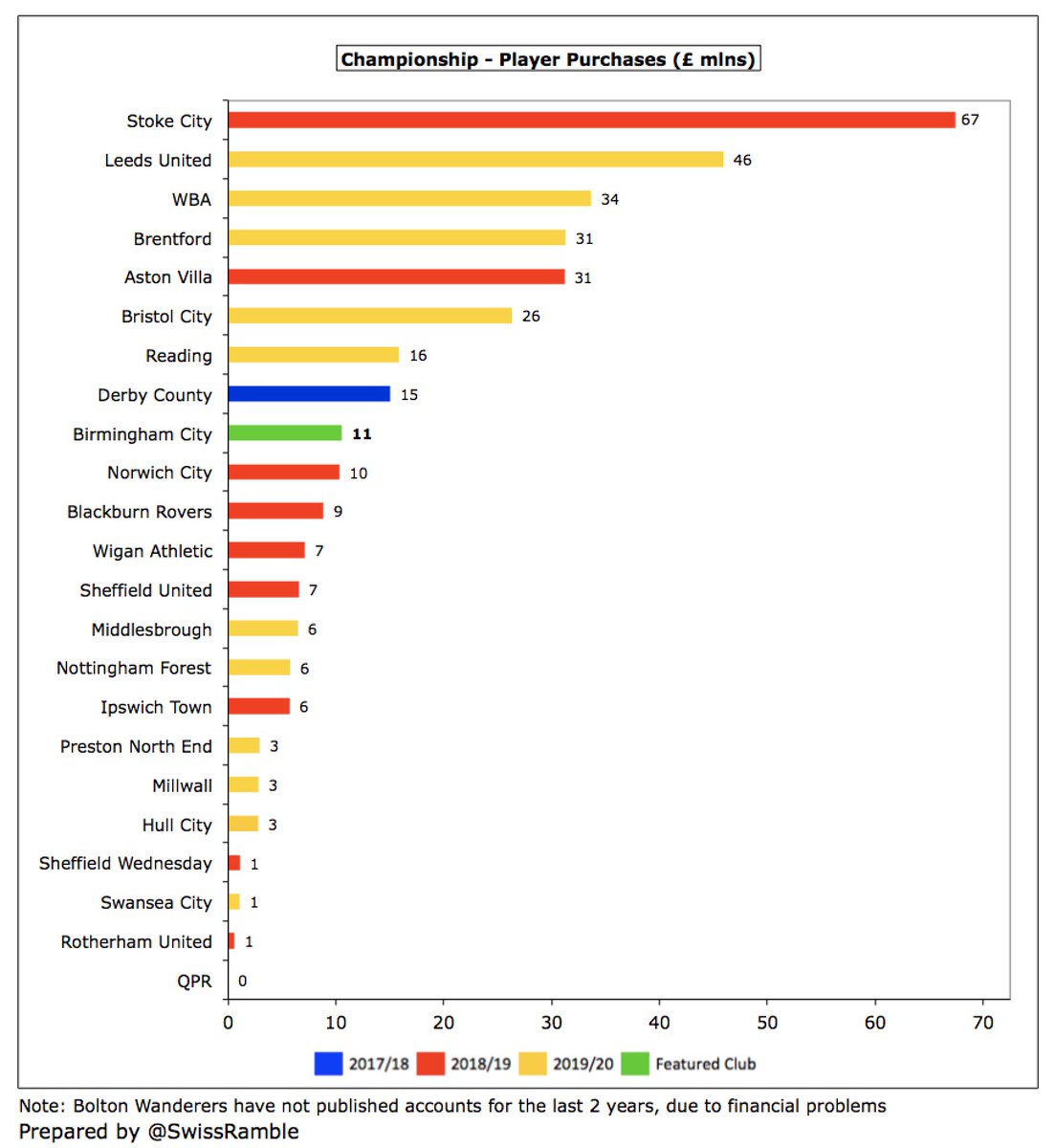

#BCFC spent £11m on player purchases, mainly Ivan Sunjic from Dinamo Zagreb, Alvaro Gimenez from Almeria and Dan Crowley from Willem II. This was in the top half of the Championship, but a long way below the likes of #LUFC £46m, WBA £34m, Brentford £31m and Bristol City £26m.

