Q&A 157

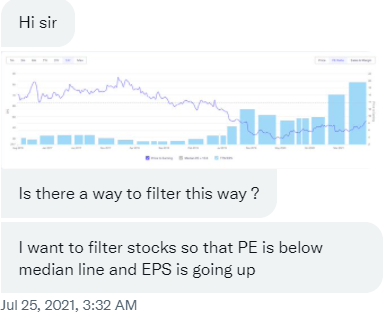

Q-> How to filter stocks so that PE is below median line and EPS is going up as shown in graph ?

1

Q-> How to filter stocks so that PE is below median line and EPS is going up as shown in graph ?

1

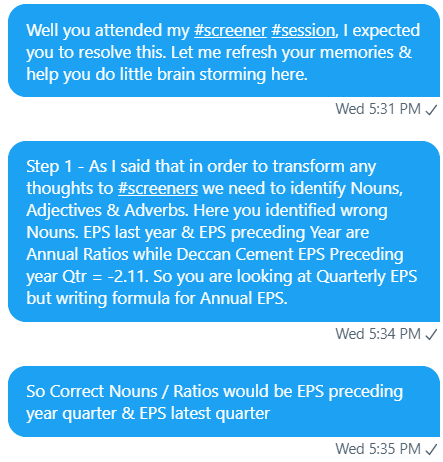

You can use this #thread of mine to learn how to use EPS formula quarterly YoY ->

For Historical EPS parameters like how we have for Profit Growth, I would request @screener_in team @ayushmitt @faltoo to consider adding it.

2

https://twitter.com/Coolfundoo/status/1416053404061913092?s=20

For Historical EPS parameters like how we have for Profit Growth, I would request @screener_in team @ayushmitt @faltoo to consider adding it.

2

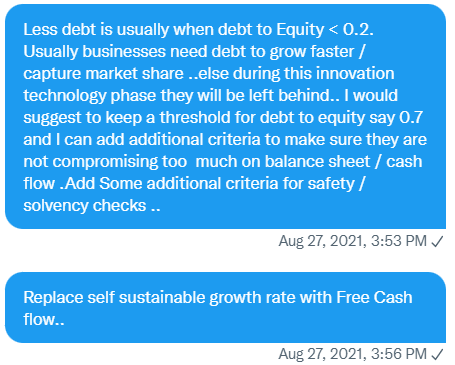

Possible workaround - Use Profit Growth instead of EPS.

For PE below 5yrs Median PE you can write following query at @screener_in ->

Price to Earning < Historical PE 5Years

3

For PE below 5yrs Median PE you can write following query at @screener_in ->

Price to Earning < Historical PE 5Years

3

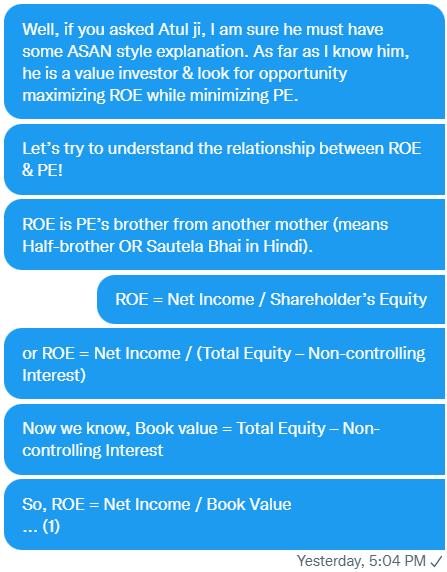

If we tweak the requirement to use Average PE instead of Median PE we can use

@Tijori1 and complete the #scanner by writing something like in #screenshot

For more strict criteria consider adding ->

1yr Growth EPS>3yr Growth EPS AND

3yr Growth EPS > 5yr Growth EPS

4

@Tijori1 and complete the #scanner by writing something like in #screenshot

For more strict criteria consider adding ->

1yr Growth EPS>3yr Growth EPS AND

3yr Growth EPS > 5yr Growth EPS

4

• • •

Missing some Tweet in this thread? You can try to

force a refresh