#BCFC gross transfer spend has increased to an average of £11m in the last 4 years, despite the EFL restricting purchases in 2018/19 following a breach of FFP regulations. This season’s recruits include Scott Hogan, Sam Cosgrove, Neil Etheridge and Jonathan Leko.

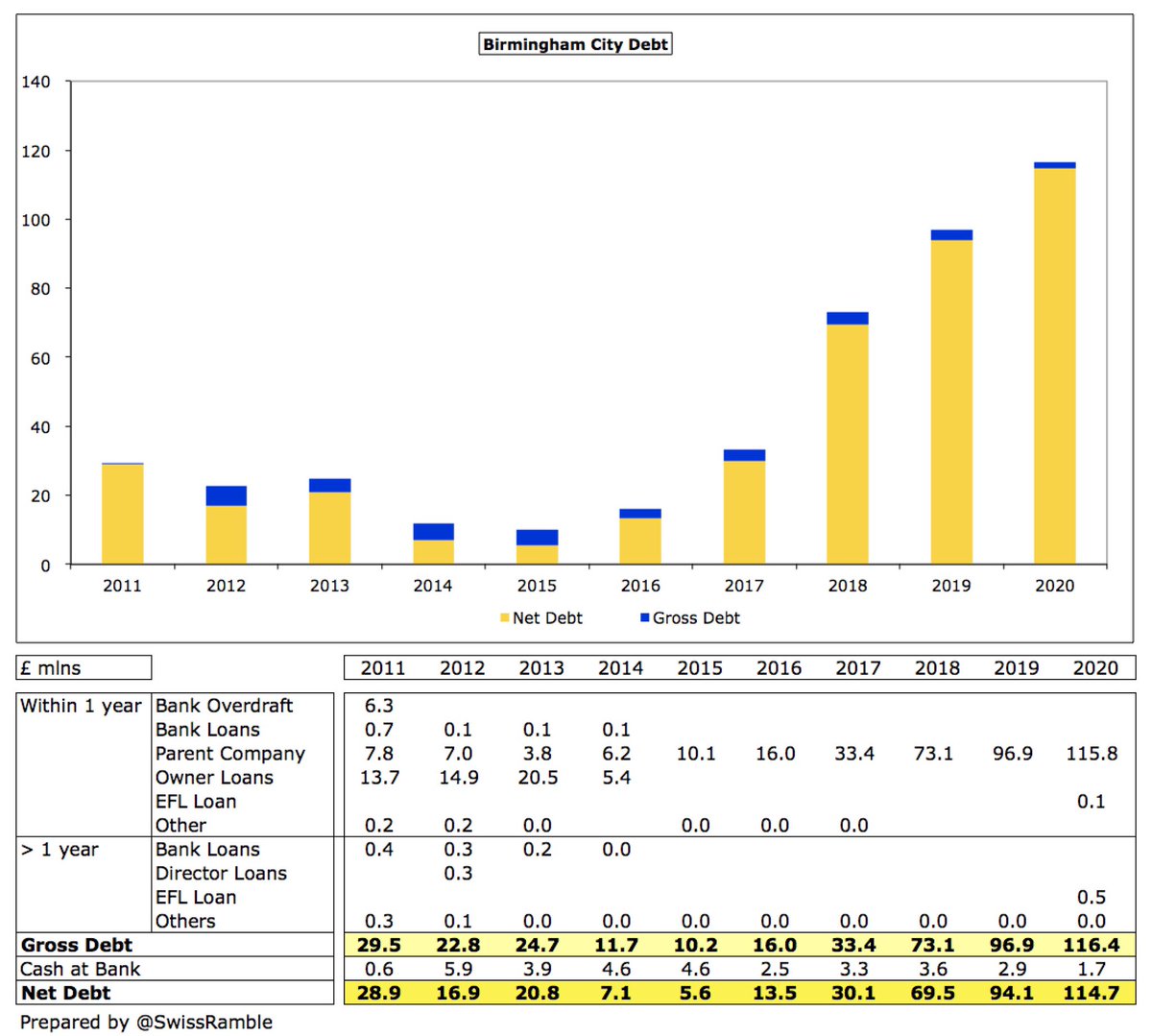

#BCFC gross debt increased by £19m from £97m to £116m, almost entirely owed to the club’s parent company Birmingham Sports Holdings Limited. This means that the club’s debt has grown by a worrying £100m in the last 4 years.

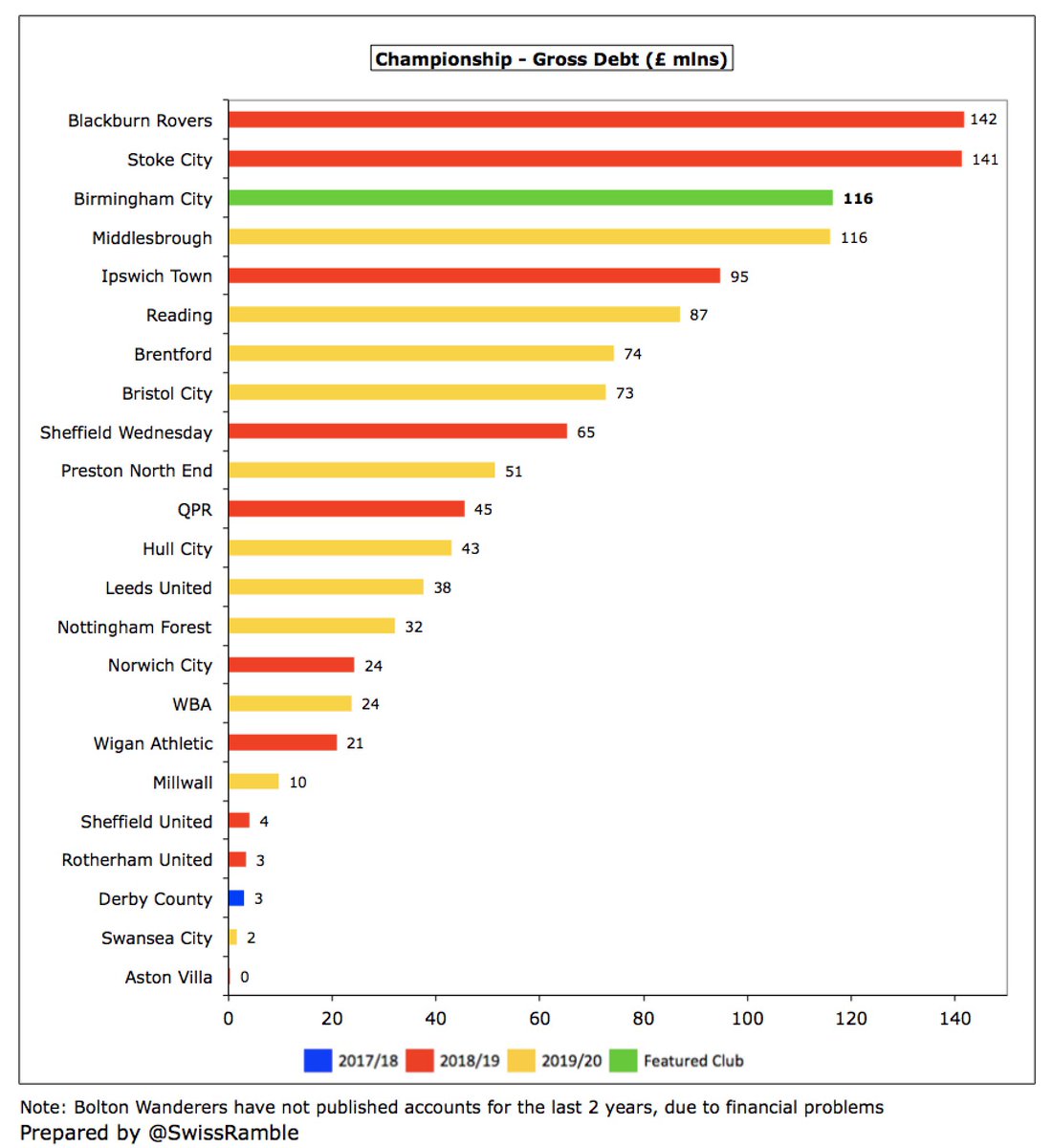

Unsurprisingly, #BCFC £116m debt is one of the largest in the Championship, only behind #BRFC £142m and Stoke City £141m. The debt is not an issue – so long as the owners continue to provide support. It is unsecured and interest-free, though repayable on demand.

#BCFC made a £1.7m interest payment, relating to leases £1.3m and transfer fee liabilities £0.4m. Although many Championship clubs have a lot of debt, very little interest is actually paid, e.g. Birmingham City are one of only 4 clubs over £1m with Hull City the highest at £1.7m.

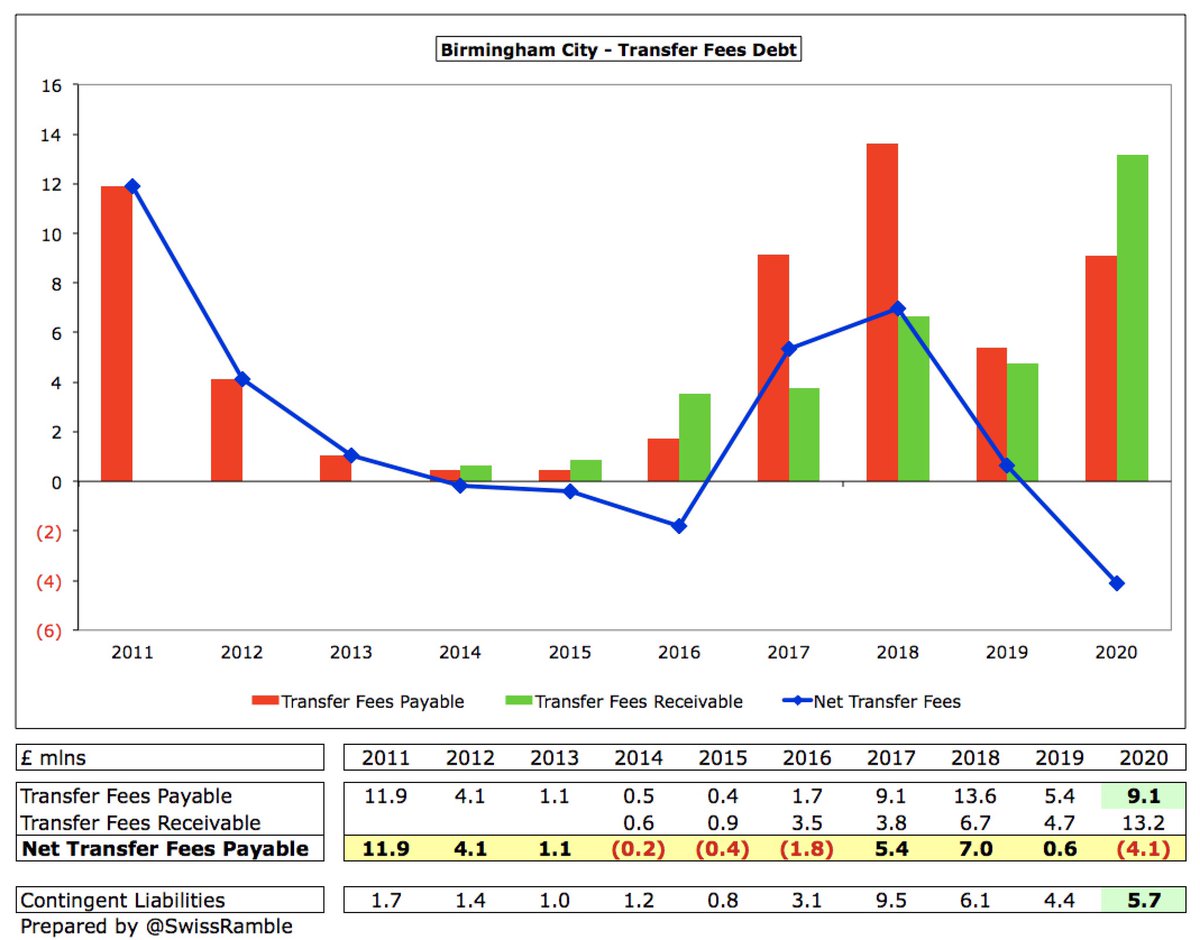

#BCFC transfer debt increased from £5m to £9m, though Birmingham are in turn owed £13m by other clubs, so they have £4m net receivables. In addition, there are £6m contingent liabilities, dependent on appearances, team success, etc.

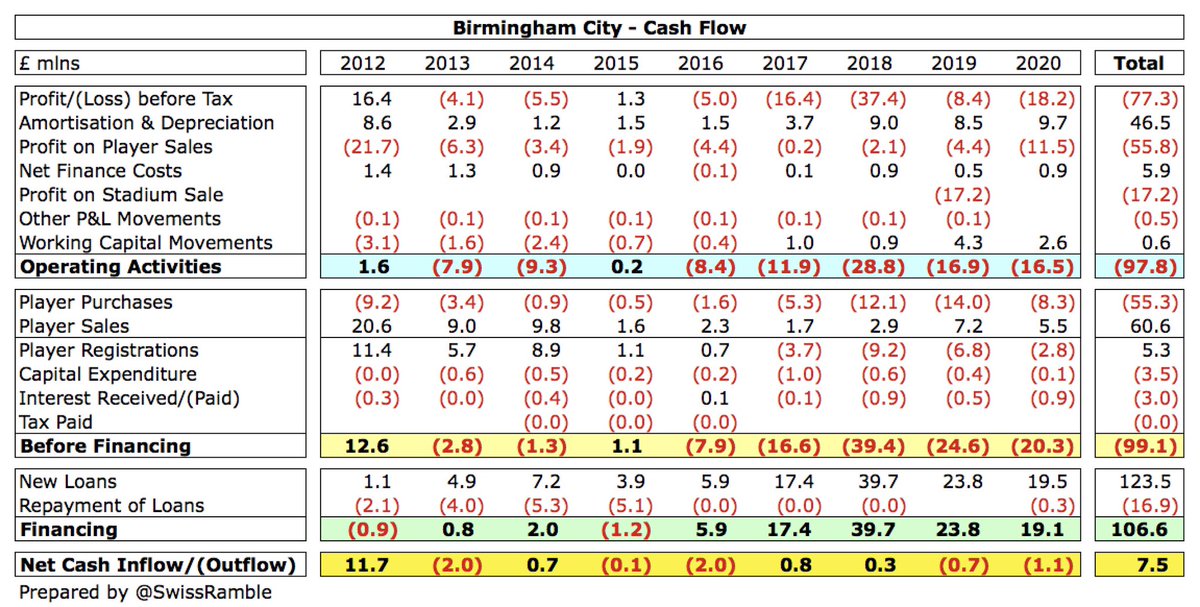

#BCFC £29m operating loss improved to £16m negative cash flow after adding back £10m amortisation/depreciation and £3m working capital movements. Spent £3m on players (purchases £8m, sales £5m) and £1m on interest, resulting in £20m net cash outflow, funded by £19m owner loan.

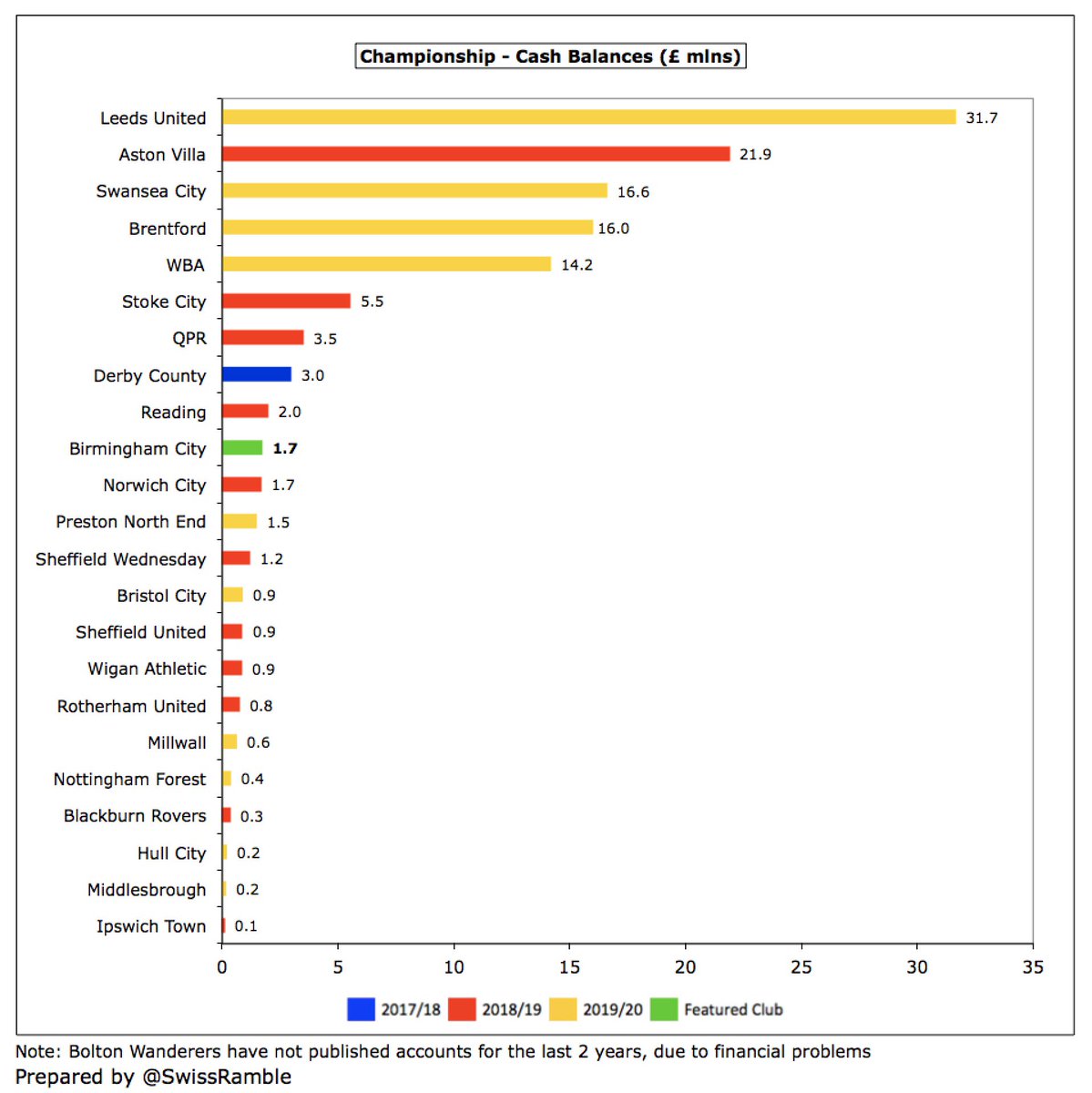

As a result, #BCFC cash balance fell slightly to £1.7m. This is on the low side, but in fairness 16 clubs in the Championship had less than £2m cash in the bank, so this was not exceptional (though not a great buffer in the current climate).

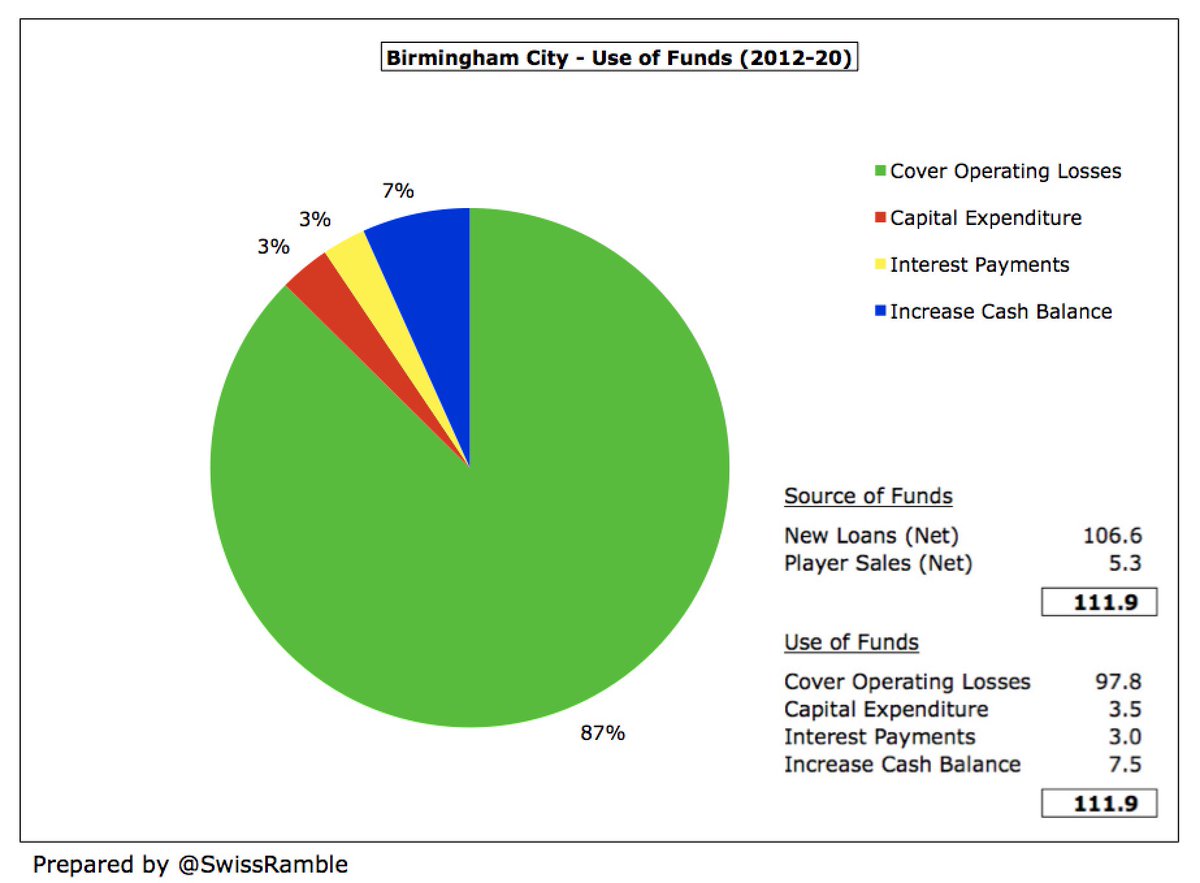

Parent company BSHL has provided £110m funding, including £43m in the last 2 years alone. This support is essential, as #BCFC do not generate cash from operations, losing £98m since 2012. In that period, they had £5m net player sales and only spent £3.5m on infrastructure.

The accounts state that #BCFC will need £38m additional funding from the owners for the period from July 2020 to March 2022. This would increase the debt to the club’s owners to a hefty £154m.

However, the auditors still note a “material uncertainty” which casts “significant doubt” on #BCFC’s ability to continue as a going concern. The club also continues to face challenges with the EFL’s Profitability and Sustainability Rules (FFP).

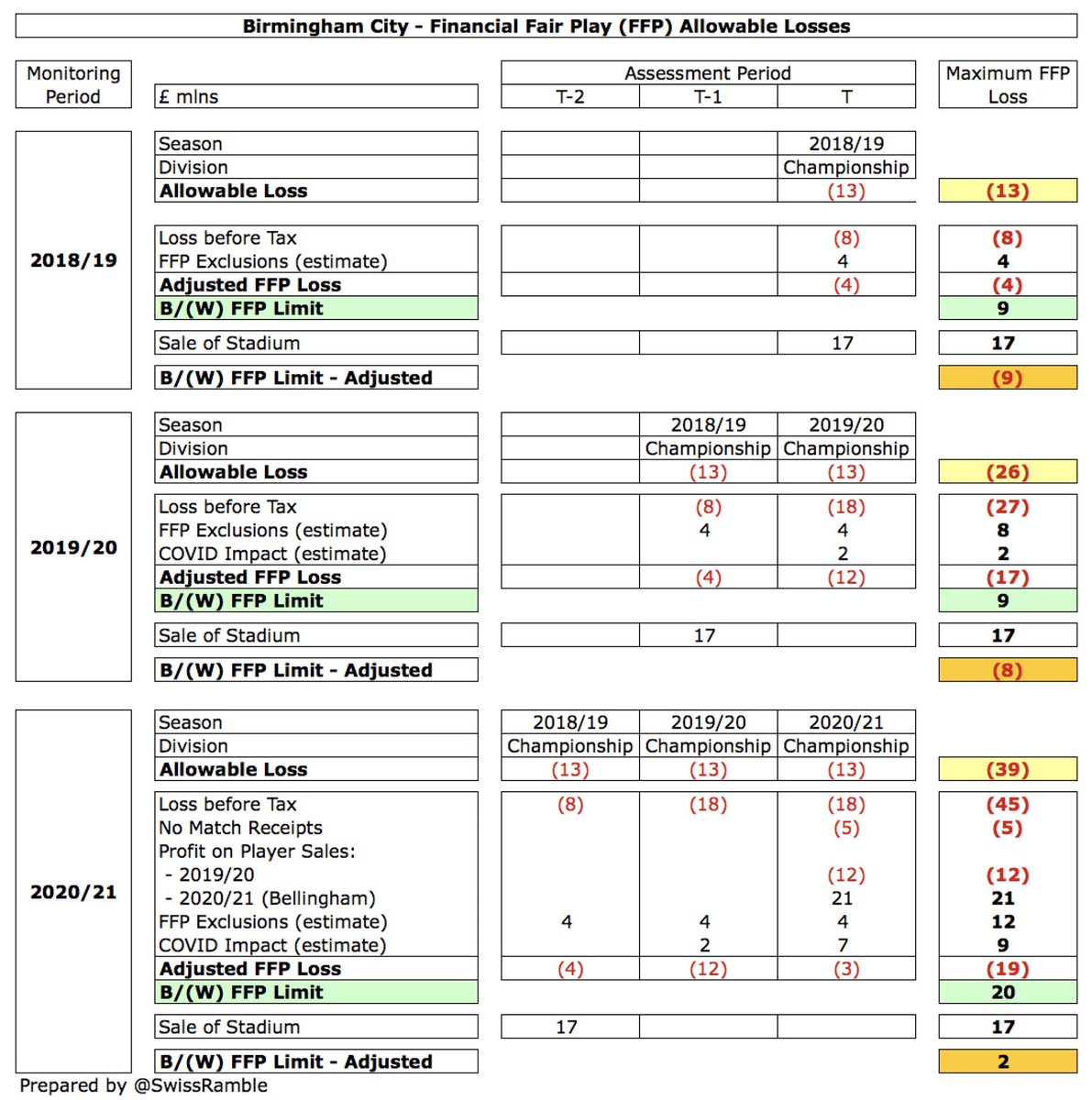

#BCFC have already fallen foul of the FFP rules, incurring a 9 points deduction in 2018/19 following overspend in 3-year monitoring period up to 2017/18. EFL also charged them with failing to comply with previously imposed business plan, but this only resulted in a reprimand.

It is worth noting that the FFP clock was “reset to zero” for #BCFC, so they were assessed on one season in 2018/19 (£13m loss) and two seasons in 2019/20 (£26m), and will only be back to three seasons in 2020/21 (£39m). On that basis, my estimates suggest they are OK.

So #BCFC creative accounting (within the rules, to be clear) solved FFP for both 2018/19 and 2019/20, as their adjusted FFP losses were well within the limit. However, if the £17m stadium profit were excluded, the FFP losses would have been above the limit.

Birmingham City Stadium Ltd have since sold 75% of St Andrews to real estate investor Kang Ming-Ming and 25% to Cambodian businessman Vong Pech, who now owns 22% of the club (BSHL stake down to 75%). The impact is unclear, though it’s not good that #BCFC does not own the stadium.

The stadium was sold for £20.6m, but only realised a £10.8m gain, as £9.8m was used to pay liabilities in Birmingham City Stadium Ltd. The ground is leased back to the football club at an annual rent of £1.25m until 2031.

To their credit #BCFC managed to restrict the 2020 loss compared to many others in the Championship, but the reality is the club still needs substantial support from its owners. This has to be of concern considering the various ownership changes and stadium transactions.

• • •

Missing some Tweet in this thread? You can try to

force a refresh